A Tale of Two Rental Markets: Metro Detroit vs. Indianapolis

Are you looking for the best place in the USA to invest in rental properties?

With 25+ years of experience operating as a Property Management Company (PMC) in Metro Detroit, we think our home market offers some very solid cash flow opportunities for investors.

Yet, we don’t know what we don’t know, so we’ve created this “Deep Dive into Detroit Neighborhoods'' series to compare Metro Detroit rental property investment pros & cons to several other markets known in the industry to be hotspots for rental investors. These articles will show you the strengths and weaknesses of each location, empowering you with the information necessary to make sound decisions for a successful rental investment. We’re going to be as factual as possible, but admit we’ll be slightly biased towards our home market when it’s a close call.

We’ll show you the potential and risk of each area, evaluating key factors such as:

- 1. The expected returns from rental properties, both appreciation & cashflow

- 2. The types of tenants to expect

- 3. The kind of management required to be successful

For this installment, we’re comparing Metro Detroit to Indianapolis, since both are popular cities for first-time landlords looking to enter the property investment world on the ground floor.

Overview of Metro Detroit

Before we get into any numbers, it’s important to understand that the Metro Detroit area is a bit unique. Real estate in most metropolitan areas gets more expensive the closer you get to the main city. In the 1960s & 1970s, a lot of wealth fled the City of Detroit for the suburbs. So, as the income map (assuming income corresponds to property values) below shows, real estate gets cheaper the closer you get to the City of Detroit:

ProximityOne: Patterns of Economic Prosperity by Neighborhood

Thankfully, since the Great Recession of 2008, the City of Detroit has experienced dramatic improvements in job & population growth. Both have caused property values and rents to increase faster than in the surrounding suburbs of Metro Detroit. Be sure to read and follow our ongoing Deep Dive series where we take an in-depth look at the investment potential of several Metro Detroit suburban cities and specific Detroit neighborhoods!

Because of this unique Metro Detroit issue, we will be comparing Metro Detroit to other cities, not other metropolitan areas. We’ll do our best to remind you of this as we go forward.

The Metropolitan Statistical Area (MSA) area of Detroit-Warren-Dearborn includes the 6 Michigan counties of Lapeer, Livingston, Macomb, Oakland, St. Clair, and Wayne. “Metro Detroit” consists of Macomb, Oakland, and Wayne counties (the Detroit Tri-county area). In total, Metro Detroit covers 3,888.4 sq mi (10,071 km2) and a population of over 4 million. Within this metropolitan area, the City of Detroit covers 142.89 sq mi (370.1 km²). Within the Detroit Metropolitan area are 72 cities as shown below.

Source: Georgetown Public Policy Review

Source: Georgetown Public Policy Review

Map showing Tri-County Metro Detroit Cities

Though the City of Detroit experienced a significant loss of population in the late 1960s & 1970s, most of those people just moved to the greater Metropolitan Detroit area. Today, the City of Detroit is still the largest city in Michigan and the Metro Detroit area also remains the most populous metropolitan area.

Out-of-State (OOS) investors need to understand these differences between the City of Detroit and the rest of Metropolitan Detroit, so their investment expectations are properly met. To that end, we’ve also created the term “Ring Cities”, to refer to the suburban cities that border the City of Detroit. The Ring Cities of Metro Detroit are known for their affordable housing stock, good rental cash flow opportunities, and high buy-and-hold investment potential. These cities, highlighted in green on the list below, are what most OOS investors are expecting when they consider investing in the Detroit market. The cities with hyperlinks are the ones we’ve already published a Deep Dive analysis for.

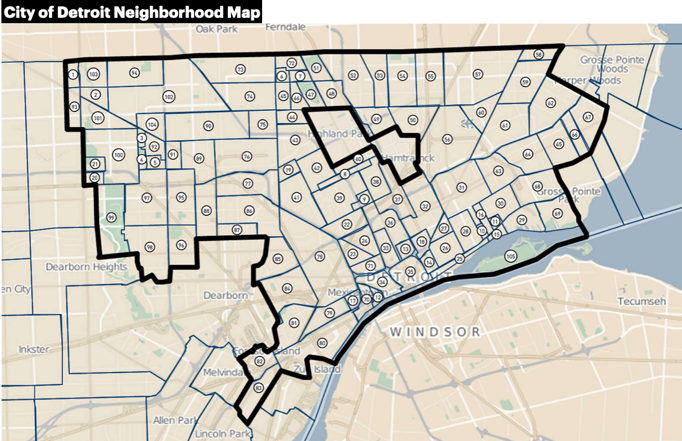

So, what about investing in the City of Detroit? Well, the city can be divided into 11 main regions as shown below.

