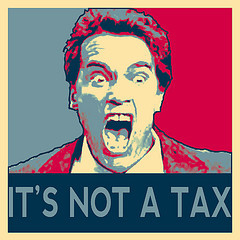

Gird Thy Loins for Obamacare

For a couple of years we’ve been wondering when the fallout from the Obamacare legislation would start to rain down upon our heads. Scattered stories have hit the news about how companies are cutting back work hours for full-time employees, trimming them from a 40-hour work week to below 30 in order to avoid the financial hit they would take from having to pick up insurance premiums under new rules.

But that wasn’t all. There’s more. Much more. Income property investors are becoming aware of something called the Net Investment Income (NII) tax, which is a 3.8% hit you’re going to take, in addition to all other income taxes, on rental income and gains from selling rental property. In other words, unearned from your investments.

The good news is that you can exempt yourself from the NII tax if you meet the following three tests:

1. Qualify as a real estate professional

2. Materially participate in the rental activity

3. The rental activity must qualify as a business for tax purposes

Let’s break these down more specifically.

How does the IRS define “real estate professional?”

To beat the NII tax you must spend at least 50% of your work time in a business related to real estate, and more than 750 hours working the real estate business annually. This means you have to put in at least 15 hours weekly to meet the minimum time test. Expect the IRS will want to see detailed records of how you spent your work time.

What does “material participation” mean?

For NII tax purposes, the goal here is to show that you worked at least 500 hours on EACH rental activity - meaning each individual property - or working at least 100 hours but more than anyone else. In their benevolence, the IRS will allow landlords to group their rental properties for the purposes of satisfying this rule.

Rental activity as a business.

The IRS has been vague over the years in defining exactly how a rental activity qualifies as a business. Conventional wisdom and history leads us to assume that if you qualify as a real estate professional it’s almost certain your rental activity will qualify as a business.

There you have it; the short and sweet version of the next Obamacare slap coming down the pike. Jason Hartman suggests you gird thy loins for more tax intrusions because this is going to be a checkbook bursting program. (Top image: Flickr | charlesfettinger)

The JasonHartman.com Team

“The Complete Solution for Income Property Investors”

Comments