Foreclosure Signals: What South Florida’s Courtrooms Are Telling Us

South Florida’s housing market isn’t just cooling, it’s showing real signs of stress. And this isn’t based on opinion or media noise. It’s based on hard numbers pulled directly from court records, the most accurate and transparent source available. From Miami-Dade to Broward and Palm Beach, official data reveals a steady climb in foreclosure filings, more auctions closing, falling prices, and banks holding onto more properties than they want. If you want a clear picture of what’s unfolding, this is where to look.

A Surge in Filings and Sales: Trouble Moves from Paper to Reality

The earliest sign that a housing market is cracking usually shows up in the courthouse. When a homeowner has exhausted all options (refinancing, restructuring, temporary forbearance) and still can’t catch up on their mortgage, the lender files for foreclosure. It’s a formal step, a legal escalation, and one that signals that things have reached a breaking point.

In South Florida, every foreclosure has to go through the judicial system. That makes the Tri-County area (Miami-Dade, Broward, and Palm Beach) one of the most transparent foreclosure markets in the country. And if you look at the official court data from the first half of 2025, the message is loud and clear: filings are climbing fast.

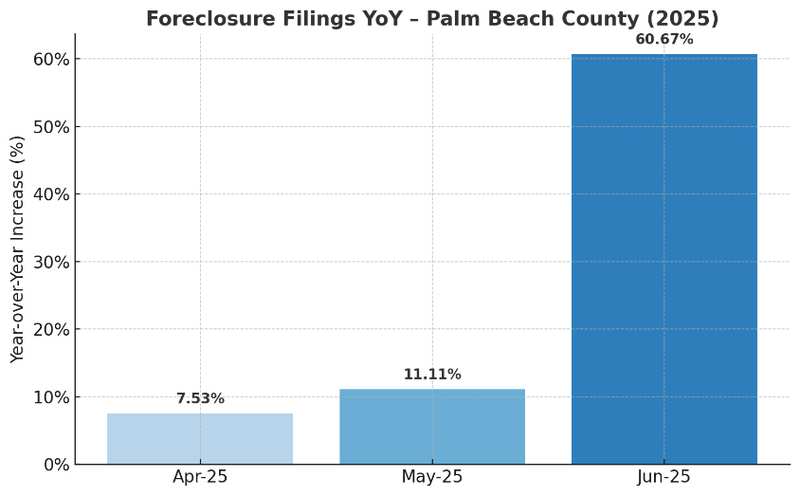

In Palm Beach County, the number of filings reaching Final Judgment has steadily accelerated over the past few months. In April, they were up over 7% compared to the same month last year. In May, that bump grew to 11%. And in June, the pace exploded, filings jumped more than 60% year-over-year. That kind of spike doesn’t happen in a stable market. It’s a clear signal that more homeowners are slipping underwater, and fewer are finding ways to escape default.

But filings are just the beginning of the story. They represent legal intent, not necessarily final outcomes. In many cases, borrowers reach last-minute settlements or file bankruptcy to stop the process. The more alarming trend is this: more foreclosures are actually being completed.

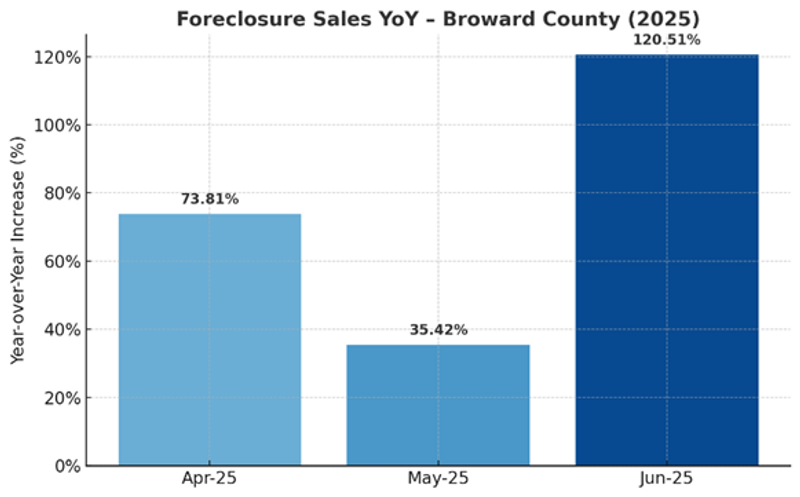

In Broward County, auction sales have surged. In April, completed foreclosure sales were up nearly 74% year-over-year. In May, they remained high, with a 35% jump. And by June, the system was flooded, foreclosure sales more than doubled, showing a 120% increase over the previous June.

