$335,000

Investment Summary

- Monthly Cash Flow

- -$753

- Cap Rate

- 3.6%

- Cash-on-Cash Return

- -11.7%

- Debt Coverage Ratio

- 0.57

- Internal Rate of Return (5 years)

- -7.4%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

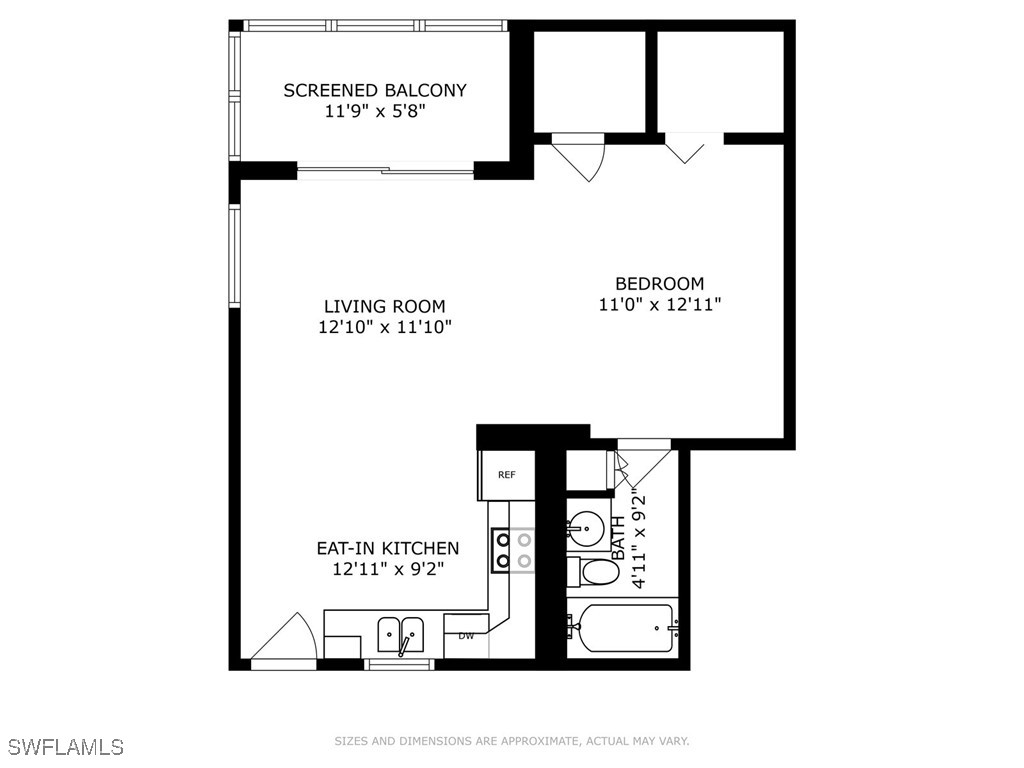

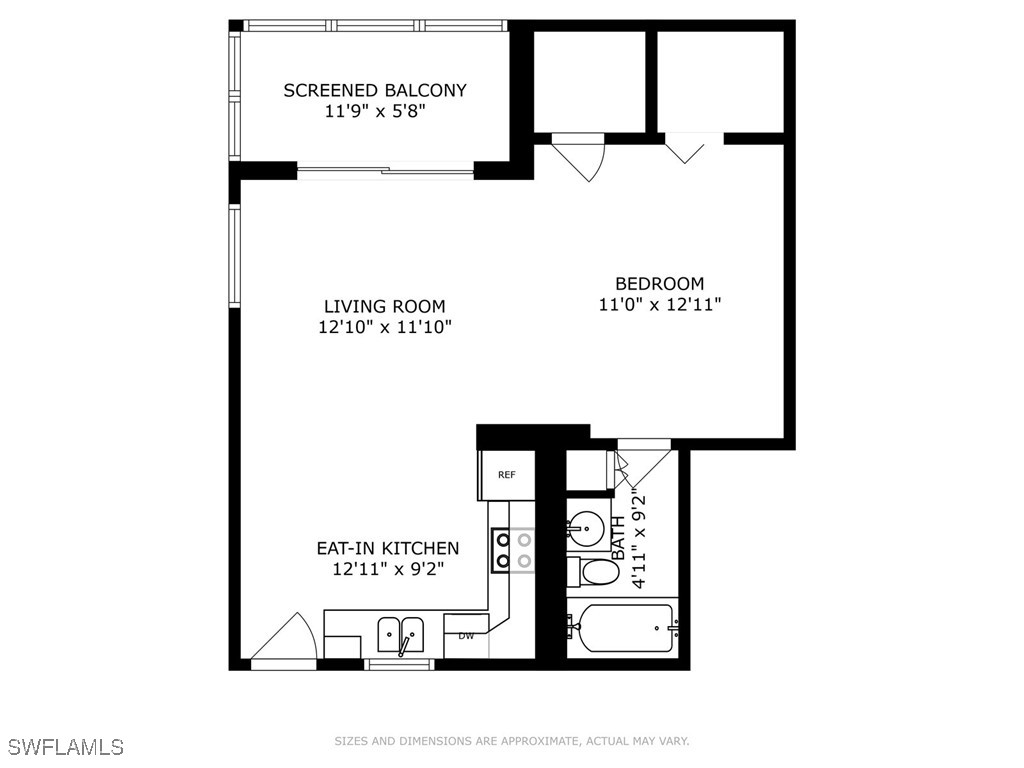

Property Description

Welcome to paradise at the highly sought-after Bonita Beach and Tennis Club, where you’re just steps away from the pristine white sugar sand beaches of Bonita Beach! This fully renovated, turnkey 1-bedroom, 1-bathroom condo on the 5th floor of Building #4 offers stunning partial Gulf views and breathtaking sunsets from your private balcony. This active community spans 15 acres and boasts a wide array of amenities scheduled to reopen in 2025, including two newly renovated heated pools (one with a handicap ramp), 10 Har-Tru tennis courts, new pickleball courts, bocce, shuffleboard, picnic areas, and a community room. For water enthusiasts, boat slips, trailer parking, and kayak storage are available for rent on the channel when available. With its prime location directly across from Bonita Beach, this condo is perfect as a vacation getaway or an income-generating rental property. The flexible rental policy with a 3-day minimum lease makes it an investor’s dream! Ask the listing agent about the seller’s excellent weekly rental income. Enjoy being just a stroll away from Doc’s Beach House, nearby restaurants, and shopping. Plus, all special assessments have been fully paid! Don’t miss this opportunity to own a piece of paradise with unbeatable beach access, vibrant community living, and incredible rental potential. ¡Bienvenido al paraíso en el codiciado Bonita Beach and Tennis Club, donde estarás a solo pasos de las prístinas playas de arena blanca de Bonita Beach! Este condominio de 1 dormitorio y 1 baño, completamente renovado y llave en mano, se encuentra en el quinto piso del Edificio #4 y ofrece impresionantes vistas parciales al Golfo y atardeceres inolvidables desde tu balcón privado. Esta comunidad activa se extiende por 15 acres y cuenta con una amplia gama de amenidades que reabrirán en 2025, incluyendo dos piscinas climatizadas recientemente renovadas (una con rampa para personas con movilidad reducida), 10 canchas de tenis Har-Tru, nuevas canchas de pickleball, bochas, shuffleboard, áreas de picnic y una sala comunitaria. Para