"The Sky is Falling!": Why Stock Market Swings Shouldn't Scare Real Estate Investors

Concerned about the massive stock market swings we’ve seen recently? Many people are. After all, the headlines have been devastating! Here are a few from 2018: A CNBC post Oct. 31 was entitled "The Stock Market Lost Nearly $2 Trillion in October. Here’s What Happened." On Nov. 20, __ wrote, "Stocks Fall, Wiping Out Gains for 2018." "Market Crash Underway" was the name of a Forbes piece published Dec. 6. And—perhaps most dramatically—CNN titled a Dec. 31 article "2018 Was the Worst for Stocks in 10 Years."

So, Are You Scared?

I’m not. If you’re heavily invested in real estate, like me, you’re probably sleeping well at night—not glued to your laptop, enjoying the third season of A Series of Unfortunate Events and chomping on semi-boneless ham. My kids would never have known about “the crash” if they hadn’t heard the nervous commentator’s voice on FOX News Radio. (We switched it back to classic rock immediately thereafter.) Real estate investors are not speculators. Or at least we shouldn’t be. We have the opportunity to buy hard assets with measurable earnings and, therefore, quantifiable values.

Why Speculate When You Can Invest ?

I look at it this way. Investing is when your principal is generally safe, and you have an opportunity to make a profit. Speculating is when your principal is not at all safe, and you have the chance to make a profit. I've written about this in detail in the past. https://www.youtube.com/embed/g-dzqiQHgJg Here are some anecdotal examples of speculating vs. investing:

- When my friends and I dropped hundreds of thousands down a North Dakota hole in the ground, wildcatting for a new oilfield, we were speculating.

- When I bought an expensive parcel of highly leveraged waterfront property, counting on a change in the zoning, I was speculating.

- When I invested in a self-storage facility, with a known, quantifiable income stream and demographics showing opportunities for more revenue, I was investing.

Paul Samuelson, the fist American winner of the Nobel Prize in Economic Sciences, once said, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Speculating is fun! It's exciting! You can watch your bank account grow and plan that trip to Maui to visit ! Meanwhile, I often find that investing is frankly… boring. And investing in real estate can be particularly boring at times. Like Samuelson said, it's like watching grass grow or watching paint dry.

When Speculating Goes Wrong

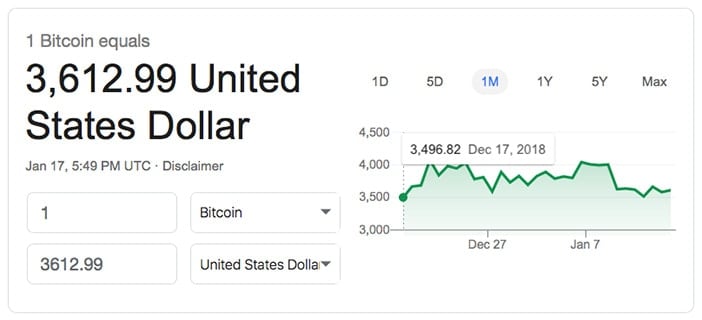

My friends who invested in Bitcoin had a lot more fun in 2017 than I did. They watched their investments double again and again. One of my friends, a smart financial planner, even convinced someone to loan him money to buy a McMansion with his unrealized cryptocurrency earnings as collateral. Then there was 2018. Bitcoin lost over 80 percent of its value (compared to December 2017), and it's still dropping. I hate to say I told you so, but I predicted as much (on Dec. 8, 2017, to be exact—about a week before Bitcoin hit its all-time high of over $18,000). _ Related: Bitcoin or Real Estate: Which is the Better Investment?_ [caption id="attachment_105704" align="alignnone" width="702"]  Courtesy of Google.com[/caption] To be clear, I easily could have been wrong. Bitcoin could have gone up to two or three or ten times that level—or dropped to zero. That’s the problem with speculating. Speculating often makes wild assumptions using massive unknowns to reach its conclusions. And when factoring in human greed and some people's natural bent toward optimism, it can be deadly. Real estate is different. Or at least it should be, if done right. And that’s why I’m sleeping like a baby in the midst of all this market turmoil. _ Related: 4 Reasons Cryptocurrencies & Blockchain Technology Are Poised to Transform Real Estate_ In a funny way, I guess the “boredom” of truly investing helps me sleep even sounder. Unlike a friend who is always on call, or sleeping with one eye open as the 24/7 world markets respond to and predict market swings, I’m busy hanging out with my wife and kids and playing my new Schecter bass. Did you just call me boring? Guilty as charged.

Courtesy of Google.com[/caption] To be clear, I easily could have been wrong. Bitcoin could have gone up to two or three or ten times that level—or dropped to zero. That’s the problem with speculating. Speculating often makes wild assumptions using massive unknowns to reach its conclusions. And when factoring in human greed and some people's natural bent toward optimism, it can be deadly. Real estate is different. Or at least it should be, if done right. And that’s why I’m sleeping like a baby in the midst of all this market turmoil. _ Related: 4 Reasons Cryptocurrencies & Blockchain Technology Are Poised to Transform Real Estate_ In a funny way, I guess the “boredom” of truly investing helps me sleep even sounder. Unlike a friend who is always on call, or sleeping with one eye open as the 24/7 world markets respond to and predict market swings, I’m busy hanging out with my wife and kids and playing my new Schecter bass. Did you just call me boring? Guilty as charged.