Florida’s Housing Reset: Stress for Owners, Openings for Buyers

It was a warm summer morning in Cape Coral, the kind of Florida day where the sun danced on the palm trees and the breeze made everything feel like a postcard. But at 9:30 a.m. on July 7th, as the auctioneer’s hammer came down, the mood shifted. A property from SE 23rd St which was once destined to be a $400,000 slice of paradise sold for just $75,000 to the plaintiff. What stood there was a half-finished house, abandoned because the owner realized his investment was underwater. With no equity left and costs like insurance and property taxes piling up, he walked away. What was supposed to be a dream became another number in the foreclosure records.

More than a single case, it is becoming a snapshot of what is happening across Southwest Florida, in Lee, Charlotte, and Polk Counties, where foreclosures are climbing, evictions are rising, and prices are bending under the weight of oversupply and shrinking demand.

Lee County – From Frenzy to Fallout

Lee County became one of Florida’s most sought-after markets during the pandemic housing surge. Buyers from across the country rushed into Fort Myers and Cape Coral, driving prices sky-high. Even empty lots were swept up in bidding wars, doubling in value almost overnight. For a while, it felt like everyone wanted in.

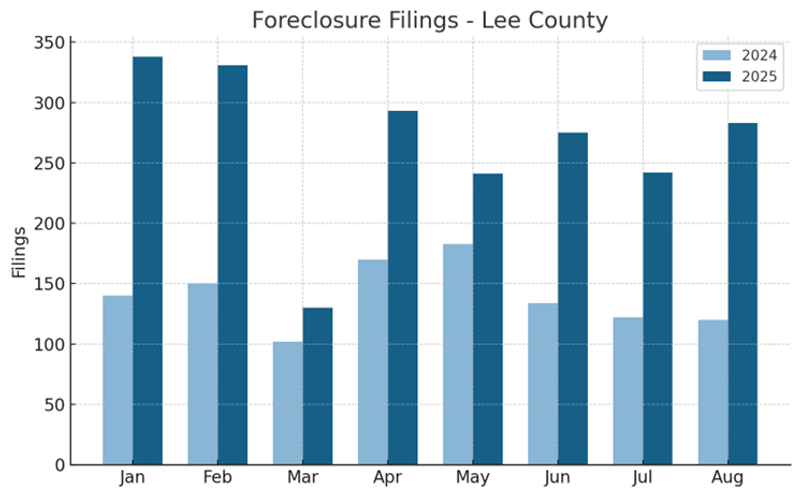

But that momentum has flipped. Court data shows foreclosure filings in Lee County up dramatically in 2025 compared to last year. In the opening months alone, filings more than doubled, with February recording a 121% increase. By mid-year, even months with smaller rises, like March (+27%) and May (+32%), pointed to unrelenting pressure.

At the auction block, more properties are being sold. Early in the year, only a little more than half of scheduled auctions ended in a sale. By August, that number jumped to more than 80%. The message is simple: more owners are unable to save their homes, and more properties are flowing into the hands of buyers.

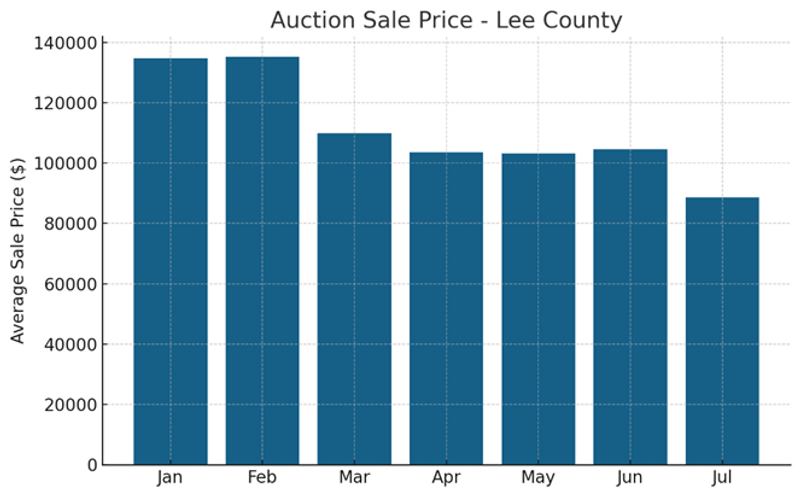

Logically, prices are going in the opposite direction. The average sale price in January stood above $134,000. By July, it had collapsed to under $90,000, a drop of 34% in just six months. Supply is outpacing demand, and buyers are showing more caution as cash becomes scarcer. For owners who trusted the frenzy, it’s a nightmare. For investors who saw the picture and waited, it’s the early sign of opportunity.

