Senior Housing: A Better Option for Successful Wealth Succession?

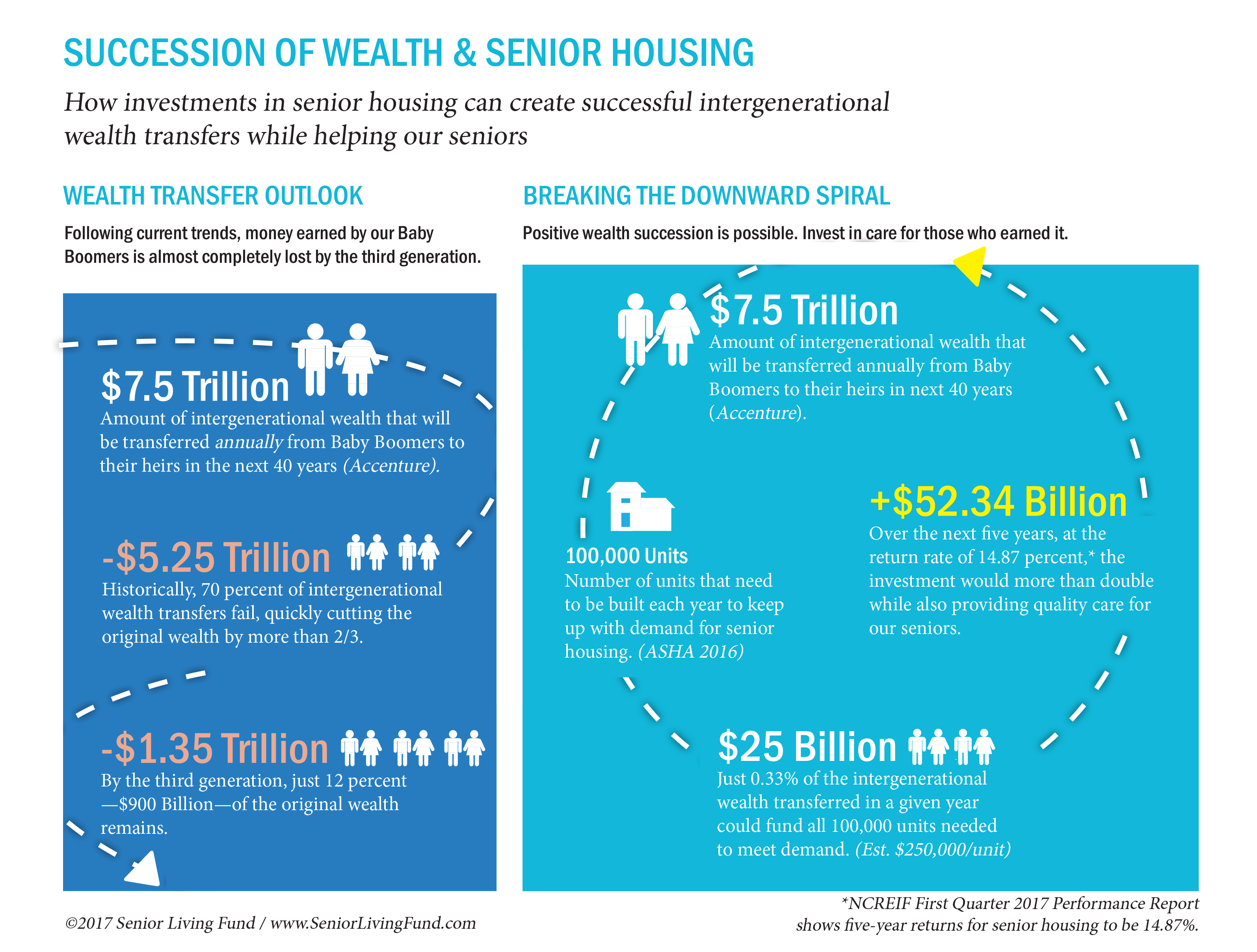

We are at the brink of the largest inter-generational wealth transfer in history. Accenture reports over the next 30-40 years, $30 trillion in assets will pass from Baby Boomers to their heirs in the United States alone. Unfortunately, it turns out 70 percent of inter-generational wealth transfers fail. So how can we ensure this value isn’t lost in succession? One good answer: investing in the seniors who created that wealth in the first place.

