A Tale of Two Rental Markets: Metro Detroit vs. Memphis

With so many real estate opportunities in the US, all investors need a bit of guidance in comparing one rental market to another. That’s exactly why we’ve created this ongoing series where we feature and compare two popular rental markets—one article at a time.

Using our 20+ years of experience operating as a property management company in Metro Detroit, we’ve written these comparative reports that feature different US real estate markets known in the industry to be hotspots for rental investors. We’ve laid down the facts as is, but admittedly, we might be a bit biased to our home market if it’s a close call. Nevertheless, our goal is to show you the strengths and weaknesses of each market, giving you all the information you need to make sound investment decisions.

The primary factors that we’ll focus on are the following:

- - The expected returns from rental properties

- - The types of tenants to expect

- - The kind of management required

For this article, we’re comparing the two key markets: Metro Detroit and the City of Memphis.

Overview of Metro Detroit

First, it’s necessary to understand how Metro Detroit is unique from other metropolitan areas. Usually, properties get more expensive the closer it is to the main city. But in Metro Detroit, a lot of wealth fled the City of Detroit to the suburbs back in the 1960s and 1970s. Because of this, the income map below (assuming that income directly relates to property values) shows that real estate gets increasingly more affordable the closer it is to the City of Detroit:

ProximityOne: Patterns of Economic Prosperity by Neighborhood

ProximityOne: Patterns of Economic Prosperity by Neighborhood

Nevertheless, in the last decade, the City of Detroit has experienced a dramatic transformation. The Great Recession of 2008 caused job and population growth in downtown, now flowing into surrounding suburbs like never before. This influx of new residents has resulted in an increase in property values, as well as rental rates for homes and apartments alike.

We’ve discussed this in more detail in our Deep Dive series, where we analyze the investment potential of Metro Detroit cities and Detroit neighborhoods. Make sure to check those out as well!

Because of the unique situation of Metro Detroit, we’ll be comparing it to other cities instead of other metro areas for the sake of clarity and accuracy. We will remind you where applicable as best we can!

The Metropolitan Statistical Area (MSA) area of Detroit-Warren-Dearborn consists of the 6 Michigan counties: Lapeer, Livingston, Macomb, Oakland, St. Clair, and Wayne. What is referred to as “Metro Detroit” includes Macomb, Oakland, and Wayne counties (the Detroit Tri-county area).

All in all, Metro Detroit covers 3,888.4 sq mi (10,071 km2) with a population of over 4 million. Within this metropolitan area, the City of Detroit covers 142.89 sq mi (370.1 km²). Here are the 72 cities within the Detroit Metropolitan:

Map showing Tri-County Metro Detroit Cities

Map showing Tri-County Metro Detroit Cities

Though the City of Detroit experienced a significant loss in population during the late 1960s and 1970s, most people just moved elsewhere in Metro Detroit. This means that the City of Detroit remains the largest city in Michigan, and Metro Detroit is still the most populous metropolitan area.

For out-of-state (OOS) investors, it’s important to know the differences between the City of Detroit and the rest of Metro Detroit, as the investment opportunities vary greatly. It’s also why we’ve coined the term “Ring Cities” to describe the suburban cities touching the City of Detroit in a semicircle. These cities are known for three things, which are what most OOS investors are expecting from a real estate market in the area:

- - Affordable housing stock

- - Good rental cash flow opportunities

- - High buy-and-hold investment potential

To help you identify Ring Cities, we’ve highlighted them in green in the chart below. If you see any of them with hyperlinks, those will bring you to our Deep Dive analysis of that city, for more information on its investment opportunities and potential:

Here’s a list of the cities in Metro Detroit. The ones highlighted in green are the Ring Cities, and the ones with hyperlinks are the areas we’ve already covered in previous Deep Dives:

Now that you know about Ring Cities, let’s look at how you can invest in the City of Detroit. The city is separated into 11 main regions, as shown in this map below:

These 11 regions can be broken down further into 105 neighborhoods. The hyperlinks you see are quick links to previous Deep Dives we’ve already published, in case you want to know more about each area:

Source: Loveland’s Detroit Neighborhoods Map

Source: Loveland’s Detroit Neighborhoods Map

What most OOS investors can’t wrap their heads around is the fact that the city had a population of roughly two million in the late 1950s, but has now dwindled to less than half of that number. This means there are thousands of vacant homes in the City of Detroit - with nobody to populate.

