Investment Strategies: Should You Airbnb, Flip, or Rent Out a Property

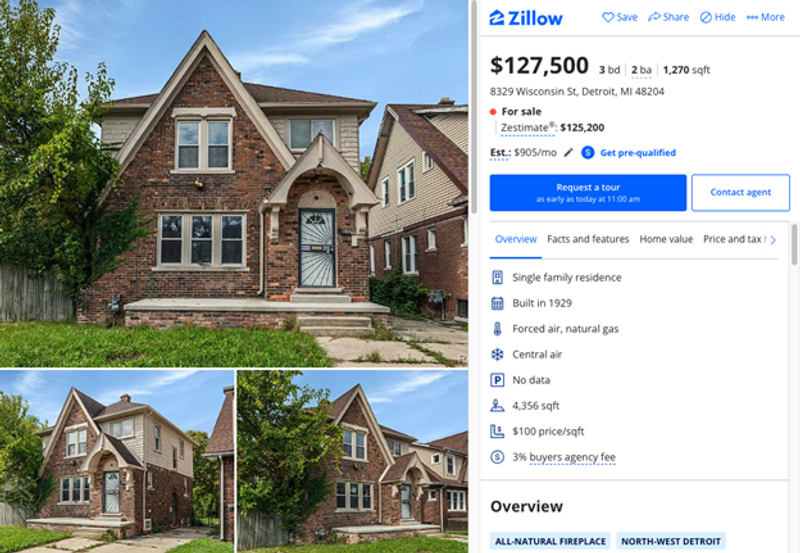

Photo from Zillow

Photo from ZillowReal estate investing has always been an option for people seeking to build wealth and secure their financial future. Whether you're a seasoned investor or just dipping your toes into the world of property investment, the key to success often lies in choosing the right strategy for each unique property.

Still, in a very competitive market filled with opportunities, how do you determine whether an investment property is best suited for Airbnb, a long-term rental arrangement, or a lucrative flipping project?

This decision can make or break your real estate investment journey, as each strategy offers distinct advantages and challenges. So, we'll take you through the essential considerations that will help you dissect the potential of an investment property.

By the end, you'll be equipped with the knowledge and insights needed to determine whether your property is destined for Airbnb success, long-term stability, or a profitable flip.

What Makes a Property Good for Airbnb?

The past few years have seen a spike in short-term rentals, primarily through the Airbnb platform. The demand is mainly because it’s a better alternative to hotels. After all, they offer a more personal experience. Still, it’s also not a fail-proof strategy, especially if you turn the wrong kind of property into an Airbnb.

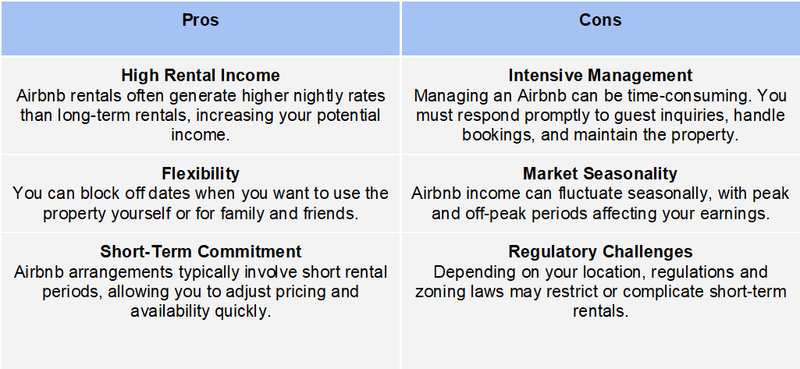

Pros and Cons of Short-Term Rentals

Criteria for Turning a Property Into an Airbnb

So, what makes a property suitable for an Airbnb? Here are the criteria:

- - Is the property located in a desirable or tourist-friendly location?

- - Are there nearby attractions, events, or activities that would attract guests?

- - Does your property offer unique features or amenities ideal for tourists?

- - Are short-term rentals allowed in the area, or are there any regulatory restrictions or zoning laws?

- - Is the property in good condition and well-maintained?

- - Do you have a plan for regular cleaning and maintenance between guest stays?

- - Is it within your budget, considering other expenses, such as closing fees, insurance, property tax, furniture, utilities, and additional costs to optimize an Airbnb?

- - Is the return on investment worthwhile? You can estimate the expected ROI based on the cap rate and cash-on-cash return. A reasonable cap rate is over 8%.

