All the Reasons Not to Invest in Real Estate

Photo by Brian Babb on Unsplash

Photo by Brian Babb on Unsplash

I know you’ve read about how easy real estate investing is. It’s so trendy right now. I know, I know, you want to buy a multi-family home and live in one side and rent out the other. Sure. You want to buy a small apartment complex. Sure. I still don’t understand why anyone thinks these are easy returns.

I am here to tell you that it’s bullsh*t. More people lose their shirt investing in real estate than you will ever know. You have to be an expert in real estate to sustain long-term growth through investment. And even those of us who have been doing it our whole lives still lose on deals.

So stop listening to your friend, who is an agent, and wants to sell you a fixer-upper in an “up and coming” neighborhood. Stop listening to the old-timers who found properties before Zillow was around. Stop listening to your greedy brain that tells you that you just need more. Just stop.

It’s not as easy as you think.

My Background

I’ve been involved in real estate since I could walk. This isn’t an exaggeration. My father was an attorney but never made any money doing that because he loved real estate so much. He knew every trick in the book. And these tricks do not exist anymore in the same way.

I was being pushed through windows of abandoned homes (I was the only one who could fit) before I was in first grade. I was surveying blocks and neighborhoods before I liked girls. I was going to yard sales to get basketballs before I grew, but my dad was going to buy the houses.

I’ve been in a family real estate investment partnership for 30 years. We have continually maintained between 10–30 units during this time. We have bought every type of property you can think of. We have rehabbed. We have flipped. We have flopped. We have rented. We have evicted. We have held. We have done it all. I have done it all.

I also was a real estate agent, trainer, team leader, and real estate coach during five years in the business. I did very well at that time but hated the business. So I left. I also ran my own off-market investment company and counseled hundreds of investors on their potential purchases. Then I got my license back again to only work with past clients, investors, and direct referrals, and set off on a plan to flip again. Now.

This is based on experience. In several different states. And over 30+ years. And I am telling you not to invest in real estate unless you make it your mission to understand everything about it.

Areas You Need To Be an Expert In

- - financial implications of real estate (taxes, 1031 exchange, budgeting, market volatility, rehab costs, mortgages, hard money, private money, property management)

- - neighborhood dynamics (the ability to spot and identify the trends that will lead prices up or down in a certain area before anyone else does, reliance on “eyeball” information rather than online sources that are six months behind)

- - acquisition principles (listed properties, off-market acquisition funnel, direct mail opportunities, driving for dollars, approaching default properties, foreclosures, courthouse steps purchases, negotiation tactics for different types of potential sellers, REO strategies, the science of bidding)

- - people (landlord/tenant relations, dealing with distressed sellers, dealing with heirs after death, working with agents, hiring bird dogs, adjusting on the fly to the unknown)

- - forecasting (how much will this be worth after rehab, how much will this be worth in five years, how many other properties on this block are likely to be purchased soon, reasonable rent increases over time)

- - data (date of sale, price of sale, amount of mortgage(s) owed, recent sales in the area, recent sales of similar properties in other areas that have already “come up,” number of cash buys in the area)

These are not even close to all of the things you need to know to win at real estate investing. Don’t listen to your cousin Fred who hit it big once. He probably is underwater on the three properties he bought with his profit from the first one.

Photo by Bernard Hermant on Unsplash

Photo by Bernard Hermant on Unsplash

All the Reasons Not to Invest in Real Estate

You Can’t Pay Cash

This is where people get p*ssed off right away. “Are you saying I should not buy real estate unless I can pay cash?” Yes. Exactly. This is why:

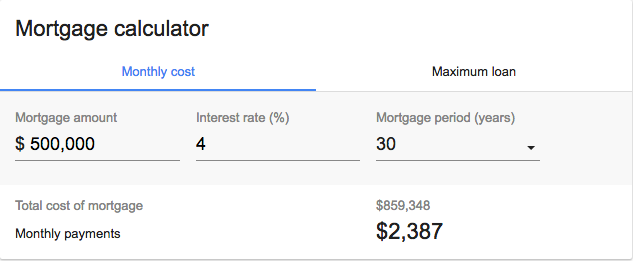

Courtesy of Google Mortgage Calculator.

Courtesy of Google Mortgage Calculator.

You pay $859,348 for a $500,000 house like this. Think about that. If this is your choice to become a homeowner for yourself then that’s understandable. Because you would rather own something than keep paying rent. But when you rent you don’t pay taxes. Or have to fix anything that breaks. P.S., that above calculation does not include your real estate taxes or home insurance.