These are further broken down into the 105 neighborhoods making up the City of Detroit, listed below.

Loveland’s Detroit Neighborhoods Map

What’s most challenging for OOS investors is understanding that the City of Detroit had a population of around 2 million in the late 1950s, but now has less than half that. So, there are thousands of vacant homes with no population to live in them! Some city areas & neighborhoods retained their populations better than others, so basic supply & demand economics have kept property values & rents relatively high in these neighborhoods. The city government has also been aggressively pursuing federal funds to demolish as many vacant buildings as they can, which is steadily lowering the over-supply of homes in many other neighborhoods, increasing property values and rents in them.

So, OOS investors shouldn’t blindly invest in a zip code or even the better neighborhoods without doing or having someone trustworthy do, a boots-on-the-ground evaluation of the area surrounding a target purchase. The class of property (A, B, C or D) can vary dramatically block-by-block and we’ve seen many investors buy what they thought was an A or B property that was actually C or D.

All of these challenges are fantastic opportunities for investing in the City of Detroit as long as proper due diligence is done. For investors looking for lesser challenges, the Ring Cities also provide some of the best opportunities in the US.

Overview of Indianapolis

The Indianapolis-Carmel-Anderson Metropolitan Area, or Indianapolis, encompasses 11 counties in central Indiana. The metropolitan area covers 4,306.58 sq mi (11,154 km²). The same name also refers to the capital and most populous city in the state of Indiana, where this article will focus. The City of Indianapolis covers a total of 368 sq mi (950 km2), making it the 16th largest city (by land area) in the country.

Map that shows the City of Indianapolis

Map that shows the City of Indianapolis

According to Mashvisor, the real estate scene of the City of Indianapolis boasts cash flow opportunities that attract both local and out-of-state investors. The area includes a wide variety of 109 neighborhoods, towns, and districts

Within the city, Mashvisor’s Investment Property Calculator determined the following areas as optimal places for owning traditional rentals or short-term rentals (Airbnbs):

- 1. Martindale-Brightwood

- 2. Devington

- 3. Arlington Woods

- 4. North and South Perry

- 5. West Indianapolis

- 6. Valley Mills

- 7. Garden City

- 8. Ameriplex

Also, based on their report on Indianapolis’ market trends, the city is currently a seller’s market—being more attractive for investors looking to sell than buy. Forbes describes Indianapolis as a place where homes are “flying off the shelf”, with nearly two-thirds of listings going under contract within two weeks.

