Hello! Another market update for Raleigh North Carolina - here's what's happening with our real estate and how it impacts you as a long term holder, short term operator, house hacker, or even a flipper.

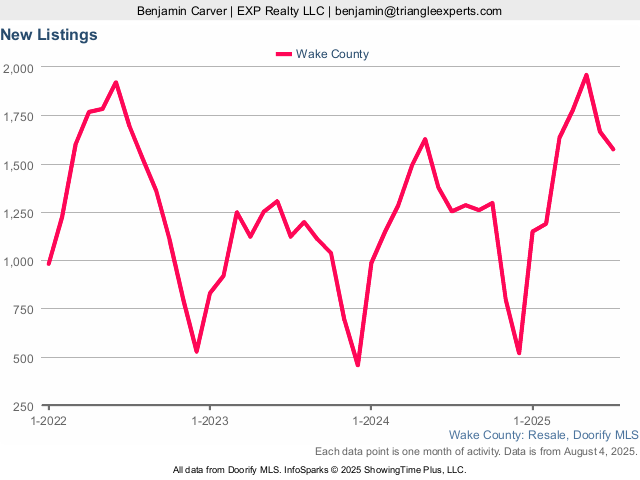

Inventory: Listing are up 25% year over year, which is an impressive jump to say the least. This summer has seen more listings than we've seen since this time 2021. Which means sellers are selling again. And buyers, they have more options than they did the last several years.

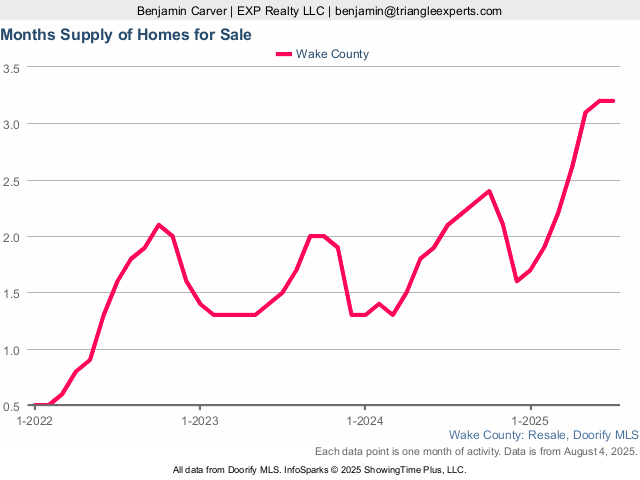

Buyer vs Seller Market: This leads me to my next question; "what type of market is it now?" When we look at month's supply, which indicates how long it would take to sell all the currently available homes if no new listings were added, assuming current sales pace. It's a key metric for understanding the balance between supply and demand in a real estate market.

What we can see from the data is a gradual but clear progression toward a balanced market (around 5 months supply). Not there yet, but definitely heading that direction barring any major economic changes.

Interestingly enough, we can see months supply INCREASE during this summer when typically it would decrease (before rising during the fall/winter).

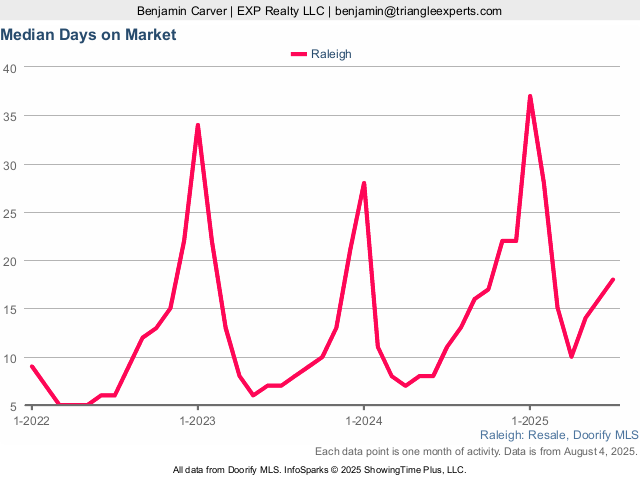

I have certainly felt this in my day to day over the last 3 months. Days on market is also a-typically high for July at an astounding 63% increase over last July. Homes overall are not flying off the shelves like they have been in the past.

So.... are we in a bubble? What's actually happening? Here's my professional opinion...

No, I do not think we are not in a bubble. I believe we are returning to some level of normalcy that frankly, many of us just are not used to. For starters, our median home prices in Raleigh are still slightly up year over year, indicating most sellers are *not* seeing house prices drop significantly. The caveat is they are having to work harder, be more negotiable, and yes... location is becoming way more important again.

Normally, summer is where we see a nice bump in prices, and is a good time for sellers to test the market - but stubborn rates and overall affordability is certainly taking its toll, slowing demand for homes. The typical home is selling for 97.5% of original asking, which reveals sellers are simply not adjusting to this a-typical summer. And thus, they have priced their home too high, see days on market go up, and eventually price drops until they reach a more realistic price range.

Bottom Line: We’re transitioning into a balanced market—investors can leverage greater inventory and longer negotiation windows. So this is actually a good thing for my buy and hold investors, like myself. Flippers have to be extremely careful right now, that they buy right and understand where the market is trending.

Feel free to DM me if you want to chat more about investing in the Triangle NC!