All Forum Categories

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

All Forum Posts by: Tucker Mason

Tucker Mason has started 14 posts and replied 16 times.

Post: Navigating Property Flipping: A Strategic Approach

Post: Navigating Property Flipping: A Strategic Approach

- Posts 16

- Votes 6

Flipping properties is a great way to make money in real estate, but it's not without challenges. To get it right, you need to plan carefully, understand market trends, and rely on accurate numbers to guide your decisions.

Understanding the Property Flipping Process

Flipping means buying, renovating, and selling a property for profit. Each step needs your full attention:

- Purchase: The key is finding a property at a good price with the potential for value-boosting improvements. It's not just about buying cheap; it's about smart buys that allow for a good return without spending too much on renovations.

- Renovation: Adding value is the goal. The right renovations—both structural and cosmetic—can raise a property’s worth significantly. You need a solid budget, a reliable team, and a clear plan to complete work on time and within budget.

- Sale: Selling the property at the right price and at the right time is your end goal. Market conditions can impact your returns, so timing your sale right is crucial.

The Importance of Financial Analysis

The numbers are what will make or break your flip. You need to know all your costs, project your potential earnings, and plan for the unexpected.

- Budget Management: List every cost from purchase to sale. This includes buying costs, renovations, permits, holding costs, and sales expenses. Don't leave anything out; knowing your total cost helps avoid surprises.

- Profit Estimation: Before you buy, estimate your profit by comparing your total costs with the projected sale price. Use accurate figures for repairs and expected market value to make sure you’re looking at a profitable deal.

Planning for the Unexpected

The real estate market can be unpredictable, and renovation projects often come with surprises. Planning ahead helps keep you on track.

- Financial Buffer: Always keep extra funds set aside for unexpected costs. Renovations can go over budget, or the market might shift. A safety net helps manage these bumps without derailing your flip.

- Alternate Plans: If the market isn’t favorable when you're ready to sell, consider renting out the property until conditions improve. This can provide income and reduce holding costs.

- Timing Your Sale: Be prepared to hold until the market is right. Selling too early in a down market can cut into your profits.

Conclusion

Flipping properties isn’t just about buying low and selling high; it’s about making the right choices from start to finish. Tools like our Property Flip Calculator can help you evaluate your investments with precision, plan for contingencies, and make the most of every opportunity. Whether you're new to flipping or a seasoned investor, having a reliable tool by your side can make all the difference.

Explore more resources and tools on our homepage at www.AssetAFC.com to help you maximize your real estate investments.

Post: Airbnb Investment Tips: Smart Strategies and Guidance to Elevate Your ROI

Post: Airbnb Investment Tips: Smart Strategies and Guidance to Elevate Your ROI

- Posts 16

- Votes 6

Investing in short-term rentals like Airbnb properties has become a popular strategy for generating passive income. But as appealing as it sounds, making the right investment decisions isn't just about finding a property and listing it online.

It’s a business that requires smart strategies, understanding your numbers, analyzing your expenses, and predicting your returns with precision. With the right approach, you can optimize your property’s performance, boost your returns, and create an unforgettable guest experience.

Let's explore some lesser-known tips and strategies for managing your Airbnb investment and why having the right tools can make all the difference.

Smart Strategies for Boosting Your Airbnb Returns 🛌

Operating an Airbnb comes with unique challenges, from managing guest turnovers to maintaining high standards of cleanliness and comfort. To stand out in the competitive short-term rental market, it’s essential to go beyond the basics and adopt practices that set you apart. Here are some expert tips to help you elevate your Airbnb investment:

- Stock Up for the Long Haul: One of the best-kept secrets of top-performing Airbnb hosts is keeping an ample supply of essentials. Stock up on high-quality linens, towels, and other amenities that can last 3-4 years. This not only saves you money in the long run but also ensures that you’re never caught off-guard by unexpected shortages.

- Create a Dedicated Storage Space: Set up a special room or storage area dedicated to your Airbnb supplies. This could be either on-site in a secure, locked room or at an accessible location nearby. Keep all your cleaning supplies, maintenance tools, spare linens, and decorative items organized in one place. This setup ensures that your property is always ready for the next guest and helps streamline your operations.

- Invest in Quality Cleaning Tools: Consistent, high-quality cleaning is key to maintaining excellent reviews. Invest in professional-grade cleaning supplies, from stain removers to reliable vacuum cleaners, to keep your property spotless. A well-kept space not only pleases guests but also prolongs the life of your furniture and décor, reducing long-term costs.

Refine the Guest Experience

Standing out in the crowded Airbnb market isn’t just about maintaining your property; it’s about creating a memorable experience that keeps guests coming back.

- Personal Touches Make a Difference: Welcome kits with snacks, a handwritten note, or local recommendations can leave a lasting impression. These small gestures can elevate your guests’ experience, leading to better reviews and increased bookings.

- Clear and Timely Communication: From booking to check-out, clear communication is essential. Set up automated messages for check-in instructions, house rules, and tips on local attractions to enhance the guest experience without extra effort on your part.

- Stay Ahead of Market Trends: Keep an eye on what’s popular among travelers, such as pet-friendly accommodations or work-from-home amenities. Updating your listing to reflect these trends can help you attract more bookings and set your property apart.

