Why is Senior Housing So Expensive? And What Can We Do About It?

One of the most common complaints I hear about senior housing today is this: it’s too expensive.

As part of a company that invests in private-pay senior housing facilities, I hear this complaint often. With monthly rents ranging between $1,500 and $6,000 per month, it’s clear today’s senior housing rents may present a significant burden to aging Americans and their families. Still, what I’d like to focus on in this article is not affordability but cost.

While it may seem like an issue of semantics, there is a difference between how affordable senior housing is, and how much it costs to build and maintain it. The latter shines some light on why senior housing has become so expensive. It also offers some insights on how aging Americans and their loved ones can make those costs a bit more manageable through a simple process of personal valuation and choice.

And yes—when it comes to senior housing—you have more choices than you may think.

Adding It Up

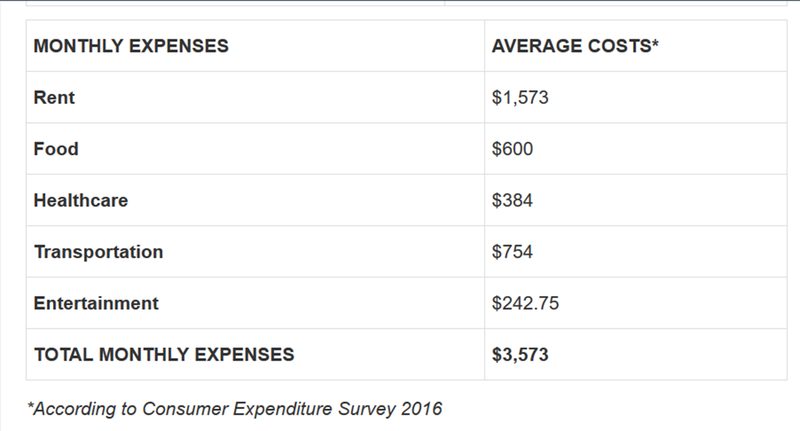

To help explain why senior housing is so expensive, let’s take a look at a quick example. Imagine for a moment you’re looking to move to an average American city, carrying the average costs most Americans incur on a monthly basis—rent, food, healthcare, entertainment, etc. How much would you be spending?

According to the Consumer Expenditure Survey 2016 your average household costs would add up to about $3,600.

Now: imagine if, in addition to the costs above, you wanted to find an apartment where staff were available 24 hours a day to help with household maintenance or health issues. You wanted access to amenities like tennis courts, pools, salons, and cafes. Chances are, your expenses would notch up a bit.

Now, let’s look further. Consider adding the costs of new construction, onsite medical equipment, memory care security features, potential lawsuits, marketing, sales, and other overhead associated with running a senior care community. Suddenly that range of $1,500 to $6,000 doesn’t seem quite so outlandish.

No, that doesn’t make senior housing more affordable. But it does provide an outline for what you’re paying for, including which services you can opt out of based on your own personal values.

Cutting Costs Based on Family Values

While determining the affordability of senior housing may not be within your power, determining the costs you spend on it are. The following are a few ways to cut down on expenses associated with elder care.

- Know What Matters. Many big-name operators offer upscale amenities that may or may not be important to you. Do you care if you have access to an onsite salon? Pool tables?Sauna?If not, consider going with a smaller community that has fewer amenities—and smaller monthly fees. In the end, the most important services you receive will relate to your physical and emotional health. Determine which services and amenities are must-haves, and which can fall by the wayside.

- Know Your Options. When we think of senior care, we often think of assisted living and memory care communities. But there are many other more affordable options out there. Senior apartments and senior co-op housing, for instance, allow you to live a more modest but comfortable lifestyle among peers your age. Yes, senior apartments likely lack the large grounds and amenities that larger communities offer. But they also lack the high monthly maintenance costs associated with those conveniences.

- Consider Secondary Locations. Just like apartment rents are higher in the big city, so are senior housing expenses. If possible, consider moving further out into suburban locations that are naturally less expensive.

- Open Your Home. There is no rush to enter senior housing. If you are happy living on your own and require minimal care, sharing your home with a friend of similar age. You’ll be avoiding one of the most devastating issues facing seniors today—isolation—while saving money and gaining the emotional support of a friend.

When it comes to senior housing today, it’s easy to feel powerless in the face of such daunting costs. Just remember: you get what you pay for—and there is no requirement to pay for everything today’s facilities offer. Many amenities are optional, and in the end, quality of care is the most important service any care community can provide. As long as you find a spot where you or your loved can find joy, purpose, physical assistance (if needed), and meaningful relationships, the location of care is completely up to you. Keep your eye on the prize—true longevity—and you may find senior housing is more accessible than you imagined.

Dan Brewer is Chief Fund Manager of Senior Living Fund, a private equity company investing in quality senior housing communities nationwide. Dan has nearly 25 years of business development and real estate investment experience, including 15 years in commercial real estate (CRE), and is a frequent speaker and panelist at industry conferences throughout the country. He is passionate about the social implications of aging and bringing senior housing to the forefront of the impact investing sector.

Comments