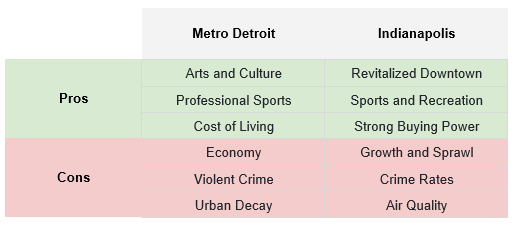

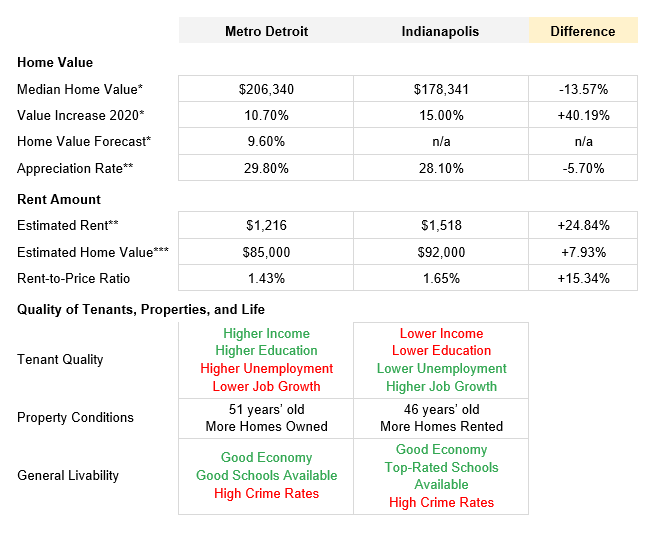

Comparing the Real Estate Scenes in Metro Detroit vs. Indianapolis

The following sections detail the key factors contributing to the financial viability of rental investments. This refers to factors such as rent amount, house value, appreciation, and the quality of tenants, property conditions, and quality of life.

The image below is an overview of the rental properties currently listed on Zillow for Metro Detroit and Indianapolis (as of April 2021).

Source: Zillow

Source: Zillow

Let’s go through the differences and similarities between the two, focusing on their house value and appreciation, average rents, and rent-to-price ratios of homes currently listed on Zillow.

House value and appreciation

House Value. According to Zillow, the average home value in Metro Detroit is $206,340. This number shows a 10.7% increase over the past year and is forecasted to rise by 9.6% in the next year:

Source: Zillow

Source: Zillow

Over in metropolitan Indianapolis, homes are typically valued at $178,341—an increase of 15.0% over the past year. There is no specific forecast available on Zillow as of the writing of this article.

Source Zillow

Source Zillow

Looking at the listings on Zillow, most of the available homes are in the City of Detroit or the Ring Cities, where many of the famous below-a-$100k properties are situated. This is because lots are smaller in Detroit & Ring Cities, which causes more housing density, which causes more listing density.

Source: Zillow

Source: Zillow

The appreciation heat map of Michigan provided by Neighborhoodscout, where the lighter colors show lower housing prices, also shows the general affordability of Metro Detroit while illustrating the lower prices in the City of Detroit and the Ring Cities. However, not discrediting the pro tip mentioned earlier, the exceptionally diverse and varied Metro Detroit does open up scattered sweet spot opportunities for rental investors to grab affordable houses for sale around expensive, developing neighborhoods.

In Indianapolis, listings on Zillow and the heat map in Neighborhoodscout both show that—while there are exceptions—property prices tend to increase the nearer you get to the center of the city.

The heat map from NeighborhoodScout shows that the north tends to be more expensive than the south, around the Meridian Heights and Wynnedale area, compared to Southport and Sunshine Gardens.

Source: NeighborhoodScout

Source: NeighborhoodScout

Appreciation. In terms of appreciation rates, Bestplaces reported the following:

- - Metro Detroit's home appreciation in the past decade is 29.8%.

- - Indianapolis home appreciation in the past decade is 28.1%.

Both areas have affordable homes and high appreciation rates.

Looking at national rates, home values climbed significantly this year, with prices forecasted to continue appreciating over the next decade. National home prices reportedly increased by almost 49% in the past decade, whereas the last two quarters (January 2021 data) show an annualized increase rate of 9.3%.

Average Rent

Looking at the chart from Bestplaces, we can see that the rent in Indianapolis is higher on average than those in Metro Detroit across all housing sizes.

Source: Bestplaces

Source: Bestplaces

The latest listings on Zillow also reflect these average rent amounts:

Examples are current listings on Zillow

Examples are current listings on Zillow

Rent-to-Price Ratio

In scanning for properties in Metro Detroit and Indianapolis, you’ll want to use the rent-to-price ratio as a quick indicator of a property’s likelihood to yield positive cash flow. You can use the industry-standard “1% Rule” as the minimum ratio to shortlist prospective properties.

The mathematical formula is as follows:

Monthly Rent / (Purchase Price + Rehab ) > 1%

In areas like Metro Detroit and Indianapolis where the properties are immensely varied and diverse, the rent-to-price ratio is a handy formula to estimate your return on investment (ROI) instantaneously.

Side by Side Chart

What better way to see this data in action, than by pulling up current listings on Zillow?

Here are examples of three-bedroom properties in Metro Detroit and Indianapolis. You can see how they compare to each other in terms of rent amount and house values:

Based on current listings on Zillow

Based on current listings on Zillow

Based on Bestplaces

Based on Bestplaces

While Metro Detroit shows a less favorable rent-to-price ratio, it does have better appreciation rates and a positive forecast for home values. Indianapolis has a more favorable rent-to-price ratio and increased home values in the past year; however, it has slower appreciation rates overall.