Planning for Success: The Importance of ROI Analysis

Airbnb investments have unique dynamics compared to traditional long-term rentals. Factors like nightly rates, occupancy rates, and seasonal demand fluctuations all play a significant role in determining your income. On top of that, costs associated with property management, maintenance, and utilities can impact your profitability. Without a clear understanding of these variables, it's easy to overestimate your potential returns.

- Evaluate Your Expenses: Breaking down monthly and yearly expenses, such as property taxes, utilities, and management fees, to understand the true cost of operation. Airbnb properties come with unique expenses, from regular cleaning fees to utilities and maintenance costs. A thorough analysis of these costs will help you see the bigger picture and adjust your pricing strategy accordingly.

- Forecast Your Income: Predicting your income based on average daily rates, occupancy rates, and seasonal demand is essential for setting realistic financial expectations. Understanding these factors helps you plan ahead and optimize your pricing to boost revenue.

- Investment Summary & Returns: Key metrics like cap rate, cash on cash return, and net operating income (NOI) provide insights into the overall health of your investment. Knowing your ROI helps you make smarter decisions.

Why You Need a Reliable Tool for Accurate Analysis

Maximizing your Airbnb investment requires a strategic approach, attention to detail, and the right resources. While these tips can help streamline your operations and improve your guest experience, having a reliable tool to crunch the numbers and provide clear insights into your property’s performance is invaluable.

A thoughtful analysis using tools like our AirbnbEasyROI can provide you with the clarity and confidence needed to make the best investment decisions. From detailed expense breakdowns to forecasting cash flow and returns, AirbnbEasyROI simplifies the complexities of short-term rental analysis, giving you a complete view of your property’s potential and ensuring you’re always a step ahead.

Explore more resources and tools on our homepage to help you maximize your real estate investments. Ready to take your Airbnb strategy to the next level? Make AirbnbEasyROI your go-to solution for optimizing your short-term rental investments.

Post: Airbnb vs. Long-Term Rentals: Which Investment Strategy is Right for You?

Post: Airbnb vs. Long-Term Rentals: Which Investment Strategy is Right for You?

- Posts 16

- Votes 6

Deciding between investing in Airbnb or traditional long-term rentals can be a tough call. Whether you’re new to real estate or an experienced investor, choosing the right strategy can significantly impact your returns. Let’s explore the pros, cons, and key considerations of both approaches to help you make an informed decision.

Airbnb rentals offer the potential for higher income by renting your property on a short-term basis to travelers. While this can mean more money in your pocket, it also comes with the challenge of managing bookings, maintenance, and guest turnover. On the other hand, long-term rentals provide a steady, reliable income stream with less hands-on management but often lower overall returns.

Pros and Cons

- Airbnb:

- Pros: You can often charge higher rates per night, allowing for greater income potential. Flexibility in pricing lets you adjust to market demands, and properties can be listed or unlisted with ease. Additionally, Airbnb allows you to use your property personally when not rented out, adding a layer of flexibility.

- Cons: Managing an Airbnb is more time-consuming, requiring regular guest communication and cleaning between stays. Income can vary, and there’s always the risk of negative reviews impacting your listing’s success.

- Long-Term Rentals:

- Pros: With a long-term rental, you enjoy stable and predictable income, especially if you have good tenants. Managing the property is generally less demanding, and your involvement can be minimized if you hire a property manager. There are also typically fewer regulations and lower turnover costs compared to short-term rentals.

- Cons: Long-term rentals usually bring in less money per month compared to short-term rentals. Additionally, dealing with tenant turnover and occasional vacancies can reduce your annual income. The income potential is lower compared to Airbnb, and rent adjustments are less flexible.

Cost Analysis

Understanding the costs associated with each strategy is crucial for maximizing returns.

- Airbnb Costs: Airbnb hosts should factor in cleaning fees, booking platform fees, utilities, maintenance costs, and the impact of potential periods of vacancy. Higher turnover means increased wear and tear, and the costs of managing guest experiences can add up.

- Long-Term Rental Costs: Long-term rentals involve ongoing maintenance costs, occasional repairs, property management fees if not self-managed, and vacancy periods between tenants. While these costs are generally lower than those of an Airbnb, they still impact your net income.

ROI Comparison

Evaluating the return on investment (ROI) is key to deciding which strategy aligns with your financial goals.

- Airbnb ROI: For Airbnb, ROI calculations focus on how often your property is booked, seasonal demand in your area, and the higher cash flow potential. However, it's important to consider occupancy rates and market competition, which can fluctuate.

- Long-Term Rentals ROI: With long-term rentals, ROI calculations focus on steady rent, appreciation over time, and the gradual reduction of mortgage debt. The returns are generally more predictable, but the overall income may be lower compared to short-term rentals.

Our Airbnb vs. Long-Term Rental Comparison Tool can help you assess the potential returns of up to five properties side-by-side. It provides detailed financial metrics, including rental income, expenses, and even a 10-year discounted cash flow analysis, making it easier to compare strategies and identify the best option for your needs.

Tips for Maximizing Returns

Airbnb:

- Optimize your listing with high-quality photos and engaging descriptions to attract more bookings.

- Use dynamic pricing tools to adjust rates based on demand and market trends.

