How Does Real Estate Fit Into A Balanced Portfolio?

This is a simple but powerful illustration of what income producing real estate can do to your overall investment portfolio, courtesy of the financial adviser that we personally work with.

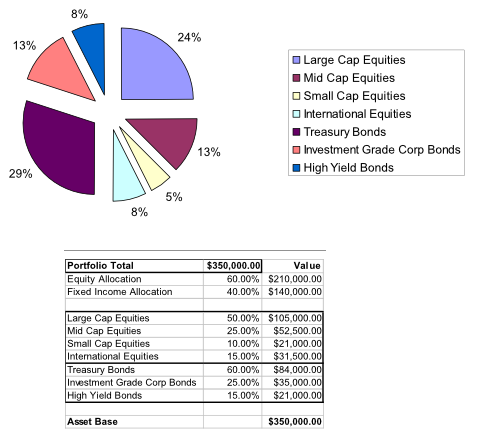

Below is a sample traditional asset allocation with 60% allocated to equity holdings (stocks) and 40% allocated to fixed income assets (bonds).

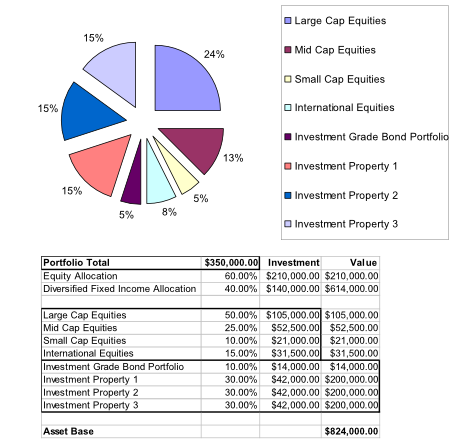

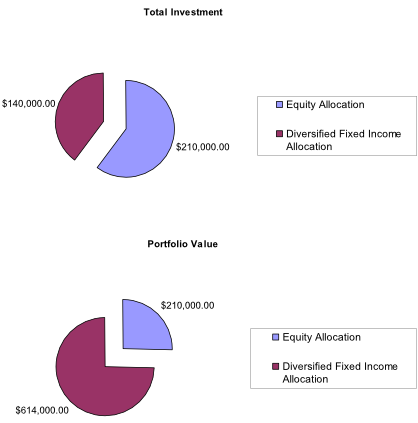

This is asset allocation with real estate as a portion of the fixed income assets. Example showing 3 investment properties acquired with 20% down payment.

With real estate, leverage enables you to significantly increase your portfolio value.

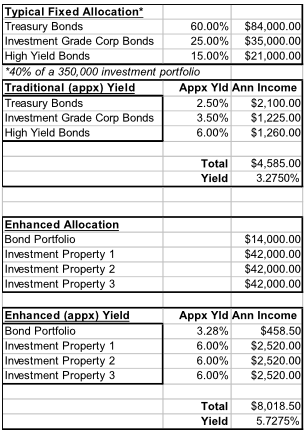

While generating better return -

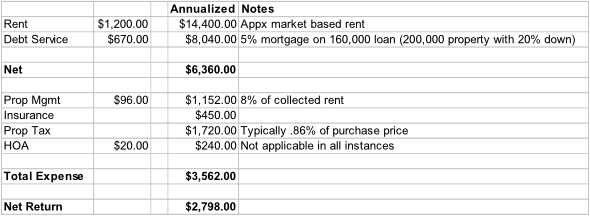

Assumptions (based on typical investment properties in Las Vegas):

Note that the real estate appreciation and tax advantages are not included in the yield estimates. And, once the mortgage is paid off the yield on real estate is going to increase significantly.

Comments