Las Vegas 2020 Investor Outlook

Executive Summary

• We expect prices and rents to rise significantly through 2020, starting almost immediately.

• Property prices are still 10% to 40% below 2006 peak prices.

• Median $/SF prices rose 3% while rents rose about 4.5% in 2019 for the segment we target.

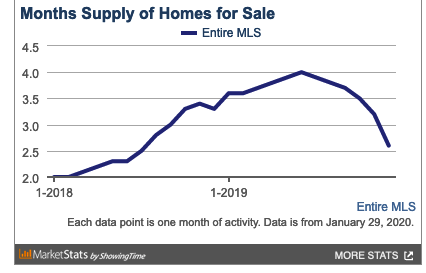

• Inventory started falling rapidly in September and is now down to a little over a 2 months supply.

• Less than 28,000 acres of non-government-owned undeveloped land remains in the entire Las Vegas Valley. About 5,000 acres of this is unusable for residential development. Land is consumed at the rate of about 5,000 areas a year. With developable land running out, prices are almost guaranteed to rise.

Are We Going to Have a Crash in 2020?

Depending on which "news" source you read, we were in a crash, are in a crash or we are about to have a crash. I talked to many people and read a lot of articles in preparation for this paper and I believe there is a low probability of a significant economic downturn in 2020 for the following reasons:

• The Fed is committed to market liquidity4,26. Many believe that the 2008 crash was actually caused by a lack of liquidity, which the Fed could have prevented. The Fed does not want a repeat so they are making as much money available as needed.

• Negative interest rates - The EU Central Bank deposit interest rate is currently -0.5%5. One of the few places for EU investors to generate a reasonable return is the US securities market. With a lot of capital pouring into the US, the US securities markets should do well in 2020. This should insulate the US economy from the downturn other countries are experiencing.

• Many major economies are either in recession or heading into recession. Governments, corporations and individuals in these countries will seek a safe refuge for their funds, which is the US6. This should insulate the US economy from the downturn other countries are experiencing.

• Consumer confidence - Consumer spending is currently about 69% of total United States GDP1so consumer confidence is critical. Fortunately, consumer confidence remains strong2, though it dipped slightly towards the end of 2019. Another metric is consumer spending. "A record 189.6 million Americans went shopping over the five-day Thanksgiving weekend, the National Retail Federation said Tuesday, and most of them did their spending online."12

• Due to the reduction in repatriation taxes, over $1T in corporate funds that were held overseas has returned to the US3. $1T in private hands is an incredible amount of money to invest and I believe it will generate a lot of investment, create jobs and boost the stock market.

• The trade war with China has not been as harmful to the US as "experts" predicted. China is in a much more difficult position since all world trade is dollar denominated. Plus, China is an export based economy. Even if China drops the RMB exchange rate they increase their manufacturers costs since many import parts from outside of China. This drives up the cost of Chinese goods. A no win situation for China. A trade agreement was recently signed that boosted the world economy. However, whether any terms agreed to by China will actually be fulfilled remains a question.

• U.S. unemployment fell to 3.6 percent, lowest since 196913. The high rate of employment will drive consumer spending.

• Interest rates in 2020 are expected to stay at about the same as they are today7.

• December housing starts are at the highest level in 17 years21. For this to happen, builders must be confident that interest rates will stay low and the economy will be stable or improving for the foreseeable future.

I see three national events that could alter my expectations for 2020:

• Trump not being reelected. Whether you love or hate Trump, financial markets like stability. Political instability may result in market fluctuations.

• Rapidly rising interest rates. Not likely and many are predicting interest rates will fall in 202028.

• An unforeseen event like the coronavirus spreading to the US in a significant way, terrorism, etc. These are things that are very unlikely to happen but are not impossible. There is no way to predict what such an event might be or its impact on Las Vegas real estate.

Las Vegas specific factors that could impact the investment market:

• Sudden release of a large amount of federal land to private buyers. This is unlikely since it takes congressional approval for this to happen. The largest release in many years was 900 acres in 2017, which was spread over the valley. The sale price was approximately $1M/acre. Residences built on such expensive lots will not impact our target property profile.

• Californians relocating to Nevada and passing "California" style legislation. This could be a problem in the future, we will have to wait and see. However, the lack of a Nevada state income tax limits what can be spent so I do not see this as a significant issue at this time.