Some cities and neighborhoods managed to retain a good part of their population, so property values and rent amounts remain relatively high, simply because of basic supply and demand economics. The city government has also been pursuing federal funds to eradicate vacant buildings, which helps lower the over-supply of homes and increase the property values and rent for them.

We advise OOS investors to research well before pouring their money in. Avoid blindly investing in a zipcode or neighborhood without a boots-on-the-ground evaluation of the property’s surrounding area. Unlike the usual neighborhoods that maintain a property class (A, B, C, or D) across a large area, a Class B property can be surrounded by Class C properties in the City of Detroit. Some inventors have bought what they think is a Class A or B property, only to find out that it’s located in a C or D neighborhood, meaning they’ll get Class C or D results.

With challenges come great opportunities for investing in the City of Detroit, as long as due diligence is carried out. If you’re an investor looking for fewer challenges, Ring Cities can provide some of the best opportunities in the country with relatively lower risk.

Overview of Memphis

Over in Tennessee, the City of Memphis is the state’s second-most populous city, with more than 600k residents. The city is part of the Greater Memphis area that ranks 42th largest metropolitan area in the country and is the seat of the state’s most populous county, Shelby County.

The City of Memphis is the anchor of West Tennessee and the greater Mid-South region, including portions of Arkansas, Mississippi, and the Missouri Bootheel.

The map that shows the City of Memphis

The map that shows the City of Memphis

According to Roofstock, the City of Memphis has affordable prices that create an influx of out-of-state investors snatching up local homes for rental investments. The Memphis Business Journal reports that homes in Memphis are frequently getting multiple offers above asking prices as soon as the property hits the market.

The area includes 112 neighborhoods, towns, and districts. They are listed below:

According to Memphis Cashflow, these are the areas rental investors should look into:

- - Cordova: An East Memphis suburb located just outside of the big city action

- - East Memphis: The neighborhood with Memphis’ best schools and a variety of housing options

- - Midtown: The vibrant and lively neighborhood attracting both locals and tourists

- - Whitehaven: The cultural neighborhood with affordable homes

House prices are climbing in these areas, where investors are experiencing the greatest growth and significant returns on investment (ROI).

Across Memphis, there is also an imbalance of supply and demand, resulting in high prices and demand for rentals. Memphis Business Journal shows that the shortage of new homes is due to the rising costs of land development and the lack of qualified workers. This opens up a lot of opportunities for rental investors to meet the growing rental demand in Memphis.

Comparing the Real Estate Scenes in Metro Detroit vs. Memphis

Let’s get into the important facts. The following sections will now detail the key factors that contribute the most to a rental investment. This includes the rent amount, house value, appreciation, tenant quality, property conditions, and quality of life within the featured areas.

The image below is an overview of the rental properties currently listed on Zillow for Metro Detroit and Memphis (as of June 2021):

Source: Zillow

Source: Zillow

With this overview, we’ll discuss the key differences and similarities between the two areas. We’ll put more emphasis on the homes currently listed on Zillow and their rent-to-price ratios.

House value and appreciation

House Value. Based on data from Zillow, the average home value in Metro Detroit is $206,340. This is an increase of 10.7% over the past year, forecasted to rise by 9.6% in the coming year:

In Memphis, homes are usually valued at $118,296. This number has increased by 16.2% over the past year. There is no specific forecast available on Zillow as of the writing of this article, however, Norada Real Estate Investments has reported Memphis 3-year appreciation forecast of 9.4%.

Looking at Metro Detroit listings on Zillow, most of the available homes are situated in Ring Cities or cities surrounding the City of Detroit. Here, many of the well-known below-a-$100k properties can be found. The lot sizes in the city and the metropolitan area are smaller than usual, which explains the housing and listing density.

Source: Zillow

Source: Zillow

Neighborhoodscout has provided a heat map of Michigan that shows two things: The general affordability of Metro Detroit and the lower prices in the City of Detroit and the Ring Cities.