So your $859,348 investment on a $500,000 house is just the start. Sure, a new kitchen will earn you more later, but it costs a pretty penny now. Also, what about everything that breaks along the way? A new hot water heater. Furnace. New roof. It adds up.

So why do so many people use loans to buy multiple properties? The f*ck if I know. They are hedging their bets that they know what they are doing. But all you need to do is look at the last downturn to know that it will be too late before you know. And then you will be stuck. With a 100 unit complex in Texas because your friends told you it was a lock.

Cash is king. Look at the calculations. Even if you are buying investment properties with a good rent roll you have to account for repairs, vacancy, wear and tear. And that is all on top of your mortgage that you are overpaying for.

I know you may ignore me on this one, but even if you do, see if you can ignore the rest of these points before deciding to invest.

You Think Being a Landlord is Easy

If I had a dollar for all the times I told someone how hard it is to be a landlord and they ignored me. And then they called six months later saying it was the worst thing they have ever done. I would be using that money to buy another property. For cash.

Being a landlord is the absolute worst. Like chlamydia worst. In most states, tenants hold all the cards. Unwitting buyers think they can just kick tenants out whenever they want to. Sorry. Not the case. You would be surprised just how much tenants can do to f*ck with you if they want to.

And all the while you are holding the bag (the mortgage). And if you make them mad they may damage your investment and disappear. Fires happen. Water leaks happen. Tenants can be very vindictive when they want to be. Especially if you have been an a**hole landlord.

Never be an a**hole landlord. It gets you nowhere.

Being a landlord is like being a babysitter. Except not only are you responsible for the kids (tenants) but the entire house. Like you come over for the night to watch Jimmy and Erin, but the dishwasher breaks. That’s coming out of your pay. Sounds great, right?

Oh, by the way, you are on call 24/7. When you are a landlord and there is a dishwasher overflow in the middle of the night, you are getting called. When it’s too cold in the winter, you will get called every day. When the refrigerator breaks in summer, you are getting a call.

I know what you’re thinking. I’ll just get a property management company. Ok, there goes another 8–10% a month to pay for that. And you are still getting a call. Because property management companies s*ck for the most part. And arranging repairs and taking those calls will cost you more.

Photo by Jose Alonso on Unsplash

Photo by Jose Alonso on Unsplash

You Want An Agent To Do All The Work

Welcome to the way to never make money in real estate investing. Relying on agents and their expertise. The great majority of agents (more than 99%) don’t know anything about investing in real estate. They just want to get a commission on a sale.

You expect agents to be experts on the new breaking areas, but they have to understand investments to even be of any use to you. Most successful real estate investors don’t use agents to buy properties, only to sell them. When we get good at it we know how to find the properties ourselves, well before they hit the market or anyone else knows about them.

If you are going to spend hundreds of thousands of dollars on an investment you can not leave the research and work to an agent. They only have access to on-market properties. And everyone can see those. So why would you buy a property that everyone has access to? It will cost way more than ones you can find yourself.

And P.S., no agents want to take you to see 100 dumps and make 25 lowball offers just to maybe get one win. They don’t think of the long game with investors enough. The agents that do aren’t helping you, they are doing it themselves.

Also, most agents know nothing about foreclosures. And they are confused about REO properties. Even those that think they know, don’t know. Because the only way you know is to have done it. Over and over. In different environments. You have to have played the game to understand the game.

Photo by rawpixel on Unsplash

Photo by rawpixel on Unsplash

You Want To Invest In a Hot Market

All this means is that you are too late to make money. That’s why you need to know all the stuff at the top. If the market is already hot, you can still make money. But not as much as you can if you find the next neighborhood.

Plus you will need more money and be bidding against more people in a hot market. There is no point. You are too late. This is where “investors” always lose money. They buy in too high. They get caught up bidding at an auction. They don’t correctly calculate their rehab costs. They think the market has no top.

Being late to the party in any type of investing is losing. Because your gains can be greater somewhere else. And your ante will be less. Doing the due diligence to bet on your own research is a long-term capital strategy that can be successful with data and deliberateness.

Sometimes in a hot market, there are soft pockets. An area of a town that hasn’t skyrocketed like the rest. But these spots can be dangerous for an inexperienced investor as well. Everything in real estate is dangerous for an inexperienced investor.

You Think You Can Manage Properties In Another State

First, you thought being a landlord was easy and now you want to buy and rent properties in another state. Because you saw it on tv. How hard can it be? Really f*cking hard. Unless you like getting skimmed all the time. You will never know what is really going on with your properties if they are in another state.