Even if a downturn does occur, people already owning Las Vegas properties that rent to our target tenant pool are unlikely to have a decrease in cash flow. Our target tenant pool are income producers for the companies they work for. They are not an "expendable" part of the workforce. If our tenant base is let go, the companies have to close.

How confident are we in this statement? During the 2008 crash, our client's properties stayed rented at the same rate and they had no vacancies. Our target tenant pool may have had their hours reduced but they stayed employed and they always need a place to live.

Why Buy Now As Opposed To Waiting?

Market inflection points, like 2010 through 2013, are the optimal time to buy. Today many have a bad case of "I wish I purchased properties in 2010..." In our opinion, we are at another inflection point. We believe it to the point that we just closed on another investment property with an ROI between 2.0% and 2.5%. For details on the property and our investment decision, see 2154223 - 7016 Town Forest Ave.

Why did we buy a property now and with a lower return? Because of what we see happening in the market. Below is a screen shot from the MLS showing all single family inventory by month. As you can see, inventory is dropping rapidly. I might expect to see this in May or June (the peak sales months) but not January. With inventory rapidly dropping, I expect prices to start rising almost immediately. The demand is also confirmed by the large number of offers sellers are receiving and how fast good properties are going under contract. Further confirmation is how many agents are queued up to show a property when we arrive. In the last few weeks, a lot!

What about rents? Rents historically lag property prices by 2 to 10 years. So, rents may not catch up to todays property prices for a year or more. However, they will catch up. It may be sooner because of the combination of events occurring in Las Vegas.

• Inventories are dropping, which will push up property prices. As prices rise, fewer people can afford to buy and become renters, which increases demand which drives up rents.

• Property prices have risen to the point where it is more cost effective to rent than to buy in Las Vegas.

• New homes will not increase the inventory for our target tenant pool. The rental sweet spot for our target tenant pool is currently between $250,000 and $350,000. Metro area median new home prices are $410,000. New homes in our target area tend to be a little more.

• Las Vegas' population continues to increase. This increases demand for homes and rentals.

• Over $24B in construction will complete over the next two years and other large projects are just starting. This will create tens of thousands of new jobs that match our target tenant pool. This will bring more people to Las Vegas, which will increase demand for rentals and homes, which will increase rents and prices.

So, while we do not know how fast prices and rents will rise, we know that buying earlier in the year will maximize your return during the coming growth period. This is why we purchased another rental property in January. We will buy more as soon as we can.

Why Our Data May Look Different

At the beginning of each year I publish a forecast for Las Vegas investors incorporating national and international events. Part of what I provide is fairly detailed data on what is happening. However, the data you will see in this paper is probably different from what you see in the national press.

Most news articles are primarily sound bites, providing generalized high level assessments and broad metro area averages. They do this because they have limited print space and most readers are unwilling to invest the time to read a detailed analysis. An example of how news article calculations work: suppose two homes were sold on a given day: one for $10,000,000 and the other for $50,000. The reporter would calculate the average price of homes sold today to be $5,000,000 (($10,000,000 + $50,000) / 2 = $5,025,000). While the information is mathematically correct it is meaningless due to over simplification and improper use of averages.

