All Forum Posts by: Blake Hanson

Blake Hanson has started 0 posts and replied 5 times.

Post: property management software and 1099 K

Post: property management software and 1099 K

- Real Estate Agent

- Minneapolis, MN

- Posts 5

- Votes 3

Quote from @Erik Acheff:

I know this is an old post, but I can not find an answer online. If the property manager uses a payment app integrated with the property management software to collect rent for the landlord, this is not gross income for the property manager. Yet the payment processor is issuing the 1099-K to the property management company. I have this issue with Buildium for all the online rent payments received through their payment app. Has anyone else had this same issue?

Did you ever find a solution? My CPA was unsure... do you issue 1090-NEC for the difference between 1099-K and 1099-MISC or do you double up the income (i.e. 1099-NEC for gross rents from PM, 1099-K of the net owner distribution on 1099-K, then owner reports double income and puts a line item expense for the 1099-K since 1099-MISC covers gross rents).

Post: 1099 for rentals

Post: 1099 for rentals

- Real Estate Agent

- Minneapolis, MN

- Posts 5

- Votes 3

Originally posted by @Donna Sommers:

@Blake Hanson All PMs should issue their own 1099 for gross rents as Dwolla is for transactions only, and it is required by any company doing financial transacting.

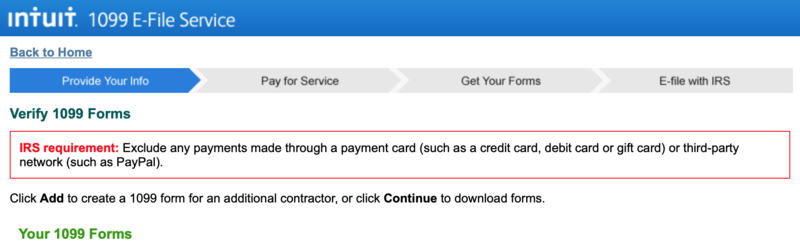

But the IRS says to exclude income that's reported by a 1099-K. Quickbooks even has this warning when you go to file 1099. For those that are over the $20,000 Owner Distributions for the year, and trigger the 1099-K, I'm going to do the difference on a 1099-MISC (i.e. the income that went towards expenses or property management fees). That way the Gross Rents will be reported between the two documents.

Post: 1099 for rentals

Post: 1099 for rentals

- Real Estate Agent

- Minneapolis, MN

- Posts 5

- Votes 3

What if a 1099-K is sent out by a PSE for Third Party Network Transactions? I use TenantCloud and the payment program (TC Payments powered by Dwolla) sends out a 1099-K for rent income paid to the owner (i.e. net rent after deducting PM fee and expenses). Do I have any obligation to report the different between gross rents and 1099-K or do my own 1099-MISC for gross rents (this would result in income being reported twice)?

My CPA said to issue my own 1099-MISC for gross rents. 1099-K would report electronic payments made and owner would file that on return ALONG with an expense line item stating the 1099-K was double up income.

Post: PMs and CPAs - do you report gross or net rents on 1099misc?

Post: PMs and CPAs - do you report gross or net rents on 1099misc?

- Real Estate Agent

- Minneapolis, MN

- Posts 5

- Votes 3

What if a 1099-K is sent out by a PSE for Third Party Network Transactions? I use TenantCloud and the payment program (TC Payments powered by Dwolla) sends out a 1099-K for rent income paid to the owner (i.e. net rent after deducting PM fee and expenses). Do I have any obligation to report the different between gross rents and 1099-K or do my own 1099-MISC for gross rents (this would result in income being reported twice)?

My CPA said to issue my own 1099-MISC for gross rents. 1099-K would report electronic payments made and owner would file that on return ALONG with an expense line item stating the 1099-K was double up income.

Post: Is there any downside to having your real estate license?

Post: Is there any downside to having your real estate license?

- Real Estate Agent

- Minneapolis, MN

- Posts 5

- Votes 3

You have to follow real estate agent licensure law when speaking to prospective sellers. The big one is a licensed agent can't just say they'll buy a property for X from a non-represented seller. They would have to provide evidence to the seller on why they're justifying the price (i.e. they are trusting you as an agent, even if you didn't sign a contract/representation agreement).

Even if market value is $X, if you as a licensed agent planned to put $Y into it to make it worth $Z, you're legally obligated to share that. And again even if no representation contract is shared, there is implied agency and you can't just try to trick them into a lower price or not tell them what options they have (like putting $Y in themselves to make $Z). Just have to disclose more.

Another blog post: https://www.biggerpockets.com/...