los amantes del agua, hay muelles para botes, estacionamiento para remolques y almacenamiento para kayaks disponibles en alquiler según disponibilidad. Con una ubicación privilegiada justo frente a Bonita Beach, este condominio es ideal como escapada vacacional o como propiedad de inversión generadora de ingresos. La política de alquiler flexible, con un mínimo de 3 días por contrato, lo convierte en el sueño de cualquier inversionista. ¡Consulta al agente de listado sobre los excelentes ingresos semanales por alquiler del propietario! Disfruta de estar a solo unos pasos de Doc’s Beach House, restaurantes cercanos y tiendas. Todo el complejo está siendo cuidadosamente restaurado tras el huracán Ian, lo que garantiza que se encuentre en condiciones impecables. ¡Además, todas las evaluaciones especiales han sido pagadas en su totalidad!

Build Your Team

Quickly find investor-friendly professionals who can help you succeed in real estate investing at any stage of the investing journey.

Agents

Match with investor-friendly agents who can help you find, analyze, and close your next deal

Lenders

Get the best funding…find investor-friendly lenders who specialize in your deal strategy

Property Managers

Transition to passive investing. Find a trusted property management partnership that lasts.

Tax Pros & Accountants

Taxes and financial reporting made easy—find experts to create tax savings strategies, file taxes, and more

Location

Property Details

Parking

- Garage Spaces: 0

- Spaces Total: 0

Bedroom Information

- # of Bedrooms: 1

Bathroom Information

- # of Baths (Full): 1

- # of Baths (Total): 1.0

Interior Features

- # of Stories: 1

Exterior Features

- Foundation: Pillar/Post/Pier

- Roof Material: Built-Up, Flat

HOA

- Has HOA: Yes

- Additional HOA Fee: $1,005/quarterly

Land Information

- Land Use: Residential

- Land Use Subtype: Condominium Unit

Lot Information

- Parcel ID: 314725B301300.0508

- Lot Size: 0 sqft

Property Information

- Property Type: Condominium

- Style: High Rise

- Year Built: 1979

Tax Information

- Annual Tax: $532

Utilities

- Water & Sewer: Public

- Cooling: Window Unit(s), Ceiling Fan(s), Wall Unit(s)

Location

- County: Lee

Listing Details

Investment Summary

- Monthly Cash Flow

- -$753

- Cap Rate

- 3.6%

- Cash-on-Cash Return

- -11.7%

- Debt Coverage Ratio

- 0.57

- Internal Rate of Return (5 years)

