$2,699,999

Investment Summary

- Monthly Cash Flow

- -$10,020

- Cap Rate

- 1.7%

- Cash-on-Cash Return

- -19.4%

- Debt Coverage Ratio

- 0.28

- Internal Rate of Return (5 years)

- -14.7%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

Property Description

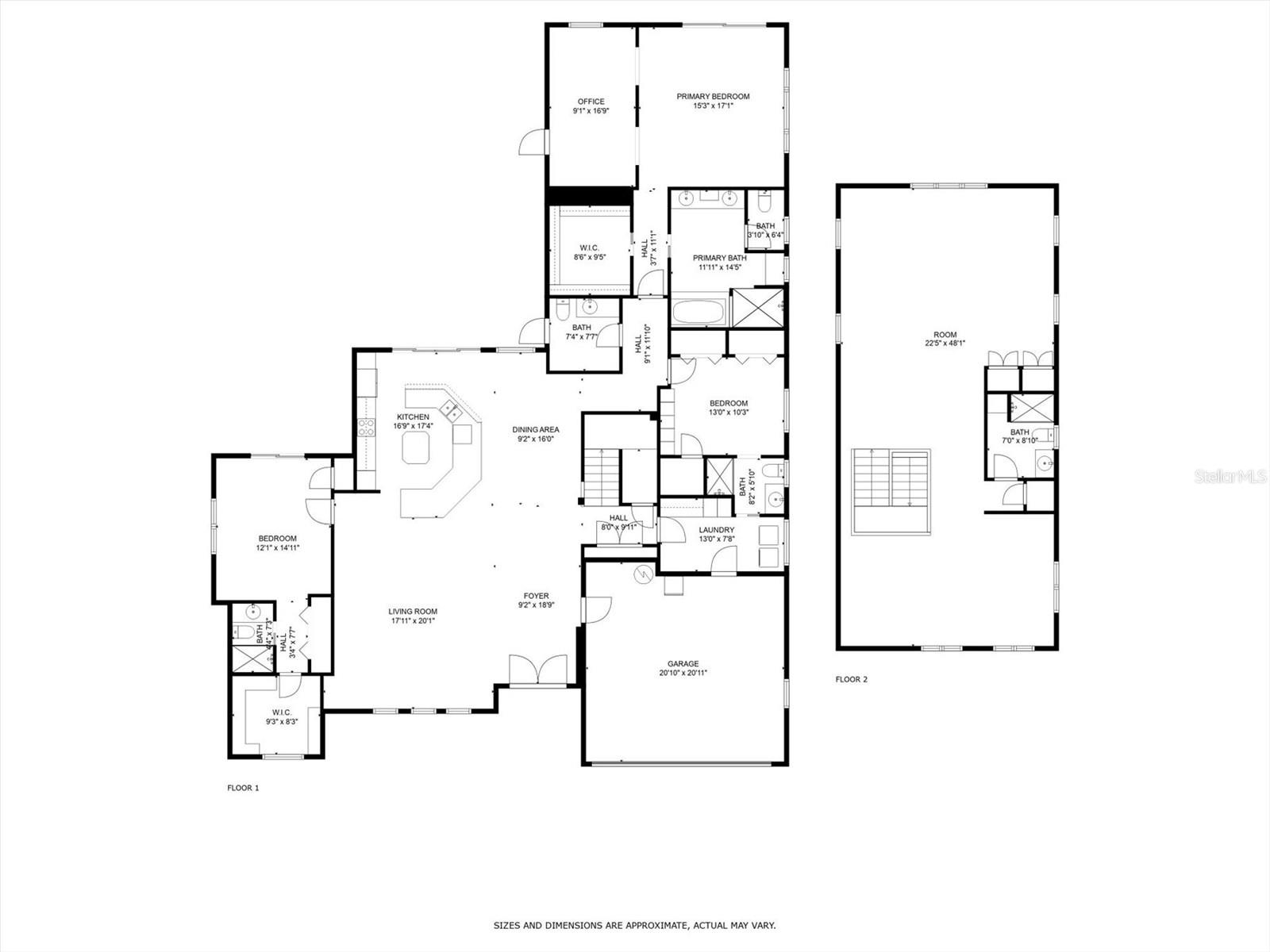

Never flooded and NO FEMA claims! Tucked away on the most desirable street in prestigious Island Estates, this exquisitely remodeled waterfront home is the ultimate retreat for boating enthusiasts and luxury seekers alike. Encompassing over 4,200 square feet of refined living space, the residence offers a perfect balance of elegance, functionality, and coastal charm. Shaded by majestic oaks and surrounded by professionally maintained landscaping, the property enjoys a deep, wide canal in a no-wake zone with minimal wave action— ideal for boaters. The state-of-the-art dock with TREK decking, features two powered lifts, a slip that accommodates vessels up to 45 feet, Gem remotes for both lifts, 2 30 amp power outlets & city water. Irrigation is supported by reclaimed water, with updated valves and sprinkler heads as of March 2025.The home is equipped with a newly updated solar power system (2025) and backup battery, providing sustainable and efficient energy. A hurricane-rated garage door, impact-rated windows, and both electric and hurricane shutters offer peace of mind during storm season. A tile roof tops the home in lasting style, and an electric vehicle charging outlet is in the garage. Inside, an open-concept great room welcomes you with soaring ceilings, abundant natural light, and elegant crown molding. 3 HVAC systems, including a new unit for the primary bedroom in 2025, ensures comfort throughout. The home features five beautifully remodeled bathrooms. The custom island kitchen is a chef’s dream, complete with a butcher block countertop, pot filler above an ergonomic cooktop, a large pantry, and extensive storage—even under the stairway. All countertops are finished in granite, marble, or quartz, blending luxury with everyday durability. The spacious primary suite offers a serene escape with crown molding, tray ceilings, and a new energy-efficient sliding door that opens to a outdoor sitting area. A custom-built adjoining library and desk area provides the perfect setting for work or relaxation. The suite also boasts a large walk-in closet and a luxurious ensuite bath featuring a double vanity with custom cabinetry, a soaking tub, a walk-in shower, and an instant hot water pump.Two additional bedrooms are located on the first floor, both generously sized with large closets and access to their own ensuite bathrooms. Upstairs, a 50 x 24-foot bonus room presents endless possibilities—easily convertible into additional bedrooms, a sitting area, media room, or playroom, all while offering beautiful sunset views. There’s also extra attic storage accessible via a pull-down stairway. Step outside to the screened pool area, where pavers have been cleaned and sealed in 2025, and a child safety fence provides peace of mind. A tranquil water feature enhances the relaxing ambiance, perfect for enjoying evening sunsets. The pool is equipped with a