Quality of tenants, properties, and living

As a rental investor, the quality of tenants, properties, and living you offer in an area heavily influence your investment success. They will determine:

- - The stability of your rental income and property maintenance of your assets.

- - The necessary and possible property renovations and rehabilitations.

- - The type of tenants you’ll attract and the kind of property management required to handle them.

The following information is based on a variety of data points and our own local knowledge. They are meant to help assess and understand individual areas and should not be taken as definitive metrics.

To get started, Roofstock has created an overview where they rate neighborhoods according to the quality of schools, home values, employment rates, income levels, and other investment criteria:

Source: Roofstock

Source: Roofstock

Based on the map, most of the properties in the City of Detroit are roughly Class C. They’re not exactly ideal for beginner investors, as you’ll run into more tenant issues and property maintenance requirements here. A similar situation goes for Indianapolis, where the lower-ranking neighborhoods are closer to the center of the city.

Let’s get into the details.

Tenant Quality

Average Income. While the average income is higher in Metro Detroit, there has been a higher unemployment rate and lower job growth in recent years here. The job opportunities in Indianapolis are stable and growing, albeit with lower average incomes:

As an investor, you’d want to have the opportunity to charge higher rents, but it’s more important to find tenants who can consistently afford rent each month. Generally, Metro Detroit has higher income and lower average rent, while Indianapolis has lower income but higher average rent. This could mean missed or late payments might be more frequent in Indianapolis, although thorough tenant screening can help landlords avoid this.

Additionally, you want a growing job market that increases the population and strengthens the economy of the particular area, as this will impact property values and rent prices, too.

Educational Attainment. There are more high school and college graduates in Metro Detroit than in Indianapolis. This increases your chances of having higher demographic, higher-income tenants.

Property Condition

Property Age. The median age of the houses in Metro Detroit is 51 years old, while Indianapolis’ is 46 years old, so the general condition of properties is fairly similar across both locations.

Nevertheless, both areas do have older homes, compared to the national average property age of 40. They have older homes even when compared to their respective larger areas (Metro Detroit versus Michigan, and Indianapolis versus Indianapolis-Carmel-Anderson Metro and Indiana).

Blighted Areas. In addition to older homes, both Metro Detroit and Indianapolis are dealing with blight, implementing their own rehabilitation plans for abandoned properties and dangerous neighborhoods.

Because of the race riots and White Flight in 1960 to the 70s that drove most of the population and industries away, the City of Detroit has a hyper-supply problem with empty, derelict houses. By 2014, the city racked up nearly 80,000 blighted properties and at least 20 square miles of vacant land. Nevertheless, the City of Detroit continued with a blight remediation program that demolished 19,000 homes and rehabilitated 9,000 others. This year, the city announced that it had sold $175 million in bonds to finance a massive project to carry on demolishing and renovating thousands of more homes.

In Indianapolis, an even higher percentage of the property stock is considered as blighted. 40% of Indianapolis’ urban blight problems are due to out-of-state investors buying cheap homes—sight unseen and in bulk—at government tax sales. Nowadays, the Indiana Housing and Community Development Authority (IHCDA) and Department of Metropolitan Development (DMD) are working with Renew Indianapolis to demolish unsafe structures. Renew Indianapolis also oversees the Blight Elimination Program (BEP) that has reduced blight by 410 structures.

As an investor, it’s important that you know how to find good properties in improving neighborhoods of Metro Detroit[1] and Indianapolis that are in good repair and located in up-and-coming neighborhoods. Blighted properties come with their own set of structural problems, among many other things, so you need to screen properties thoroughly before purchasing.

Home Ownership and Rental. More homes in Metro Detroit are owned (61%) rather than rented (27.7%). This indicates that homes are likely better maintained, as owners tend to treat their property with long-term living in mind.

On the other hand, Indianapolis has an even split of owners (46.4%) and renters (40.50%), which increases the tenant pool for rental businesses to thrive, but can also impact the overall condition of the housing stock, since renters generally do lower levels of maintenance on their properties.