- -7.4%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

Purchase Details

Purchase PriceThe price paid for the property. Purchase price:

| $335,000 |

|---|---|

Amount FinancedThe amount of the purchase financed through a loan. Amount financed:

| -$268,000 |

Down paymentThe initial payment made towards the purchase. Down payment:

| $67,000 |

Closing CostsFees and expenses associated with purchasing a property, typically ranging from 2% to 5% of the home’s purchase price, paid at the end of a home purchase to cover services like lending, title transfer, and taxes. Closing costs:

| $10,050 |

Rehab CostsCosts incurred to repair or improve the property, including: roof, flooring, exterior siding, kitchen, exterior paint, bathrooms, etc. Rehab costs:

| $0 |

Initial Cash InvestedThe total initial cash invested in the property. Calculation:Down payment + Buying costs + Rehab costs Initial cash invested:

| $77,050 |

Square Feet (SQFT)The total square footage of the property. Square feet:

| 508 |

Cost Per Square FootCost per square foot of the property. Calculation:Purchase Price / Square Feet Cost per square foot:

| $659 |

Monthly Rent Per Square FootMonthly rent divided by the number of square feet. This ratio helps investors compare rental income efficiency across properties, markets, and unit sizes Calculation:Monthly Rent / Square Feet Monthly rent per square foot:

| $3.94 |

Financing Details

Loan AmountThe total sum of money borrowed from a lender to finance a property purchase. Calculation:Purchase Price - Down Payment

Loan amount:

| $268,000 |

|---|---|

Loan to Value Ratio (LTV)Loan amount divided by the market value of the property. Calculation:Loan Amount / Market Value

Loan to value ratio:

| 80.0% |

Loan TypeThe type of loan (e.g., fixed, adjustable).

Loan type:

| Amortizing |

TermThe loan repayment period in years.

Term:

| 30 years |

Interest RateThe percentage a lender charges on the borrowed amount of a loan, determining the cost of borrowing money.

Interest rate:

| 6.840% |

Principal & Interest (PI)The principal is the portion of the loan payment that reduces the loan balance. The interest is the lender's charge for borrowing money. Calculation:(P * r * (1 + r) ** n) / ((1 + r) ** n - 1) Where:

P = Loan amount (principal)

Principal & interest:

| $1,754 |

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services.

Property tax:

| $44 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified.

Insurance:

| $140 |

Private Mortgage Insurance (PMI)A fee that borrowers pay when they take out a conventional loan with a loan-to-value (LTV) ratio above 80%.

Private mortgage insurance (PMI):

| $0 |

Monthly PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. Monthly payment:

| $1,938 |

Operating Income

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Gross RentThe total rental income received from tenants before deducting any expenses. Includes base rent, late fees, pet fees, parking fees, and other recurring charges.

Gross rent:

| $2,000 | $24,000 | |

Vacancy LossExpected loss of rent due to vacancies.

Vacancy loss:

(6%)

| 6% | -$120 | -$1,440 |

Operating IncomeGross rental income minus vacancy loss. Calculation:Gross rent - Vacancy loss

Operating income:

| $1,880 | $22,560 |

Operating Expenses

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services. | 2% | -$44 | -$533 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified. | 7% | -$140 | -$1,680 |

Property ManagementThe costs associated with hiring a property manager to handle the day-to-day operations of a rental property. Includes management fees, leasing fes, eviction fees, etc. Calculation:Assumes 8% of gross rental income. | 8% | -$160 | -$1,920 |

Repairs & MaintenanceOngoing costs for routine upkeep and minor fixes needed to keep a property in good working condition. Calculation:Assumes 5% of gross rental income. Varies by property age and condition. | 5% | -$100 | -$1,200 |

Capital ExpensesLarge, infrequent costs for major improvements or replacements, like a new roof, HVAC system, or appliances. Calculation:Assumes 5% of gross rental income. Varies by property age. | 5% | -$100 | -$1,200 |

HOA FeesRegular dues paid to a Homeowners Association for community maintenance, amenities, and management. Similar fees include: Condo Association Fees, Co-op Maintenance Fees, etc. | 17% | -$335 | -$4,020 |

Operating ExpensesRecurring costs required to maintain and manage a rental property, including property taxes, insurance, maintenance, repairs, utilities (if paid by the owner), property management fees, and other day-to-day expenses. Calculation:Insurance + Property Taxes + Property Management + Repairs & Maintenance + Capital Expenditures + HOA Fees | 44% | -$879 | -$10,553 |

Cash Flow

| Monthly | Yearly | |

|---|---|---|

Net Operating Income (NOI)The income generated from a property after deducting all operating expenses but before deducting mortgage payments, taxes, and capital expenditures. Calculation:Gross Operating Income - Operating Expenses

Net operating income:

| $1,001 | $12,012 |

Mortgage PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. | -$1,754 | -$21,048 |

Cash FlowNet Operating Income (NOI) minus mortgage payments. Calculation:NOI - Mortgage Payments | $753 | $9,036 |