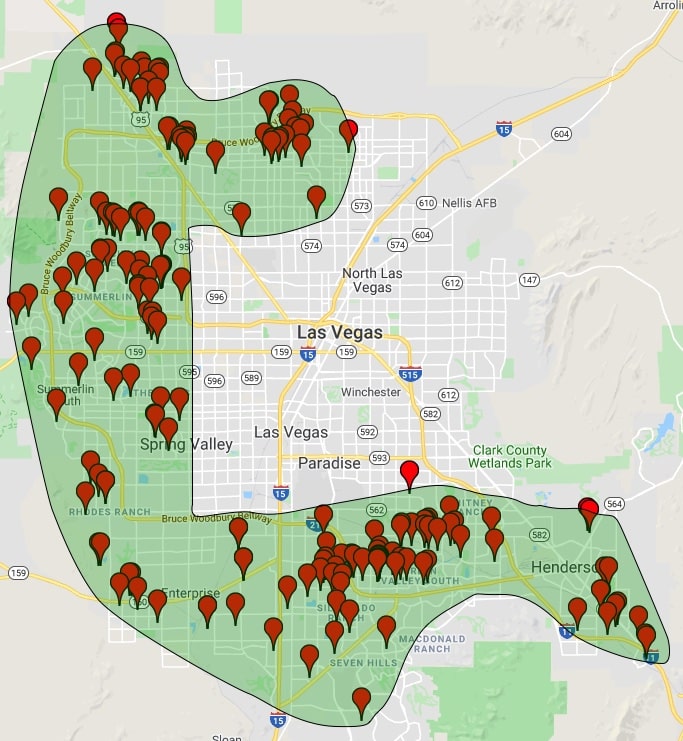

This paper attempts to strike a balance between the highly detailed data we use for data mining (data at the subdivision/individual property level) and the broad generalizations the news provides by focusing on a specific property profile in the areas where our target tenant pool desires to live. See the map below.

A general description of our property profile is:

- • Single family

- • 3-4 bedrooms

- • 2+ baths

- • 2 car garage

- • Built after 1985

- • One or two story

Before I talk about what we expect to occur in 2020, what happened in 2019?

2019 in Review

Unless otherwise noted, all the charts below are based on MLS or InfoSparks data and only includes properties that conform to our property profile.

2019 was another good year for investors. In early 2019, I had concerns that prices would rise too fast and the market might become overheated. Fortunately, that concern did not come to pass. Median $/SF prices rose 3% while rents rose about 4.5%.

I will start with how properties were purchased and sale types.

Purchase and Sale Types

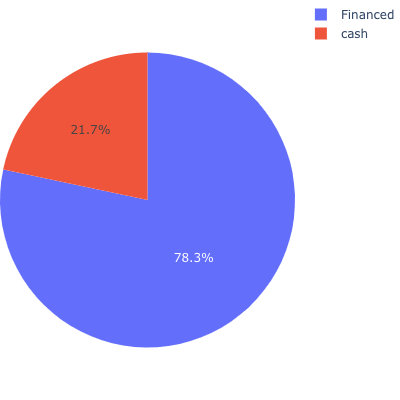

Cash vs. Financed Purchases

The percentage of cash buyers has decreased to a little over 21% . I believe this was largely due to a decrease in Chinese buyers.

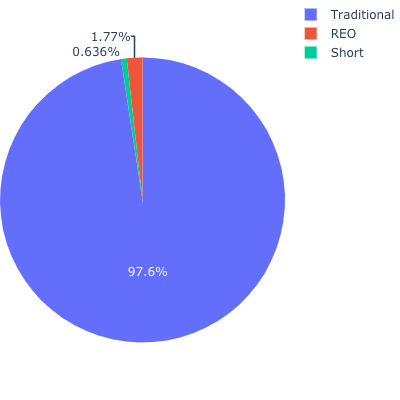

Traditional Sales vs. REO and Short Sales

We are seeing very few foreclosures (REO) or short sales. Property prices have risen to about 90% of peak 2006 prices so few people are still under water.

Rental Statistics

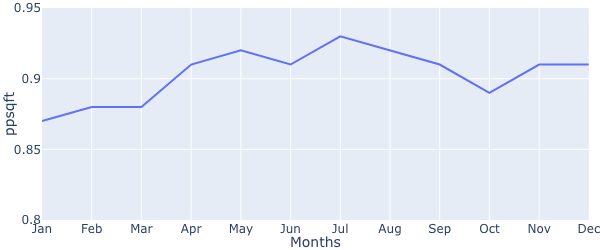

Median Rents Rose Approximately 4.5% In 2019

In January, median $/SF was $0.87/SF and at the end of 2019 median $/SF was $0.91/SF. We expect rents to rise faster in 2020, as you will read later in this report.

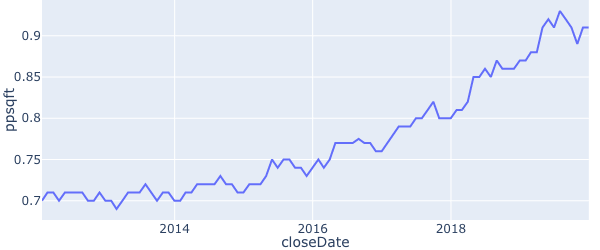

Rents Rose Continuously Since 2013

Rents were flat after the 2008 crash until mid 2013 when they started to rise. Notice the seasonality of the data. Peak rents occur between mid May through the end of July and lows are mid November through the second week of January.