- Regularly review your expenses to keep costs low without sacrificing guest satisfaction, and maintain excellent guest communication to boost ratings.

Long-Term Rentals:

- Screen tenants carefully to reduce turnover and maintain a steady cash flow.

- Keep up with routine maintenance to avoid costly repairs down the line.

- Consider regular rent adjustments in line with market trends to maximize income, and invest in property improvements that enhance value over time.

Making the Decision

Ultimately, the choice between Airbnb and long-term rentals depends on your personal goals, risk tolerance, and how much time you’re willing to invest in managing your property.

- Airbnb could be a great fit if you prefer the potential for higher income and are ready to handle the extra work and variability in income. This option can offer faster returns, but it also requires more active involvement and a tolerance for market fluctuations.

- Long-Term Rentals might be the better option if stability and less hands-on involvement are more your style. With long-term rentals, you trade some potential income for predictability and ease of management.

Remember, there’s no right or wrong choice—it’s about what works best for you. A thoughtful analysis using tools like our Multi-Property ROI Comparison can provide the clarity you need to make the best investment decision.

Explore more resources and tools in our home page to help you maximize your real estate investments.

Post: Introducing Cashflow Analyzer Pro the ultimate tool for real estate investors!

Post: Introducing Cashflow Analyzer Pro the ultimate tool for real estate investors!

- Posts 16

- Votes 6

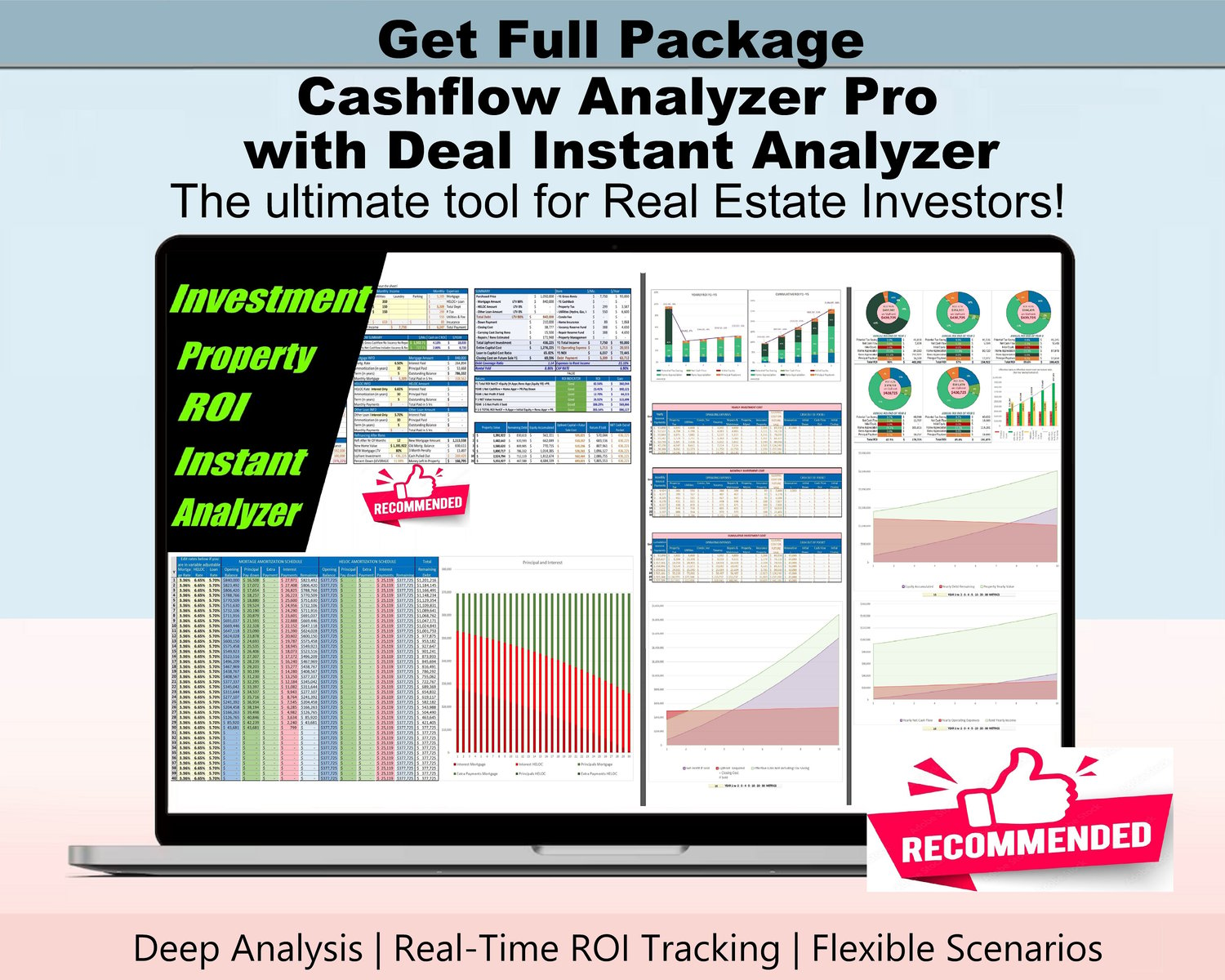

Cashflow Analyzer Pro with Deal Instant Analyzer is designed to help real estate investors to analyze potential deals for rental properties, helping them to make well-informed investment decisions. The tool provides a detailed real estate investment analysis, considering all potential income sources that your investment can generate and accurately calculates the total ROI. It breaks down components such as cashflow, principal paydown, home and renovation appreciation, initial equity, depreciation, and interest deduction for tax savings, showing their individual gains and ROI over a 30-year period. This helps in identifying which factors provide the highest returns for making informed investment decisions.

