3 Big Data Trends for Real Estate Investors

The Deal is in the Data

What are real estate investors looking for? Great deals! Properties that are in distress with a high upside of value.

Investors use a multitude of sources to locate these deals. These strategies include, but are not limited to:

- - Searching on the MLS (i.e. public websites like Zillow or Redfin)

- - Craigslist (i.e. searching properties listed by the homeowner)

- - Facebook groups (i.e. responding to a post from a person that needs to move and sell their home fast)

All of these strategies encompass using data to make informed decisions. Data used to be expensive to obtain in terms of feasibility. Now data is cheap. It is right at your fingertips!

You can browse through Zillow for deals on your phone while you wait in line for your tall Starbucks coffee. It's incredible right? Or is it?

With everyone having the same levels of access to property data online, the advantage of having it becomes stale. It is more important to be the first to receive property information. Similar to the concept of frontrunning in trading.

How can we obtain data that provides us an advantage to find incredible deals?

We need to leverage new types of data, specifically big data analytics.

What is Big Data Analytics

As stated by SAS Insights, Big Data Analytics is:

Big data analytics examines large amounts of data to uncover hidden patterns, correlations and other insights. With today’s technology, it’s possible to analyze your data and get answers from it almost immediately – an effort that’s slower and less efficient with more traditional business intelligence solutions.

Basically, big data is like the evolution of driving a 1990 Toyota Tercel vs a Model S Tesla. With the old school car, the only data you're receiving is about the vehicle itself. This includes the speed, mileage, and gas tank level. Big whoop.

Now with the Model S Tesla, you not only get information about the vehicle but also of the surrounding environment. Features include parking sensors, auto-raising suspension based on location, and emergency braking for pedestrian detection.

This is possible with the computing power to process large datasets from cameras and sensors in real-time. The data helps you make better decisions and ultimately a better driver.

Let's see how big data is shaping the landscape for real estate investors.

3 Trends

1. Foot Traffic

Scope

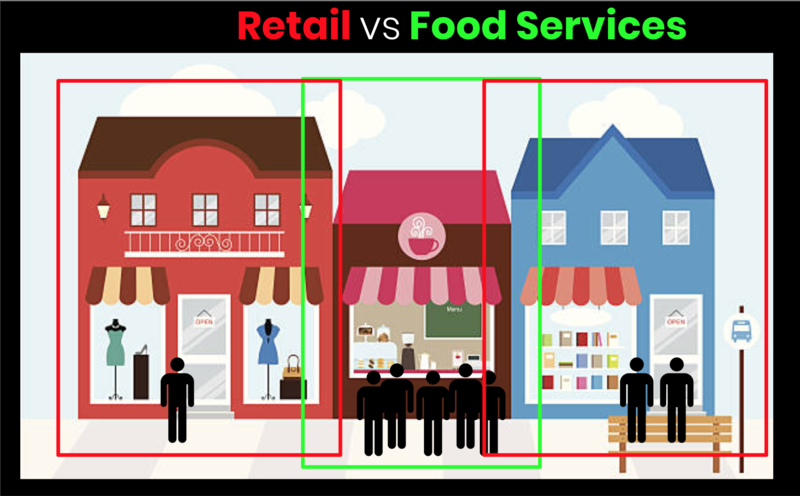

Let’s imagine we are landlords for a commercial real estate property, like a strip mall. Our strip mall hosts several lines of businesses including retail stores and service-based stores. We have two vacant units that we would like to fill.

How should we fill these vacancies?

Problem

Our concern is the type of businesses in our strip mall. We want them to be profitable. That way it lessens the likelihood of our tenants becoming bankrupt, creating a vacancy, and cutting into our profits.

In that case, it interests us to know the foot traffic of the stores on our property. Knowing the number of people entering a store is a good indication if that store is receiving business.

Is foot traffic increasing or decreasing over time for certain lines of business? Can we use this information to identify which types of businesses we should target to fill our two vacant units?

Setup

We can use cameras as our data source. The live stream from our cameras can be processed for people detection. We can have our system track the count of total people entering or exiting a store.

Findings

We monitor foot traffic and see that each retail store generates a small number of people entering their stores daily. Each week we see the number of total visitors decreasing.

It makes sense the retail industry is suffering, considering online competitors like Amazon taking large market share.

Next, we focus on our service-based stores, like Sue’s cafe, and notice a spike of foot traffic. There is high foot traffic throughout the day to this store.

Strategy

We continue to monitor traffic and notice, in general, our service-based stores such as restaurants, cafes, and spas have WAY more foot traffic on average than our retail businesses that sell clothing.