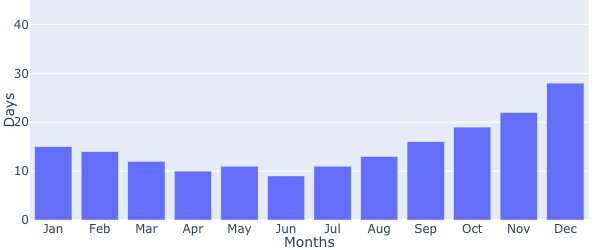

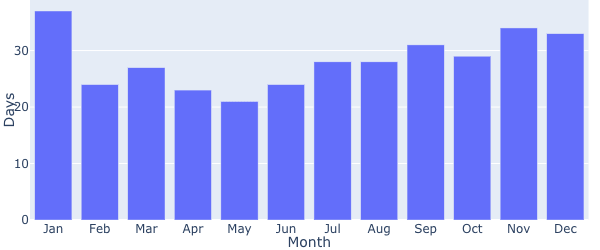

Median Time To Rent Remains Low

Median time to rent even in the slowest time of the year is about 28 days, which is exceptional. In many markets, properties sit on the market for months so 28 days is excellent for slowest time.

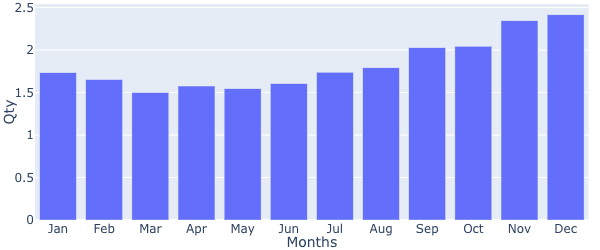

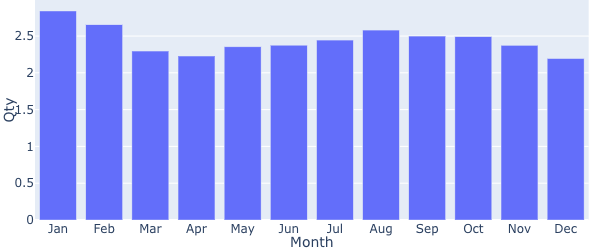

Months of Supply Stayed Below 2.5 Months

Inventories normally increase towards the end of the year and decrease as we approach the peak summer months, as shown by the build up of rental inventory in November and December. We started seeing a lot of activities after the 1st of the year so we expect to see the rental supply decline in the first quarter.

Sales Statistics

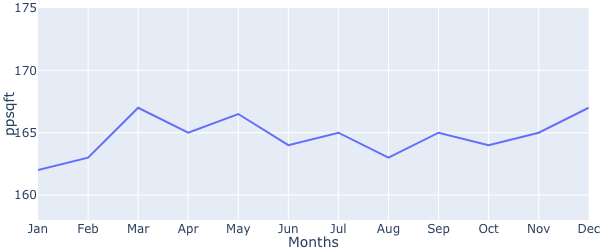

Median $/SF Rose By Approximately 3%

In 2019, conforming properties appreciated by about 3% ($162/SF to $167/SF). This is good news for investors. A large increase in $/SF after many years of large increases would have concerned me that the market was overheated. 3% is a healthy and sustainable rate of increase.

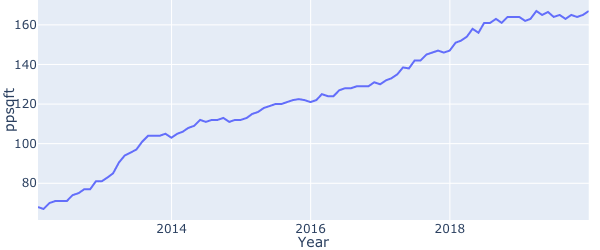

Prices Rose Continuously Since 2013

Median $/SF more than doubled between 2013 through 2019 but still have not reached 2006 peak prices.

Days on Market Stayed Low

Median list to contract days fell after January and slowly rose after August which is characteristic of recent years.

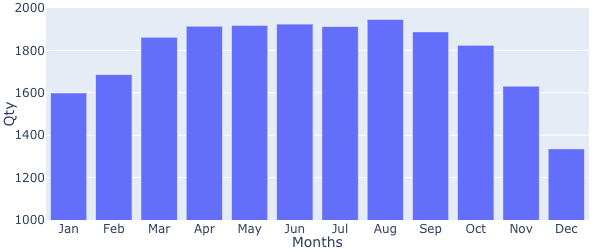

Inventory Fell Rapidly Starting in September

Inventory started falling rapidly since September and we expect it to fall further in January 2020. I have not seen an end of year sharp decline in inventory before. If this continues, demand will drive up prices and rents as we reach the peak rental periods of May through August.