One of the standout features is the ROI Indicator. It uses color-coded cells to visually represent the quality of your ROI: green for strong, red for poor, and orange for acceptable. This makes it easy to quickly understand the investment potential.

Additionally, the tool allows you to explore different scenarios, like using HELOC, Cash, or other loans for funding or renovations, and the calculator will take into account the payments you need to make for these funds.

The tool can even simulate variable rate changes over the years, enabling real-time ROI tracking by monitoring changes in home value, rent, and interest rates, to evaluate their impact on returns.

Plus, it calculates various metrics like Cash on Cash ROI, CAP rates, Rental Yield, Debt Coverage Ratio, BRRR strategy, Net Profit If Sold, and more.

If you’re serious about making the most of your real estate investments, we highly recommend checking it out: in Etsy or at our website: AssetAFC.com

This powerful tool offers everything you need to evaluate potential deals, track crucial metrics, and maximize your return on investment.

Deal Instant Analyzer is designed to help you quickly evaluate potential deals, providing a simple summary of your investment opportunities within seconds. It's perfect for quickly analyzing multiple deals at once to determine which ones are worth pursuing. While the other package, Cashflow Analyzer Pro provides you more detailed analysis considering all sources of income that your investment can generate and accurately calculate your total ROI. This combo is like a super tool made just for seasoned or new real estate investors.

👉 How It Works: It is simple and very easy to use. Just enter your property details—purchase price, rental income, expenses, and financing terms—and let our tool do the rest. It provides an in-depth analysis of your investment, showing detailed charts and breakdowns over a 30-year period, so you can see how each factor contributes to your total ROI.

Key Features to Elevate Your Investment Strategy:

🔍 Deep Analysis: Go beyond basic calculations! Cashflow Analyzer Pro evaluates every factor affecting your ROI, including home appreciation, renovation value, depreciation, initial equity, cash flow, and more. With clear breakdowns, you'll see the individual gains of each component over 30 years.

🌟 ROI Visualization Tool: Our color-coded ROI indicator uses cell colors to show the quality of potential deals. Green means strong ROI, red signals poor ROI, and orange suggests an acceptable ROI. This makes it easy to quickly understand the investment potential. However, it's important to conduct your own research and analysis to ensure a suitable investment for your goals. This feature is an additional layer of information to support your decision-making.

🔄 Flexible Scenario Analysis: Explore different scenarios like using HELOC, cash, or other loans for funding the investment or the renovations. Our tool take into account the payments you need to make for these funds, whether interest-only or principal and interest, providing you with accurate analysis personalized to your specific needs.

💡 Real-Time ROI Tracking: The tool can even simulate changes in interest rates, home value and rent over months or years, enabling you to track ROI in real time. It helps you monitor these changes to see how they impact your overall return on investment. Track your investment's performance over time and make adjustments as needed to stay on top of your game.

📊 Simplify Analysis: Calculate essential metrics like Cash on Cash ROI, CAP Rate, Rental Yield, Debt Coverage Ratio, BRRRR strategy, and Net Profit If Sold. Our tool organizes everything into easy-to-understand visuals that make complex data simple.

⏳ Track Crucial Factors Over 30 Years: Get a comprehensive view of your investment strategy by tracking key factors for three decades. This long-term analysis helps you see the big picture, helping you to make smarter, more profitable decisions.

💡 Years of Experience in the Industry: Developed by real estate professionals, our tool reflects years of experience and insights. We created Cashflow Analyzer Pro because we couldn’t find a tool that truly covers every aspect of real estate investing. Now, you have access to a comprehensive package that sets you up for success.

Why Choose Cashflow Analyzer Pro with Deal Instant Analyzer?

🔸 Tax Savings: Calculate depreciation and interest deductions for both US and Canada.

🔸 Net Cash Flow: Know your income after expenses.

🔸 Home & Reno Appreciation: Track value increases from market gains and renovations.

🔸 Principal Pay Down: Monitor your loan reduction over time.

🔸 Debt Coverage Ratio: Assess your property’s ability to cover its debts.

🔸 Total ROI: See the big picture with a complete evaluation of all income streams.

🚀 Take Control of Your Investments Today! Don't leave your real estate success to chance. Equip yourself with the Cashflow Analyzer Pro and Deal Instant Analyzer combo and make informed decisions with confidence.

👉 Ready to level up your investment strategy? Get the full package now to take control of your real estate journey and maximize your ROI!

🛒Available in Etsy or at our website: AssetAFC.com

Post: 🏆Powerful Calculators for Real Estate Analysis, Income & Expense Tracking, Budgeting

Post: 🏆Powerful Calculators for Real Estate Analysis, Income & Expense Tracking, Budgeting

- Posts 16

- Votes 6

🏡 At Asset AFC , we're here to make real estate investing and financial planning simple and effective. Whether you’re looking to analyze new deals, track your portfolio, or budget your expenses, we have the perfect tools to help you reach your goals.