We can use this information to help make decisions for what future tenants we want to fill vacancies.

We should focus on filling our vacancies with service-based stores since they generate more foot traffic and become more sustainable businesses. What does that mean for us landlords? Long term tenants with less chance of failing businesses that BAIL. It’s a win for us!

2. Job Postings

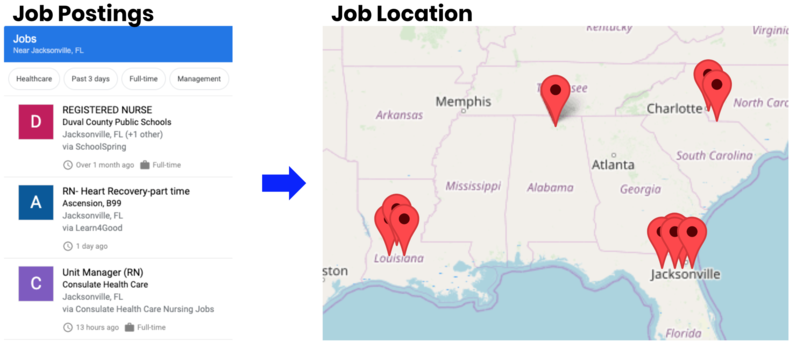

Investors frequently seek out markets that are hiring occupations that are high in-demand for the future. In-demand occupations can mean stable tenants and market growth.

We can identify in-demand occupations through job postings. Job postings are an advertisement created by a recruiter that alerts the public of a job opening within a company.

Job postings used to be posted on bulletin boards or referenced by word of mouth. Lucky for us, we can get all the job posting information on the web.

Scope

We are looking to identify areas of future job growth. As baby boomers age into retirement, there is an increase in demand for nurses. By locating what areas are hiring nurses the most, we can target what markets to invest in.

Setup

We choose Google Jobs as our data source from the web to gather job posting data. We use web scraping to pull elements of interest from the web page. This can be converted to a digestible format, like an excel file, to process for decision making.

Findings

We set a few parameters: our keyword is "nurses" and the time window of postings is 30 days. We use a third-party tool or our trusted data scientist (me!) to perform web scraping.

We log information such as the job location, type of employment (full-time vs. part-time) and time posted.

We plot our data on a map and see Jacksonville, Florida is the location that is hiring nurses the most!

Strategy

There are several investment strategies we can pursue with our new knowledge.

We can look at commercial real estate properties with units meant for medical facilities such as doctor offices, nursing home facilities, and other private practices.

We can also look at single-family homes in neighboring towns. If there is an influx of nurses in the area, they’ll need a place to live right? The neighborhood where they work may be too expensive so we can look at close neighborhoods that expect high demand for renters.

Also, by tracking a profession like nurses, we can expect some of them to continue in their education. This may be an indication for us to invest in multi-family properties in nearby college towns to the facilities in Jacksonville they work in.

3. Social Media + News

Social media posts contain rich information on public opinions posted by users. These posts can be distilled using sentiment analysis.

Sentiment analysis is an AI method that can classify text data as positive, negative, or neutral.

How can we use this text data for our benefit?

Scope

We are looking for new areas to invest in. There is a trend in the New York metro area of people sprawling out to neighboring towns, such as Hoboken and Bushwick. These towns that were once Class C areas now have some of the best tenants and strongest rent growth in the housing market.

What these towns have in common is that they are in close proximity to NYC with easy access to public transportation. We want to find the next local town to become a commuter hotspot.

Setup

We use Twitter's API to extract tweet content. We log information like tweets, time, and location. Then, we apply natural language processing, a branch of AI, for our computer system to interpret text data.

Findings

We identify there are neighborhoods surrounding NYC that have not received a surge of growth due to their lack of reliable transportation. Locals are angry with the current infrastructure in place. It can take over an hour to drive less than 15 miles.

This information does not give us an indication to invest, however, we can keep it on our radar. We can set up web crawlers to process online news articles that reference the neighborhood's development.

Several months later, our system alerts us a deprecated train line is being revitalized by the city's transit service. This will alleviate road traffic, improve transit options, and increase demand in the area.

Strategy

We continue to use web scraping to track the progress of the train line development. We can scrape data from the town's site for permit data. Once we are confident the revitalized transit line is happening, we invest in a property in the neighborhood.

Our property cash flows from day one and increases year over year through rapid appreciation. Thanks to leveraging big data.

Conclusion

Big data is key to analyzing new investment opportunities at SCALE. It should be on the radar for every investor in their process of analyzing new investments.

Check out the supported YouTube video here.

Comments