The Inverted Yield Curve Explained

After the Fed cut interest rates by ¼% on July 31, 2019 my friend Warren was sort of excited telling me that NOW he is seriously thinking about refinancing his home for a lower rate. I was like, “what are you talking about Warren? the Fed doesn’t control the interest rates that affect your fixed rate mortgage”.....and then it began...the confused look I see every time I try to explain that all that publicity over the Fed either hiking or cutting interest rates does little to affect mortgages, car payments or credit card APRs. and then the head scratching starts when I go on with my Ghostbusters analogy where Egon educates Ray and Venkman about crossing the streams and how it would be... "bad". Egon continues to explain about the consequences of crossing the streams, "Try to imagine all life as you know it stopping instantaneously and every molecule in your body exploding at the speed of light." Well, in the financial world we call this crossing of the streams the “inverted yield curve” and it also could be bad, which can provoke a scenario where all credit as you know stops instantaneously and wealth can transfer from those who guessed wrong to those who guessed right at the speed of light.

I am writing this article for Warren and anyone else who struggles to understand who controls interest rates and what it means for the everyday person.

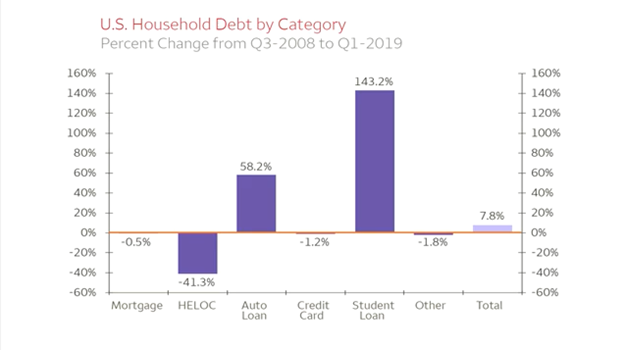

The Federal Funds rate and interest rates used to underwrite mortgages, car payments and credit cards are not as correlated as most people believe.

The Federal Funds target rate is the interest rate set by the Fed's monetary policymaking body and it controls short-term rates. It is the rate banks charge each other when they borrow from each other. If this rate decreases it penalizes savers who get a lower interest for holding cash and rewards borrowers that invest for higher returns. Since this rate influences the short-term cost of the money supply, consumers will only feel the effects through home equity lines of credit, adjustable rate mortgages and credit cards.

- The 10 Year Treasury note is the most popular debt instrument in the world because it's backed by the guarantee of the U.S. Government. It sets a fixed face value and controls long-term interest rates. The interest and price paid for these notes have an inverse relationship. As the rate of return decreases the price of the 10 year treasury goes up. This note is sold at an auction where any person, government or business entity can purchase. Where the Fed controls the funds rate, it is this open market demand that controls the rate of return and price of the 10-year treasury. This is what my friend Warren needed to understand for his refinance. The fixed interest rate that Warren would lock in on his mortgage is directly correlated with the 10-year treasury rate. Since Treasury notes are guaranteed by the federal government, they are ultra-safe. As a result, treasury investors don't require high rates of return, also called yield by so many in the financial world. To compete against the 10-year treasury lenders need to offer a 1%-2% premium to mortgage backed security investors. Since the 10-year treasury rate influences the long-term term cost of the money supply, consumers will feel the effects through fixed rate mortgage, auto loans & student loans.

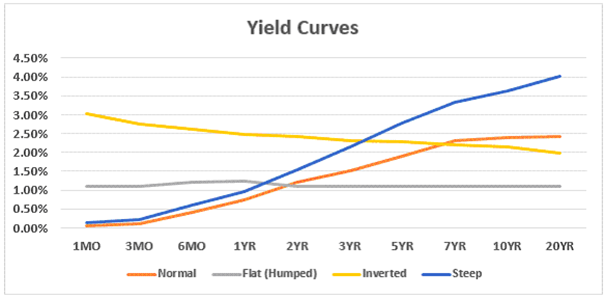

- The Inverted Yield Curve has been inverted since May, meaning that the returns on the short-term over-night federal funds rate is higher than the return on a longer term 10-year Treasury. At the time I write this August 7th, the federal funds rate is 2.25% and 10-year Treasury is 1.684%. This is known as an inverted yield curve and has historically been a precursor to a recession.

Two reasons why you should be concerned about an inverted yield curve:

- Bond Holders Price in a Recession- Usually, bond holders, also called debt investors, demand a higher rate on long-term debt to compensate for the additional uncertainty of what might happen over a long period of time. That is why the 10-year treasury rate is usually higher than federal funds rates. When long-term rates are lower than short-term rates, bond holders assume that the Fed will have to drop the federal funds rate in the future as the economy slows, and for this reason the bond market “prices in a recession” by pushing the bond return down and price up. The fed is always slower to react because it’s mission is to keep inflation and unemployment in check. The fed isn’t really interested in what the bond market is saying. This disconnect between the fed controlling the short-term rate and the debt market controlling the long-term rate only strengthens the probability of a recession.

- Banks stop lending- The inverted yield curve also can contribute to a recession because banks lose their incentive to lend. When the banks cost of borrowing (always short-term) exceeds the revenue from loans they are making (usually longer term), the banks stop making loans, companies stop growing, and a recession ensues.

When the streams cross on the yield curve people should be more concerned than usual that a recession is near. Even though we should feel confident the mortgage industry will not be the cause of the recession this time, every asset class from equities, bonds and real estate will go through headwinds when a significant Macro-economic event occurs.

Live above the line,

Stevan Garcia

Comments