🔧 Our featured tools include:

- Full Package Cashflow Analyzer Pro with Deal Instant Analyzer - 🛒Check it out in Etsy or at AssetAFC.com - 🔍 This combo is like a super tool made just for seasoned or new real estate investors. Nowhere in the market exists a comprehensive real-estate investment calculation tool with such in-depth analysis, considering all factors. It is simple and very easy to use.

- Cashflow Analyzer Pro - 🛒Check it out in Etsy or at AssetAFC.com - 📊 Designed to help real estate investors analyze potential deals for rental properties, helping them make well-informed investment decisions.

- Deal Instant Analyzer - 🛒Check it out in Etsy or at AssetAFC.com - ⚡ Evaluate potential real estate deals quickly and easily. It's perfect for analyzing multiple deals at once to determine which ones are worth pursuing.

- Airbnb EasyROI - 🛒Check it out in Etsy or at AssetAFC.com - 🏠 The Easy Way to Master Your Short-Term Rental Calculations. The most comprehensive tool for analyzing short-term rentals.

- PortfolioMax Tracker - 🛒Check it out in Etsy or at AssetAFC.com - 📈 Your Entire Real Estate Portfolio ROI And Performance All in One Summary. Real-time ROI up to 40 properties, consolidated into a single dashboard summary overview.

- Income & Expense Tracker - 🛒Check it out in Etsy or at AssetAFC.com - 💡 Your simple path to Financial Clarity. Streamline your personal budgeting and keep your finances on track.

- Rental Multi-Property Income & Expense Tracker - 🛒Check it out in Etsy or at AssetAFC.com - 🏢 The ultimate tool for landlords and property investors, no matter the size of your portfolio. Whether you're a property manager, a small landlord with a few rentals, or managing a large portfolio, this tracker makes it easy to stay on top of your finances.

- Airbnb Portfolio Income and Expense Tracker - 🛒Check it out in Etsy or at AssetAFC.com - 🏢 This tool is the perfect tool for hosts, landlords, and property investors, regardless of the size of your portfolio. Whether you're managing a single Airbnb property, a few rentals, or a large portfolio of short-term and long-term rentals, this tracker simplifies your financial management. Track income and expenses for up to 50 properties—Airbnb, traditional rentals, or a mix—with the same ease and effectiveness.

- BRRRR Property Calculator - 🛒Check it out in Etsy or at AssetAFC.com - 🔄 Our tool simplifies the famous BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat), making the property evaluation straightforward and hassle-free.

- Airbnb vs Long-Term Rental Comparison - 🛒Check it out in Etsy or at AssetAFC.com - ⚖️ The Most Versatile ROI Comparison Tool for All Rental Strategies. Designed to help you evaluate and compare side by side the potential returns on short-term rentals, long-term rental investments, or a mix of both.

- Property Flip Calculator - 🛒Check it out in Etsy or at AssetAFC.com - 🔑 Your key to real estate success, unlocking the full potential of your real estate investments and achieving financial success quickly and easily.

💼 Our goal is to provide everything you need to manage your investments and grow your wealth with confidence.

👉 Ready to take the next step toward financial freedom?

Visit us at www.AssetAFC.com and start making your investments work smarter for you!

📈 Looking forward to helping you achieve your goals.

Tools for Real Estate and Budgeting. Investment Analysis, ROI Calculator, Cash on Cash ROI, CAP rates, Rental Yield, Airbnb and Rental Income Expense Tracker, Real Estate Portfolio ROI Tracking, Real Time ROI, Budgeting, Personal Finance and more.

Post: Real Estate Returns: How to Calculate Cap Rate, Rental Yield, NOI, Cash on Cash ROI?

Post: Real Estate Returns: How to Calculate Cap Rate, Rental Yield, NOI, Cash on Cash ROI?

- Posts 16

- Votes 6

Are you ready to dive into the world of real estate investment analysis? Understanding key metrics like cap rate, rental yield, net operating income (NOI), and cash-on-cash ROI is crucial for making informed decisions and maximizing returns on your investments. In this comprehensive guide, we'll walk you through these essential metrics using real-world examples and step-by-step formulas to empower your investment journey.

1. Cap Rate: Let's start with cap rate, a metric that measures a property's income potential relative to its market value. Basicly cap rate tells you how much money a property makes compared to its price. The formula for cap rate is straightforward:

Cap Rate = (Net Operating Income / Property Value) * 100%

Imagine a property with an NOI of $50,000 and a market value of $500,000. Plugging these values into the formula and you'll find a cap rate of 10%. .

This means that for every dollar invested, you can expect a 10% return annually.

2. Rental Yield: Next up, let's delve into rental yield, which measures the return generated from rental income relative to the property's value. Basically rental yield shows how much rental income a property makes compared to its price. The formula for rental yield is:

Rental Yield=(Annual Rental Income/ Property Value)×100%

For instance, if a property generates $30,000 in annual rental income and has a market value of $600,000, the rental yield would be 5%. Plugging in the numbers:

Rental Yield=($30,000/$600,000)×100%=5%

A rental yield of 5% indicates a potential return of 5% annually based on the property's value.

