The Buy 3-Sell 2 Plan - Path #3 to Free & Clear Real Estate

This is part 3 in my series about 3 Paths to Free & Clear Real Estate.

If you’re just joining me, I am writing about achieving Destination Financial Independence and the engine to take you to this destination, The Free & Clear Real Estate Goal.

This series of articles gives you three general paths that may help you climb the mountain towards your free & clear goal.

- 1. The All Cash Plan

- 2. The Snowball Plan

- 3. The Buy 3-Sell 2 Plan

In this article, I will briefly explain plan #3.

The “Buy 3-Sell 2” Plan

When I have discussed the All Cash and Snowball plans in the past, some have complained that it could take years to save up enough cash to get started.

I would argue that is just part of the game. Becoming a big-time saver is a requirement to be a true investor. But, maybe you want to use real estate to boost your savings or maybe the deals right now are just too good to pass up in today’s market.

It is also possible that you live in an appreciating market with very high prices, and it could be difficult to get good cash flow deals that fit my first two plans.

Whatever the reason, if you can sleep at night taking on more risk, here is a plan that uses more leverage but that can get you started towards your free & clear goal.

The plan works like this:

- 1. Buy three income properties (or some multiple of three)

- 2. Use small down payments plus loans for purchases

- 3. Rent for a short period of time (1-5 years)

- 4. Sell two of the three properties, but keep the third.

- 5. Use the net cash from the two sales to pay off the third keeper.

Example “Buy 3-Sell 2” Plan

The primary goal of this plan is this: buy quality properties at a discount.

The quality properties ensure that you can sell someday, hopefully at an appreciated price. The discount on your purchase gives you a better chance of earning a profit when you sell.

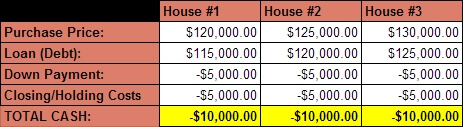

Here is what the initial purchases might look like on my sample three properties.

The down payments in this scenario are relatively small. To do this you will probably need to use a flexible private lender or find conventional mortgage lenders who allow smaller down payments.

My assumption is that my loans are from a private lender at 7% interest with interest only payments. The math for the first loan works like this: $115,000 x .07 = $8,050 ÷ 12 = $671 per month.

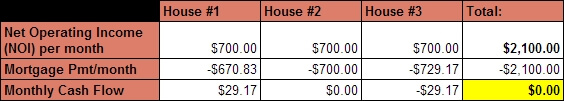

Because of the smaller down payments and higher interest rates, my mortgage payments will be much higher than in the Snowball Plan and my cash flow will be break-even at best, as shown in the chart below.

If I am making zero cash flow, why would I do this?

Answer: the resale of the properties, also known as a capital gain.

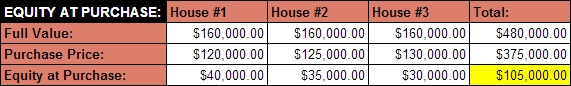

This chart shows that my primary reason for purchasing these properties was that I bought them at a discount below the full value.

Essentially I have captured equity that can then be harvested later on. It is also possible that I can build more equity if the property appreciates (not guaranteed, but remember this strategy is for higher quality, appreciating markets) and if I get an amortizing loan (I did not in this example).

When I sell someday, this harvested equity can be used to buy more properties, perhaps with a 1031 tax-free exchange. Or, I can can just pay my taxes on the gain and pay off debt on other properties.

Paying off the debt is what I’m discussing in this plan.

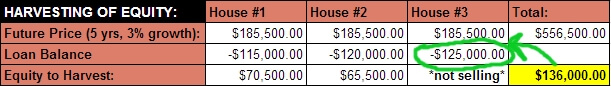

Let’s say I rent my properties for a short period of time, perhaps 5 years, and then I sell them at top price whenever the timing is right. My favorite method is to sell the property to my tenant because I avoid vacancy times and real estate commissions.

The net cash from the two sold properties can then be used to pay off the debt on the third keeper property.

Here are the numbers when the equity is harvested:

At a reasonable appreciation rate of 3%, the sale of two properties will generate enough net cash to payoff the third loan on your remaining rental.

Bingo! Goal accomplished!

This process can be repeated over and over until your hit your goal.

Or you can just use this method to get a couple free and clear properties quickly, and then you can switch to my other strategies, the All Cash or the Snowball plans to grow your base steadily over time.

Now aren't we having fun?!

Closing Thoughts

You will always have to adapt plans to the reality of your life, of your location, and of your market fluctuations. My numbers may not match your numbers or realities, and that is ok.

The concepts are what I hope stimulate your thinking. The concepts can be applied and adapted to your situation.

The concepts of all three plans are really basic and fundamental. I hope you see that you don’t have to get fancy to make big progress financially using real estate.

What most of us need is just a simple plan that we can stick to over the long run, because consistent, persistent, long-run actions lead to the financial independence you are looking for.

So, if you are excited about a free and clear goal, and if one of the my three plans (1. All Cash, 2.Snowball, 3. "Buy 3-Sell 2") resonates with you, just get started!

That is the big point here. Movement.

You need a plan to get moving. Once you get started, you can adjust as needed.

As always, it is a privilege to share this information with you. I hope it is helpful, and I hope you’ll share with me your comments and your successes.

Enthusiastically,

Comments