Charlotte County – The Affordable Heaven No Longer Shielded

For years, Charlotte County was the affordable alternative to Fort Myers and Cape Coral. Towns like Port Charlotte and Punta Gorda welcomed both investors and retirees, offering lower prices and a quieter lifestyle. Property values rose quickly as demand spilled over from neighboring markets.

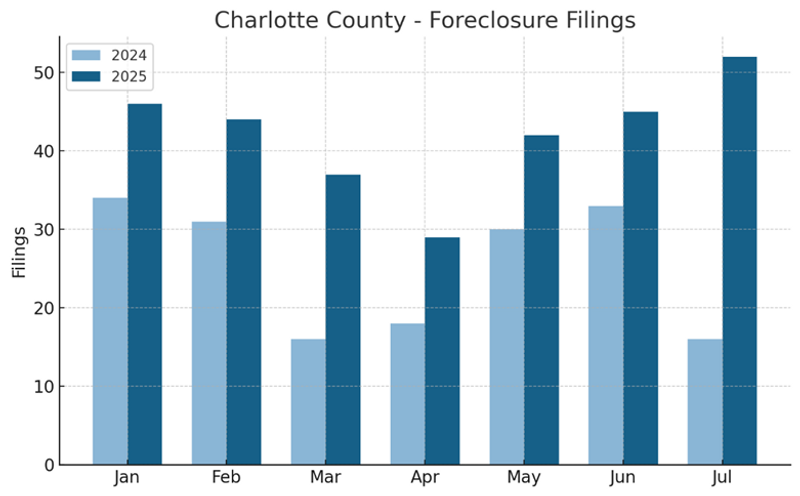

Now, those gains are fading. The same pressures seen in Lee are showing here: rising costs, mounting inventories, and slowing demand. Court filings reveal foreclosures rising steeply in 2025, with March more than doubling over the prior year and several other months posting double-digit growth. The trend is broad and persistent, not a temporary spike.

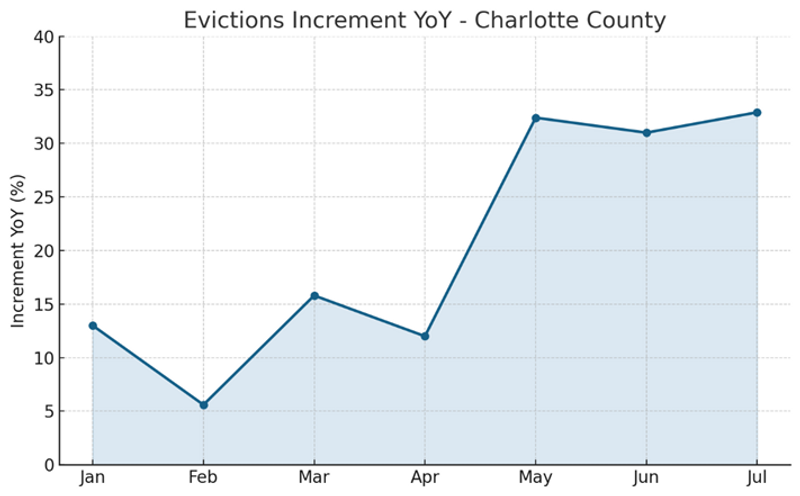

Evictions highlight the human side of the strain. Starting the year with moderate increases, filings climbed past 30% higher by the summer compared to 2024. That means more evicted renters falling behind and more foreclosed homeowners unable to keep up with dues or payments. The causes are the same ones squeezing the entire region: insurance premiums, property taxes, and loans taken at inflated prices are eroding financial cushions.

Charlotte County’s market no longer reflects rapid appreciation. Instead, it’s a test of survival for owners under pressure. But for investors, this stress is pushing more properties into the pipeline, creating chances to buy at prices that would have been unthinkable just a year ago.

Polk County – Florida’s Foreclosure Capital

Polk County is different in character but not in outcome. Its location between Tampa and Orlando gives it a unique advantage: less than an hour to either city and surrounded by major highways like I-4, the Turnpike, US-27, and US-17. It feels like small-town Florida but with the access and convenience of a metro hub. This is why towns like Davenport and Lakeland exploded in recent years, with logistics hubs for Publix, Amazon, UPS, Walmart, and more planting roots here. Winter Haven’s lakes added lifestyle appeal, attracting retirees alongside workers.