3. Net Operating Income (NOI): NOI is a critical metric that provides a clear picture of a property's income potential before considering financing or taxes. The formula for NOI is:

NOI=Total Income−Operating Expenses

NOI helps you understand the property's profitability and potential cash flow.

4. Cash-on-Cash ROI: Finally, let's discuss cash-on-cash ROI, which focuses on the return generated from the cash invested in the property. Suppose you've invested $100,000 in a property and generate an annual net cash flow of $10,000. The formula for cash-on-cash ROI is:

Cash-on-Cash ROI=(Annual Net Cash Flow / Total Cash Invested)×100%

Plugging in the numbers:

Cash-on-Cash ROI=($10,000 / $100,000)×100%=10%

A cash-on-cash ROI of 10% indicates a potential return of 10% annually on your cash investment.

Conclusion:

With these simple key metrics and their formulas, you're well-equipped to navigate the complexities of real estate investment analysis. Remember, each metric provides valuable insights into different aspects of an investment property, helping you make informed decisions and maximize your returns.

Let's embark on this journey together, exploring the nuances of real estate investing and unlocking the full potential of your investments.

For more advanced analysis, check out our Cashflow Analyzer Pro with Deal Instant Analyzer. Link here.

Happy investing!

Cash-on-Cash Return in Real Estate Investing

Cash-on-cash return (CoC) is a fundamental metric in real estate investing that measures the annual before-tax cash flow generated by a property relative to the total cash invested. This metric provides investors with insight into the property's cash yield and helps assess its immediate profitability.

Understanding Cash-on-Cash Return

The basic formula for calculating cash-on-cash return is:

Cash-on-Cash Return = (Annual Before-Tax Cash Flow / Total Cash Invested) × 100%

Where:

- Annual Before-Tax Cash Flow: The net income from the property after operating expenses and debt service (mortgage payments) but before taxes.

- Total Cash Invested: The total amount of cash invested in the property, including the down payment, closing costs, and any initial renovation expenses.

Example:

If an investor purchases a property with a $300,000 down payment and expects an annual before-tax cash flow of $60,000, the cash-on-cash return would be:

($60,000 / $300,000) × 100% = 20%

Factors Influencing Cash-on-Cash Return

Several factors can impact the cash-on-cash return of a real estate investment:

- Financing Terms: Interest rates and loan terms affect mortgage payments, influencing annual cash flow.

- Property Management: Efficient management can optimize rental income and control expenses, enhancing cash flow.

- Market Conditions: Local real estate market trends, including rental demand and property values, play a significant role in determining rental income and expenses.

- Unexpected Expenses: Maintenance issues or vacancies can reduce cash flow, affecting the cash-on-cash return.

Limitations of Cash-on-Cash Return

While useful, the cash-on-cash return has limitations:

- Ignores Property Appreciation: It doesn't account for changes in property value over time.

- Excludes Tax Implications: It doesn't consider the investor's specific tax situation, which can influence net returns.

- Short-Term Focus: It provides a snapshot of annual performance but doesn't reflect long-term investment potential.

Best Practices for Using Cash-on-Cash Return

Investors should use cash-on-cash return alongside other metrics, such as Internal Rate of Return (IRR) and capitalization rate (cap rate), to gain a comprehensive understanding of an investment's performance. Regularly reevaluating the cash-on-cash return, especially after significant events like refinancing or major repairs, ensures it accurately reflects the property's current financial status.

In conclusion, cash-on-cash return is a valuable tool for assessing the immediate profitability of a real estate investment. However, it should be used in conjunction with other analyses to make well-informed investment decisions.

Post: Maximizing ROI: A Guide to Smart Investments in Rental Properties

Post: Maximizing ROI: A Guide to Smart Investments in Rental Properties

- Posts 16

- Votes 6

In this comprehensive guide, we'll explore the ins and outs of achieving the highest Return on Investment (ROI) in the realm of rental properties. From strategic property selection to effective management techniques, we'll uncover the essential strategies and insights you need to make informed decisions and maximize the profitability of your real estate investments. Whether you're a novice investor or a seasoned pro, this guide will provide you with the knowledge and tools necessary to succeed in the competitive world of rental property investment.

Are you looking to build wealth through real estate investments? Rental properties can be a lucrative avenue for generating passive income and building long-term wealth. However, achieving a high return on investment (ROI) requires careful planning, research, and strategic decision-making. In this guide, we'll explore the key factors that contribute to maximizing ROI in rental properties, and how using resources like our Cashflow Analyzer Pro with Deal Instant Analyzer can streamline your approach, making your investment journey smoother and more profitable.

- Location, Location, Location:

The old adage holds true in real estate investing. The location of your rental property plays a significant role in its potential for high ROI. Look for areas with strong job growth, low vacancy rates, and amenities such as schools, parks, and public transportation. Neighborhoods with a high demand for rental properties often command higher rental rates and attract quality tenants, ultimately boosting your ROI.

