Say YES to Seller Financing

When you get ready to sell your next investment property, have you thought about taking on the financing yourself? There’s money in this strategy and it needs to be a part of your toolbox as a successful real estate investor.

I realize that a lot of investors are looking for NOW money, not LATER money. But setting up a seller financing deal on your next property has returned thousands of dollars more for me in both NOW money and LATER money.

Seller Carryback With A Mortgage Already In Place

Let’s say you have a property you want to sell for $100,000 – just to use a nice round number. And there’s a mortgage on the property for $60,000. Because you’re offering owner financing, you can now post your house for sale for $110,000.

Here are two ways to approach the financing structure:

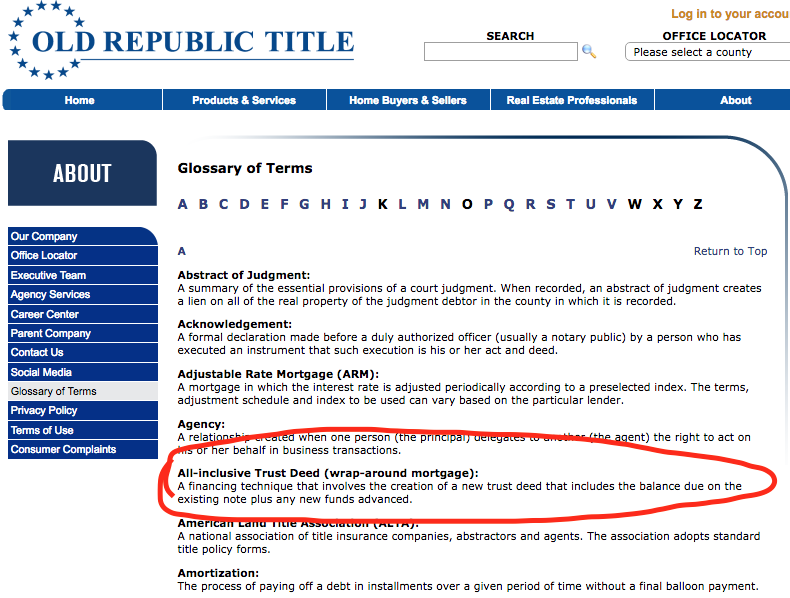

1. You can do a wraparound mortgage using an All Inclusive Trust Deed adding the remainder to the total, and bumping up the total interest by a point or two. The cool thing about this situation is that you’re making interest on that first loan without any of your own money.

2. You can also set the financing up with two loans in order to create the highest value to you. You’ll have $60,000 on the first mortgage held by the bank, and with a 10% down payment of $20,000, you carry a second mortgage for $30,000 for 15 years at 8%.

Boom – you’ve just put $20k in your pocket, which is probably close to what you were going to get without seller financing, minus closing costs and fees. AND you’ll get $286.70 every month for the next 15 years according to my mortgage calculator, unless your buyer sells first. And he probably will, because most people own their properties for an average of 7 years.

Pay An Attorney To Create The Contract

That first mortgage will get paid down every month of course, and your agreement will stipulate that if your buyer fails to pay, you’ll take the house back and sell it to somebody else. A good real estate attorney can easily draw that up for you. It’s totally worth the money too.

An extra bonus is that you can sell that payment stream of $286.70 in whole or in part to a note investor like myself, so you can pocket your money sooner if you like. You can take that money and use that monthly payment to cover house expenses, or a car loan, or put it in your Roth IRA after taxes.

Defer Capital Gains

And by the way if you sell your property by financing it, you’ll avoid paying a big capital gains tax. You’ll pay it in smaller chunks over time, which is much better. Believe me – I’ve written some big checks to Uncle Sam and it’s not particularly fun.

So how do you do this safely, and securely? I’ve had people ask me about this, so I put together a pdf report that lays it all out. You can get the on my website for free. If you do just a couple of the 10 things on the list, you’ll earn thousands of dollars more than you would otherwise. Keep it on hand when you want to sell, and follow the steps to put more money in your pocket.

So how do you do this safely, and securely? I’ve had people ask me about this, so I put together a pdf report that lays it all out. You can get the on my website for free. If you do just a couple of the 10 things on the list, you’ll earn thousands of dollars more than you would otherwise. Keep it on hand when you want to sell, and follow the steps to put more money in your pocket.

Comments