$645,000

Investment Summary

- Monthly Cash Flow

- -$1,107

- Cap Rate

- 4.1%

- Cash-on-Cash Return

- -9.0%

- Debt Coverage Ratio

- 0.66

- Internal Rate of Return (5 years)

- -4.7%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

Property Description

FABULOUS PRICE AND BUYER INCENTIVES! Not only can you get this home at an AWESOME price, but the sellers are also offering an Exmark Zero-Turn lawn mower and a $5,000 credit for the buyers to use however they want!! You will have to see everything this home offers! Welcome to this beautifully crafted Barantine Downing December 2022 - new build, 4-bedroom, 3.5-bathroom custom ranch home, offering modern elegance and thoughtful design. Nestled in a friendly and charming community with sidewalks and a central mailbox, this home is designed for both comfort and convenience. Step onto the rocking chair front porch and enjoy your morning coffee before heading inside to an inviting open floor plan. The great room features a cozy fireplace and flows seamlessly into the kitchen, which boasts custom cabinetry, a large island, stainless steel appliances, a farmhouse sink, quartz counter tops and a spacious breakfast area with a dedicated space for a coffee bar! There is a small room off of the kitchen that is a flex space and has endless possibilities like an additional pantry, office, pet room, storage etc. Adjacent to the kitchen, a dedicated dining room with a beautiful feature wall of wainscoting and open to seat 12+ people if so desired. The primary suite is tucked away in its own private hallway, featuring a spacious closet and a luxurious ensuite bath with double sinks, a large glass encased tiled shower and a free standing bathtub. Two additional bedrooms, one of the bedrooms has a custom feature wall and they share a convenient Jack-and-Jill bathroom, each offering privacy, walk in closets and ample space. Upstairs, you'll find a fourth bedroom with a full bathroom, perfect for guests or a private retreat. Walk in attic space with plenty of room for storage and very easy to access. This home also features a three-car garage (one with a private exterior door) with a built in storage cabinet and bench, a hard piped pressure washer system, tankless water heater, natural gas, high-speed internet, and energy-efficient foam insulation in the rafters. The covered back porch is perfect for your outdoor entertaining with friends and family or just unwinding after a long day. There are so many great features and details on this home which includes tall doors, accent walls, custom mirrors, tongue and groove porch ceilings front and back, black rubber mulch and so much more! Perfect private yard for a pool and the location is perfect and convenient! Come visit this stunning home and make it yours today!

Build Your Team

Quickly find investor-friendly professionals who can help you succeed in real estate investing at any stage of the investing journey.

Agents

Match with investor-friendly agents who can help you find, analyze, and close your next deal

Lenders

Get the best funding…find investor-friendly lenders who specialize in your deal strategy

Property Managers

Transition to passive investing. Find a trusted property management partnership that lasts.

Tax Pros & Accountants

Taxes and financial reporting made easy—find experts to create tax savings strategies, file taxes, and more

Location

Property Details

Parking

- Description: Attached, Garage Door Opener, Garage, Parking Pad

- Details: Attached, Garage, Garage Door Opener, Kitchen Level, Parking Pad, Storage

