All Forum Posts by: Frank Huang

Frank Huang has started 0 posts and replied 6 times.

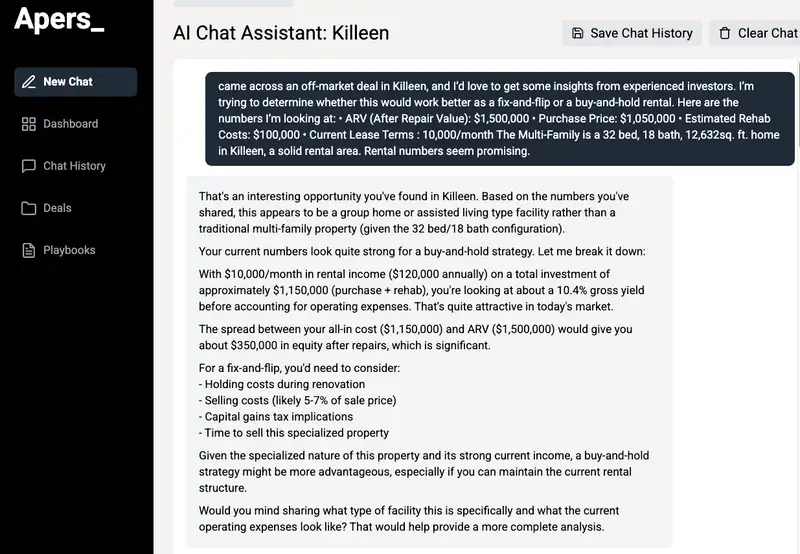

Post: Would This Be a Good Flip or Rental in Killeen?

Post: Would This Be a Good Flip or Rental in Killeen?

- Investor

- Boston

- Posts 6

- Votes 5

Hey Uzoigwe,

This is an interesting project, so I ran it through our system as an exercise.

The first step was straightforward—I copied and pasted your question into our system. The quick takeaway: The spread between your all-in cost ($1,150,000) and ARV ($1,500,000) gives you about $350,000 in equity after repairs, which is significant.

I was surprised that our system initially categorized the property as a potential group home or assisted living facility.

Of course, I didn’t stop there—your core question of whether to hold or flip remained unanswered. So, I factored in the current cost of capital, using today’s T-bond rate + 200 bps as a starting point.

The system recommended a buy-and-hold strategy based on strong cash-on-cash returns and consistent cash flow. The biggest risk for a flip is the speed of the value-add execution and the potential for rehab cost overruns.

I wasn’t entirely satisfied with the system’s “specialty asset type” assumption, so I pulled more rental market data from Redfin for Killeen and also attached the property photo you provided to refine its understanding of the project.

Even with the updated inputs, the system still leans toward buy-and-hold. Here’s why:

1. The property already generates strong cash flow at $10,000/month

2. Financing terms for multi-family are typically favorable, especially with established income

3. Renovations can be phased in systematically while maintaining partial occupancy

4. Multi-family properties in military markets like Killeen tend to have stable demand

5. Long-term appreciation and equity buildup provide strong wealth-building potential

Overall, this is a fascinating project in a unique market (and quite fun to do a quick research!)—I didn’t realize Killeen was a military hub until seeing your post! Seems like a great deal!

Post: Operating Real Estate Business Under An Existing LLC for Another Business

Post: Operating Real Estate Business Under An Existing LLC for Another Business

- Investor

- Boston

- Posts 6

- Votes 5

For bigger deals, it's always a good idea to set up a new entity, like a special purpose vehicle (SPV). The main reason we put real assets under an LLC is to keep risks isolated, which just gives you more peace of mind. Plus, forming and dissolving LLCs is pretty affordable right now, so why take the unnecessary risk, right?

Post: How to Compare Real Estate and Stock Returns?

Post: How to Compare Real Estate and Stock Returns?

