What Does the Rest of 2020 Hold?

While it’s impossible to truly predict the future of the U.S. housing market, we can look to the educated guesses made by the experts in the industry.

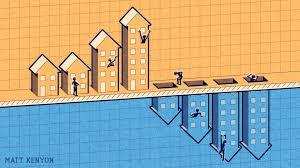

The Yo-Yo of Recovery

While we’re in the midst of a strong seller’s market — a trend that will likely continue due to tight inventory and high demand, particularly in secondary markets — it’s probable that we will see a “yo-yo” effect in the real estate industry. While May saw a surge of homebuying and market activity, this activity will likely retreat as COVID cases spike and some cities return to stay-at-home orders or other public health provisions. While a resurgence of the virus was expected for the fall, we’re already seeing a growth in cases that could put a damper on real estate transactions. At the same time, inventory will no doubt remain tight while demand for larger homes with more amenities grows and demand for apartment housing shrinks.

A Big Economic Question

While interest rates and inventory conditions are likely to sustain home equity in the coming months, the economy will play a major role in where the real estate market goes from here. As government financial provisions and protections expire (including increased unemployment benefits and rent and mortgage relief) and the distance grows between Americans and their stimulus checks, we will likely see a rise in foreclosures. With a high unemployment rate and a general lack of market affordability, it will be difficult for American families particularly those in lower-income tiers, where jobs were most impacted to afford their living arrangements, be it mortgage or rent payments. The recovery of the economy or lack thereof will play a major role in the state of the housing market moving forward. Developments in new government relief packages, virus trends, and vaccine dates will all shape the real estate market.

As we enter the second half of 2020, we can make some wise predictions while recognizing that these are uncertain times. Real estate market moves will take a cue from dozens of nuanced factors and because of this, real estate investors would do well to invest wisely with the experts by their side, guiding the way through an ever-shifting market.

Topics: COVID-19, Real Estate, Investment Work cited: Chris Clothier, July 15, 2020 https://blog.reination.com/the-present-and-future-for-the-u.s.-real-estate-market

Comments