Do Economic Indicators Show Potential Improvement for Investors?

A slew of recent data from across the economic spectrum suggests an economic recovery gaining steam and directly hitting individuals across the country.

Let’s do a quick rundown of some key economic indicators and reasons why this data points to good things ahead for real estate investors.

Employment

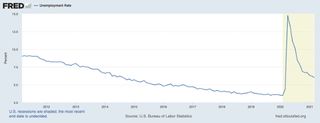

Job growth is one of the most important economic indicators, and it has been trending in the right direction for several months. After the initial surge in joblessness last March and April due to the COVID-19 crisis, unemployment claims stabilized around September of 2020, as you can see in this news release from the Department of Labor.

Note that this graph only shows the last year of data. Before the pandemic, weekly claims averaged around 200,000, and the stabilization in 2020 was much higher (around 850,000).

The Department of Labor’s data shows that since the beginning of 2021, however, initial unemployment claims have decreased by about 40%. For the week ending May 15th, claims dropped from 478,000 to just 444,000 in one week.

This reduction in new joblessness has driven down the unemployment rate nationally from a peak of 14.8% in April 2020 to 6% in March of 2021.

There is still a long way to return to the 3.5% unemployment rate of February 2020, but employment is absolutely trending in the right direction.

Personal income

According to the April 30 release from the U.S. Bureau of Economic Analysis, March was an excellent month for personal income.

| | November 2020 | December 2020 | January 2021 | February 2021 | March 2021 | | Personal income | | | | | | | Current dollars | -1.2 | 0.5 | 10.3 | -7.0 | 21.1 | | Disposable current income | | | | | | | Current dollars | -1.4 | 0.6 | 11.6 | -7.9 | 23.6 | | Chained (2012) dollars | -1.4 | 0.2 | 11.3 | -8.1 | 23.0 | | Personal consumption expenditures (PCE) | | | | | | | Current dollars | -.06 | -0.6 | 3.4 | -1.0 | 4.2 | | Chained (2012) dollars | -0.6 | -0.9 | 3.1 | -1.2 | 3.6 | | Price indexes | | | | | | | PCE | 0.0 | 0.4 | 0.3 | 0.2 | 0.5 | | PCE, excluding food and energy | 0.0 | 0.3 | 0.2 | 0.1 | 0.4 | | Price indexes, year-over-year | | | | | | | PCE | 1.1 | 1.2 | 1.4 | 1.5 | 2.3 | | PCE, excluding food and industry | 1.3 | 1.4 | 1.4 | 1.4 | 1.8 |

Except where noted, all numbers are percent change from preceding month

The report starts that personal income increased by 21% ($4.2 trillion) over February numbers, with disposable personal income rising even faster at 23%. Much of this is likely bolstered by federal stimulus checks, but the total amount of that package was just under $2 trillion, and much of that money is yet to be spent. So even if you subtract the stimulus money from these numbers, there was still enormous growth in personal income in March.

Wage growth

It’s not exactly a change from recent trends, but it’s worth noting that the pandemic has not really impacted growth.

It’s not exactly exploding either, but it’s encouraging to see that despite all of the economic volatility of the last year, wage growth remains steady at around 3.5%.

Mortgage delinquencies

Fannie Mae’s monthly releasehighlighted that the “Serious Delinquency Rate”—loans that are three or more months past due or are already in foreclosure—decreased from 2.76% to 2.58% for single-family homes and dropped from 0.84% to 0.66% for multifamily properties. For context, in February 2010, this metric peaked at 5.59%—the numbers are much better now than they were following the financial crisis.

GDP growth

All of this data is amounting to bullish forecasts on GDP growth. According to the Calculated Risk blog, three major forecasters are seeing major growth for Q2 of 2021. Goldman Sachs is forecasting 10% quarter-over-quarter growth, the NY Fed is predicting 5.3%, and the Atlanta Fed anticipates 10.4%.

Takeaways for real estate investors

To me, this data points to three positive trends for real estate investors.

More stable tenants

Rental property investing is returning to a much more normal level of risk. Throughout COVID-19, no one knew what would happen with unemployment, lockdowns, stimuli, etc. This created a huge amount of financial uncertainty for landlords and tenants alike. Rental property investing was riskier than I remember it in the last ten years.

With the economy picking back up, the personal financial situations of current and prospective tenants are much less tied to events out of their control.

Improving employment numbers and GDP growth creates an environment where more tenants can meet the obligations of their leases. This should give rental property owners much more confidence that vacancy rates and on-time payments should return to pre-COVID-19 levels soon.

Potential rent growth

I threw in the chart about wage growth for a reason. Recently, I wrote about the relationship between income growth and rent growth. Basically, rent can only grow so much without tenants’ incomes growing. That should be fairly intuitive, but it’s worth noting.

Wages continue to grow above 3%, which means that rent growth is likely to continue, albeit more modestly than it has over the last decade. Combined with employment growth, competition for rental units should increase in the coming months, which could drive up rent prices.

Strong housing market fundamentals

The reduction in delinquency rates suggests that the housing market’s fundamentals are still fairly strong. Yes, prices are going crazy, but that is due to historically low inventory and low interest rates.

One thing that can cause depreciation in housing prices is a large slew of foreclosures like we saw around the financial crisis. Any increase in delinquencies is a red flag for housing prices. On the other hand, fewer delinquencies are a positive indicator.

Of course, there are many other factors in the housing market, but all other things being equal, fewer delinquencies means less of a decline in the housing market.

Looking forward

Overall, pretty much all economic indicators are pointing to a very strong Q2 and 2021. While the housing market is not directly tied to the overall economy, they are correlated, and any positive economic news should be considered positive news for real estate investors.