Which is a Better Gauge - Capitalization Rate or Cash-on-Cash Return?

Cash flow is king or so the saying goes. When it comes to owning rental properties, a positive cash flow is absolutely essential. When an investor purchases an income producing property, there can be several motivations such as future appreciation, portfolio growth, income stream creation, retirement income, income tax shields or any other reason. Nevertheless, the primary reason should be to create a stable return on the investment.

How to Use the Capitalization Rate

Investors frequently hear of the Capitalization Rate as the gauge of a property’s profitability. The Cap Rate refers to the ratio of Net Operating Income divided into the market value of the property. Here’s an example to help you see it in action:

- A 4-Plex rents for $750 each unit which produces a gross monthly income of $3,000.

- Applying the 50% rule to account for all expenses and vacancy the NOI is $1,500.

- You will earn $18,000 each year less the mortgage and taxes.

- You paid $250,000 for the property less than a year ago.

- The Capitalization Rate is $18,000/$250,000 or 7.2%

What does the Capitalization Rate really tell you? The main use for a Cap Rate is to use it as a comparison with other investments. This analysis is able to accurately compare the profitability of apples to oranges or single family rentals to apartment buildings to commercial properties. Here is how it works:

Here you have three totally different investment opportunities with a huge range in prices. Which one is the better investment option?

The higher the cap rate, the better the investment. When you examine the cap rate for each property, the 20 unit apartment building will generate the best rental yield in comparison to the price.

Limitations of the Capitalization Rate

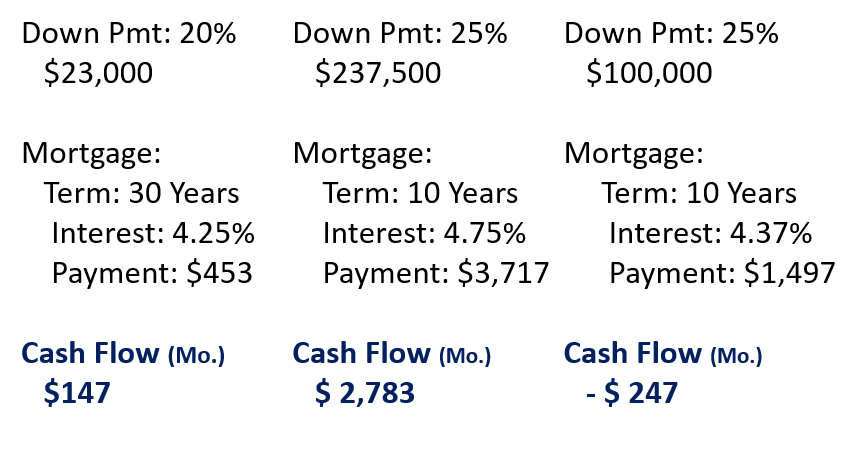

There are limitations to the cap rate, however. The capitalization rate does not factor in any mortgage payments. It also does not address the specific return on the money that you have invested. These two factors will significantly impact the Return on Investment. Notice the effect as the analysis continues:

You can now clearly identify that the retail store is a negative cash flow property. The apartment building has a strong cash flow and continues to look appealing, but what is the return on your investment?

Cash-On-Cash Measures Your Profit

I find that the cash-on-cash return is a much better gauge of profitability. It compares the pre-tax net income to the actual money you’ve invested in that piece of real estate. This is an excellent way to compare different investment opportunities and the return you can expect from them. The pre-tax cash flow is divided into the down payment which is the actual amount of money you have spent to obtain the investment. Here is how it works:

The cash-on-cash return will tell you the return you are earning on the actual cash you have spent. As you can see from this example, the apartment building continues to look like the better investment.

Investors can now take this C-o-C return and compare it to other investment opportunities such as stocks and bonds which also measure the return on the money you pay in. So the question is, can you find a stock or bond that will give you a better return than 14.06%? If not, then again your apartment building is looking like the best investment decision.

But what if you found out that the single family house was being leased below market and the lease is up. Notice how this can change your investment choice dramatically:

All of a sudden, you have a single $23,000 investment earning $5,364 a year. In just over 4.25 years, you will have earned back your investment in full!

All of a sudden, you have a single $23,000 investment earning $5,364 a year. In just over 4.25 years, you will have earned back your investment in full!

Sure, you may be able to find a stock that offers that kind of return but what is the risk level? If the rent price of $1,800 a month is market based, your risk will be very low.

As you can see, including the Cash-on-Cash return calculation in your investment considerations will help you to make the best financial choice. In addition, it help a buyer to see “what is in it for me” rather than the more obscure capitalization rate.

Make sure you stop by next week as we will talk about how using leverage (i.e. the bank’s money) can increase your cash on cash return.

Comments (4)

"The pre-tax cash flow is divided into the down payment which is the actual amount of money you have spent to obtain the investment."

This is backwards because it won't yield a percentage.

Brandon McCombs, about 10 years ago

@Ralph Hunter - this is an excellent overview and the way you showed it should help everyone truly understand the difference between Cap Rates and C-o-C.

This is the first post of yours that I have read, and I have just subscribed because I think it is excellent. One thing I thought I would point out (and please provide your feedback) but I think it would be great if you can also add the calculations you used to show your C-o-C calculation as I imagine others might not realize you did (rent x 12 x 50%) - (monthly mortgage payment x 12) to get your annual cash flow where mortgage payment is P&I and the 50% includes all expenses (including taxes and insurance).

I am sure you can show/write that more eloquently then me in your post!

Ryan Landis, about 10 years ago

very good lesson. Don

Don Alberts, about 10 years ago

This is a good explanation and really simplifies it with visuals that makes sense. I will definitely pay more attention to the C-O-C from now on when analyzing properties. Thanks @Ralph Hunter.

Andrew Hofing, about 10 years ago