Determining a Property

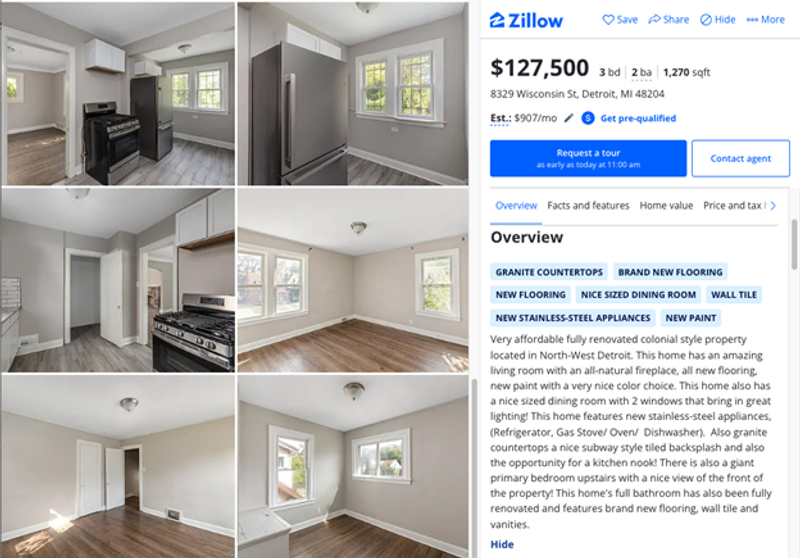

Let’s use this property listed on Zillow as an example. Let’s see if the property is suitable to be listed on Airbnb based on the criteria:

The property’s location is the most crucial factor in any real estate investment. In this particular example, the neighborhood is not near any tourist spots or an area where short-term rental is in high demand.

Results: Not Good for Airbnb

So, based on the location alone, which is in Bagley, Detroit, it’s safe to assume that this property will not be as profitable as Airbnb. That’s because it’s in an area without any tourist interest and just a plain neighborhood. This means there’s no high demand for the Airbnb property, which may result in higher vacancy rates, meaning loss of profits. So, if you’re not getting enough guests monthly, you’ll pay more for maintenance rather than putting more money in your pockets.

What Makes a Property Good for Flipping?

Another real estate investment strategy is house flipping. It’s when an investor purchases a property, typically a distressed or undervalued one, intending to renovate it and resell it at a higher price within a relatively short timeframe. The goal is to profit by increasing the property’s market value through improvements and upgrades.

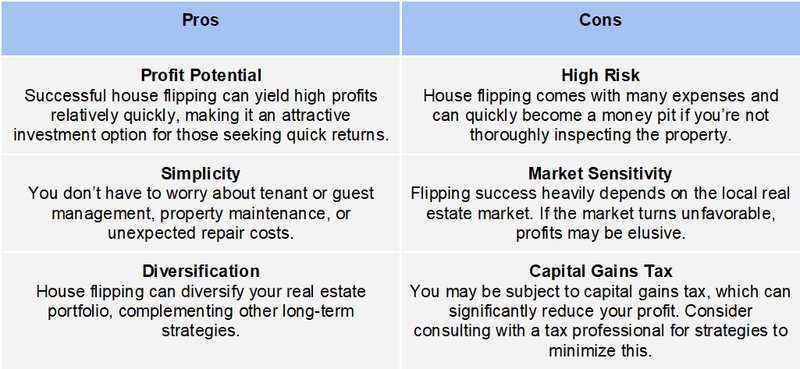

Pros and Cons of Short-Term Rentals

Criteria for Flipping a Property

- - Is the property in a desirable neighborhood with good schools, low crime rates, and convenient access to amenities?

- - Is the purchase price below market value? Usually, a property is sold lower due to distress, foreclosure, or motivated sellers.

- - Does the property’s condition allow for improvements that will justify the investment?

- - Does the property have a fast turnaround potential? When flipping properties, time is money. The average time to flip a property is 3 to 9 months.

- - Is there a demand for the type of property you plan to flip? Consider the property size, layout, and features.

- - Is the potential resale value of the property after renovations high enough? You can use the industry standard’s 70% rule to get this value. Multiply the After Repair Value by 0.7 and deduct the expected rehab costs. Many real estate investors consider a 20% profit a success.

- - Is it within your budget? Your budget should account for the acquisition, renovation, carrying costs (e.g., property taxes, utilities), and resale expenses.

Determining a Property

We’ll use the same property from a while ago.

