Florida Sub account elimination in Tax Lien Auctions

Recently, several Florida counties announced they are eliminating the use of “Subaccounts” in the annual tax lien certificate auction.

I have seen several posts on various websites – including my own posts – that tout this as a win for the individual investor and it should “level the playing field”.

But in reality, it will probably result in a mixed bag for investors.

It helps to understand what subaccounts are and why individual investors feel their use is unfair. In many online tax lien certificate auctions, you create an account to use for bidding. Each account requires a Tax ID number of some sort so that the county can issue a 1099-INT at the end of the year to the winning bidder who has had certificates redeemed and interest paid.

For most individual investors, they use their Social Security number as the Tax ID. If you have an LLC or other business that also has a Taxpayer Identification Number, then you can open an additional “subaccount” for bidding. Thus you have two accounts (or more) for bidding.

All subaccounts are bid at the same rate as the main account for any one certificate. So if you had one account with 4 subaccounts, you would have 5 bids placed on one interest rate for any certificate you bid on.

This is significant because the online auctions work this way; you bid down the interest rate you are willing to accept on the certificate. The lowest bid wins.

For example, in Florida the top interest rate you can earn is 18%. You can bid down in quarter point increments. But you’re not bidding in an open auction. You’re bidding online and you get to put your bid in at one interest rate. So you have to know the lowest interest rate you want to accept and place your bid at that rate before the auction closes.

You don’t get to see what rates others are bidding on the same certificate. You can see only the total number of bids for that certificate before the auction closes. After the auctions closes, within seconds actually, you can see the breakdown of where all the bids were placed for that certificate.

You’re “flying blind” in a way, because you know how many bids there are, but not where the bids are placed during the open auction time.

So where do multiple subaccounts give an advantage?

If there is a tie for the lowest interest rate bid, the auction company software randomly picks a winning account from the pool of bids at that rate. In other words if you had 5 accounts and I had only 1, and we tied for the lowest rate, then you have 5 chances versus my 1 chance to be awarded the certificate.

Banks and funds use the Tax ID’s of all their investors as subaccounts. An institution can have tens of thousands of subaccounts. Talk about David and Goliath! You are competing against tens and yes, hundreds of thousands of subaccounts of banks and funds sometimes.

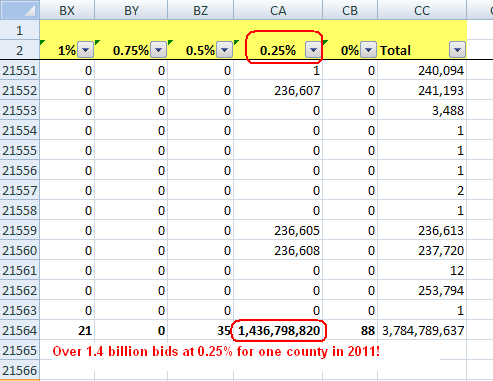

Look at this spreadsheet of the bid counts from Polk County Florida’s 2011 tax sale. Notice the column for 0.25% and that the total bids that were made for all the certificates at that rate totaled over a BILLION bids!

Further, there were only 111 people/entities that won certificates in the auction. From 111 winners and numerous others who bid but did not win any certificates, there were a total of almost 3.8 billion bids for this one county!

Online auctions are fairly new to the tax lien auction industry. In Florida there are auctions that see over 1 million bids on one interest rate for one certificate! And guess what? That interest rate bid is often 0.25%.

And if you bid 0.25% then you have one in a million chance for winning the certificate.

On first glance the prospect of the elimination of subaccounts seems to level the playing field. No more will banks and funds be able to bully their way around with several hundreds of thousands of bids. It’s no longer a Chicago election where one person can cast many votes under other ID’s. One person, one vote - going forward.

I haven’t seen the new rules, but it might be that a bank/fund could still open individual accounts for each Tax ID. Unlikely, because they would have to allocate the total funds they want to invest among the hundreds of thousands of accounts. They also would have to ACH for each individual account the 10% deposit and then also the payment for all the certificates they win.

So we’ll put the “open individual accounts” aside as it requires a lot of manual work – which some banks can easily outsource if they really wanted to. (I would not like the bank giving my SS# to some overseas person to open an online auction account in several Florida counties – but how do I know what the bank does with my ID numbers anyway?)

While the initial thought about eliminating subaccounts is that banks will be treated just like an individual investor with one account, you have to remember why the bank is buying tax liens in the first place.

They are parking cash in relatively safe investments to get better rates of return than other safe instruments.

T-bills are paying nothing, same with other Treasury securities. The average overall interest rate for all the certificates sold in the Polk County auction last year was 5.17%. Divide that number by 12 and that is how much a certificate earns each month it is unpaid. (0.431%)

Seems like peanuts when you consider that most certificates are paid in the first year. After all, if the property owner paid in the first month, 0.431% on the average lien amount of $1,153.63 is $4.97.

But Florida has a law – the minimum any certificate earns is 5%. The property owner will have a penalty that equates to making the interest earned be at least 5% for the certificate holder.

So no matter how low the winning rate is bid, the certificate holder will earn at least 5%.

This is why I say it’s a mixed bag for individual investors. Yes there will be less bids placed for certificates. But banks and funds can still participate and they will still bid 0.25% because they know they will earn 5% on the certificates when paid off in the first year. And 5% is plenty for the banks, they've proved that by using over a billion bids in Polk county alone last year on 0.25% bids.

Individual investors will have a better chance of winning certificates, but the overall rates will not rise much higher than what they have been in the past. Banks/funds will still bid 0.25% and gladly accept a 5% return on the funds.

If the individual investors also gravitate to accept a 5% return than yes, more individual investors will have a shot at winning certificates because of the elimination of subaccounts. They just won’t get higher rates.

Mixed bag - less bids, still low rates.

Comments