Within the Longevity Market, there are numerous ways to invest, from wearable technology to new pharmaceuticals, and any number of other innovations and ventures. But one of the easiest ways to make the most impact with your investment is also perhaps one of the easiest: senior housing. As the senior population climbs to 72 million by 2030—more than doubling from the year 2000—families throughout the country will be looking for safe, accessible, social spaces where their parents can live comfortably and happily. For this reason, senior housing has consistently been the best-performing asset class in commercial real estate over 1, 3, 5, and 10 -year periods. Not only does it help our seniors—it also helps their wealth grow.

For instance, in its Q1 2017 report, NCREIF showed that on a 10-year basis, Senior Housing outperformed apartments by returns of 11.13% vs. 6.42%, and hotels at 11.13% vs. 4.38%. Even retail — the closest runner-up — hit only 8.16% over 10 years. So, what is leading Senior Housing — such a small segment of the CRE market — to see such high returns?

Pushed by a huge demographic trend of aging baby boomers — 10,000 turning 65 every single day — Senior Housing has grown to become a $300 billion asset class anticipated to grow through at least 2040. And although some worry about rising interest rates when investing in CRE, the senior housing market still holds growth potential—both because it’s a need-based property-type, and because its historical returns can withstand the rate increases.

“Because senior housing has a long-term history of providing higher returns on investment compared to all other commercial real estate sectors, it’s better able to withstand the impact of higher interest rates,” says Dan Brewer, Chief Fund Manager at Senior Living Fund. “Where some asset classes like hotels or retail may find it’s not economical to build during higher-rate periods, senior housing can often continue to build and experience profits—albeit compressed.”

Not only is Senior Housing a strong, recession-resistant candidate for investment, it’s also a meaningful one. Investors help bring quality senior care to those who need it, and in turn create the following positive impact:

Senior Communities Alleviate Loneliness

Senior isolation has been linked to increased mortality rates in adults 52+. It’s also been linked to depression, increased risk for dementia, chronic illness, and high blood pressure. In terms of creating an impact in longevity, this is one of the most tangible investments you can make, as it gives seniors a place to socialize, exercise, and feel part of a community—all things that help alleviate loneliness and isolation.

Investing Helps Build Much-Needed Housing

According to the American Seniors Housing Association (ASHA), some 2 million senior housing units will need to be built to keep up with demand by 2040. Without enough space, families will be struggling to care for their loved ones in cramped homes while managing the stress of life, work, and children. Investing in senior housing will help ensure that enough quality housing is available when our loved ones need it.

Investing Brings Peace to Surrounding Families

When you invest in senior housing, you are not just helping seniors. You are helping entire families who are pushed to the limit with worry, finances, commitments, and time. You’re helping to ease the burden on them while providing a sense of independence to the senior, as well.

The next few decades will see unprecedented wealth transfer between our aging seniors and their heirs. One of the best ways to break the cycle of wealth loss in that transfer is to invest in those who built the wealth up in the first place: our seniors themselves. Not only will it prevent wealth loss—it will earn more for future generations, and help our seniors in the process.

Jess Stonefield is a contributing writer on aging, technology, mental health and the greater longevity economy for publications such as Changing Aging, The Mighty and Next Avenue. She is passionate about impact investing and the greater concept of “equitable equity” — spreading wealth to all levels of our society. She is a communications expert for Senior Living Fund.

Comments (2)

Thank you so much for reading! There are lots of ways to get in to senior housing investment. Please visit seniorlivingfund.com to sign up to receive our welcome information packet and see if one of our funds is right for you.

Jess Stonefield, about 7 years ago

This was a very informative article. I learned something extremely mindblowing today! Wow! Thank you for this. So how does a newbie from NJ get started in this avenue of REI?

Angelia Curtis, about 7 years ago