Still, let’s not forget the pro tip mentioned earlier, where the diversity of Metro Detroit opens up many sweet spots for rental investors to acquire affordable houses near expensive, developing neighborhoods.

Over in Memphis, current listings on Zillow show that property prices are similar to that of Metro Detroit. Neighborhoodscout reports that the property prices in Memphis typically range from $61k to $243k (for all sizes and types), as we can see in the map below:

Source: Zillow

Source: Zillow

In terms of appreciation, the heat map from NeighborhoodScout shows that the central area of the city (including neighborhoods such as Channel Ave / Pier St and Poplar Ave / N Danny Thomas Blvd) tend to appreciate higher than the rest:

Source: NeighborhoodScout

Source: NeighborhoodScout

Appreciation. In terms of appreciation rates, Bestplaces reported the following:

- - Metro Detroit home appreciation in the past decade is 29.8% (up by 8.2% YOY)

- - Memphis home appreciation in the past decade is 7.1% (no YOY data as of now)

Both areas have affordable homes and high appreciation rates.

Compared to the nation, home values increased significantly by almost 49% in the past decade, where the last two quarters (January 2021 data) show an annualized increase rate of 9.3%. At this rate, we'll reach an average home price of $382,000 by 2030, according to Renofi.

Average Rent

Looking at the chart from Bestplaces, we can see that the rent Memphis is roughly the same as those in Metro Detroit across all housing sizes:

The latest listings on Zillow also reflect these average rent amounts:

Based on current listings on Zillow

Based on current listings on Zillow

Rent-to-Price Ratio

As you scan your options in Metro Detroit and Memphis, use the rent-to-price ratio as a quick indicator of the cash flow the property can potentially generate. Generally, you want the ratio to conform to the “1% Rule” where the ratio of the monthly rent to purchase price should be at least 1%.

Here’s the mathematical formula:

Monthly Rent / (Purchase Price + Rehab) > 1%

In large areas like Metro Detroit and Memphis with varying neighborhoods and cities, the rent-to-price ratio makes it easy for you to shortlist your options based on the estimated return on investment (ROI).

Side by Side Chart

Let’s pull up current listings on Zillow to see these data in action.

Here are examples of three-bedroom properties in Metro Detroit and Memphis. See how they compare against each other in terms of rent amount and house values:

Metro Detroit shows a more favorable rent-to-price ratio, with better appreciation rates and a significant forecast for home values. Memphis has seen more increased home values in the past year; however, it has a less favorable rent-to-price ratio and somewhat slower appreciation rates overall.

Quality of tenants, properties, and living

Apart from the financial viability of your rental properties, you also need to consider the quality of tenants and properties in the area. Knowing these details will help you determine the following:

- - The stability of your rental income and property maintenance of your assets

- - The necessary and possible property renovations and rehabilitations

- - The type of tenants you’ll attract and the kind of property management required to handle them

We’ve done the research for you, collecting data points from various sources, including our first-hand experience in Metro Detroit. This information is meant to guide you in assessing individual areas and should not be taken as definitive measures.

To get started, here is an overview provided by Roofstock that shows the livability of Metro Detroit and Memphis neighborhoods. Their evaluation is based on the quality of schools, home values, employment rates, and income levels, among other investment criteria:

Looking at the map, the City of Detroit has mostly Class C properties. Lower-class properties such as these are more suitable for experienced investors who can handle more tenant issues and property maintenance requirements. Memphis reflects a similar situation, where neighborhoods tend to fall on the lower end of the spectrum the closer you get to the center of the city.

Tenant Quality

Average Income. The average income, unemployment rate, and job market in Metro Detroit are more favorable than in Memphis:

As a rental property investor, you want to be able to charge higher rent and collect full rent payments each month. You need a tenant pool with a higher and more stable income to have that stability and assurance. A strong and growing job market provides them with opportunities to do so while increasing the population and strengthening the economy for higher property values and rent prices.

Educational Attainment. Generally, the locals in Metro Detroit have higher educational attainment than those in Memphis—even though Memphis has a large population of young professionals looking to start their careers. Based on data, there are still more high school and college graduates in Metro Detroit. This increases your chances of having a tenant pool with a higher income.

