Arizona Analysis - what I did & why

Picture this, you go to bid on a tax lien certificate. You see there are 7,165 other bids. Do you bid?

Most people would think "I don't have a chance!" The way you bid is that you choose a round number between 0% and 16%. You're bidding the lowest interest rate you would accept for the certificate.

With almost 7,200 bids what do you think your odds of winning are going to be? With that many bids surely ALL the interest rates are covered with at least one bid.

Nah.

And I know it. I make a big deal out of online tax lien auctions because, well, no one else does. And there is money to be made when no one else is looking closely.

In baseball there's a saying - "Hit it where they ain't." In other words try to hit the ball where the defensive players are not covering.

In online tax lien auctions, no one is covering analysis based on past results. Yet that is exactly how you can make bids that will win highly competitive certificates.

In my last post I showed the properties for the two certificates I won in the 2012 auction. Nice looking properties, each with many bids.

I targeted 3 prime certificates that I wanted to win. I won 2 of them. I also had a couple of really choice parcels that had certificates that I placed bids on just in case I missed out on the 3 prime certificates.

My 3 prime targets

Property "#1" was the expensive residential lot with the fantastic views. It had 2 years worth of back taxes up for auction so the lien amount was fairly high for a residential lot.

I had bought a certificate on this same property in 2010 but the owner paid that back in a month. I skipped it last year when I saw it was up again, thinking he would pay it off again in a month. When I saw it was in this year's auction AND it had 2 year's worth of taxes, I knew the owner did not pay last year's taxes or the previous.

This is a really nice area and the certificate would get a couple of hundred bids. I looked at my spreadsheet of bid results for the auction the last 2 years and I knew what rate I had won it in 2010 and I saw the winner last year had won it with almost the same rate.

Based on my knowledge of past results, I went to place my bid a day before the auction closed. I saw there were 170+ bids. No matter, I placed my bid at 4% knowing it was one percent below last year's winning rate.

The auction software does not show what each person is bidding, only the total number of bids. So unless someone has gone to the trouble of taking all of last year's bid results - that are only available after the auction is over - they will not know where all the bids were placed for each certificate the previous year.

I have that data so I can be confident my bids are competitive based on previous year results.

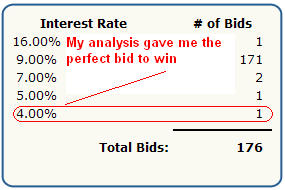

Here are the final bid numbers for that certificate:

You can see I was the single lowest bid and my analysis paid off since I beat out a person who in fact bid 5% - just like last year.

Property #2 was a certificate on a commercial building that had 2 apartments. This was my first bid ever on a commercial property certificate. I looked at my previous year results and filtered to show only similar types of parcels in the area.

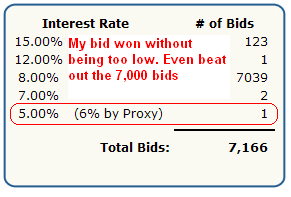

I was able to place my single bid at a rate that seemed competitive based on past auctions. The morning the auction was going to close, I was stunned to see that there were 7,165 bids on that one certificate!

Did I change my bid or cancel it? No. This certificate was late in the auction. I started to look at certificates that would close hours before this one would close. I saw certificates that also had 7,000 plus bids. I knew it was a fund or bank that was bidding and they could place those 7,000 bids on only one interest rate per certificate.

Once the first batch of certificates closed in the morning, I went to see the results that showed at which interest rate the bids were placed. I saw consistently that any 7,000+ bids were placed at the same rate for each certificate - 8%. My bid was lower, so I didn't change or cancel my lone bid.

Here are the results of the bidding that were available after the auction:

I won the certificate and actually received 6% even though I only bid 5%. So 7,000 bids should not scare you off.

Now we get to the third prime property I bid on. This was another residential lot but not quite the luxury area as the first lot. I saw that in 2011, lots in this neighborhood that had liens went for about 5%. In 2010, there was an individual who had bid 2% for several certificates in the same neighborhood - but that person did not bid in 2011.

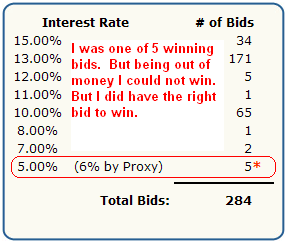

I couldn't be sure if the person would be back in 2012, but I also know I did not want to earn less than 4% on any certificate I won. There were only 29 bids for this certificate, but the bidding went against past results. Here are the bids:

There were several bids below mine at 4% so I lost out. You don't win them all, but at least I was in the game as opposed to the people who bid way above the rate.

You don't have to build the detailed spreadsheet with all the bid breakdowns I use. The auction website offers a text file of all the winning bids for each property that you can import into a spreadsheet.

At least you'll know what the winning interest rate was for each certificate, so next year you could make your bid based on the previous year's winning bids for that area. You'll be in the game.

As I said, I had two other certificates that I had as backup in case I did not win any of the 3 prime certificates. But because I did win 2 of them, I did not have enough money left in the account to win either of the final 2 certificates.

But we can look at my bids and see if I was in the ballpark for winning them.

Both certificates were on residential vacant lots in a very pricey area with great views.

Certificate #1 results:

I could have won - but out of money. However, my analysis of prior year results gave me the best bid to win.

Certificate #2 results:

Again I had the right bid thanks to my spreadsheet analysis, but if I only had more money, I would have had a chance to win.

Due diligence is the most important analysis to perform. You have to make sure the property is worth something, does not have EPA issues, bankruptcies and other legal issues.

But after that, if you're using online auctions, you need to have prior year results to do your analysis of the competition and create your bid strategy for the next year.

Comments (2)

It's time for a newer post just like this one! Great info.

Cynthia Bistrain, almost 5 years ago

Sharing your method at this level of detail is fabulous! Newbies like me appreciate it!

Hilary Garber, almost 13 years ago