During the pandemic “pricing frenzy,” Polk became one of Florida’s fastest-growing housing markets. Prices leapt upward, fueled more by speculation than fundamentals. But today, Polk stands as the epicenter of the correction.

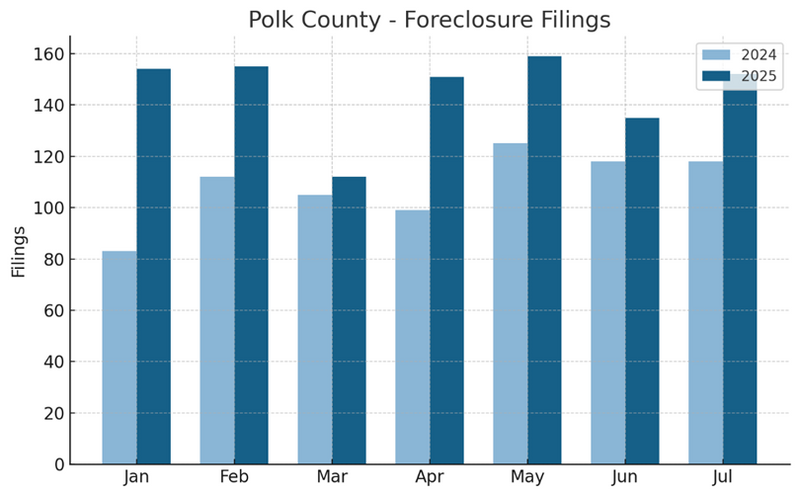

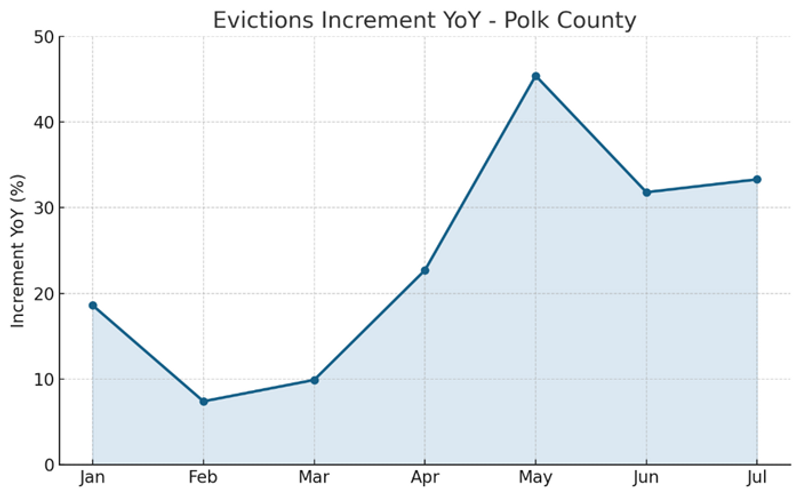

Court data shows foreclosure filings nearly doubled at the start of 2025 and continued to rise through the summer, with May alone up more than 25% compared to last year. Evictions paint an even starker picture. By May, filings were up more than 45% year over year and have stayed above 30% growth since.

The national press has taken note. In 2024, Polk County recorded the highest foreclosure rate in the country, with one in every 172 homes facing a filing, more than double the national average. Lakeland was singled out as the U.S. city with the most foreclosures, blamed largely on soaring insurance premiums and stubbornly high interest rates.

For those who bought during the speculative upswing, particularly with high-cost mortgages, this is a brutal reality. But for forward-looking buyers, Polk’s fundamentals, its location, infrastructure, and long-term demand drivers, remain strong. Once the market finds its floor, Polk may be one of the fastest counties to rebound.

Stress Today, Opportunity Tomorrow

Across Lee, Charlotte, and Polk Counties, the pattern is unmistakable: foreclosure filings are climbing, evictions are accelerating, and prices are falling. For homeowners and tenants, it’s a stressful and uncertain environment. But for investors, the story is different.

The frenzy of the past few years was built on shaky ground, and what we are seeing now is the correction. More properties are flowing into auctions, more are selling, and prices are softening. For those with patience, cash, and the willingness to do careful research, the opportunities are sharpening. What began as scattered distress is now turning into a regional wave, and those ready to catch it may secure the best deals in years.

Comments