Storms Didn’t Break Florida’s Insurance Market: People Did

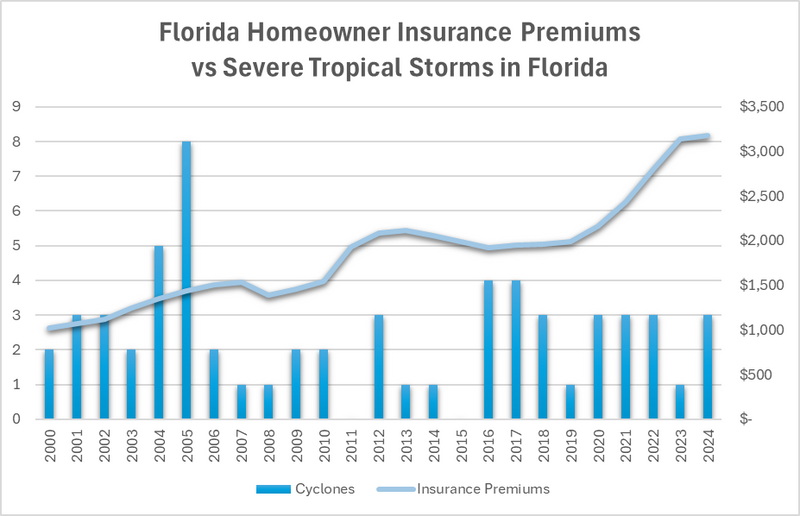

Florida homeowners have endured a shocking surge in insurance premiums in recent years, even as the state’s hurricane impacts have been relatively mild, underscoring a glaring mismatch between storm trends and insurance costs.

According to NOAA data, the past few seasons have not been unusually stormy, for example, out of 20 named Atlantic storms in 2023, only one (Hurricane Idalia) actually made landfall in Florida. Long-term records likewise show no clear increase in hurricane frequency over more than a century, meaning there is little evidence that climate change or heightened tropical activity is to blame for Florida’s current insurance woes.

In stark contrast to the benign storm data, Florida’s average homeowners’ insurance premiums have skyrocketed. The Insurance Information Institute reports that rates doubled (a 102% jump) in just the past three years, reaching roughly $6,000 in 2023 (about three times the U.S. average and the highest in the nation).

Clearly, the pricing explosion is not correlated with any uptick in hurricanes or losses from major storms. Industry experts and analysts instead point to man-made problems in Florida’s insurance market. As the Insurance Information Institute observes, the state’s crisis “has little to do with [Florida’s] hurricane exposure”. Florida uniquely leads the country in homeowner insurance lawsuits, nearly 80% of all such suits nationwide come from Florida, even though only about 9% of U.S. homeowner claims occur in the state.

This indicates an epidemic of litigation unrelated to actual disasters, which has driven insurers’ costs through the roof. Years of rampant lawsuit abuse (often stemming from fraudulent roof repair schemes and generous attorney-fee laws) have saddled Florida insurers with staggering underwriting losses. The result has been a mass exodus of insurers: many companies have gone insolvent or withdrawn from the state, drastically reducing competition. At least nine Florida-focused insurers have failed since 2021 alone, and others have pulled back coverage, leaving consumers with fewer options.

The fallout is evident in the exploding size of Citizens Property Insurance Corp., the state’s insurer of last resort. Citizens has been forced to take on an enormous number of policies as private insurers flee, it covered over 931,000 policies by mid-2022, more than double the count just two years prior. This shift to a state-backed carrier of last resort further highlights the market’s dysfunction and concentration of risk.

Other cost drivers have piled on as well: reinsurance (insurers’ insurance) costs have spiked for Florida carriers, and the rapid development of expensive homes in high-risk coastal areas means even relatively ordinary storms can generate very large claims payouts. All these factors have contributed to premium hikes, while storm activity itself has remained average or below average.

It’s an uncomfortable truth that Florida’s insurance turmoil is largely self-inflicted, a product of legal system abuse, fraud, and market failures, rather than a result of any recent surge in hurricanes or some sudden climate shift. In fact, federal climate data show no definitive trend toward more hurricanes hitting the U.S., and Florida’s quieter storm seasons of late make clear that an increase in disasters is not driving premiums.

The narrative that climate change or frequent storms are to blame for Floridians’ sky-high insurance bills is not supported by the evidence. Instead, the evidence points to a systemic crisis in the insurance market. Homeowners are paying the price for a broken system: excessive lawsuits and claim costs, insurer insolvencies, and policy missteps over decades.

State lawmakers have only recently begun enacting reforms to curb lawsuit abuse and stabilize the market, and it remains to be seen if these changes will reverse the trend. Until then, Florida residents face ever-rising premiums that far outpace their actual hurricane risk, a situation that experts bluntly note is driven by man-made factors in the insurance system rather than by Mother Nature.

Comments