new pump (2024), rounding out the home’s long list of recent upgrades. Security cameras, outdoor lighting, and a comprehensive alarm system add another layer of safety to this already well-appointed home. Perfectly located just minutes from Clearwater Beach and only 30 minutes to Tampa International Airport, this home offers the ultimate in waterfront living, modern convenience, and timeless elegance. Whether you're setting out on the water, hosting guests, or enjoying quiet evenings at home, this Island Estates gem is a rare find—beautifully appointed, meticulously maintained, and move-in ready.

Build Your Team

Quickly find investor-friendly professionals who can help you succeed in real estate investing at any stage of the investing journey.

Agents

Match with investor-friendly agents who can help you find, analyze, and close your next deal

Lenders

Get the best funding…find investor-friendly lenders who specialize in your deal strategy

Property Managers

Transition to passive investing. Find a trusted property management partnership that lasts.

Tax Pros & Accountants

Taxes and financial reporting made easy—find experts to create tax savings strategies, file taxes, and more

Location

Property Details

Parking

- Description: Garage

- Details: Attached

- Garage Spaces: 2

- Spaces Total: 0

Bedroom Information

- # of Bedrooms: 4

Bathroom Information

- # of Baths (Full): 4

- # of Baths (Total): 5.0

Interior Features

- # of Rooms: 4

- # of Stories: 1

Exterior Features

- Exterior Walls Materials: Stucco

- Foundation: Slab

- Roof Type: Gable

- Roof Material: Tile

- Pool: Yes

Land Information

- Land Use: Residential

- Land Use Subtype: Single Family Residential

Lot Information

- Parcel ID: 052915434560730580

- Lot Size: 10629 sqft

Property Information

- Property Type: Single Family Residence

- Year Built: 1971

Tax Information

- Annual Tax: $13,882

Utilities

- Water & Sewer: Public

- Heating: Central

- Cooling: Central Air

Location

- County: Pinellas

Listing Details

Investment Summary

- Monthly Cash Flow

- -$10,020

- Cap Rate

- 1.7%

- Cash-on-Cash Return

- -19.4%

- Debt Coverage Ratio

- 0.28

- Internal Rate of Return (5 years)

- -14.7%

Cash Flow

Net Operating Income (NOI) minus mortgage payments.

Calculation:

NOI - Mortgage Payments

Cap Rate (Market Value)

Capitalization Rate is a rate of return that compares the yearly Net Operating Income (NOI) to the market value.

Calculation:

NOI / Market Value

Cash-on-Cash Return (CoC)

Annual Cash Flow / Cash Invested

Calculation:

Annual cash flow divided by initial cash invested.

Debt Coverage Ratio (DCR)

Net Operating Income (NOI) divided by total debt payments.

Calculation:

NOI / Total Debt Payments

Internal Rate of Return (IRR)

A metric for assessing profitability over time. IRR is the discount rate at which the net present value (NPV) of all future cash flows (positive and negative) from an investment equals zero — including both periodic cash flow (such as rent) and a projected sale at the end of the holding period. It represents the expected annualized return, accounting for income, expenses, and the recovery of capital through a future sale.