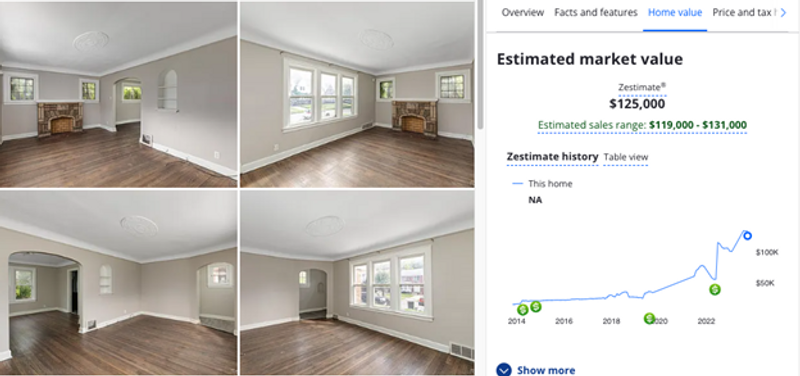

Source: Zillow.

Source: Zillow.The property is in Bagley, Detroit, a superb neighborhood with increasing rent prices and home values. However, as we can see, the property is well-kept, fully renovated, and has a purchase price above its market value.

Results: Not Good for House Flipping

The only criteria the property met is that it’s located in a desirable neighborhood. But it doesn’t have below-market value, and it doesn’t require major renovations. Therefore, you won’t have good profit margins if you buy and sell the property. Having a high profit from flipping a distressed house is the primary goal of house flippers.

What Makes a Property Good for Long-term Rental?

The last investment strategy we’ll discuss is renting out a property long-term.

Long-term rental, also known as traditional renting, involves leasing a residential property to tenants for an extended period, typically six months to several years. The primary goal is to generate a consistent and steady rental income while retaining tenants from the rental property.

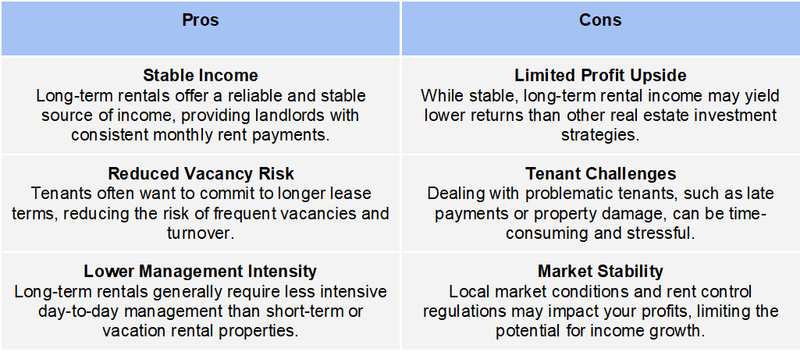

Pros and Cons of Long-Term Rentals

Criteria for Long-Term Rentals

- - Is there a high demand for rental properties in the location of the property? The answer is usually yes if it’s an urban area, a luxury area, around colleges, in an up-and-coming neighborhood, near grocery stores, and the rents have been steadily increasing.

- - Is there a growing job market and development in the area? You want an area with a strong growth in employment rates.

- Does it offer appealing amenities to renters? These usually include parking and outdoor spaces, well-maintained flooring, new appliances, and walkability.

- - Is the property in a good structural condition that requires minimal immediate repairs or renovations?

- - Does it have an excellent rent-to-price ratio? The general rule is that the ratio should be 1% to ensure a strong cash flow.

- - Do you have the budget to cover the mortgage principal, interest, property taxes, and insurance with the monthly rent? If yes, then you’re in good shape to be a landlord.

Determining a Property

The colonial-style property has appealing amenities, newly renovated with new appliances and flooring. Plus, it’s a big enough house (1,267 sqft) to cater to multiple renters if you want to rent out each bedroom or target families with kids.

Results: Suitable for Long-Term Rentals

If we calculate the rent-to-price ratio using Zillow’s estimated monthly rent, the ratio comes out at 0.6%. This may be lower than the industry standard’s 1%, but the Bagley neighborhood shows a robust rental market. Plus, if you add more amenities or make minor renovations, you can always increase your rental price to 1% or at least 0.8%.

So, if you have the budget, this property is a good investment for a long-term rental business.

Maximize a Property’s Potential With The Right Strategy

In the world of real estate investment, the decision to sell, rent, or Airbnb a property is critical. Each option has its own pros and cons, and understanding these factors is vital for making informed choices.

Whether you embark on the journey of house flipping, opt for the stability of long-term rental income, or explore the dynamic world of short-term rentals on Airbnb, the key lies in aligning your investment strategy with your goals, risk tolerance, and market conditions.

If you’re eager to embark on a lucrative long-term rental journey, comment below, and let’s talk.

Comments