- Garage Spaces: 3

- Spaces Total: 3

Bedroom Information

- # of Bedrooms: 4

Bathroom Information

- # of Baths (Full): 3

- # of Baths (Partial): 1

- # of Baths (Total): 3.5

Interior Features

- # of Stories: 1

- Basement Description: None

- Fireplace: Yes

Exterior Features

- Exterior Walls Materials: Fiber cement siding (Hardi-board/Hardi-plank

- Foundation: Slab

- Roof Type: Gable

- Roof Material: Composition

HOA

- Has HOA: Yes

- HOA Fee: $650/annually

Land Information

- Land Use: Residential

- Land Use Subtype: Single Family Residential

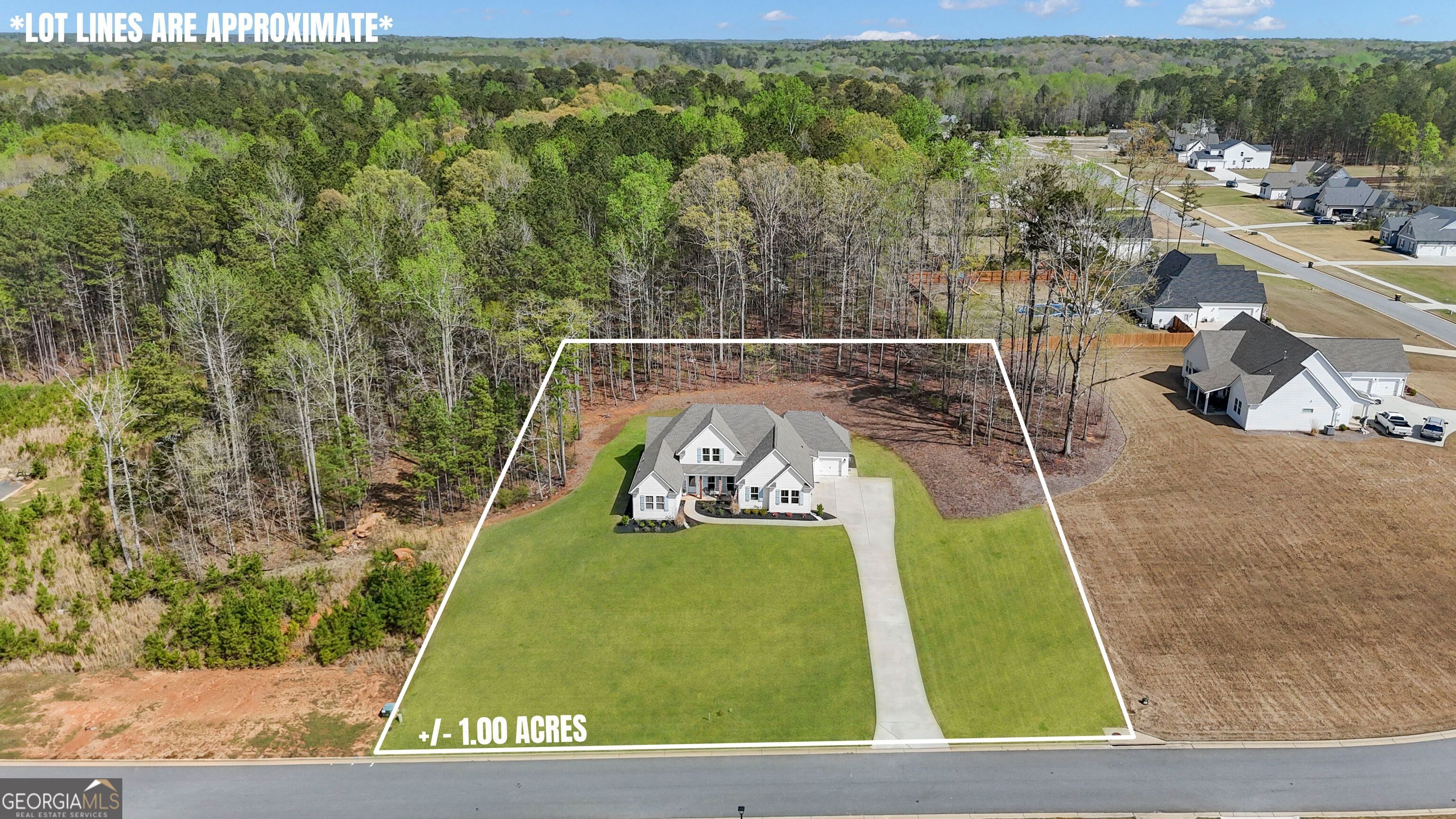

Lot Information

- Parcel ID: 1141026027

- Lot Size: 0 sqft

Property Information

- Property Type: Single Family Residence

- Style: Ranch

- Year Built: 2022

Tax Information

- Annual Tax: $5,285

Utilities

- Water & Sewer: Public

- Heating: Central, Natural Gas

- Cooling: Ceiling Fan(s), Central Air, Electric

Location

- County: Fayette

Listing Details

Investment Summary

- Monthly Cash Flow

- -$1,107

- Cap Rate

- 4.1%

- Cash-on-Cash Return

- -9.0%

- Debt Coverage Ratio

- 0.66

- Internal Rate of Return (5 years)