Months of Supply Remained Below 2.7 Months

Months of supply peaked at about 2.7 months and has declined since August. 6 months supply is considered a "balanced" market in Las Vegas so we are still in a seller's market.

Good properties are receiving multiple offers and only stay on the market 1-3 days. Since the second week in January sales activities increased to the point where at times we've had difficulty scheduling a showing. For example, one property had 18 showings and received 3 offers on the first (and only) day on the market.

Based on rapidly declining sales inventory and the unexpected uptick of competing buyers, we expect prices to start rising in the next few months. Low housing inventory going into the peak May through August sales period will almost guarantee prices will rise faster in 2020 than they did in 2019.

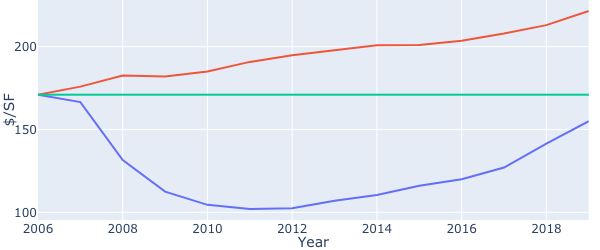

Price Still 10% to 40% Below Pre-Crash Peak Price

Below is a graph comparing the current median $/SF to the peak ($171/SF) in 2006 for conforming properties. The blue line is the non-inflation adjusted $/SF. The red line is the peak $171/SF inflation adjusted over time. The green line is just the peak price $171/SF with no consideration of inflation. If you ignore inflation, the current median $/SF (blue line vs. green line) is approximately 90% of the 2006 peak price. If you consider inflation, the current $/SF is about 40% below the peak price. Whether you compare current $/SF to non-inflation adjusted or to inflation adjusted peak $/SF, Las Vegas still has a long way to reach 2006 peak prices.

The fact that Las Vegas housing price has still not reached the 2006 peak prices and the 3% increase in 2019 is a strong indicator that the market is not overheated.

Time for the crystal ball!

What I Expect in 2020

Please keep in mind the following:

"Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window." ...Peter Drucker

"Predicting anything beyond yesterday is guessing." ...Eric Fernwood

Ignore the "Experts"

I read over 150 articles in preparation for this report and I come to an important conclusion.

Ignore the "experts", they keep getting it wrong.

For example, Paul Krugman, New York Times chief economist and Nobel Economics Prize winner, predicted that if Trump won the 2016 election: "... we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened."

In my opinion, the rate of correct predictions by the so called "experts" is little better than random and the articles I read mostly just expressed the political views of the author. The lesson learned was to do my own research.

What Will Prices and Rents Do in 2020?

I've read many contradictory reports about what 2020 will hold for Las Vegas housing prices. The most dire prediction I read is that property prices will fall 9.5%10. Other sources predict that Las Vegas will be one of the hottest markets for the next 5 years11. I see two major problems with all of the "predictions" I've read:

• They are general in nature, usually combining all single family homes and some also include condos and town homes. This does not make sense to me. For example, I see no commonality between a buyer for a $900,000 property and a $150,000 property. Buyers for single family homes are not the same demographic as condo buyers. This is mixing apples and donuts.

• None of the reports took into account factors unique to Las Vegas:

• Land shortage - 87.5% of Clark County is federally owned. The total amount of privately owned vacant buildable land within Clark County today is less than 28,000 acres and as much as 5,000 acres of this is not viable for residential development. The consumption rate is about 5,000 acres/year so Las Vegas is rapidly running out of land. I have never heard of a situation where an increasing number of buyers bidding on a limited pool of assets where prices did not increase. The lack of land and the increasing population are one of the major reasons we believe so strongly in the future of Las Vegas. Below is a time lapse from 2008 through 2018. The brown area is federal land. There were major developments during 2019 so the remaining land today is even less than in 2018.

Could more land be released by the federal government for private ownership? Yes, in 2017 one of the largest releases ever occurred. Almost 900 acres, spreaded throughout the Valley, was released for private ownership. Cost, approximately $1M/acre. So, federal land becoming private is not a major factor.

