The Key to Wealth in Real Estate is Relationships

The past month has been all about process and relationships. The checks continue to roll in from my two single family rental properties. The property in Virginia is bringing in about $50 a month in cash flow while my Milwaukee property is bringing in $350 a month in cash flow. That’s an additional $4,800 a year. My immediate goal is to make that amount per month in cash flow. The purpose of today’s blog is to highlight the actions I’ve taken in the past month to get closer to that goal. If you’re reading and following this blog it’s probably because I’m providing full transparency and actual details. Here we go.

Relationships

Realizing you cannot do everything yourself for a sustained period of time and after making a hard commitment to my mastermind group, I dove right in. I looked up the most successful real estate agents in Fayetteville, Arkansas based on Zillow, then I cross searched that with investor friendly agents. I also searched investor friendly agents/brokers on BiggerPockets. As a result, I reached out to the three top agents according to my research. One agent was going on vacation and said she’d get back to me in a week, the other was slightly interested and put me on her MLS email (mildly useful), and the other exchanged emails and showed interest in investing. I’ve spent the past month getting to know this guy, figuring out what his personal values and future goals were. As a result, we’ve built a solid relationship and have tossed around the idea of partnering on flips. To date, we’ve looked at three specific deals he has found, ran the numbers, and are pending further action. One of my future post will be about a success him and I have, I can almost guarantee it.

David Greene talks about relationship all the time. One of his primary points is always about the value a person brings. For me, I bring capital, two deal experience (although basic and easy), leadership & decision making, and a great attitude. In terms of capital I see it as a total of $175,000 broke down as such:

- 1. Saved income $50k of cash today and growing.

- 2. Access to a private lender for another $30k-$40k.

- 3. I’m active duty military-$40k from American Express in a 3 year interest free loan.

- 4. I can cross collateralize the equity in my two properties for about $50k.

Of course, I’d only put some of that money to use for an awesome deal because it comes at cost. I’m continuing to grow my local network in Arkansas through referrals to a couple of local lenders and property management. The bottom line is; be clear on your values, your value, and your goals. Consistently meet and talk to people in the markets you’re interested in and the components will start to fall in line.

Process & Systems

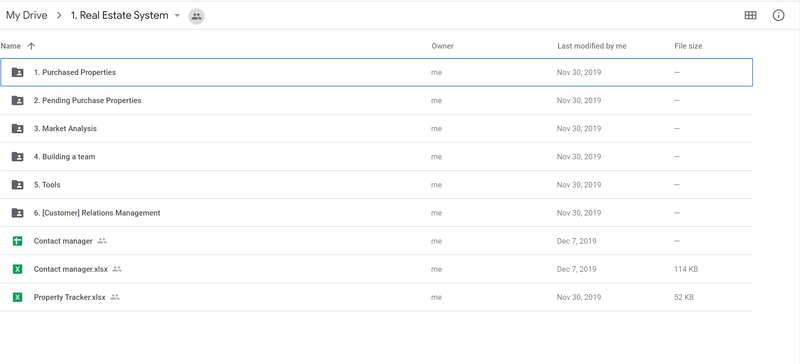

I’m entirely confident in my ability to build teams and build a formidable real estate portfolio. A concern I have is ensuring I build it correctly. Our idea of correctly is that it is systematized and organized from the beginning. As we scale, we can easily hire out parts of the organization. Determining what parts are hired off will be a blog post for a later date. People call these systems, I personally see it as being organized. Here’s how I’m using google drive.

I’m organized into six primary folder and two first level documents. The first level documents are a snapshots of both properties and contacts/relationships. The properties document highlights dates of maintenance and other capital expenditures that were completed. It allows me to project when things need to be done. Conceivably my property managers are doing this too, but my job is to manage my managers.

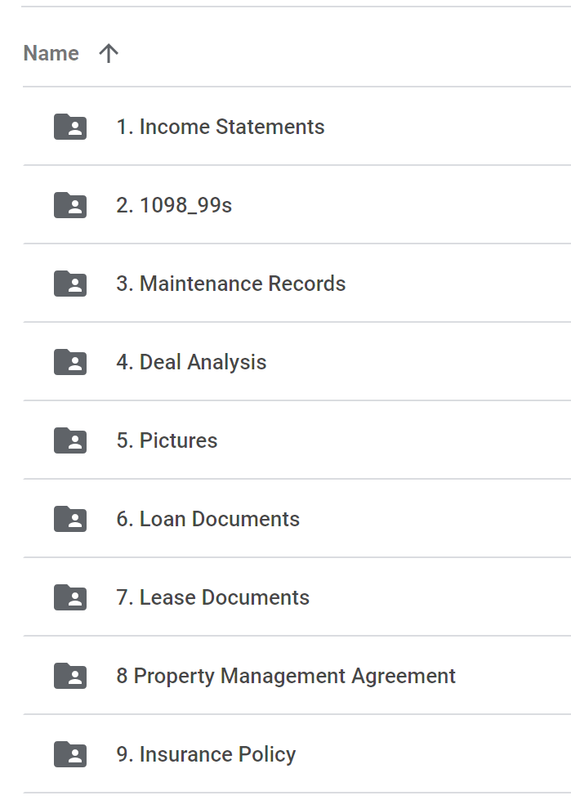

Purchased properties have sub folders with property addresses. In each of those includes the folders you see pictured below.

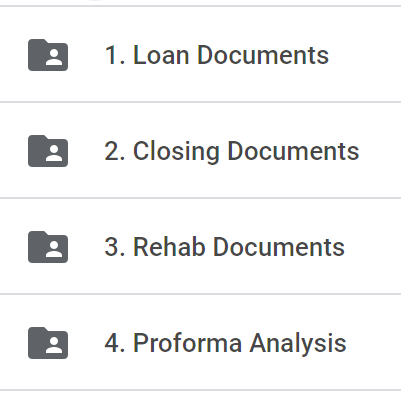

While properties that are under contract and in the process of closing include this:

Each folder includes a sub folder for the typical requirements you’d have in a loan, closing, or rehab. As you can probably imagine the other folders have a number of various tools and excel spreadsheets that allow me to analyze or track some aspect of real estate.

If you want to connect or have questions about my journey you can find me on Instagram (rei_aw) or facebook (Adam_Rei) or Linkedin. If you want me to write more specifically about an aspect covered in my journey leave a comment.

Comments