Creative Real Estate Financing

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated 6 days ago on . Most recent reply

HELOC Advise for Debt Consolidation

Hello All - We recently decided to apply for a HELOC on our primary home to pay off all revolving debt, etc.. We found a lender here on BP forum and applied.

Initially , based upon the data we provided, we thought we were looking at close to 7.5% to 7.75% rate but after submitting all the required info we've jumped up to 8.625%. My wife and I pulled FICO 8 scores yesterday before applying (850 for her and 830 for me). The lender said we're at 749 for their needs. Here's a snapshot of what they provided:

(I'm the top one and my wife is the bottom.)....Keep it clean....LOL

They said our LTV is "just under 70%". We owe right at $520k and their "electronic" appraisal came in at $911,217. (I calculate that at about 68.75%)

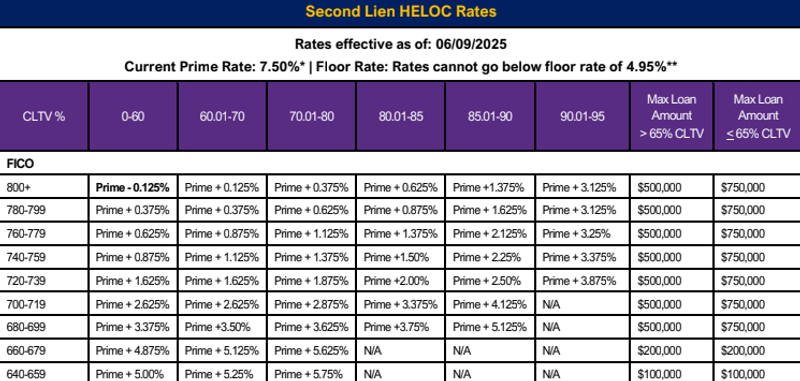

Based upon the chart they provided (below) it puts us at prime + 1.125% (Which is the 8.625% they're quoting)

Here's my issue with all of this....

1. With our FICO 8 scores so much higher, WHY are the scores they pulled so much lower? Is it a way for them to "manipulate" their rate? WHICH FICO score are they pulling that is SOO much lower?

Here's what the lender said:

They use a matrix of FICO and LTV for rates.

As for FICO, all lenders take the middle score, and for 2 borrowers, the lower one.

My question to you all is....Are there better rates out there right now for same scenarios?

Or are we getting a "fair" deal right now based upon the variables provided? (For example, BofA offered 8.75% with ZERO closing costs and 6 months at 6.75%. One of our credit unions offered 7.875% without closing costs.)

We just don't want to pull the trigger on something that doesn't make sense and after a 1-5/8 point increase I'm not sure we're making the right decision.

As always, thank you all for your help!

Most Popular Reply

Lenders are not using Fico 8. A mortgage pull is going to calculate a different score. Also, is it really wise to tie up consumer debt into your primary residence? I look at my primary as a savings account, not a piggy bank. The smartest move is to cut spending / downgrade lifestyle and paydown down the debt, not tie the debt into your biggest asset, your home. Just my 2 cents.

- Matthew Crivelli

- [email protected]

- 413-348-8346