These numbers tell a deeper story than just an overworked docket. They show that distressed homeowners are no longer finding off-ramps. Modifications are failing. Buyouts are drying up. And more homes are going all the way to the auction block.

This is the classic outcome process. It starts in filings. It ends in sales. And right now, that pipeline is accelerating.

When the Process Doesn’t Stop: A System Under Strain

In a healthy market, foreclosure filings don’t always mean disaster. Plenty of homeowners find ways to resolve their situations, through refinancing, modifying their loans, or negotiating settlements. That’s why, under normal conditions, only a small fraction of foreclosure filings actually go all the way to public auction. But that balance is starting to crack.

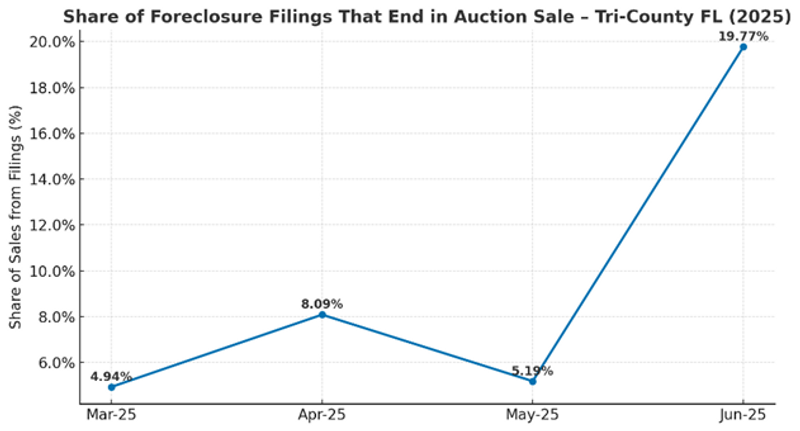

Recent court data from across Miami-Dade, Broward, and Palm Beach counties shows that more and more of these cases aren’t getting resolved, they’re getting sold. The share of filings that end in actual foreclosure sales has surged over just a few months.

In March 2025, less than 5% of filings led to an auction, a typical number for a system still absorbing delinquency. But by April, that rate had jumped to over 8%. Then, despite a brief dip in May, June delivered a clear signal: nearly 20% of foreclosure filings resulted in a completed auction sale. That’s one in every five cases moving from paper to gavel.

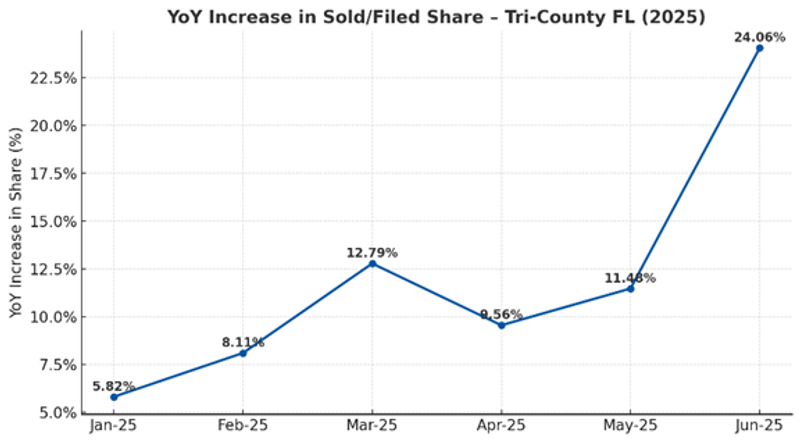

And it’s not just volume that’s growing. The pace of this shift is accelerating. Looking at the year-over-year change in this ratio (the percentage of filings that end in a sale) 2025 started with modest increases. January to May showed a steady climb from 5% to about 11%. Manageable. Predictable. But then came June, when the YoY increase spiked to over 24%. That’s not just an uptick, it’s a tipping point.

This tells us something simple but powerful: more homeowners aren’t making it out. They’re entering foreclosure and staying on that path all the way through. Whether due to lack of refinancing options, tighter lending rules, or simple exhaustion of resources, the process isn’t stopping like it used to.

This sales-to-filings ratio acts like a stress test on the housing market’s resilience. And if you read the numbers the way experienced investors do, the message is clear: the market is feeling the pressure, and the cracks are getting wider.