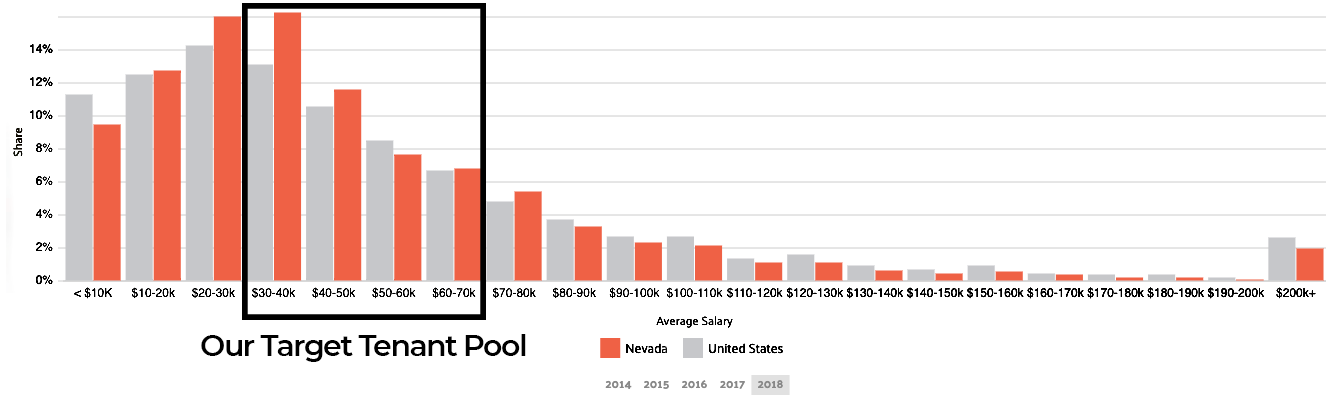

• The median new home price is over $410,0008. The rental sweet spot for our target tenant pool is currently between $250,000 and $350,000 so new homes will not increase supply. With the limited number of properties in the key price range and the population growing by about 3%/Yr I believe rental prices will continue to increase.

• Californian residents and businesses migrating to Las Vegas. In 2019, 33% of surrendered drivers licenses were from California. Also, 30% of properties sold in 2019 were to Californians14. As California continues to pass onerous regulations and increases taxes, more people and businesses will leave the state and a portion will choose Las Vegas.

• New Jobs - There is currently $24B under construction and more major projects announced. When these projects are completed they will create tens of thousands of new well paying jobs in Las Vegas. This will draw more people and businesses to Las Vegas. Most of these jobs will go to our target tenant pool. With a limited supply of properties due to limited land, rents are going to increase.

In summary, I expect prices and rents to increase more in 2020 than they did in 2019 for the property profile we target.

Las Vegas Economic and Market Drivers

I believe the Las Vegas economy and real estate market will continue to grow for the foreseeable future due to a number of factors.

• Low operating cost - No state income taxes, right to work state, minimal government regulation, pro business environment, low property taxes.

• Low cost electric power - California commercial energy rate is $0.1795/KwH. Nevada is $0.0781/KWH22.

• Reliable electric power - Las Vegas is one of the few cities in the US with dual sources of electric power (California and Hoover Dam). Northern California experienced many rolling blackouts in 2019 and it is expected to continue for many years to come. "Californias new normal: Wildfires, ash and power outages could last a decade23". Companies facing high power costs combined with unreliable service will look for an alternate location. Nevada's commercial energy rates over 50% less than California will attract energy intensive businesses.

• Convention business - Oracle World decided to move its annual convention from San Francisco to Las Vegas for 2020, 2021 and 202215. This is a $64M/Yr injection into the city economy that was not expected. Other conventions are likely to follow. Such conventions (and sports teams like the Raiders or the Golden Knights) have a significant knock-on effect. As people from California and other locations experience Las Vegas, more people and companies will relocate here. Las Vegas has changed over the last few years from "Sin City" to a good place to work, live and raise a family.

• Construction - In 2019 Applied Analytics in conjunction with Sales Traq came out with a list of major projects. The full report is here and a list of large construction projects is here. These projects will create 10's of thousands of new jobs in Las Vegas for our target tenant pool. This will bring more people to Las Vegas who are more likely to be renters than home buyers. An increasing population combined with a relatively fixed supply of rental properties will almost guarantee prices and rents increase.