Source: Bestplaces

Source: Bestplaces

Property Condition

Property Age. The median age of the houses in Metro Detroit is 51 years old, while Memphis’ is 48 years old. This means the general condition of properties is relatively similar across both locations.

With the national average property age of 40, both areas do have older homes. These homes are also older than the average age of their respective larger areas (Metro Detroit versus Michigan and Memphis versus Memphis Metro).

Source: Bestplaces

Source: Bestplaces

Blighted Areas. Both Metro Detroit and Memphis are also dealing with blighted properties in their housing stock. Nevertheless, both areas deal with the issue by implementing respective rehabilitation plans that seek to revive the abandoned and dangerous neighborhoods.

The City of Detroit has been fighting the issue with a blight remediation program that demolished 19,000 of those homes and rehabilitated 9,000 others. This year, the city proudly announced that it had sold $175 million in bonds to fund a massive project to continue demolishing and renovating thousands more blighted homes.

Blight is also a persistent problem in Memphis, where data from 2015 estimated at least 13,000 blighted structures and vacant lots. Among these properties, 76.9% are abandoned properties with high weeds and grass concerns. Due to the low population density within the core city and lack of coordination in resolving the issue, blight spread easily to other neighborhoods.

Nevertheless, the city is now coming together to fight the issue. Memphis and Shelby County have passed the Memphis Blight Elimination Charter to enable a coordinated approach in remediating blight. From this Charter, the Blight Elimination Steering Team was also formed to bring organizations together, maximize efforts, and bring new sources to resolve their city-wide blight problem.

As a rental investor, you want to secure properties in up-and-coming neighborhoods that are in good repair. Blighted properties will come with structural and persistent problems, which means you need to have a thorough inspection and screening before acquiring them.

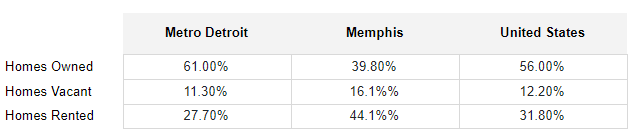

Home Ownership and Rental. Metro Detroit has more homes that are owned (61%) rather than rented (27.7%), which means you can expect the properties to be in fairly good condition. Homeowners tend to maintain their homes better than renters, as they’d treat the property with long-term living in mind.

Memphis has the opposite ratio, where they have more renters (44.1%) than owners (39.8%). The upside is that this increases your tenant pool. The downside is that the properties might be in poorer condition, as renters tend to have lower levels of maintenance than of homeowners.

Our general advice is to pay attention to the condition of older and poorer homes in both locations. Hire a professional to properly inspect the home before purchase, allowing you to have accurate budgeting of necessary renovations and upgrades.

Quality of Life

Local Economy. With the recent pandemic that swept the world, the economy of Metro Detroit was greatly affected. Smaller businesses and the leisure and hospitality industry were hit hard, even with the resilience of the automotive and manufacturing sectors within the famous “Motor City.”

Nevertheless, statistics from Freep and Roofstock are showing promise:

- New business applications in Michigan increased by 42.2% in 2020 compared to the previous year. Construction permits in the pandemic year are also reflective of pre-pandemic levels.

- Within Metro Detroit, the median sale price of single-family homes increased by 23.3% from the first to the third quarter of 2020, now reaching an impressive $236,300.

- The economy is showing strength as one of the city’s biggest employers, Ford Motor Co., announced its multi-year plan for a 30-acre “mobility innovation district” in late 2020. The project is centered on the former Michigan Central train station, just west of downtown Detroit. This significant redevelopment is set to accommodate 5,000 new employees, bringing new job opportunities to the city.

- Employment is forecasted to continue growing, as the Federal Reserve Bank of St. Louis reported the GDP of Metro Detroit to be over $237 billion—a number that has increased by more than 28% in the last decade. The city’s employment growth is 1.77% YOY, with the metropolitan area home to more than 2 million employees.

Memphis was not spared from the effects of the pandemic. Dr. John Gnuschke, an economics professor from the University of Memphis, even said the economy experienced an economic setback of 20 years, where their restaurants, hotels, and overall tourism industry were greatly affected.

