Is Real estate crashing?

Is the single-family real estate market going to crash?

Crash chatter has been going on for years (and it’s getting louder), but is it an emotional reaction or based on market data?

The real estate market couldn’t sustain the same level of growth it experienced during the pandemic.

With mortgage rates having spiked sharply from historic lows, buyers are facing much higher mortgage payments than they were a year ago.

Naturally, home sales have slowed sharply.

For real estate prices to collapse though, there needs to be significantly more supply than demand.

Currently, according to macro data, that hasn’t happened yet.

Housing Inventory

While single-family housing inventory has increased from its lows in 2022, there are still fewer homes for sale now than before the pandemic.

Increased housing inventory faces headwinds, including a slowdown in single-family housing construction and homeowners with fixed-rate mortgages below 5% who are reluctant to sell.

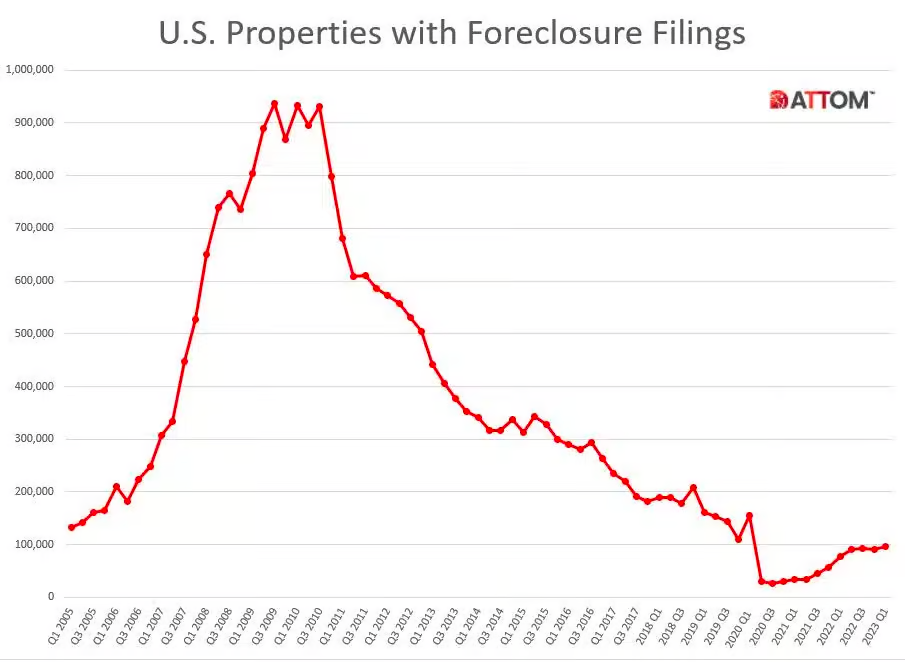

Foreclosures

There has been a slight uptick in foreclosures, but we are currently at a 17-year low in foreclosure rates.

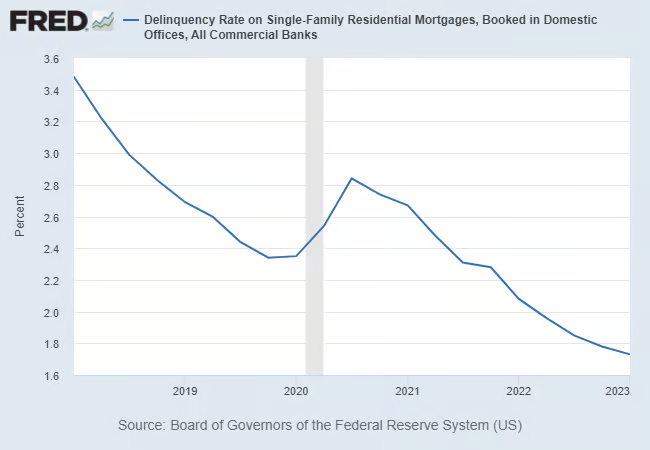

Mortgage Delinquency

A lagging indicator for foreclosures is mortgage delinquency.

With an increase in delinquency, you can expect to see a rise in foreclosures in the future.

Similar to foreclosures though, delinquencies are lower now than they were before the pandemic.

Summary

The housing market is complex, and its future performance cannot be predicted by simply looking at inventory, foreclosures, and delinquency rates alone.

However, considering that data, the risk of a collapse in housing prices in the near-term seems to be low.

Other factors to consider include trends in unemployment rates, employment data, home sales, days on the market, demographics, and unknown black swan events.

It’s also important to remember that national trends may not necessarily reflect your local real estate market.

As the saying goes, all real estate is local.

Comments