Deferred Sales Trust – The 1031 Exchange Alternative

I’d be willing to bet that the single largest expense over your career will be TAXES.

I see too many doctors/high-income professionals that accept this fact (paying up to 50% of their salary to the IRS) yet fail to address it.

Maybe they become complacent and simply accept it for what it is? I’m not sure but if you haven’t found a CPA or tax advisor that can assist with a tax deferral strategy or tax planning, put that on your to do list.

Only YOU can take action and get the ball rolling to keep from paying Uncle Sam any more legally than you need to pay.

Yes, you should work hard but also smarter the more years you put under your belt.

One of the ways that I’ve personally been able to do this (besides connecting with great CPAs) is investing in an asset class that receives some of the best tax advantages the IRS allows…..real estate assets.

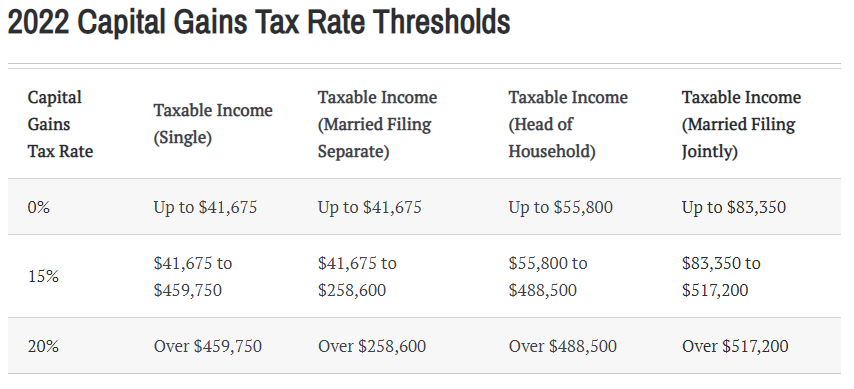

But once you sell property, typically you’ll be taxed on that sale which is called a capital gain.

Some of the common strategies real estate investors use to defer any capital gains tax exposure when selling investment property are by using:

- Delaware Statutory Trust (DST)

- 1031 exchanges

But these aren’t the only options.

Another tax deferral tool that allows postponement of capital gains taxes are deferred sales trusts.

What Is a Deferred Sales Trust?

When selling real property or other assets subject to capital gains tax, a deferred sales trust is a method that can be used to defer that tax.

For example, if you’re selling an apartment complex, typically you’d receive the sales proceeds at closing. By using a deferred sales trust, these proceeds are placed into this trust and only taxed as the funds from the sale are received.

This allows you to reinvest money from the sale into investment vehicles that aren’t allowed by other capital gains tax deferral strategies.

Internal Revenue Code 453 is a tax law that prevents a taxpayer from having to pay taxes on money they haven’t yet been received on an installment sale.

This is where the deferred sales trust comes in. The process works by selling the asset (i.e. apartment complex) to the trust with an installment sale.

Next, the trust sells the asset to the buyer and the funds are placed in the trust without paying taxes on the capital gains. The trust doesn’t have any capital gains taxes because it sold the real estate asset for the same amount it paid for it with the installment sales contract.

If you’re the seller, because you haven’t physically received funds from the sale, you don’t pay any capital gains taxes yet.

With this set up, instead of the buyer paying you in one lump sum at the time of sale, the buyer agrees to pay you over multiple future installments which can start instantly or be deferred for several years.

The third-party trustee can invest the funds however you like. You can earn interest income on the money from the sale while it sits in the trust and only begin paying capital gains taxes when you start receiving principal payments.

IRS Rules Governing Deferred Sales Trusts

As you can imagine, the Internal Revenue Service (IRS) has a few strict guidelines in place with regards to the formation of these trusts.

- The trust must be completely independent of you and any business or personal interests.

- All sales proceeds must go to the trust and not to any investors.

- All ownership interests must be relinquished by transferring it to the trust prior to selling an asset.

How Does a Deferred Sales Trust Work?