Overall, investors need to pay attention to the condition of older homes in both locations and should hire a professional to inspect the home for accurate budgeting.

Quality of Life

Local Economy. With the recent pandemic, the economy of Metro Detroit was hit hard. While the automotive and manufacturing sectors within the City of Detroit (or “Motor City”) show resilience, smaller businesses and the leisure and hospitality industry have been greatly affected.

Nevertheless, the following statistics are showing promise:

- - Michigan’s new business applications increased by 42.2% in 2020 compared to 2019.

- - The median sale price of single-family homes in Metro Detroit increased by 23.3% from the first to the third quarter of 2020, reaching a healthy $236,300.

- - New construction permits in 2020 are reflective of 2019 levels.

- - In late 2020, Ford Motor Co. unveiled its multi-year plan for a 30-acre “mobility innovation district” centered on the former Michigan Central train station, just west of downtown Detroit. The new redevelopment will eventually accommodate 5,000 new employees.

Indianapolis was not spared from the impact of the pandemic, either, although Mayor Joe Hogsett and Develop Indy reported the following economic development results for 2020:

- - There is now $1.4 billion in capital investment and more than $728 million in real estate development across Marion County (where Indianapolis is the county seat).

- - Financial assistance worth $20 million has been approved, enabling more than 2,000 small businesses via multiple loans and grant programs in recent months.

- - Early 2021, Mayor Joe Hogsett shared the revitalizing development projects in downtown Indianapolis: the airport, new hotels downtown, the opening of Bottle Works, and a 58-million-dollar residential development that will surely attract new residents to the city.

Both Metro Detroit and Indianapolis are showing solid growth, despite an unpredictable year of battling the pandemic. This is great news for rental investors, as both locations will remain attractive to citizens seeking greener pastures.

Safety and Crime. Looking at the safety of each area, both Metro Detroit and Indianapolis have higher crime rates than their respective larger areas (Metro Detroit versus Michigan, and Indianapolis versus Indianapolis-Carmel-Anderson Metro and Indiana).

According to NeighborhoodScout, Indianapolis has one of the highest crime rates in the nation compared to communities of all sizes. Within Indiana, less than 1% of all communities have a higher crime rate than the City of Indianapolis.

There is a similar situation in the City of Detroit, also being a city with one of the highest crime rates in the country. Within Michigan, less than 1% of all communities have a higher crime rate than the City of Detroit—as there are cities in Metro Detroit that are much safer. For example, SafeWise ranked Oakland Township and Huntington Woods as two of the ten safest cities in Michigan.

As a rental investor, keep in mind that there will be localized crime rates for every block, neighborhood, and city in Metro Detroit and Indianapolis. While a property may be in an area deemed unsafe, there might be a house that’s perfectly safe just a few blocks away.

Good quality tenants will prioritize safety in choosing their place of residence—therefore, so should you.

Diversity. The racial diversity is nearly identical for the two locations:

In running a rental business, you need a tenant base that is reliable, communicative, and responsible for paying rent and taking care of your properties. As the potential tenants you’ll have in Metro Detroit are quite different from Indianapolis, a self-evaluation on what kind of tenants you want as a rental investor is strongly recommended when choosing between the two cities.

Liveability. The pros and cons of living in Metro Detroit and Indianapolis as a resident are as follows:

Overall, both economies indicate strong growth for tenants seeking job opportunities, with many schools for tenants with families to consider.

Investors should be careful when choosing particular cities and neighborhoods to buy rental properties in, choosing only those that are in high demand with high-quality tenants. Consider the characteristics of each sub-area, its particular tenant demographics, and its common property conditions carefully. With the diversity and variety of neighborhoods in Metro Detroit and Indianapolis, each investment factor needs to be considered in full detail and, ideally, with expert guidance (especially if you’re investing from out of state).

Conclusion

At the end of the day, each investor has to conduct a rigorous evaluation of the opportunities within Metro Detroit and the City of Indianapolis. Each of these markets has many cities and neighborhoods with their own pros and cons—being highly dependent on your priorities as an investor.

Here is a recap of all the data in this comparative report:

Image courtesy of Karolina Gabrowska

Comments