Falling Hammer Prices: What Auction Trends Reveal About Market Confidence

As foreclosure volumes rise across South Florida, another critical signal is flashing red: auction sale prices are falling, and fast. Each month, more distressed properties are entering the system. But instead of absorbing this supply at stable prices, the auction market is responding with sharply lower closing bids. It is a direct result of a market that’s been pushed beyond its limits and is now hitting a hard reset.

Let’s call it what it is: a correction after an artificial surge.

During the pandemic, mortgage rates dropped to historic lows, some buyers locked in loans at 2.5% or even less. That once-in-a-lifetime monetary environment pumped massive liquidity into the housing market and drove prices to unsustainable highs, especially in Florida. Investors, flippers, and even average families paid premiums that weren’t backed by wage growth or rental fundamentals.

Now, with rates having more than doubled and the stimulus era behind us, reality is setting in. Prices inflated by cheap money are no longer supported by real-world economics. And the auction market is where that correction shows up early and unfiltered.

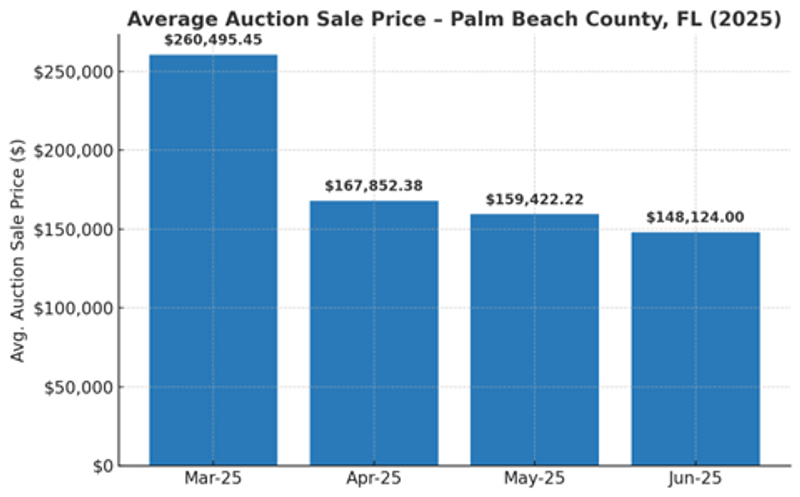

Across both Broward and Palm Beach counties, the decline is striking. In Palm Beach, the average foreclosure auction price has dropped from $260,495 in March to $148,124 in June, a 43% decline in just three months.

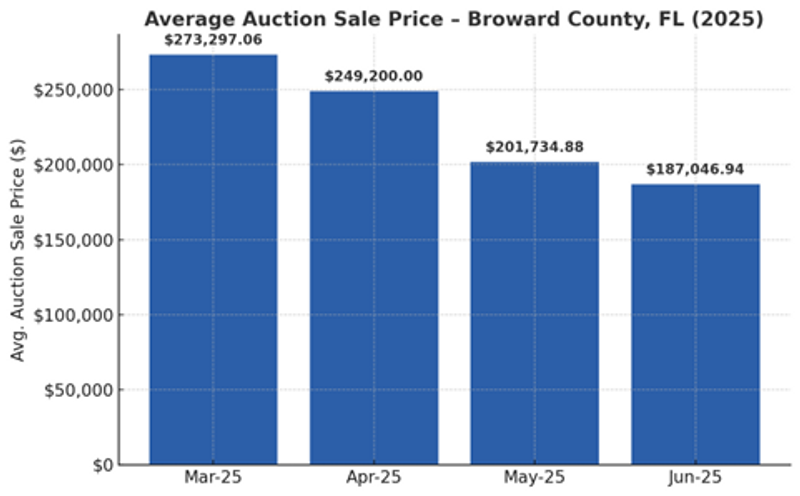

In Broward, it’s a similar story: from $273,297 to $187,046, a 31.5% drop over the same period.

This isn't just about short-term economic headwinds or rising costs like insurance, HOA fees, and financing hurdles, which, while real, are only part of the picture. The deeper issue is that many properties were bought or refinanced at prices that simply don’t reflect the true earning power of today’s economy.

Buyers are pulling back. Investors are recalculating. And the market is no longer willing to pay peak prices for assets that don’t produce strong, immediate returns. The result? Less aggressive bidding, more cautious underwriting, and a fast re-pricing of real estate assets, especially in the foreclosure space

Rise in REO Properties: The Banks Are Stuck with the Assets

There’s a hard truth in real estate finance: banks don’t want houses, they want money. They’re built to lend, not to manage properties. When a property goes unsold at auction and the plaintiff (usually a bank) ends up taking it back, that property becomes an REO, a “Real Estate Owned” asset. And for the bank, it’s a problem they need to convert back into cash as fast as possible.