- -4.7%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

Purchase Details

Purchase PriceThe price paid for the property. Purchase price:

| $645,000 |

|---|---|

Amount FinancedThe amount of the purchase financed through a loan. Amount financed:

| -$516,000 |

Down paymentThe initial payment made towards the purchase. Down payment:

| $129,000 |

Closing CostsFees and expenses associated with purchasing a property, typically ranging from 2% to 5% of the home’s purchase price, paid at the end of a home purchase to cover services like lending, title transfer, and taxes. Closing costs:

| $19,350 |

Rehab CostsCosts incurred to repair or improve the property, including: roof, flooring, exterior siding, kitchen, exterior paint, bathrooms, etc. Rehab costs:

| $0 |

Initial Cash InvestedThe total initial cash invested in the property. Calculation:Down payment + Buying costs + Rehab costs Initial cash invested:

| $148,350 |

Square Feet (SQFT)The total square footage of the property. Square feet:

| 2,628 |

Cost Per Square FootCost per square foot of the property. Calculation:Purchase Price / Square Feet Cost per square foot:

| $245 |

Monthly Rent Per Square FootMonthly rent divided by the number of square feet. This ratio helps investors compare rental income efficiency across properties, markets, and unit sizes Calculation:Monthly Rent / Square Feet Monthly rent per square foot:

| $1.48 |

Financing Details

Loan AmountThe total sum of money borrowed from a lender to finance a property purchase. Calculation:Purchase Price - Down Payment

Loan amount:

| $516,000 |

|---|---|

Loan to Value Ratio (LTV)Loan amount divided by the market value of the property. Calculation:Loan Amount / Market Value

Loan to value ratio:

| 80.0% |

Loan TypeThe type of loan (e.g., fixed, adjustable).

Loan type:

| Amortizing |

TermThe loan repayment period in years.

Term:

| 30 years |

Interest RateThe percentage a lender charges on the borrowed amount of a loan, determining the cost of borrowing money.

Interest rate:

| 6.625% |

Principal & Interest (PI)The principal is the portion of the loan payment that reduces the loan balance. The interest is the lender's charge for borrowing money. Calculation:(P * r * (1 + r) ** n) / ((1 + r) ** n - 1) Where:

P = Loan amount (principal)

Principal & interest:

| $3,304 |

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services.

Property tax:

| $440 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified.

Insurance:

| $273 |

Private Mortgage Insurance (PMI)A fee that borrowers pay when they take out a conventional loan with a loan-to-value (LTV) ratio above 80%.

Private mortgage insurance (PMI):

| $0 |

Monthly PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. Monthly payment:

| $4,017 |

Operating Income

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Gross RentThe total rental income received from tenants before deducting any expenses. Includes base rent, late fees, pet fees, parking fees, and other recurring charges.

Gross rent:

| $3,900 | $46,800 | |

Vacancy LossExpected loss of rent due to vacancies.

Vacancy loss:

(6%)

| 6% | -$234 | -$2,808 |

Operating IncomeGross rental income minus vacancy loss. Calculation:Gross rent - Vacancy loss

Operating income:

| $3,666 | $43,992 |

Operating Expenses

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services. | 11% | -$440 | -$5,285 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified. | 7% | -$273 | -$3,276 |

Property ManagementThe costs associated with hiring a property manager to handle the day-to-day operations of a rental property. Includes management fees, leasing fes, eviction fees, etc. Calculation:Assumes 8% of gross rental income. | 8% | -$312 | -$3,744 |

Repairs & MaintenanceOngoing costs for routine upkeep and minor fixes needed to keep a property in good working condition. Calculation:Assumes 5% of gross rental income. Varies by property age and condition. | 5% | -$195 | -$2,340 |

Capital ExpensesLarge, infrequent costs for major improvements or replacements, like a new roof, HVAC system, or appliances. Calculation:Assumes 5% of gross rental income. Varies by property age. | 5% | -$195 | -$2,340 |

HOA FeesRegular dues paid to a Homeowners Association for community maintenance, amenities, and management. Similar fees include: Condo Association Fees, Co-op Maintenance Fees, etc. | 1% | -$54 | -$648 |

Operating ExpensesRecurring costs required to maintain and manage a rental property, including property taxes, insurance, maintenance, repairs, utilities (if paid by the owner), property management fees, and other day-to-day expenses. Calculation:Insurance + Property Taxes + Property Management + Repairs & Maintenance + Capital Expenditures + HOA Fees | 38% | -$1,469 | -$17,633 |

Cash Flow

| Monthly | Yearly | |

|---|---|---|

Net Operating Income (NOI)The income generated from a property after deducting all operating expenses but before deducting mortgage payments, taxes, and capital expenditures. Calculation:Gross Operating Income - Operating Expenses

Net operating income:

| $2,197 | $26,364 |

Mortgage PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. | -$3,304 | -$39,648 |

Cash FlowNet Operating Income (NOI) minus mortgage payments. Calculation:NOI - Mortgage Payments | -$1,107 | -$13,284 |