- Property Selection:

When selecting a rental property, consider factors such as property condition, size, layout, and amenities. Properties with updated features and modern conveniences tend to appeal to tenants and can justify higher rental rates. Additionally, multi-family properties or units with multiple bedrooms can generate higher rental income compared to single-family homes. Conduct a thorough inspection of the property to identify any potential maintenance issues or structural concerns that could impact your ROI.

- Financial Analysis:

Before making an investment, conduct a comprehensive financial analysis to assess the potential ROI of the property. Calculate key metrics such as cash flow, cap rate, and return on investment to determine if the property aligns with your investment goals. Factor in expenses such as mortgage payments, property taxes, insurance, maintenance costs, and property management fees to ensure you have a clear understanding of the property's financial performance. Tools like our Cashflow Analyzer Pro with Deal Instant Analyzer simplifies this process by offering detailed projections and scenario analyses, helping you see the big picture and make confident, data-driven decisions.

- Effective Property Management:

Efficient property management is essential for maximizing ROI in rental properties. Consider hiring a professional property management company to handle day-to-day tasks such as tenant screening, rent collection, maintenance, and property inspections. A reputable property manager can help minimize vacancies, reduce turnover costs, and ensure your property remains in optimal condition, ultimately improving your ROI.

- Continuous Improvement:

To maintain and increase the value of your rental property, consider implementing upgrades and renovations over time. Focus on improvements that offer a high return on investment, such as kitchen and bathroom renovations, energy-efficient upgrades, and landscaping enhancements. These upgrades can attract quality tenants, justify higher rental rates, and ultimately boost your ROI in the long run.

- Market Trends and Rental Rates:

Stay informed about market trends and rental rates in your area to ensure you remain competitive in the rental market. Monitor rental prices for similar properties in the neighborhood and adjust your rental rates accordingly to maximize rental income. Additionally, keep an eye on economic indicators and demographic shifts that could impact demand for rental properties in your area.

- Tax Benefits:

Take advantage of tax benefits available to real estate investors to boost your ROI. Deductible expenses like mortgage interest, property taxes, insurance premiums, and depreciation can lower your taxable income, increasing your overall cash flow. Cashflow Analyzer Pro, you can easily calculate deprecation and these tax savings and see how they integrate into your total ROI, helping you optimize your returns and identify every opportunity to boost your profits. For personalized guidance, consult with a tax professional to ensure you're leveraging all available deductions and credits related to your rental property investment.

By following these strategies and principles, you can maximize the ROI of your rental property investment and build long-term wealth through real estate. Remember to conduct thorough research, seek professional advice when needed, and stay proactive in managing your investment for optimal results. With careful planning and strategic decision-making, rental properties can be a valuable asset in your investment portfolio.

Explore more resources and tools in our home page to help you maximize your real estate investments.

Post: How to Analyze Rental Properties Before Buying?

Post: How to Analyze Rental Properties Before Buying?

- Posts 16

- Votes 6

Real estate investing might sound intimidating at first, especially when you hear about formulas and math involved. But understanding the numbers is what separates successful investors from the rest. Let’s simplify some of the key metrics that can help you make smarter decisions when evaluating a property.

The Importance of Real Estate Math

When you invest in real estate, you’re not just buying a property; you’re buying income potential, future growth, and financial stability. To ensure you’re making the right choice, it’s crucial to understand how the numbers work. Here are the main calculations every investor should know:

Key Real Estate Formulas

1. Cash Flow

Formula:

CashFlow=TotalIncome−TotalExpenses

Cash flow shows you how much money you’ll have left after paying all your expenses, including mortgage payments, taxes, insurance, property management fees, and maintenance. Positive cash flow means your property is earning you money each month, while negative cash flow means it’s costing you.

Example: Let’s say you purchase a rental property with a monthly rent of $2,000. Your monthly expenses include:

- Mortgage: $1,200

- Taxes: $200

- Insurance: $100

- Maintenance and Property Management: $150

Total Expenses: $1,650 Cash Flow: $2,000 - $1,650 = $350/month

This positive cash flow means you’re earning $350 each month after covering expenses.

2. Cap Rate (Capitalization Rate)

Formula:

CapRate=(NetOperatingIncome/PurchasePrice)×100

The cap rate is a quick way to assess a property’s potential return. A higher cap rate usually indicates a better return on your investment, but it’s essential to compare it to market averages for similar properties.

Example: Imagine you buy a property for $300,000 that generates $30,000 in annual income after expenses.

CapRate=(30,000/300,000)×100=10%

A 10% cap rate suggests a strong return, depending on your market.

3. Cash-on-Cash Return

Formula:

Cash−on−CashReturn=(AnnualCashFlow/TotalCashInvested)×100

This metric focuses on how much return you’re making based on the actual cash you’ve invested. It’s especially useful for evaluating leveraged investments where you’ve used financing to purchase the property.

Example: You buy a property for $300,000 with a $60,000 down payment. Your annual cash flow is $4,200.

Cash-on-Cash Return = (4,200 / 60,000) × 100 = 7%

This means you’re earning a 7% return on your invested cash.

4. Gross Rent Multiplier (GRM)

Formula:

GRM=PropertyPrice/GrossAnnualRentalIncome

GRM helps you quickly compare properties without diving into detailed expenses. A lower GRM indicates that the property may be a better deal, but it's not as comprehensive as other metrics.

Example: A property priced at $250,000 generates $25,000 in annual rent.