• 2018 Tax Act - The cap on SALT deductions is another huge incentive to leave California. Consider the impact on Las Vegas real estate prices if even a small percentage relocate to Las Vegas. For example, if 0.25% of the 6 million retired Californians relocate to Las Vegas, and one residence is needed for every two people: 0.25% x 6,000,000 / 2 = 7,500 residences. Only about 47,000 residences were sold in 2019 so an additional 7,500 demand would drive up sales and rental prices significantly.

• Computer infrastructure growth will likely continue in part because the fiber optic lines connecting Southern California and the East coast go under the Las Vegas Blvd; dual sources of electric power and the low cost of electricity. Google is one company taking advantage of the low cost of energy. They are building a $600M data center in Henderson. More will follow.

• Las Vegas is within two days drive time of 20% of the US population - an important consideration for services and manufacturing.

• Population growth - Clark County's population continues to grow at a very healthy rate of about 3% per year. And, they are largely the demographic we target.

• Today, approximately 16% of the US population is retired27. The current and persistent low interest rates are a problem for retirees and other investors. For many, buying income producing real estate is a safe alternative and a portion will buy Las Vegas real estate which will increase demand and prices.

• Large population of permanent renters - Our target tenant pool is not engineers, doctors, lawyers or other high income earners. Our target tenant pool typically earns between $40,000 and $60,000/Yr. Only a small percentage of this wage group is likely to accumulate enough savings to become home buyers, especially since prices are increasing. These "permanent renters" are the reason why our average tenant stay is just under 5 years. See the graph below which shows the distribution of income for Clark County Nevada25.

Thank You For Your Time

Thank you for taking the time to read this paper. We welcome and appreciate your feedback, especially If you see errors or areas where we could improve. We will be happy to update the report.

Best regards,

Eric Fernwood

[email protected]

702-358-8884

Sources

- The Balance - Components of GDP Explained ↩

- OECD Data - Consumer confidence index (CCI) ↩

- Bloomberg - U.S. Companies' Repatriated Cash Hits $1 Trillion Under Tax Law ↩

- The Wall Street Journal - Fed Pumps Nearly $70 Billion in Short-Term Liquidity Into Markets. ↩

- European Central Bank - Key ECB interest rates ↩

- Forbes - Here Are The Countries On The Brink Of Recession Going Into 2020 ↩

- Kiplinger - Fed Signals Desire to Stand Pat ↩

- Las Vegas Review Journal - New home prices expected to rise in 2020 ↩

- Channel 3 News Las Vegas - Adios, California: Thousands of homebuyers flocking to Las Vegas for 'American Dream' ↩

- 24/7 Wall Street - These Are the Housing Markets That Will Grow Fastest in 2020 ↩

- Mansion Global - Las Vegas, Dallas and Fort Collins, Colorado, Poised to Be Real Estate Hotbeds in Coming Years ↩

- Washington Post - A record 190 million Americans shopped Black Friday and beyond most of them online ↩

- Washington Post - [U.S. unemployment fell to 3.6 percent, lowest since 1969 ↩

- Digital Journal: Las Vegas may be the best city to retire in the US - "Today, 30% of the homebuyers on the Las Vegas real estate market are in fact Californians, a majority of them being members of the Baby Boomers generation." ↩

- Washington Post - Oracle will move its annual OpenWorld conference to Las Vegas because San Francisco is too expensive ↩

- The Wall Street Journal - The New Math of Renting vs. Buying ↩

- Forbes - California Threatens $1 Trillion Gig Economy With New Law ↩

- Google Earth Engine Time-Lapse ↩

- National Association of REALTORS Median Sales Price of Existing Single-Family Homes for Metropolitan Areas ↩

- CPI Inflation Calculator ↩

- America just had its best month for new home construction in 13 years ↩

- Choose Energy ↩

- Californias new normal: Wildfires, ash and power outages could last a decade ↩

- Clark County sports nations 2nd largest population growth ↩

- DataUSA - Clark County ↩

- The Fed is ramping up its repo operations to head off year-end funding issues ↩

- Statista - Share of old age population (65 years and older) in the total U.S. population from 1950 to 2050 ↩

- Housing Wire - Liked 2019s mortgage rates? 2020 will be lower ↩

- Las Vegas water usage ↩

- Lake Mead will be at its highest water level since 2014 by the end of February. ↩

Comments