Is the Fed Acting Political, by Trying Not to Act Political?

Welcome to the Skeptical Investor blog, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today, we’re talkin’ potential war, risks to economic growth, and is the Fed acting political by trying not to act political?

Let’s get into it.

---------------

Today’s Interest Rate: 6.84%

(👇.07% from this time last week, 30-yr mortgage)----------------

The Weekly 3 in News:

- - Nashville Property tax rate, lower? Last week, the city council approved its annual budget, with a blended property tax rate of 2.81%, lower than the current rates of 3.254% and 2.922%. However, home values are up, so despite the lower rate, many folks will pay more this year in property taxes. Property taxes fund more than 50% of the entire city’s budget (WSMV).

- - Home purchase application data is up +14% year-on-year. “This despite elevated mortgage rates, trade war uncertainty, rising property taxes and home insurance, terrible consumer confidence data and a downgrade of the government’s debt. But, housing demand continues to hold up (Mohtashami).”

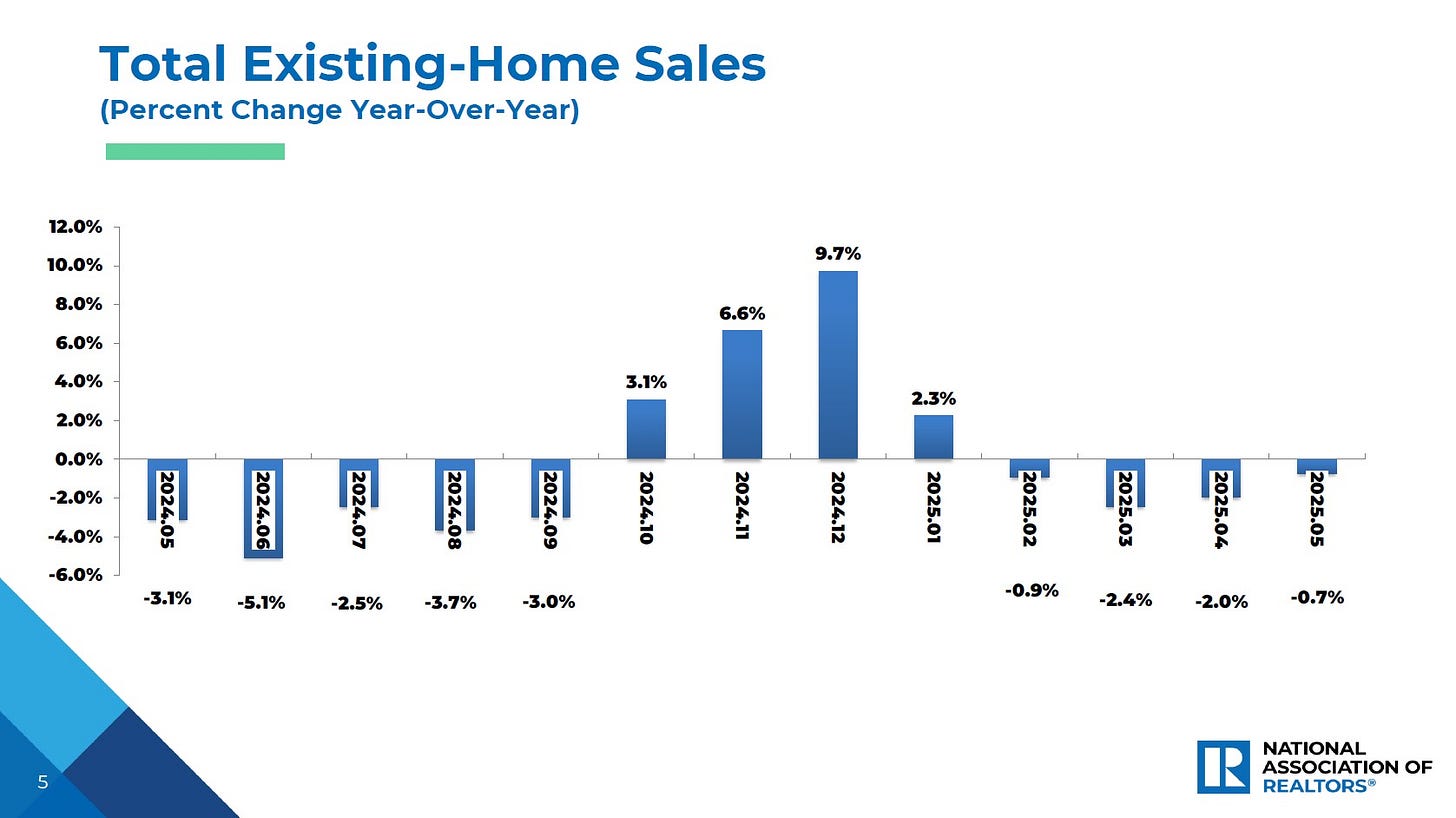

- - Existing-home sales are fairly flat, suppressed by relentlessly high interest rates. In May, sales rose .8% but were down .7% year-on-year. Median existing home prices were up 1.3% to $422,800. Sales elevated in the Northeast, Midwest and South, but retreated in the West (NAR).

Earth. It’s not boring, that’s for sure.

Last week, I said there were only 2 real risks for investors to monitor:

- - the US government deficit-spending us into oblivion, and

- - a global trade war.

If either one of these two things happens, all bets are off, and we likely are in for a deep recession (although interest rates would plummet, and we all would refinance, which is one reason real estate is such a robust financial strategy).

If neither happens, we’re fine. The economy should keep chuggin’ along.

And I added an honorable mention: actual war. That could screw up our GDP’s mojo.

And then a few days later, we bombed Iran.

Shit.

Are we “at war” now?

Now, I’ve heard from a lot of you, and no, I didn’t have any inside information. I’m not deep in the government game anymore. Just a tingle in my spine, and I thought to mention.