Nevertheless, updates from Roofstock, Biz Journals, and the Economic Development Growth Engine (EDGE) show optimistic news regarding the housing market and economy of Memphis:

- Based on the data from the Memphis Area Association of Realtors, sales numbers of Memphis properties are on track to out-perform the pre-pandemic year. Even with the sales dropping by 16% (versus the previous year) in the early months of COVID-19, October data shows that the numbers are now only 4% short of 2019 levels. The sales are with an increase of 13% in median price as well.

- The sales are with a 13% YOY increase and are projected to grow 11.8% more in the next 12 months (as of January 2021).

- In 2020, EDGE provided financial assistance for growing companies in Memphis and Shelby County. Said projects were to create and retain 1,900 jobs with an average wage of nearly $51,000. The Greater Memphis Chamber also assisted companies, retaining 580 jobs and increasing 2,700 new jobs to assure locals of stable employment.

Both Metro Detroit and Memphis show economic strength amidst the pandemic year. This is great news for rental investors, as both locations will remain attractive to people seeking greener pastures.

Safety and Crime. Both Metro Detroit and Memphis have higher crime rates than their respective larger areas (Metro Detroit versus Michigan and Memphis versus Memphis Metro).

Source: Bestplaces

Source: Bestplaces

With a crime rate of 81 per one thousand residents, Memphis has one of the highest crime rates in the country, according to Neighborhoodscout. The chances of being a victim in Memphis is alarmingly at one in 12. Within Tennessee, less than 1% of all communities have a higher crime rate than the City of Memphis. The city is also found to be one of the top 100 most dangerous cities nationwide.

A similar situation can be seen in the City of Detroit, where the crime rate is also one of the highest in the country. Within Michigan, less than 1% of all communities have a higher crime rate than the City of Detroit—however, indicating that the other cities in Metro Detroit are much safer. To illustrate, SafeWise ranked Oakland Township and Huntington Woods as two of the ten safest cities in Michigan.

Keep in mind that there will be localized crime rates for every neighborhood and city in Metro Detroit and Memphis. A property that is deemed unsafe may be a few streets away from one that is situated in a perfectly safe neighborhood—attracting good quality tenants for you.

Diversity. In terms of racial diversity, here is the breakdown for Metro Detroit and Memphis:

To run a successful rental business, you want a tenant base that is reliable, communicative, and responsible for paying rent and maintaining the property. Since the tenant pool in Metro Detroit varies greatly from Memphis, you need to self-evaluate to know what kind of tenants you want to handle when choosing which area to invest in.

Liveability. The pros and cons of living in Metro Detroit and Memphis as a resident are as follows:

Overall, both Metro Detroit and Memphis economies are attracting tenants seeking new job opportunities and a better living experience.

In choosing your area to invest in, make sure to prioritize cities and neighborhoods that are in high demand amongst high-quality tenants. Look into the characteristics of each sub-area, its tenant demographics, and its common property conditions. The wide variety of options Metro Detroit and Memphis offers begs investors to carefully consider all factors in full detail and, ideally, with expert guidance.

Conclusion

At the end of a long day, each investor should rigorously evaluate their opportunities in Metro Detroit and the City of Memphis. Each market has many cities and neighborhoods with pros and cons for investors—all depending on your priorities as an individual.

Let’s recap all of the information provided in this comparative report:

The markets are tough to compare when it comes down to which one is the best. But, if we could recommend our own market based on wealth and revitalization efforts then Detroit would be at the top of that list! The City of Detroit has come a long way since 2011, and we’re only expecting it to explode with potential in the next few years.

Disclaimer: One of the core tenets of investing is to focus on financials—especially with purchasing investment properties. Rental investors should look for those that have a good balance between cash flow and appreciation, both in short-term gains as well as long-term success.

—

We’re glad to see that you’re thinking of investing in the rental market of Metro Detroit and Memphis!

If you want us to analyze a particular rental market, please leave your suggestion below. Our comparative reports won’t stop here! We’ll be sure to prioritize your input for our next installments.

Comments (1)

So glad I found this blog! Looking forward to future posts.

Les Williams, almost 4 years ago