MULTIFAMILY LOAN OPTIONS

In my last article, WHY APARTMENTS ACCELERATE WEALTH FASTER THAN SINGLE FAMILY INVESTMENTS, I mentioned why multifamily has favorable lending over single family. Now let’s expand on some of the finance options available to multifamily operators.

Lenders will consider several factors determining which multifamily debt product best suits your deal.

IMPORTANT TO UNDERSTAND, underwriting apartments 5 units or more is governed by the rules of commercial financing in which the property’s ability to create income is more important than the owner’s personal income or credit score when determining interest rates and credit worthiness. This is very different from Residential financing of 4 units or less, where the owner’s personal income and credit score is critical to locking in interest rates and credit worthiness.

Commercial lenders scrutinize the number of units, the loan amount, market & property occupancy rates, market population, property’s 12 month trailing income statement, current rent roll, price per unit & borrower’s experience/net worth/liquidity, all to determine which multifamily debt program is possible.

Based on the variables above, loan features will vary to down payment, interest rate, amortization schedule, length of loan, recourse or non-recourse and pre-payment penalties. A borrower must consider all of these loan features when selecting a multifamily commercial loan.

All multifamily loans are not created equal. If you are looking to finance your apartment building you may want to consult a commercial loan broker. Here are some examples of common multifamily mortgage programs for stabilized properties (Minimum 85% Occupied):

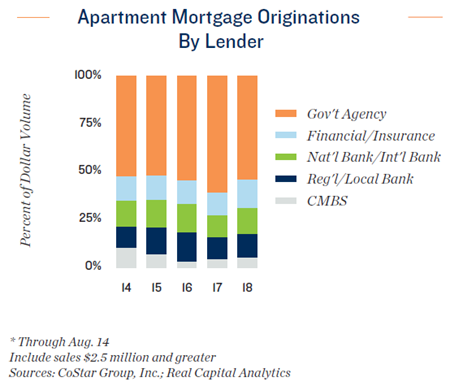

GOVERNMENT SPONSORED AGENCIES

The HUD program amazingly features 35-year fixed rates and amortization with the lowest interest rates and down payments in the industry. Loan amounts can go down to $2M but many lenders do not want to lend less than $5M. The challenge with a HUD loan is that capital reserves can be tapped from the escrow account only twice a year and there is a mandatory annual auditing fee. Another drawback is these loans have a longer due diligence/underwriting period, which can take longer to close, ranging from 5-9 months. The HUD program is an amazing product because the low interest rate and 35-year amortization make a property cash flow well. The program is for a more experienced investor due to involved management of the cost and inflexible structure of the escrow account. Pre-payment penalties are negotiable and can vary by lender. HUD loans are non-recourse, which simply means the lender cannot personally go after the borrower in case of default. These loans are typically for medium to large multifamily syndicators or institutional buyers since they can be used on a variety of property types and classes including apartments, multifamily affordable housing, manufactured housing communities and senior living communities from primary to tertiary markets.

Government Sponsored Enterprise products like Fannie Mae and Freddie Mac are a great option if your loan amount is above $1M. Agency lenders offer 3-12 years fixed interest rates with up to 30-year amortization and interest only options. Interest rates, although not as low as HUD, are very attractive and down payments as low as 20% depending on the market. Escrow accounts and withdrawals to cover capital expenditures are more flexible than HUD and due diligence/underwriting is quicker closing in 2-3 months. Agency lenders continue to provide more permanent loans to apartment properties than any other type of lender and is a favorite among small to large multifamily syndicators because they remain the most competitive overall package. Agency debt is non-recourse used in primary to tertiary markets for different class types of apartment buildings, student housing, affordable housing, or independent senior living.

PRIVATE FINANCIAL

Life insurance companies compete head-to-head with agency lenders on the highest quality apartment properties in the strongest markets. Life companies tend to excel on moderate-leverage (65 percent LTV or lower) loans, and generally have better pricing than Freddie or Fannie. They can offer 10-year fixed interest with five years of interest-only payments followed by a 30-year amortization schedule. The loans are non-recourse, and the rate locks at application and closing can be quick and certain. Pre-payment penalties are flexible and borrowers are typically large syndicators or institutional.

REGIONAL LENDERS

Regional banks can offer 5-10 year fixed interest rates with up to 30-year amortization for loans below $1M. Interest rates and down payments are going to be higher than national programs. Pre-payment penalties are flexible but these loans are typically recourse. The minimum loan amounts on some of these programs vary from $250K to $999K. These loans are typically for smaller ma-n-pa owners and general partnerships but can close quickly.

There are programs for loan amounts below $250K but the rates are higher and the terms not as favorable but you still have the ability to utilize the 30-year amortization. These loans require personal guarantees from the borrower.

LOCAL LENDERS

Finally, you can go to the local bank and get a loan but their products are different. Most local banks require the clients to live in the area of the bank and the property. The local bank typically offers a 5-year fixed rate with a 20-year amortization or 15-year fixed rate with a 15-year amortization. The 15 and 20-year amortization interest rates are better than the 30-year but since the debt is serviced more quickly the monthly PAYMENT ends up being higher.

Local bank loan qualification and documentation are more tedious. They look at the borrowers personal and business tax returns and debt to calculate the debt service usually at higher interest rates.

CMBS

Commercial mortgage-backed securities (CMBS) are effectively the backbone of commercial property financing. These loans are bundled with other loans with the same maturity and sold as a mortgage back security bond to investors providing liquidity to real estate investors and commercial lenders alike.

CMBS loans offer low interest rates and lax underwriting parameters to CRE investors. They are also an appealing choice because they are non-recourse and fully assumable. Although this loan has higher rates than a Fannie or Freddie, the loan is made more to the quality of the property than the quality of the borrower. The rates are comparable to bank commercial loans and can be fixed for 5 or 10 years with a 30-year amortization. For stronger deals, a few years of interest-only can be negotiated. Minimum loan is $1.5M and max LTV of 75%. The downside of CMBS is potentially top-heavy prepayment penalties and closing costs.

The lesson here: it is easier and less risky to get a loan against a bigger apartment complex than a smaller one. The faster you can go bigger or partner with someone who can leads to a lower cost of capital and loan risk.

Live above the line,

Stevan Garcia

Comments