RE Syndication: A Case Study with Numbers

In my last blog post Real Estate Syndication: What is it and How it Works, I mentioned a case study of a recent project. Well here it is. This one turned out to be a phenomenal success. The performance of this project can be attributed to three things: 1) Entering a sub-market at the right time, 2) optimizing management and rents, and 3) exiting at peak performance.

The property was a complete gut rehab triplex in an up and coming neighborhood in Philadelphia. We had a great working relationship with a local developer who gave us priority access to some projects. Negotiating and being true to the deal for a win/win can’t be understated in real estate. While still under construction, we agreed to a sale price of $420k with no contingencies. Don’t do this unless you have a tried and true relationship with the developer!

UNDERWRITING THE PROPERTY

The underwriting process is the most critical aspect of the deal. Underwriting the deal is all about knowing the numbers that make up income and expenses over time and then seeing if or how those fit into an investment model. We knew that if we hit our conservative projected rent rates, we would be buying at 7-7.5% cap rate with lots of potential for that to increase over time. Lots of numbers and fancy analysis tools go into our process. Reach out if you want to dig in deeper here, but be sure to love math and formulas!

FUNDING THE DEAL

When calculating the total raise amount, we estimated additional expenses – closing costs, lender fees and points, legal fees, and a variable amount – to ensure we could close. The amount was then converted into a share price equated to a percentage equity. For this project we needed to raise $130k, which meant $13k for a 10% equity share. This calculation also considered a sweat equity share for the sponsor. The rest of the money came from the bank. Leverage is the operative word here, which I will cover in a future blog post.

Going Beyond the Basics

Raising funds is pretty straightforward. We create an offering in the form of a detailed analysis of the project, pro-forma and expected returns. From there it’s a matter of reaching out to our existing network of prospective investors for interest. We quickly received responses from 2 investors interested in funding the whole deal. Done!

PROPERTY PERFORMANCE

As I mentioned, the performance of the property is where you make the deal work. It’s about getting the rent and expense projections as accurate as possible, while balancing expectation for some unforeseen expenses.

In this case we projected just over $45k a year in gross rents, including a 3% vacancy rate. We don’t cut corners in our marketing and advertising, which translates into fast lease-up and quality residents. We also start marketing as soon as we find out a resident is leaving, so we didn’t have more than a couple of days vacancy at any time during ownership. This isn’t easy!

The actual gross revenue, which included laundry income, was actually over $48k year one. Unit rents were $1350, $1290 and $1350. We raised rents mostly on turnover or after the two year anniversary for existing residents. Rent increases weren’t large, but that’s because we got the rent right from the start. From there you’ll see in the chart below that the cash flow was well in the black each year. The fluctuations between years is primarily due to acquisition date (Year 1), the timing of last quarter owner draws (Year 2), and apartment turnover costs (Year 3). We also were recognizing rent payments when made instead of on the due date, which we have since changed.

Getting the Rents Right Drives the Most Value

PROPERTY VALUE

Several factors drive a property’s appreciation rate.

First – property location. This building is directly off a major street in a quickly-developing area of South Philadelphia, minutes from public transit, food/drink establishments, and shopping. The location is central to many major employers within the region.

Second – initial property quality. The layouts and finishes in each apartment are above what is typically found in the neighborhood.

Third – maintaining property quality. Through our in-house management services, we maintain the building in the best condition possible to make it just as desirable for future residents and owners. Too often we see new construction apartments become neglected after a resident is placed. There’s a lack of routine and proactive maintenance, communications go unanswered, maintenance issues go unresolved, and conditions can quickly degrade. This results in unhappy residents, higher turnover rates, lower quality new residents, and bigger maintenance headaches (and costs!). The value of the asset declines or doesn’t appreciate at the rate it might otherwise. Ultimately this leads to a lower sale price than one might otherwise get.

The chart below shows the value of the property explode upwards. The buy and sale price are actual, with the years in between calculated based on the average increase per year from the sale price.

Maintaining the Property Accelerates Appreciation

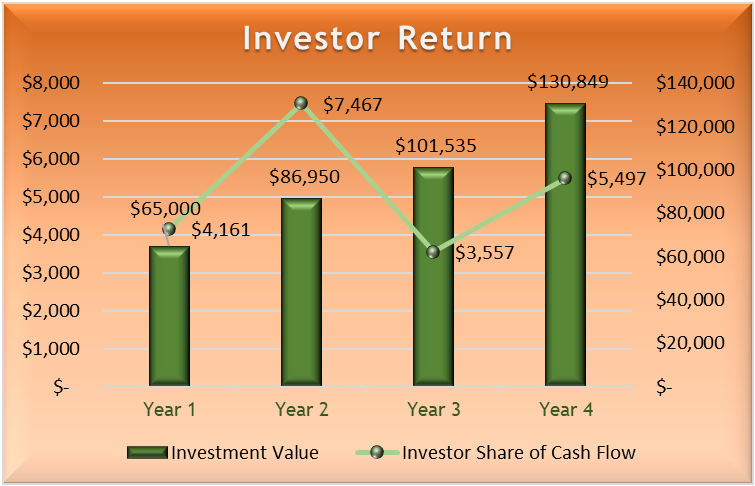

INVESTOR RETURN

This is the fun part. There are two truly rewarding aspects in this business. One is the joy of moving residents into a new home. The other is turning investor funds into great returns. The tax deferred income and building wealth along the way helps too. As you’ll see in the chart below, investors doubled their money in under four years. All while also receiving a draw based on net cash flow every quarter. The end result? Both investors turned an investment of $65k into $130k. As the project sponsor, we shared in the wealth by meeting performance incentives mapped out in the operating agreement. The overall performance and return on the property was a whopping 33% IRR!

What might not be obvious is that at the end of each year there were no taxes paid on this money. Consult with you accountant on the specifics, but just know that investment property is very tax friendly. That being said, there are taxes that need to be paid upon sale. These taxes are typically lower than ordinary income rates.

Great Investments Generate Great Returns

Great Investments Generate Great ReturnsCONCLUSION

This is a case study in hitting a home run over a relatively short period of time. As I said, this is not the norm, but even if you slice the return in half it beats most alternative investments. From the investor’s perspective, they had the same level of activity as owning stock. This is the true beauty of real estate syndication.

We don’t know where the market is heading, but as long as you recognize that real estate is a long-term wealth tool, there will be deals in every phase of a market cycle. Please let me know what other real estate investing topics interest you.

Please be sure to lave me a comment below or reach out to learn more. I also encourage you to share this to your social networks. There’s nothing better than helping friends and family with great knowledge.

Thanks for reading!

Comments