Why I Love Investing in Multifamily Assets

Working with capital raisers for a large multifamily syndicator, I often meet investors interested in apartment investing.

They see the attractive returns but do not invest as they feel only institutions or independently wealthy individuals invest in such assets. This is because they have not been exposed to the private equity syndication model.

The SEC regulations prohibit advertising to the general public, which puts an extra layer of mystery around these investments. As per regulations, only accredited investors are able to invest in these types of investments.

Most real estate investors start their journey by investing in smaller apartments – duplexes, four-plexes or 10 or 20 unit buildings. This requires being actively involved in managing the investment and most high-income earners simply do not have the time.

Due to the demands on their time, most high-income earners prefer to be passive investors in attractive assets. Instead of trying to learn/do everything themselves, in my experience, they employ the smarter strategy: focus on their area of expertise – medicine, law, accounting, business – while making their capital work for them by investing in attractive assets classes like multifamily properties.

Syndicate groups provide the exact service these investors are looking for.

Syndicates pool capital from passive investors for acquisitions and provide attractive income and capital returns. In the multifamily niche, most syndicates like to target older apartments (Class B or C, 1980s) because of the value-add component – renovations, implementing up-to-date systems, professional property management.

In my experience, value-add syndicators often target:

- Preferred Returns: 8-10%

- Cash on Cash Returns: 10%

- IRR: 20% over a 5 year period

With a volatile equities environment, great uncertainty around the public markets, and the scars of the 2008 recession still fresh, commercial multifamily apartments have stepped in as an attractive investment niche and have proved themselves as one of the best generators of wealth. This becomes more obvious when one considers the 4 fundamental changes causing this shift:

- Largest Rental Group – Millennials

- Second Largest Rental Group – Baby Boomers

- US Home Ownership Ratio

- Economies of Scale

Largest Rental Group – Millennials

The new households aged 18-30 numbers – 76 million – are driving increased rental rates. The 2008 recession has left them disenfranchised with the concept of home ownership and ~75% are more likely to rent than own.

Second Largest Rental Group – Baby Boomers

The largest demographic group in the US – 78 million – is transitioning from home ownership to renting and is likely never to own again. As the lifespan continues to increase, their rental demand lifecycle is expected to increase.

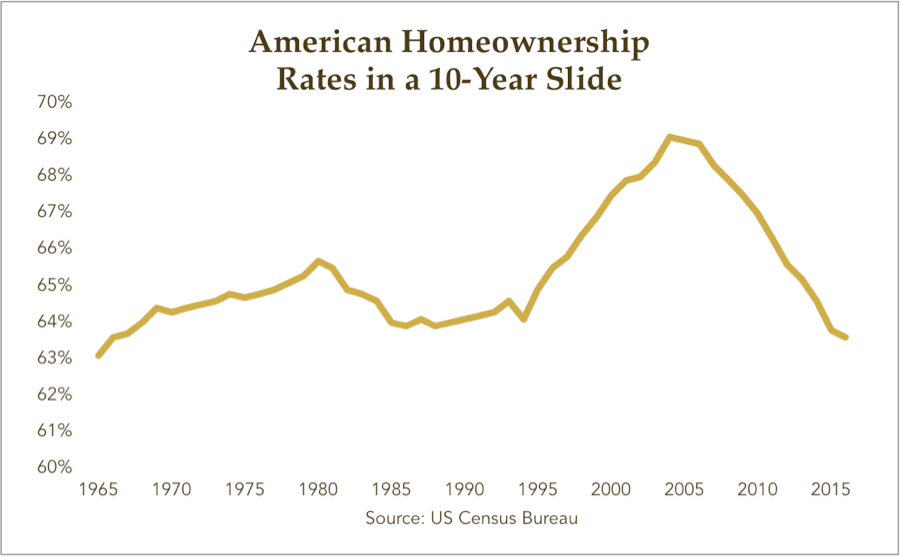

US Home Ownership Ratio

Home ownership has declined from 69.2% (2004) towards the mean of 64% (today). This displacement has driven, and will continue to drive, households out of residential owner-occupied property to renter-occupied apartments.

Source: Wellings Capital

Economies of Scale

Go Big or Go Home: Economies of scale at a very high level

Go Pro: Large multifamily apartments have access to professional property management on a different scale than smaller properties

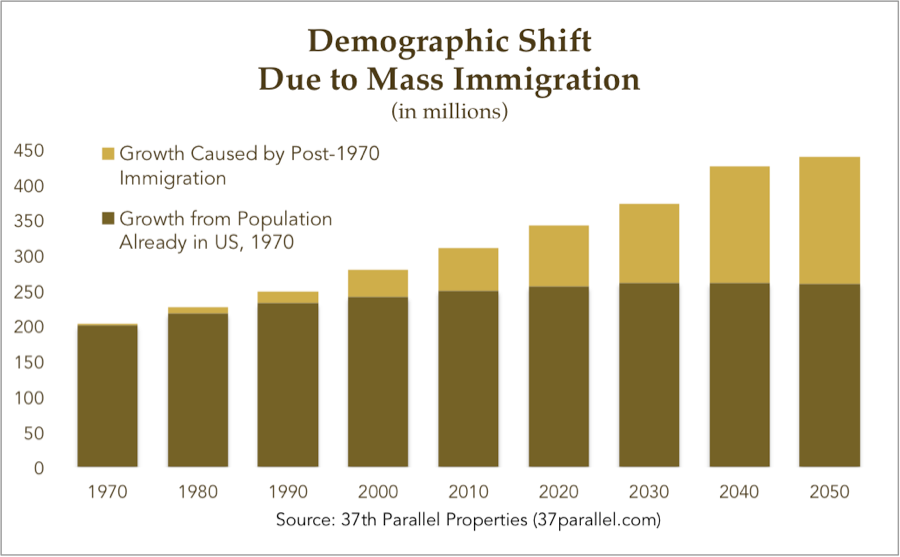

Furthermore, immigrants now represent half of the population growth in the US and studies have shown that immigrants tend to rent, not buy, when they first arrive in America, and they tend to stay in apartments longer than homegrown Americans. All these are reasons why the National Multifamily Housing Council has concluded that America will need 4.6 million new apartment units between now and 2030 to accommodate the increased demand.

