Updated over 6 years ago on . Most recent reply

Choosing an out-of-state location

Hi All - I've recently been bitten by the real estate bug; I've just finished Brandon Turner's Book on Rental Property Investing and am all-in on BiggerPockets. I'm still in the information gathering stage at this point but want to start analyzing realistic deals.

I live in the Bay Area of California which is outside of my budget, so will likely be taking on some form of David Greene's long distance property investing. I'm having trouble focusing on a handful of key metrics that will help me narrow down my analysis to a few broader markets (city / state). I'm thinking historical property appreciation, price-to-rent ratio, and maybe vacancy rates are a good place to start. Does anybody have any other ideas and/or sources of information for the metrics? Or does anyone have a method for choosing markets to enter when going the long distance route? Thanks!

Most Popular Reply

Hello @Art Perkitny,

I agree with you. You need to define what you want and then look for locations that enable you to achieve your goal. Fortunately, real estate is very forgiving. As long as you buy property in a good location, all but the worst mistakes will be corrected over time through appreciation, inflation and rent increases. However, the corollary is also true. If you buy in a bad location, there is little you can do to turn things around after the fact.

I look for long term buy and hold investments, not just the current return. I look for locations where properties will appreciate and rents will increase over time. When I was first looking for such a location, I developed the following criteria:

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Likely to appreciate over time - Properties appreciate in locations that have increasing demand, which is the key driver for sustained profitability.

- Located in an area where you can make money and business risks are low. Only in such an environment can you achieve both current and long term profitability.

While the above seems simplistic, few locations can achieve all three criteria. A few comments on the criteria:

Return

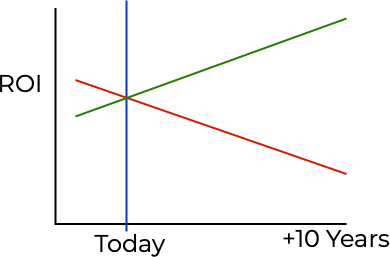

Return (ROI, cash flow) is only a snapshot in time. Such calculations only predict how the property is likely to perform today; it does not tell you anything about how the property is likely to perform in 2 years, 5 years or 10 years. What happens in the future is almost more important than today. The diagram below illustrates what can happen over time, depending on the direction of the market.

The red line represents a declining market (where rents and prices are declining, constant or increasing below the rate of inflation) and the green line represents an appreciating market (rents and prices are increasing above the rate of inflation). Both have the same ROI today but the ROI in buying power will be very different in 10 years. You need to carefully consider how the location is likely to perform in the foreseeable future. The easiest indicator of market direction is how property prices have performed over the last 10 years. Rents lag property prices by 2 to 10 years so sales price trends are a good predictor of future rental rates.

Appreciation and Inflation

Static prices are not static. Official inflation is running at about 3%, which does not include food or energy. I will use 5% as a more realistic inflation rate (if you drive a car, use electricity or eat, 5% is a more realistic estimate). Suppose you are renting a property today for $1,000/Mo. and rents are not increasing. What is really happening over time?

After only 5 years, the purchasing power of $1,000 will only have the buying power of $772. This is why appreciation, at least equal to inflation, is critical.

An Area Where You Can Make Money

In some locations it is very hard to make money due to the cost of doing business. Significant cost factors include: property taxes, insurance costs, state income taxes, property age and construction, climate and eviction time and cost.

As an example, we own properties in both Las Vegas and Austin. Below is a comparison of just three cost items:

The $/SqFt of rent between Las Vegas and Austin are not that different. So, property taxes and insurance cost alone make Austin properties very difficult to cash flow.

Location Selection Criteria

Below are some of my criteria for selecting a buy and hold investment location:

- Appreciation - I covered the importance of appreciation. Make sure to check the property price trends for the location.

- Population size - I would focus on cities with a population of 1M or more. Small cities tend to be reliant upon a single industry, which makes them vulnerable to economic changes.

- Population growth - If people are moving into a location, it is probably a good location for jobs and a desirable place to live. If people are moving away, demand will drop and prices will be static or declining.

- Per capita income growth - It is not just the quantity of jobs, it is also the quality. Per capita income growth is a good indicator of the number and quality of jobs in a location. For example, if businesses are moving away from a location people will have no choice but to take service sector jobs, which usually pay less than office or manufacturing jobs. If this is happening, then you will likely see static or declining per capita income. And, rents will follow per capita income. There are many sites where you can get this information. Here is one such site.

- Urban sprawl - Not talked about much but you have only to look at any major city and you will see locations that were once the best in town and are now distressed. This is usually the result of urban sprawl. You need to be very aware of which way the city is expanding and buy in newer areas. See this site for time lapses. Look at cities like Memphis, Atlanta, Austin and Las Vegas.

- Crime - High crime and long term profitability do not go together. I would not consider any city on the top 100 most dangerous cities list. You might know one of these cities well enough to know that there is a great location near the city. The problem is that companies looking to open new locations will not choose high crime cities. Also, people with sufficient funds will leave these areas and the area will go into decline.

- Climate - Properties in areas with hard freezes and excessive moisture will tend to require more maintenance than in milder and dryer climates.

- Property cost - There is a tendency for new investors to choose locations with very inexpensive properties. Remember that price is a function of demand. No demand, low price. High demand, high price. Of course, you need to hit a balance. If your budget allows a maximum of $250,000, do not consider coastal California.

- Taxes - Both income tax and property taxes are a direct hit on profitability.

- Insurance cost - Insurance cost is a good barometer of the likelihood of damage, usually due to climatic or seismic events. Be certain to take the cost of landlord insurance into account when comparing locations.

Summary

Choosing the right location is critical. Consider what the market is like today and what it is likely to be in the foreseeable future.

Hope this is helpful.

- Eric Fernwood

- [email protected]

- 702-358-8884