But it’s a stark reminder of why we must always remain skeptical and prepared for when the heat comes ‘round the corner. This is when we, as investors, must exercise our skeptical thinking muscle. What are the 2nd, 3rd 3rd-order effects of this conflict? Are the headlines correct? If not, what sources have their finger on the pulse? How could oil prices increase? Could they decrease? Is Iran even capable of closing the Straight or Hormuz? What are the exit ramps for both countries? How may the US get involved, get more involved, or stay at arms' length? Etc...

Investors need to think through where the incentives are, who benefits from what, and who is damaged by what decisions…? As the famed investor Charlie Munger was fond of saying, “show me the incentive and I’ll show you the outcome.”

So, no. We are not in a war. Not at this time. Not my a long shot.

Israel and Iran may be, but not the US. Thus far, this is sadly business as usual for the US, and for us humans.

Remember, every US President in the last 40+ years has authorized targeted strikes on a foreign nation, mostly in this area of the world. Didn’t know this? Here is a short list:

- - Biden - 2021, Syria. 2021–2024, Yemen. 2021–2024, Iraq. 2021–2024, Somalia.

- - Trump 1.0 - 2017, Syria. 2018, Syria. 2020, Iraq. 2017–2020. 2017–2020, Somalia

- - Obama - 2011, Libya. 2014–2017, Syria. 2014–2017, Pakistan. 2011–2017, Yemen. 2011–2017, Somalia (not counting the Iraq and Afghanistan wars).

- - GW Bush - 2008, Somalia. 2008, Pakistan (not counting the Iraq and Afghanistan wars).

- - Clinton - 1993, Iraq. 1998, Sudan.1998, Afghanistan. 1998, Iraq. 1999, Serbia.

- - Bush 1.0 - 1989, Panama. 1993, Iraq.

- - Reagan - 1986, Libya. 1987, Iran. 1988, Iran.

This is important context for us investors.

Of course, this can always change. So far, this conflict is noise investors should ignore.

So far, the market agrees.

After the US conducted airstrikes in Iran, Iran's “Parliament” voted to close the Straight of Hormuz (pending Iran's Security Council approval aka their dictator the Ayatollah). Yet, as I write this on Monday night, the stock market is UP and oil prices are DOWN.

