Why commercial mortgage pre-approvals don't exist

When a consumer is shopping to purchase a home, obtaining a mortgage pre-approval is a typical part of the process. The pre-approval helps the buyer determine how much they can afford to spend on this major purchase ahead of time. The process works the same for a real estate investor buying a home to rent out as well — their personal finances, income, and credit score are key factors to determining the mortgage amount they are pre-approved for.

Some residential buyers are surprised, then, when they start shopping for their first commercial investment property (which includes 5+ unit Multifamily), that the financing process works significantly differently. There is no such thing as a pre-approval for commercial mortgages. Here’s why:

No pre-approvals for commercial mortgages

Underwriting is deal-specific

Note that I am not even saying that underwriting is property-specific, as that’s still not exactly right. Two borrowers with the exact same amount of money, same credit score, and similar levels of experience can both attempt to buy the same building, and they’ll likely end up with different financing options. Why? Because a “deal” encompasses the borrower’s financial strength, the property, and the borrower’s plan for the property. If a property currently has cash flow, one investor may ask to borrow funds based on the property’s existing operating income, while another may plan to renovate. Those are two different deals which a lender would underwrite.

Less emphasis on the borrower’s financials

A borrower’s financials can kill a deal in commercial real estate, but it can’t always save one. You can be a billionaire, but a lender simply won’t lend above an appropriate underwritten value if the real estate numbers don’t work out.

This is especially true of non-recourse loans, which means the borrower is not personally liable for the loan amount. The property itself is the collateral, rather than the borrower’s personal finances (with exceptions, sometimes referred to as “bad boy” carve-outs).

Experience is king

Acceptable property, financials, and business plan — what could go wrong? The answer is a failure to execute the business plan. This is where the experience factor comes into play. Successful deals in the rear view mirror act as evidence that the borrower will be able to make good on their plan. But this can’t be pre-approved, because a successful track record investing in multifamily properties in a particular city does not automatically carry over to another asset class, or another city, or another deal scenario. Relevant experience is a qualitative factor.

Term Sheets: What you get instead of pre-approval

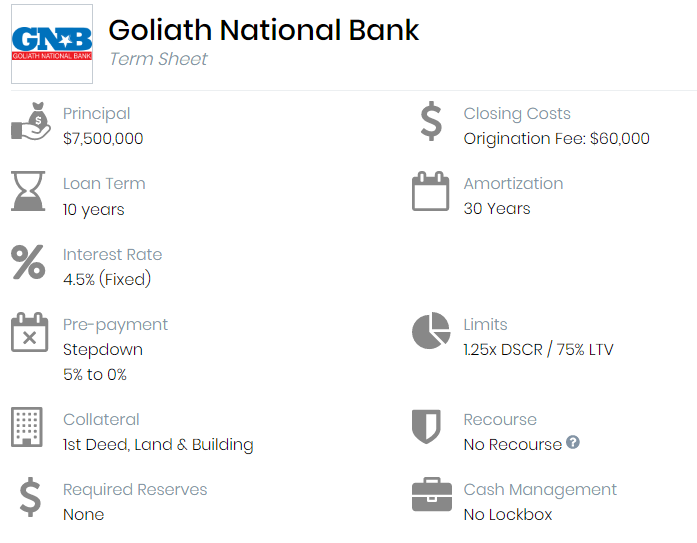

Quotes and term sheets are deal-specific in commercial real estate, and you’ll be able to source one when you find the right lender that underwrites and believes the borrower has a solid plan for a particular piece of real estate and the track record to back it up. You can see a sample term sheet abstraction in the image at the top of this post, or take a deeper dive via this previous post:

Comments