Which Is the Better Investment?

A new client sent us a property in Austin, TX that was listed for $252,500 with an estimated rent of $1,700/Mo. and asked for our opinion. We compared that property with a similar Las Vegas property with an asking price of $255,000 and an estimated rent of $1,490/Mo. The rent to price ratio (Austin: 8.1%, Las Vegas: 7.0%) indicates that the better investment is the Austin property, but is this true? A teaser, there is a 5.3% difference in return between the two properties! Read on to find out more.

Comparing Two Properties

A new client sent us the following property: MLS#1551927 - 204 Joshua Tree Cir in Pflugerville, TX. Here is the MLS data sheet. (Pflugerville is a suburb of Austin.) Below is a photo of the property.

Below are the relevant property specifics.

- Purchase Price: $252,500

- SqFt: 2,068

- Beds: 4

- Baths: 3

- Stories: 2

- Monthly Fees: $41/Mo.

- Property Tax: $6,022/Yr. Note that this is the tax amount with “homestead” exemption. Without the homestead status the tax will be $300-400 more.

- Insurance: $1,625 - Note, we used the average home owner’s insurance for the state of Texas from this site. We believe this to be a low number for Austin plus landlord insurance is typically 10% to 20% higher than home owner’s insurance.

- Estimated Rent: $1,700. Note, this estimate comes from recent rentals of similar properties. See the rental comps here.

As a comparison property, I chose a similar property from one of our recent investment property lists: 1851544 - 7354 Divine Ridge St. Here is the MLS data sheet. Below is a photo of the property.

Below are the relevant property specifics.

- Purchase Price: $255,000

- SqFt: 2,033

- Beds: 3

- Baths: 3

- Stories: 2

- Monthly Fees: $0/Mo. Note that I will use the same Monthly Fee as 204 Joshua Tree Cir ($41/Mo.) in the calculations to make the comparison more “apples-to-apples”.

- Property Tax: $1,511/Yr.

- Insurance: $450. This is close to the actual cost based on a similarly priced property we recently sold.

- Estimated Rent: $1,490. Note, this estimate comes from recent rentals of similar properties. See the rental comps here.

I will assume the following for both properties:

- 20% down

- 4.5% rate

- 30 year term

- 3% closing cost

- 8% property management

- 0% state income tax. Neither Texas or Nevada have a personal state income tax.

The formula we use for ROI and cash flow is:

ROI = (Income - DebtService - ManagementFee - Insurance - RETax - PeriodicFees) x (1 - StateTax) / ( DownPayment + ClosingCosts)

Cash Flow = (Income - DebtService - ManagementFee - Insurance - RETax - PeriodicFees) * (1 - StateTax)

As an example, below are the calculations for the Austin property:

ROI = (1700*12 - 1024*12 - 1700*12*8% - 1625 - 6022 - 41*12) / (3%*252500 + 20% * 252500) = -2.87%

Cash Flow = (1700*12 - 1024*12 - 1700*12*8% - 1625 - 6022 - 41*12) = -1659/Yr or -139/Mo.

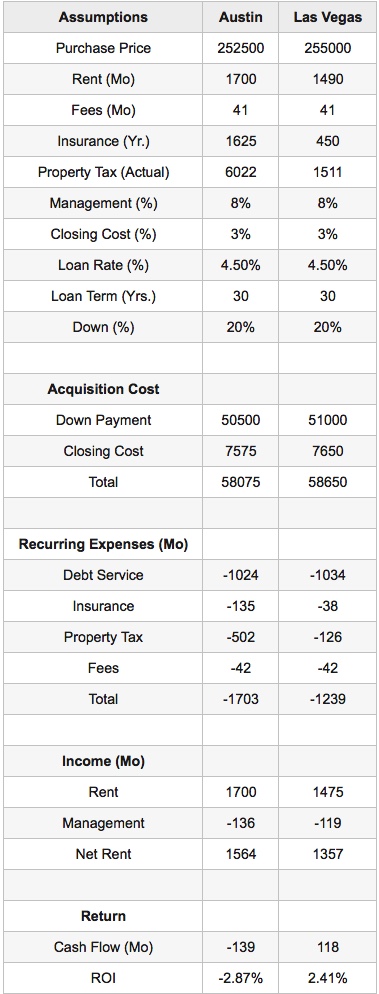

Below is a table comparing the two properties:

Notes:

1. I used the same monthly HOA fee for both properties to make the comparison more "apples-to-apples".

Below is a map showing the relative distance between the properties and the effective business center.

1551927 - 204 Joshua Tree Cir

1851544 - 7354 Divine Ridge St

Vacancy Rate and Maintenance?

I did not include either a vacancy rate or a maintenance factor because these factors are property specific. There is no universal constant for either because all properties are different. Only after you have a detailed understanding of the specific property can you make a guess on these factors. Also, since we are comparing the ROI for two properties, if I applied such universal constants equally to both properties, the net difference would remain unchanged.

Summary

When you are evaluating the potential return of any property, you must include all the significant recurring costs. Failing to include all the costs in your calculations will provide invalid results. The example illustrated here shows that property taxes and insurance differences resulted in a 5.3% return difference. Simple factors like rent to price ratio (Austin: 8.1%, Las Vegas: 7.0%) might make the Austin property look like the better investment, once you include all the major recurring costs the reality is very different.

Comments