Always be skeptical of the headlines.

Further, my intuition is that Iran won’t try to close the critical oil passageway. Or at least, that is not a concern of mine, as of now, for two reasons: 1) They likely lack the capability to keep it closed past a few days, and 2) it would have an asymmetric effect on China and most all other wealthy oil-selling, Middle Eastern countries. Far more than the US. Here is who relies on that passageway:

The truth is, disruption in the oil-rich Middle East is just not as relevant to our country or our markets as it may have been 20 or even 10 years ago.

The oil markets figured this out quickly. Here is a chart of oil prices this month.

Although, it should be said that oil is a global market. So even though the US is energy independent, our oil prices could go up considerably. That on its own could bring us into a larger conflict, and if it persisted, would limit US economic growth. And the severity of those economic effects would depend on how long the passageway was closed. Keeping oil moving through that area of the world would likely be the priority for all involved, so again, it likely wouldn’t stay closed for long. After day 3, 4, 5…. Iran’s feeble military readiness, weapons stockpile and logistics capabilities would be revealed. The only major world player I can think of who may support it is Russia, as they are eager to sell more of their oil to Asia.

On CNBC yesterday, famed investor Tom Lee translated how markets are taking the news.

And just this, BREAKING NEWS! As I’m writing this, there may be a ceasefire deal on the table, per the President:

And then an hour ago, Israel and Iran both either violated the ceasefire or poured on the violence just hours before it was to begin, which made the President, well, not very happy. The truth is, we may have multiple ceasefires that are violated, on again off again, especially when Iran has so many third parties it funds.

War and violent conflict are horrible things, and I hope it ends as soon as possible. Ukraine-Russia too. And conflicts all over the world. But, again, my point is, the Iran-Israel conflict may not really matter all that much for you and yours (strictly speaking, as investors, of course). The US is stronger and more independent than today than ever before.

So, since we are investors, let’s shift gears back to the US, and see what we need to do to get our house in order (pun intended).

Is Powell Acting Political by Not Trying to Act Political?

The Federal Reserve chose not to cut interest rates at its meeting last week.

Why?

Inflation is down, labor markets are showing signs of deterioration, no trade war has happened, and by its own numbers, the Atlanta Fed predicts that GDP is slated to grow a robust 3.4% this quarter.

“For those in the real estate and mortgage industry, remember that 65%-75% of the movement in the 10-year yield and mortgage rates is driven by Fed policy, which is why Fed interest rate hikes and cuts matter (Mohtashami).”

So what was Chair Powell’s reasoning?

Here is a summary of his comments on 6/18/25:

- Will likely get to a place where rate cuts are appropriate.

- The Fed will make “smarter” decisions if it waits a couple of months.

- Fed expects “meaningful” amount of inflation in the coming months

- Unemployment remains in a “reasonable” place.

- It will take time to see how large the inflation effects will be.

- The Fed’s inflation forecast for this year is higher due to tariffs (Kobeissi).

This doesn’t seem like they are being “data dependent” to me…

Wells Fargo and famed investor Tom Lee hammered home this point yesterday. Goods, housing, and car inflation continue to tick down, and are showing no tariff impact.

The Fire Under the Fed has been Lit

The President and most lawmakers on Capitol Hill in both parties want the Fed to cut rates. The President, the Vice President, Secretary Bessent, Secretary Lutnick, the Director of Federal Housing FHFA..even fellow Federal Reserve Governors, area all calling for the Fed to cut, or even to resign.

Again, as I wrote about last week, the Campaign to Cut against the Fed has begun.

The Administration is now blatantly attempting to influence monetary policy, without replacing Powell. The next step is for the President to name a successor. I predict he will by the Fall, especially if the Fed doesn’t act by September. And this person, with encouragement from Administration officials, will take to the media with a clear and calculated message: on day 1, the Fed will cut rates and lower mortgages. If successful, this campaign would signal that this shift in monetary policy is inevitable and will take place in just a few months, moving bond markets. In other words, if the Fed does not act, the bond market will do its job for them.