Source: Wellings Capital

Value-Add Properties

Unlike non-commercial (> 4 units) residential properties that are valued on comparables, large multifamily apartments are valued on income method. Without going into detail, the formula is: Market Value = NOI / Cap Rate, where NOI is Net Operating Income and Cap Rate is the return an investor would expect to earn if they paid 100% cash.

This results in my favorite method to increase the market value (and our equity) in a property. For instance, when our group finds value-add properties and increase the NOI, we can greatly increase the market value (and our equity) of the property, even if the general market conditions are stagnant.

For e.g. if a multifamily property is valued at $1M at a cap rate of 7%, we should expect a return of $70K annually. Assuming the cap rate stays the same and we increase the NOI, even modestly, the market value will increase exponentially. In our example, if we increase NOI by only $15K, the market value would have increased by ~$214K! This concept called forced appreciation is what makes apartment investing and commercial real estate so powerful and so little understood by the average investor.

Keep in mind, we are not relying on comparable properties to drive appreciation as much as looking at what value-add opportunities our own residents would be willing to pay and letting the valuation model take care of the rest. Overall, we have more control in driving value than reliance on outside forces.

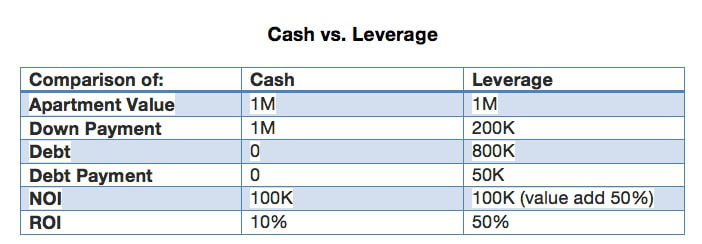

Leverage is the other big factor playing in our favor. This goes for all real estate but is especially powerful in multifamily apartments as we combine leverage with scale (200 units are better than 1 unit!). This idea is best explained with an example. For e.g. if we bought a $1M apartment building for cash and the building generated a NOI of $100K/year, then we are getting a 10% ROI (return on investment).

Now let’s assume, we purchase the property with the standard 20% down payment (or $200K) and added value to improve the NOI by 50%. Our new NOI would be $150K/year, less new debt payments of $50K, would result in a NOI of $100K (which is the same as buying all cash). However, $100K (NOI) / $200K (down payment) now results in a 50% ROI vs. the 10% on the all-cash deal! This is the power of leverage. You can see the table below for a quick summary:

Along with forced appreciation and leverage, the tax-advantaged nature of commercial real estate is another major (and attractive) feature. As mentioned earlier, syndicators target preferred returns of 8-10% and these can be offset as a paper tax loss on your annual K-1 partner distribution tax statement. This is because depreciation (the mother of all deductions!), property taxes and loan interest are significant deductions that offset gains.

Over the course of an average 5-year holding period, with accelerated depreciation, syndicators can easily ensure a stream of positive cash flows offset by tax losses i.e. the investor does not have to pay taxes on income. Additionally, most value-add syndicators frequently do a cash-out refinance (akin to refinancing your paid-up residence or getting a loan through a home equity line of credit (HELOC)) after renovations are complete and the NOI is stabilized. The IRS considers the refinance as a return of capital and hence, this is not considered a taxable event. At the time of sale, there is some depreciation recapture but the expected gain at sale is taxed at the long-term capital gains, currently 15%.

From an operational management point-of-view, more units equal more opportunity to gain economies of scale. This results in lower maintenance costs per unit. Obviously, there are certain thresholds after which onsite property management and maintenance makes sense. The cost of an onsite manager for a 100-unit or 20-unit apartment building is virtually the same, but cost per unit goes down dramatically as we move up in scale.

From a risk management perspective, my mentor, David Thompson, has shared his experiences in how multifamily apartments retain their value.

He has provided case studies where his operating partners have provided data showing how value-add Class B/C properties held their value vs. Class A properties, during the oil downturn in Houston. Class A properties had occupancy drops of 15-20%, as people tend to “psychologically” and incrementally move down the rental market (from A to B, but not A to C). Hence, Class B/C properties are able to withstand a higher level of stress (downturns, recessions) than more expensive properties.

In “The Perfect Investment”, Paul Moore’s research indicates that during the 2008 recession, delinquency on residential mortgages was as high as 4-5% nationwide while multifamily loan delinquencies were 1% and almost nil if you excluded over exuberant markets (think Las Vegas, Phoenix and Miami) and had experienced operators.

In summary, there are many benefits of being an investor in large multifamily apartments. Focusing on value-add Class B/C properties is where the most opportunities lie for attractive, risk-adjusted returns. Accredited status is required for many of these deals, but if you meet the criteria, you can get your money working in an attractive niche of an already attractive asset class.

Reach out to me and I can share some closed deals to help educate you further on what’s possible. If you’re accredited, we can spend some time understanding your goals and objectives to see if any future opportunities would be a good fit for you. What is most exciting is finding an asset class that can accelerate your financial goals and get you towards financial freedom faster!

This article can also be found at: https://www.boardwalkwealth.com/2017/10/love-investing-multifamily-assets/

Comments