Unlike regular sellers, banks can’t afford to wait for better market conditions. They can’t hold out for a higher offer next spring. They don’t have that luxury. Their balance sheets depend on liquidity, not drywall. And when a foreclosure sale doesn’t produce a winning bid that matches or exceeds the judgment amount, the bank ends up holding the bag. Right now, South Florida is seeing a fast-growing wave of exactly that.

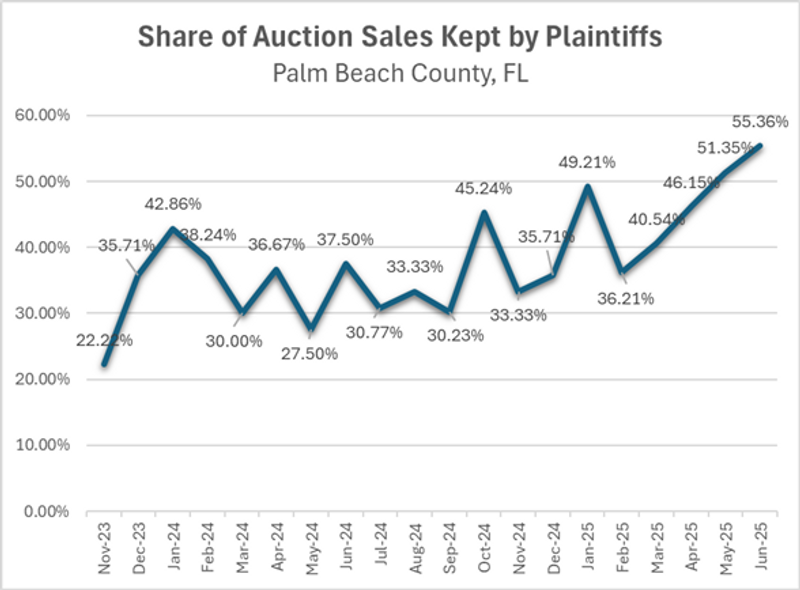

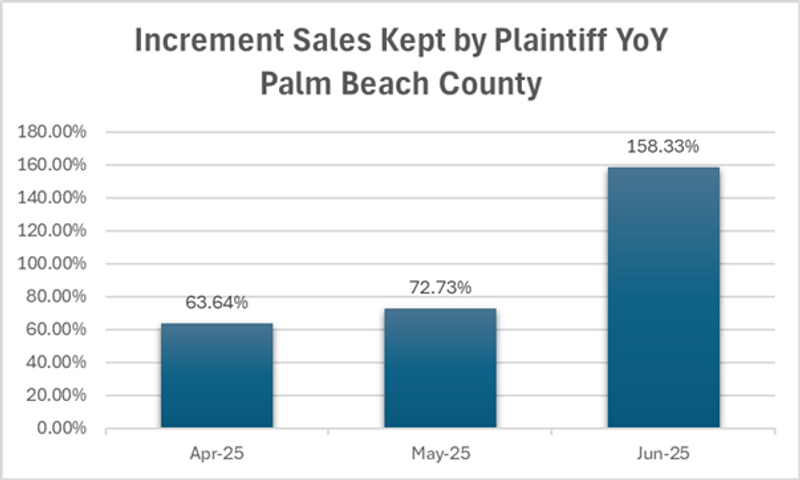

In Palm Beach County, the share of foreclosure sales that ended up being kept by the plaintiff surged to over 55% in June 2025, up from just 22% back in November 2023. That’s more than double in less than a year, a sign that buyers are backing away from auctions where the pricing just doesn’t make sense anymore.