- Investor

- Boston

- Posts 6

- Votes 5

This is a great question, something we often see in the institutional LP world. Basically, you want to split your real estate investment metrics into two main categories: 1) pre-tax returns, which cover unlevered IRR and levered IRR, and 2) after-tax returns. Pre-tax returns are more about the nitty-gritty of the asset itself and will change depending on whether you're investing all cash or using a lot of leverage. After-tax returns focus on how your cash flow looks once taxes kick in, like depreciation, 1031 exchanges, and capital gains.

Post: Vacancy Rate - What is good/bad

Post: Vacancy Rate - What is good/bad

- Investor

- Boston

- Posts 6

- Votes 5

I usually think of vacancy rates below 10% as pretty good and under 5% as really top-notch. But, of course, it all depends on the location’s current and future prospects. A 6-7% vacancy rate might look tempting, but it’s important to keep an eye on any new developments, like Build-To-Rent apartments, that could pop up in the neighborhood.

There’s also some research* out there showing that average vacancy rates across Metropolitan Statistical Areas (MSAs) have ranged from 17% to 10% in the past (95-17). The data might be a bit dated, but it can still give us a rough idea of what’s healthy in the rental market. This can be a handy benchmark when you’re trying to gauge the strength of different rental markets.

*The Anatomy of Vacancy Behavior in the Real Estate Market from RERI, see table 3 and 4

Post: Is house flipping a smart way to jump into REI?

Post: Is house flipping a smart way to jump into REI?

- Investor

- Boston

- Posts 6

- Votes 5

Quote from @Account Closed:

Quote from @Gabe Morrell:

Hi BP Community,

My wife and I are looking to get into the REI game and exploring our options as to what our first strategy could be. In talking with people already in the game, many have told us that long term rentals right now are not a great option due to high home prices and higher interest rates; they would be very hard to cashflow aside from a sizeable down payment.

What these same people have recommended is fixing and flipping right now, since homes are still selling. One BP community member I got lunch with yesterday told me successful flippers avoid minor cosmetic repairs such as paint, trim, floors, etc. due to a glut of investors all trying to do the same. They instead focus on fully gutting their projects and install entirely new kitchens, bathrooms, fireplaces, accent walls, etc. and any exterior or mechanical upgrades necessary.

While I understand this whole hog strategy, part of me says this will end up increasing the value of a home so far beyond other homes in the surrounding area that it wouldn't sell for what it's likely worth. (maybe this is area dependent?)

For any successful flippers out there, what strategy have you found the most success in? Minor cosmetic repairs only? Full interior gut and remodels? How did you get started in with the fix and flip strategy?

And finally, do you recommend a fix and flip as our first REI endeavor? We both have some home repair skills, but would likely need to hire out larger work such as electrical, plumbing, roofing, siding, etc.

Thanks for the help!

How you buy the property matters the most. Walking away from bad deals is even more important. Those of us who have done a lot of flips and especially using creative ways to buy have made the most money. Team up with someone who has some experience. Knowing what to avoid is sometimes the difference between making money and losing your shirt.

Can't agree more. Contrary to how youtubers glorify the profits, property-flipping is essentially a value-add/opportunistic strategy and the key risks you, as the investor, are taking are 1) asset prices, i.e., how well will the market be when you sell the property, and 2) capital expenditures, i.e., can you financially efficiently improve the asset to the end users (renters or users). Starting small-size and less levered are always good ideas in the early days.

Post: What Is Your Risk?.

Post: What Is Your Risk?.

- Investor

- Boston

- Posts 6

- Votes 5

The cap rates appear attractive at first glance, though a thorough analysis of the local markets is essential, especially the long-term vacancy rates. Typically, when evaluating and underwriting deals, we do not project a 100% occupancy rate to avoid overly optimistic forecasts that might result in negative carry post-acquisition. In scenarios where occupancy falls below 80%, equating to approximately 2-3 months of vacancy, the likelihood of encountering negative carry increases significantly. Should you decide to proceed with such a transaction, it would be prudent to ensure that sufficient capital reserves are available to mitigate this risk. I hope you find this insight valuable.