GRM=250,000/25,000=10

A GRM of 10 suggests it would take 10 years of rental income to pay off the property's price (ignoring expenses).

5. Debt Service Coverage Ratio (DSCR)

Formula:

DSCR=NetOperatingIncome/TotalDebtService

Lenders use this ratio to determine whether a property's income can cover its debt payments. A DSCR greater than 1 means the property's income exceeds its debt obligations, which is a good sign for both investors and lenders.

Tools to Simplify the Math

You don’t need to be a math wizard to calculate these metrics. Tools like Cashflow Analyzer Pro with Deal Instant Analyzer can save you time and provide accurate insights. With automated calculations and visual breakdowns, you can focus on finding the right investment instead of crunching numbers.

Why These Metrics Matter

Real estate investing is all about reducing risk and maximizing returns. By understanding these formulas, you can:

- Avoid properties with poor cash flow.

- Spot hidden opportunities with good cap rates or GRMs.

- Ensure your investment aligns with your financial goals.

- Gain confidence in your decision-making process.

Final Thoughts

Learning the math behind real estate investing isn’t as scary as it seems. These formulas are your tools for success, helping you evaluate properties objectively and make informed decisions. Whether you’re just starting or looking to refine your strategy, understanding these numbers will set you apart from the crowd.

At Asset AFC we are here to make your journey easier. Ready to start running the numbers? Let’s make your next investment your best one!

Post: Tips and Tricks for Real Estate Success: Why Deep Analysis is the Key to Wealth

Post: Tips and Tricks for Real Estate Success: Why Deep Analysis is the Key to Wealth

- Posts 16

- Votes 6

Investing in real estate is a powerful way to grow your wealth, but analyzing a property carefully before buying is crucial. Success in real estate comes from running the numbers and taking a closer look at every detail. Proper analysis helps you make informed decisions, reduce risks, and maximize returns. Whether you're new or experienced, these tips will guide you on what to consider in a potential investment.

1. It’s Not Just About Cash Flow: The Bigger Picture Matters

Many investors focus only on cash flow—the money left after paying expenses like mortgage, taxes, and maintenance. But to really understand your investment, you need to go deeper. Consider factors like vacancies, rent changes, unexpected repairs, and future costs. The more detailed your analysis, the better you can predict your cash flow and handle surprises.

Quick Insight: Even a small change in vacancy rates can significantly impact your cash flow. Planning for these changes helps you stay ahead.

2. Breaking Down ROI: Where Your Money Works Best

ROI (Return on Investment) is often viewed as a single number, but a deeper breakdown can unlock hidden opportunities. Breaking it down into parts like cash flow, appreciation, debt paydown, tax savings, and forced appreciation from renovations can reveal what's really driving your returns. This helps you see what's working well and what needs attention.

Simple Example: Renovations can give your ROI a big boost in the first year, but it won't happen every year. Evaluating ROI over multiple years shows you what's sustainable and what's just a temporary spike.

3. Understanding Market Trends: Beyond Price Tags

Looking at average property prices isn’t enough. You need to dig deeper into the local market—check out job growth, new projects, and rental demand. This information gives you a clearer picture of where the market is heading and helps you make smarter buying decisions.

Tip: Areas with growing job markets often see higher rent and property values, making them great spots for investment.

4. Choosing the Right Financing: More Than Just Rates

Financing is not just about getting a loan; it’s about finding the right loan that works best for you. Options like interest-only loans, HELOCs, and short-term loans can affect your cash flow and profits differently. Understanding these options lets you leverage your financing to boost your returns.

Pro Tip: If you’re planning to buy, renovate, and refinance, consider short-term loans for easier refinancing. Always understand the terms and penalties before committing.

5. Planning for Different Scenarios: Be Ready for Anything

Market conditions can change, and planning for different scenarios helps you prepare. Test how changes in rent, expenses, or interest rates could impact your investment. Don’t just assume everything will stay the same—running “what if” scenarios can protect your returns.

Why It Matters: A small rise in interest rates can impact your ROI. Running different scenarios helps you see the risks and opportunities clearly.

6. Use Analysis Tools: Make Your Life Easier

Using tools like Cashflow Analyzer Pro with Deal Instant Analyzer from Asset AFC can simplify your analysis. These tools help break down all the details of your investment, test different financing options, and keep track of changes in rent and property values in real-time.

Why It’s Great: These tools allow you to adjust your strategy on the go, making it easier to stay on top of market changes and make smart decisions.

7. Real-Time Tracking: Stay Ahead

Markets change, and so should your investment strategy. Real-time tracking of property values, rental income, and interest rates helps you adapt quickly. This proactive approach ensures you’re not just reacting to changes but capitalizing on them.

Key Point: Reacting late can cost you money, but tracking in real-time keeps you ahead of the game.

Conclusion: Why Deep Analysis Pays Off

Building wealth in real estate isn’t just about buying properties—it’s about buying smart. Deep analysis helps you make informed decisions, avoid costly mistakes, and maximize your returns. Use tools, plan for different scenarios, and always dig deeper than the surface numbers. Invest wisely, stay informed, and let your analysis be your guide to real estate success.

Explore more resources and tools on our homepage to help you maximize your real estate investments.