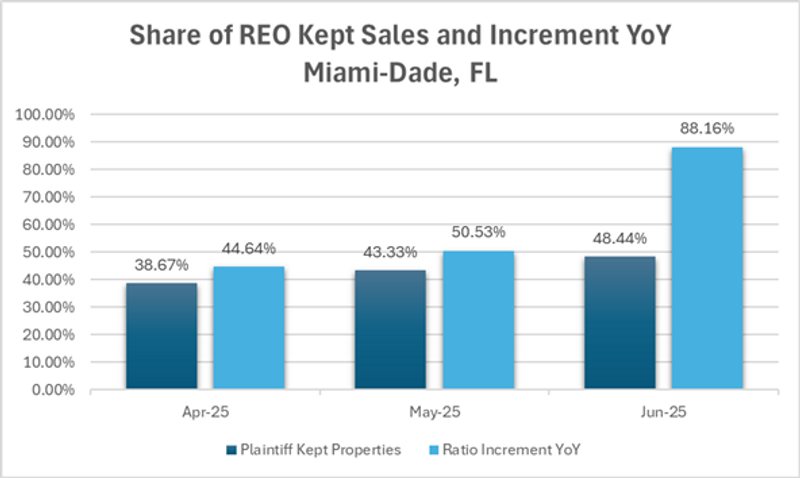

In Miami-Dade, we’re seeing the same story unfold. Nearly half of all foreclosure auctions in June were kept by the plaintiff. And the pace is picking up, the year-over-year increase in REO conversions jumped 88% in June. When that many distressed assets return to the lender's books, it means the market is rejecting the prices set by foreclosure judgments.

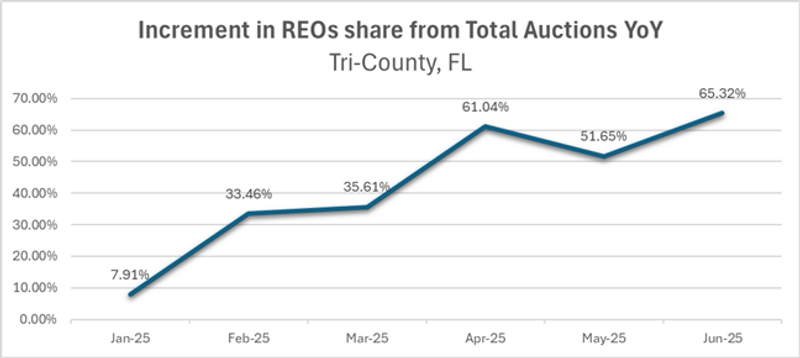

And across the Tri-County area, the picture is just as telling. The share of REO properties has increased every month in 2025, climbing from a 7.9% increase in January to over 65% by June, compared to the same months in 2024; showing continuous distress.

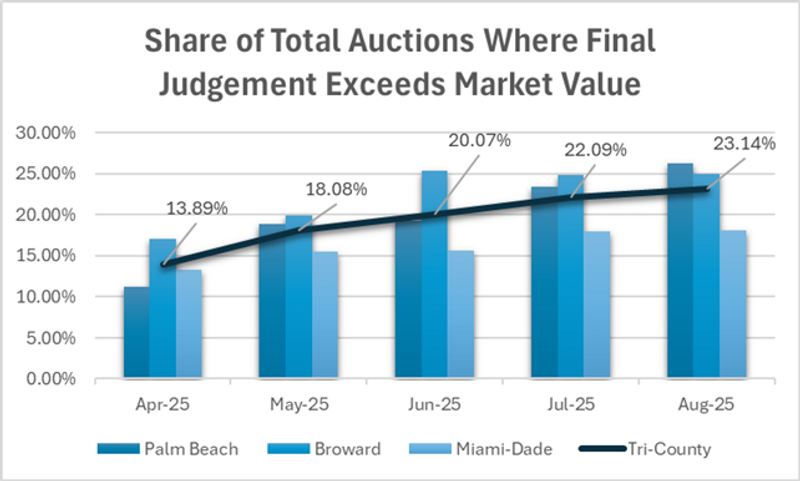

But perhaps the clearest warning comes from the most forward-looking data we have: the number of auction filings where the final judgment exceeds the property’s market value.

In April 2025, around 15% of auctions in South Florida had final judgments higher than the estimated property value. By August, that number had climbed to over 23% across the Tri-County area, with Palm Beach and Broward leading the trend. That means more and more auctions are being priced out of reach from the very start. And as listing prices continue to drop, and sit longer on the market, the REO wave isn’t just here, it’s growing.

This isn’t a coincidence. It’s a cycle. First banks secured loans with overvalued collateral during the post-pandemic boom. Then borrowers defaulted when they could no longer justify paying inflated prices. Consequently, foreclosures moved forward, but the market won’t absorb those prices. Finally banks are forced to take properties back, and liquidate them quickly, at a loss.

It’s a self-correcting mechanism. A painful one. And in South Florida, it’s already well underway.

Conclusion

This isn’t chaos, it’s correction. The South Florida housing market is adjusting after years of runaway prices and easy money. It’s not time to panic, it’s time to pay attention. The data shows clear patterns: foreclosures are rising, prices are softening, and banks are offloading properties fast. For those ready to do their homework, this creates a window of opportunity. Smart investors and buyers willing to explore the foreclosure space could find some of the best deals we’ve seen in years.

Comments