All Forum Posts by: Fallon Gilbert

Fallon Gilbert has started 9 posts and replied 58 times.

Post: Town of Brookhaven

Post: Town of Brookhaven

- Posts 58

- Votes 14

Depending on how many rentals you have and how often things break, you might want to look into property management or see if a company near you does monthly servicing. I use a company where, yes it's a monthly fee, however they take care of the lawn, do checks, and when something breaks the labor is included up to a certain amount. 100% worth it not to deal with it.

Post: What are your methods to finding Private money lenders?

Post: What are your methods to finding Private money lenders?

- Posts 58

- Votes 14

@James McGovern I under stand, which is why in my case I would probably want a private money lender. Just not sure where to find them.

Post: What are your methods to finding Private money lenders?

Post: What are your methods to finding Private money lenders?

- Posts 58

- Votes 14

Hi all!

I feel like I'm a fish out of water here a bit. I know that there are tons of different types of lenders but I believe for my case I would need a private money lender or hard money lender. To my knowledge, hard money lenders only do shorter terms? Not really sure.

Another issue I'm finding is the amount of money - the deals I do are typically about $30,000 and it seems like not many people are willing to lend on such a small amount. Does anyone know why?

I have, what I think, are good deals, and other properties that are owned free and clear which can be used as collateral. Does anyone know someone that would lend on this amount? Would love to have a conversation!

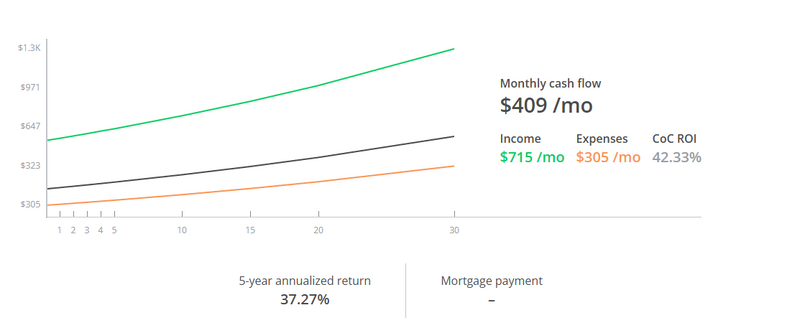

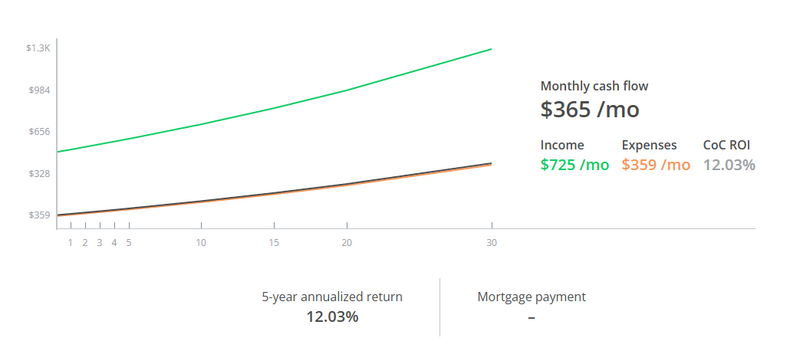

Here are two of my properties that I put into the bigger pockets calculator. Thanks in advance!

Post: Best way to find buyers?

Post: Best way to find buyers?

- Posts 58

- Votes 14

@Josh Robertson Thanks for your comment Josh! I'm definitely always looking to keep myself informed legal wise and appreciate the advice. I was planning on networking starting tomorrow and trying to scale from there.

Post: Thoughts on OH markets for flipping?

Post: Thoughts on OH markets for flipping?

- Posts 58

- Votes 14

Quote from @Micah White:

Hi Natasha!

There are great flipping opportunities in Ohio. Especially near the universities. It would be helpful to know a little more information about your current financial standing. That way I can better help you come up with a solid plan for your next investment! Feel free to reach out!

Following this! I was wondering the same thing.

Micah do you recommend any areas in Ohio specifically?

Post: Best way to find buyers?

Post: Best way to find buyers?

- Posts 58

- Votes 14

Hi everyone!

I'm not sure if this is the place I would post this but I'm doing some creative deals and I'm curious if anyone has a suggestion to build a buyers list for contract for deed/executory agreements or other seller-finance type deals? I've debated if I should reach out to lenders in the areas and offer referral fees but is that allowed? I don't know how the lending process works if someone doesn't get approved or whatever the case may be.

I guess what's holding me back from full on jumping in is worrying about getting someone to purchase the properties from me and then having them sit. I'm sure this is a common fear but any and all suggestions would be appreciated!

Post: Cannot find a lender. Please help!

Post: Cannot find a lender. Please help!

- Posts 58

- Votes 14

Quote from @Logan M.:

My suggestion would be to sell the three and 1031 into something bigger. I know you didn't ask for my opinion but unless you want to just continue in the SFH route there are so many more opportunities in multifamily.

I appreciate the opinions anyway because it gives me more options. Two of the properties are duplexes and the third is a SFH. They provide more cash flow than 1 bigger option in addition to having to front the cash for renovations etc. which wouldn't help my situation

Post: Cannot find a lender. Please help!

Post: Cannot find a lender. Please help!

- Posts 58

- Votes 14

Quote from @John Clark:

Quote from @Fallon Gilbert:

Quote from @Sasha Mohammed:

this is a toughie. truth be told, there are lenders out there that will do an individual DSCR loan w/ a $55k minimum. Problem is, the fees are going to be SO EXCESSIVE... it may not even be worth it for you to press forward.

i would recommend the conventional route if that's an option.

Because the 3 properties provide much more income than 1 other house regardless of how much more it's worth.

Post: Cannot find a lender. Please help!

Post: Cannot find a lender. Please help!

- Posts 58

- Votes 14

Quote from @Jay Hurst:

Quote from @Fallon Gilbert:

Hey all,

I’ve been having an extremely hard time finding a lender for my situation. I have 3 properties that are owned free and clear however the values are less than $75,000 each which most lenders will not do a portfolio loan on. I would think there would be a lender some where that would since the houses sell for under $75,000 on average. I’ve tried contacting local banks and credit unions however they’re telling me I would have to live in the state which I do not. Any advice or help would be appreciated.

Thank you!

What state are the properties in?

PA

Post: Cannot find a lender. Please help!

Post: Cannot find a lender. Please help!

- Posts 58

- Votes 14

Quote from @Brittany Minocchi:

Quote from @Fallon Gilbert:

Quote from @Brittany Minocchi:

Do you HAVE to put them in a portfolio, or can you cash them out separately with conventional financing? If that's not an option, I may know of a lender who will go a bit below $75k per property for a portfolio. Depends on the scenario.

Nah you're not doing anything wrong, lots of local banks DO have minimum loan amounts, but not all. Not sure where you're located, I'm in Ohio and I see $50k+ amounts regularly. There are a couple of issues with low loan amounts: 1.) there's not much to be made on them, so many loan officers aren't super eager to do them and 2.) it's harder to get them to pass compliance. DSCR with those loan amounts will be tough unless you can find someone to portfolio them.

My properties are in PA. I totally get that too. I’m trying to portfolio them but I can’t seem to find someone.