What House Flippers and Construction Owners Have in Common

I’ve noticed house flippers and construction companies have a lot of similarities. For one, a house flip is really a construction project, so it makes a lot of sense that both parties have the same headaches.

Both are constantly looking for the next project. Additionally, they may not be tracking their actual costs against their estimated costs, and cash flow may not be managed well.

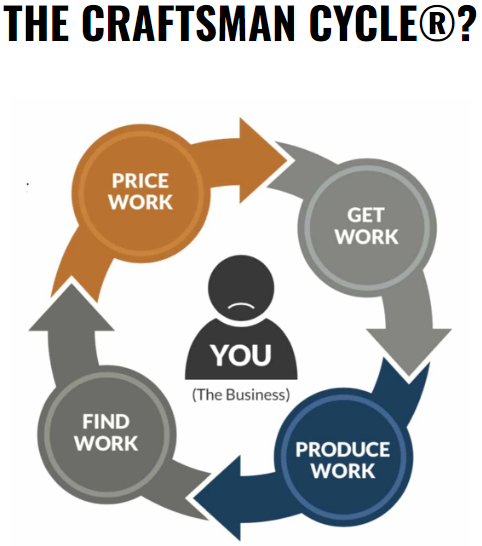

The Craftsman Cycle

(R) SHAWN VAN DYKE

(R) SHAWN VAN DYKE

The Craftsman Cycle is a term I first heard used by Shawn Van Dyke in his book, Profit First for Contractors.

Shawn describes the constant cycle of pricing work, getting work, producing work, finding work, and doing it all over again.

House flips are quite similar as they usually involve finding deals, analyzing the deal, remodeling and selling.

I think both parties are guilty of not tracking their renovation costs accurately against their estimates. And winging it when it comes to monitoring their cash flow.

Estimated vs Actual Costs

Direct Costs

If you’re actively tracking your costs, you should be able to give a rough estimate to renovate a kitchen, bathroom, or nearly any other room of a home. If you can’t, I strongly encourage you to review the costs of your previous projects. Then start building a process to help you estimate the future costs of all projects.

The most common resources I’ve seen can estimate the cost per square foot using a multiplier for whether the finishes are low, mid, or high-end. The next piece of information you should have is something that can tell you what your estimated costs are against what they actually are.

Indirect Costs/Overhead

Each job needs to cover its share of overhead. This is generally determined by a percentage. For example, the overhead to run your office is 25% of your gross revenue. So each job should contribute 25% of its income to your overhead.

This is where having an accurate markup becomes very important in construction. House flippers have a slightly different way of estimating the costs of remodeling. They use the rule of 70 to make sure overhead costs are covered.

Cash Flow

- Construction – dependent on customers’ down payments for materials and the remaining balances for labor

- House Flippers – dependent on construction draws to pay contractors

(Some construction companies also use draws)

For this example, we’ll use residential since those are the most similar.

In construction, best practices generally include a down payment from the customer so materials can be ordered. Then one or two more payments to cover the labor performed on the project.

For house flips, construction draws are generally made from a bank. In some cases, the flipper will use their own funds to cover the costs.

I think the safer way to go would be to use draws so that the money for the project is kept separate from the company’s operating account. However, if house flippers use their own funds I would recommend putting the funds to be used for the project in another account. This keeps them separate from the overhead operating account. This helps avoid using funds that are intended for the remodeling project.

Otherwise, some kind of due diligence should be made to make sure what’s in the operating account is used for its intended purpose.

Comments