Another tenet of real estate investment — don’t trust anyone else to manage your investment for a small percentage of your monthly earnings. There’s not enough skin in the game there.

So you live in New York and you buy a property in Oklahoma. You have an agent there who goes by the house to check on it. P.S. — that means he or she never goes by. You need to call plumbers, electricians, roofers in an area where you know no one. So you rely on the Internet because it’s always reliable.

Say goodbye to more of your profit. And your investment. Because when you can’t drive by it yourself, out of sight becomes out of mind and you rely on people you shouldn’t rely on for such a big investment.

Photo by João Silas on Unsplash

Photo by João Silas on Unsplash

You Don’t Understand the Importance of a Home Inspection and How to Succeed Without One

Real investors don’t do full home inspections. Because cash buyers move quickly and assume the risk. It’s how you get the best properties. In some areas, you may just do an oil tank sweep for underground tanks and nothing else.

But there are ways to inspect without doing an inspection. And if you don’t understand how important it can be and what you should be looking for, just go out back right now and light your money on fire.

So many things can be wrong with a house that will cost you more money than you ever thought. If you don’t know how to look for yourself, you will not get any properties. Because rehab properties aren’t won by people who want to do a home inspection with multiple contingencies.

There are also several other important non-physical detectors you need to pay attention to in order to protect your future profit margin.

Here’s a list of things you will miss if you don’t know what the f*ck you are looking for:

- - foundation issues (how the house is supported)

- - plumbing issues

- - asbestos (may require hazardous removal teams)

- - oil tanks (old ones can be buried underground and may have leaked causing environmental impact)

- - survey (you may not have the exact land acreage you think)

- - easements (that driveway of yours may not be all yours)

- - old windows (replacing all the windows in a house is not cheap)

- - water damage (underneath or associated with water damage is mold)

- - roofing

This is not even half of them. It’s not just a home inspection that you will need to waive to win. It could be liens. If you buy on the courthouse steps you will be taking on any liens. They are not always all disclosed at the time of a sale.

Photo by Taton Moïse on Unsplash

Photo by Taton Moïse on Unsplash

So, It’s Impossible to Succeed As a Real Estate Investor?

Absolutely not, but these are warnings for all the noobs out there salivating at what it took most of us years to understand. There are 100 moving parts in every transaction, every rental, every rehab. And if you aren’t on top of all of them, you are letting money escape.

Real estate investment is a numbers game. But it’s also a data game. And a people game. And a marketing game. And a search game. You have to be a professional at them all. When you don’t keep your head in the game, you lose.

This isn’t all of the information you need to know, but it’s a stop sign for those entering into the fray without open eyes. I’ve done it. I’ve made terrible deals. I’ve been crushed by the downturn. I’ve gotten extremely lucky. I’ve been in the right place at the right time. You have to experience it over time and through different market cycles to truly understand how to do it the right way.

If you don’t listen to my advice, don’t say I didn’t warn you. Even if you know what you are doing, you might want to just run through this to make sure you have an idea how all the factors at the top can help you stay ahead of everyone else. Because everyone wants to invest in real estate these days.

But now you know that it’s not as easy as they think.

Comments (4)

Great Article thanks Jonathan!

Steven Gralow, almost 6 years ago

Thanks for the comment, Steven. Sorry it took me so long to see it!

Jonathan Greene, almost 6 years ago

Thank you for the post, Jonathan.

I can agree on multiple levels, although I don't have the same experience you do. Ive only been doing this for a couple years now.

Im not one to boast, but I think I do really well in all those areas you touched on. My only downfall right now is not being able to utilize cash. Every property I own is leveraged, and then some. Everything ive built to this point has been through sweat equity, and relationships ive been able to obtain along the way. But, I still needed a place to start, and the bank makes that easier then my W2 paycheck.

That 25k kitchen you talk about, im building for 8k. Those 12k hardwood floors, im installing and finishing for 5k. And this is all over the course of months. Everything I save, is put into my projects. And most of them have been "house hacks".

I know I have A LOT to learn. Luckily, I enjoy all the challenges ive faced so far. You are right about one thing, though. It is not easy by any means!

Brian Ellis, about 6 years ago

Thanks for the comment, Brian. Sorry I didn't see it until now. The cash thing is just to help people know that starting off leveraged to-the-max can be soul-crushing when the market tanks. It sounds like you are doing well. Send me a message if there is anything I can ever do to help.

Jonathan Greene, almost 6 years ago