Here’s the breakdown of how the use of a deferred sales trust works:

- A third-party trust is formed that will be managed by a third-party trustee.

- The capital asset is sold to the trust (not individual) using an installment contract or installment sale contract.

- The trust holding the asset then sells it to a buyer.

- The trust receives the funds of the sale.

- A third-party trustee either distributes installment payments or invest the funds via the seller’s instructions.

- The seller must pay capital gain taxes on any amount received from the installment payments.

Here’s an image of the process courtesy of jrw.com:

Why You Should Defer Capital Gains Taxes

The difference between the amount you sell an investment for and your “basis” in that investment is termed a capital gain.

Usually the basis represents the purchase price or fair market value at the time it was acquired.

Example

If you purchase a duplex for $200,000 and 5 years later it’s sold for $500,000 then you’ve made a capital gain.

In this example your basis is $200,000 (purchase price). If you subtract this amount from the property’s selling price then the capital gain is $300,000.

($500,000 – $200,000 = $300,000)

This particular capital gain counts as a long-term capital gain.

If you hold on to an investment before selling for less than a year it’s considered a short-term capital gain and the tax rate is the same as you pay on wages and other “ordinary” income.

For most doctors and other professionals this could be up to 37%.

Using a deferred sales trust doesn’t get you out of paying capital gains taxes, but it does allow you to defer them while you reinvest the money.

Potential Advantages of a Deferred Sales Trust

The primary benefit using a deferred sales trust is that you’re able to defer capital gains taxes.

Other potential advantages can include:

#1. 1031 exchange option

One of the ways someone can defer taxes is by using a 1031 exchange. The timeline looks like this:

- Timeline #1 – You have 45 days after you sell your property to identify up to 3 new properties. This can be done in writing but you have to purchase one or more of them.

- Timeline #2 – You have 180 days to close on one or more of the three properties that were identified.

If you were trying to use this method yet missed a deadline, then your Qualified Intermediary (QI) might send the funds back to you. If this is the case, you’d responsible for capital gains taxes.

By using a deferred sales trust, the QI releases funds to the trust instead of you.

#2. More investment options

If using a 1031 like kind property exchange, you’re restricted to investing in real estate property only.

For someone that doesn’t want to continue investing in real estate, the deferred sales trusts offers options when it comes to alternative investments such as:

- stocks

- other real estate

- bonds

- cryptocurrency

- CDs

- REITs

- mutual funds

Potential Disadvantages of Deferred Sales Trusts

Here are a few potential deferred sales trust disadvantages:

#1. Complex

Due to the tedious set up process, launching and managing deferred sales trusts can be complex in nature.

#2. Depreciation recapture

If accelerated depreciation was used that resulted in deductions higher than the straight-line method, you could incur depreciation recapture taxes when using a deferred sales trust.

#3. Taxes are deferred (not eliminated)

Remember, when using a deferred sales trust, your capital gains taxes are deferred and NOT eliminated.

When you begin receiving cash from the trust, you’ll have to pay capital gains taxes on those principal payments.

How Do You Create a Deferred Sales Trust?

If you’re interested in getting a deferred sales trust set up, contact your tax attorney, CPA or an estate planning attorney with experience regarding this process.

The third-party independent trustee must not be related to the beneficiary or the real estate transaction. They’re responsible for managing the trust and the money in it according to the taxpayer’s risk tolerance.

There are many things to consider when using a real estate tax deferral strategy which makes it imperative to work with a professional that understands the tax code. This person can assist you choosing the best tax strategy for your real estate investments.

Bottom Line

A deferred sales trust can be a valuable estate planning tool. When entering retirement, you’re able to elect when to begin receiving payments from any interest earned from funds held in the trust trust.

When you take a payment you must remember that it will generate a taxable event.

For those that have failed to complete their 1031 exchanges, a deferred sales trust will allow them to defer capital gains from the sale of their assets.

Due to its complex nature, it’s a good idea to have an estate planning team and/or seek legal advice with those that have experience setting up and operating deferred sales trusts to ensure it’s valid and properly managed.

Comments