Purchase Details

Purchase PriceThe price paid for the property. Purchase price:

| $2,699,999 |

|---|---|

Amount FinancedThe amount of the purchase financed through a loan. Amount financed:

| -$2,159,999 |

Down paymentThe initial payment made towards the purchase. Down payment:

| $540,000 |

Closing CostsFees and expenses associated with purchasing a property, typically ranging from 2% to 5% of the home’s purchase price, paid at the end of a home purchase to cover services like lending, title transfer, and taxes. Closing costs:

| $81,000 |

Rehab CostsCosts incurred to repair or improve the property, including: roof, flooring, exterior siding, kitchen, exterior paint, bathrooms, etc. Rehab costs:

| $0 |

Initial Cash InvestedThe total initial cash invested in the property. Calculation:Down payment + Buying costs + Rehab costs Initial cash invested:

| $621,000 |

Square Feet (SQFT)The total square footage of the property. Square feet:

| 4,265 |

Cost Per Square FootCost per square foot of the property. Calculation:Purchase Price / Square Feet Cost per square foot:

| $633 |

Monthly Rent Per Square FootMonthly rent divided by the number of square feet. This ratio helps investors compare rental income efficiency across properties, markets, and unit sizes Calculation:Monthly Rent / Square Feet Monthly rent per square foot:

| $1.69 |

Financing Details

Loan AmountThe total sum of money borrowed from a lender to finance a property purchase. Calculation:Purchase Price - Down Payment

Loan amount:

| $2,159,999 |

|---|---|

Loan to Value Ratio (LTV)Loan amount divided by the market value of the property. Calculation:Loan Amount / Market Value

Loan to value ratio:

| 80.0% |

Loan TypeThe type of loan (e.g., fixed, adjustable).

Loan type:

| Amortizing |

TermThe loan repayment period in years.

Term:

| 30 years |

Interest RateThe percentage a lender charges on the borrowed amount of a loan, determining the cost of borrowing money.

Interest rate:

| 6.625% |

Principal & Interest (PI)The principal is the portion of the loan payment that reduces the loan balance. The interest is the lender's charge for borrowing money. Calculation:(P * r * (1 + r) ** n) / ((1 + r) ** n - 1) Where:

P = Loan amount (principal)

Principal & interest:

| $13,831 |

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services.

Property tax:

| $1,157 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified.

Insurance:

| $504 |

Private Mortgage Insurance (PMI)A fee that borrowers pay when they take out a conventional loan with a loan-to-value (LTV) ratio above 80%.

Private mortgage insurance (PMI):

| $0 |

Monthly PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. Monthly payment:

| $15,492 |

Operating Income

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Gross RentThe total rental income received from tenants before deducting any expenses. Includes base rent, late fees, pet fees, parking fees, and other recurring charges.

Gross rent:

| $7,200 | $86,400 | |

Vacancy LossExpected loss of rent due to vacancies.

Vacancy loss:

(6%)

| 6% | -$432 | -$5,184 |

Operating IncomeGross rental income minus vacancy loss. Calculation:Gross rent - Vacancy loss

Operating income:

| $6,768 | $81,216 |

Operating Expenses

| % Rent | Monthly | Yearly | |

|---|---|---|---|

Property TaxesAnnual taxes levied by local governments on real estate properties. These taxes fund public services like schools, roads, and emergency services. | 16% | -$1,157 | -$13,882 |

InsuranceThe costs for insurance coverage to protect against financial losses due to risks like fire, natural disasters, theft, liability, or tenant-related damages. Calculation:Assumes 7% of gross rental income, unless insurance rates are specified. | 7% | -$504 | -$6,048 |

Property ManagementThe costs associated with hiring a property manager to handle the day-to-day operations of a rental property. Includes management fees, leasing fes, eviction fees, etc. Calculation:Assumes 8% of gross rental income. | 8% | -$576 | -$6,912 |

Repairs & MaintenanceOngoing costs for routine upkeep and minor fixes needed to keep a property in good working condition. Calculation:Assumes 5% of gross rental income. Varies by property age and condition. | 5% | -$360 | -$4,320 |

Capital ExpensesLarge, infrequent costs for major improvements or replacements, like a new roof, HVAC system, or appliances. Calculation:Assumes 5% of gross rental income. Varies by property age. | 5% | -$360 | -$4,320 |

HOA FeesRegular dues paid to a Homeowners Association for community maintenance, amenities, and management. Similar fees include: Condo Association Fees, Co-op Maintenance Fees, etc. | n/a | n/a | n/a |

Operating ExpensesRecurring costs required to maintain and manage a rental property, including property taxes, insurance, maintenance, repairs, utilities (if paid by the owner), property management fees, and other day-to-day expenses. Calculation:Insurance + Property Taxes + Property Management + Repairs & Maintenance + Capital Expenditures + HOA Fees | 41% | -$2,957 | -$35,482 |

Cash Flow

| Monthly | Yearly | |

|---|---|---|

Net Operating Income (NOI)The income generated from a property after deducting all operating expenses but before deducting mortgage payments, taxes, and capital expenditures. Calculation:Gross Operating Income - Operating Expenses

Net operating income:

| $3,811 | $45,732 |

Mortgage PaymentThe fixed amount a borrower pays each month to repay a loan. It typically includes principal and interest (P&I) and may also cover property taxes, insurance, HOA fees, and PMI if escrowed. | -$13,831 | -$165,972 |

Cash FlowNet Operating Income (NOI) minus mortgage payments. Calculation:NOI - Mortgage Payments | $10,020 | $120,240 |