And at some point, it would appear overtly political if Powell does NOT cut rates, rather than the reverse. Perhaps we will have to wait for that point, likley this Fall.

What to watch next.

The next part of the campaign will be to shift from blaming the Fed for high interest rates (and thus making cars, houses, business investment etc.. more expensive) to risking job losses. This will be phase 2 of the campaign, so be on the lookout. I predict that if and when phase 2 begins, rates will tick down further.

The Fed’s Curious Calm Amid Labor Market Stagnation

Frankly, the Fed’s recent behavior raises eyebrows, particularly when juxtaposed with its earlier concerns on unemployment. For months, the Fed has leaned on the narrative that its policy stance is "moderately restrictive"—a tidy label meant to reassure markets that they’ve struck a delicate balance. Yet, the latest employment data, while still showing labor markets in ok shape, is starting to tell a less comforting story. Job growth has flatlined, hiring has stalled, and the unemployment rate is creeping toward the Fed’s previously flagged worry line of 4.2%.

So why the apparent nonchalance by Fed Chair Powell?

Cast your mind back to the start of the year. The Fed made it clear: a breach above 4.2% unemployment would signal trouble, a threshold that would presumably prompt action. Fast forward to today, and that concern seems to have vanished. Instead, we’re told they’re fine with the current lack of hiring—a stance that feels less like calculated restraint and more like a refusal to engage with the data. If the labor market continues to weaken and the Fed only reacts after the damage is done, don’t be surprised if the Administration lashes out to lament their sluggishness, a sign that we are in phase 2 of the campaign.

Bold Prediction: I think the Fed cuts in September, but not July. However, the bond market is going to start to act. By year’s end, we are in the low 6s% for mortgage rates.

My Skeptical Take:

Investor outlook is positive, near an all-time high in fact.

And markets continue to expect this to be a short-lived conflict, and one that the US will not enter.

Using the stock market as our guide, notwithstanding all that is going on in the world, investors are deploying their capital in a risk-on fashion. The stock market is about to hit another all-time high.

And despite the salacious headlines and all that is going on in the world, foreign investors are still choosing to deploy their capital in the US, and US Treasuries/the Dollar is still the currency for all global transactions.

Anyone I know investing in real estate is taking advantage of persistently high interest rates, driving inventory up, and stagnating home prices. I personally am actively looking for my next multifamily property.

There are only 3 real economic risks: suffocating US deficits, a global trade war, and an actual war/black swan event.

If either one of these three things happens, we get a deep recession. If not, it’s all to the good.

Ironically, all three of these threats are up to our government, not us, the American people, nor American businesses.

So I have one message for you G-Men, please dont fuck this up, ok? Let’s keep on the straight and narrow path of success. And keep that other straight open too.

Pointing my ire back on the Federal Reserve, I have one message for Mr. Powell: Wake up Jack, you little sleepy head.

This isn’t 2022, the Fed doesn’t have the same flexibility to wait. The labor market then was at an all-time low unemployment. Today, unemployment is ticking up, and continuing claims are now at a three-year high. Labor conditions are no longer as robust. Job openings and job growth are steady but down. Powell himself admits, “[it is becoming difficult to find a job].”

Is the Fed just disconnected from reality or playing politics?

For investors, this disconnect is more than academic. The Fed’s willingness to sit on its hands as potential cracks form in the labor market could spell trouble ahead. A deteriorating jobs picture without a timely policy pivot risks amplifying market volatility and forcing a rethink for us market participants. The data isn’t lying—hiring isn’t happening like it was, especially as AI enters our lives.

As always, it’s up to us to question the soothing narrative and let the numbers guide our next steps. I am skeptical of the Fed’s position on inflation and labor markets. I think their attempt to be seen as apolitical is ironically making them make political, not data-driven, decisions, even if unwittingly.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

P.S. Reach out! Who knows, maybe we can workup a deal together :)

Comments