The Debt Snowball Plan - A Path to Free & Clear Real Estate

This is part 2 in my series about 3 Paths to Free & Clear Real Estate.

If you’re just joining me and need to catch up, I write about using real estate to help you reach a destination of financial independence.

A simple goal of free & clear (no debt) real estate is a measurable and powerful goal that helps you achieve financial independence.

Your free & clear goal might be, for example, to own 10 houses that together rent for $12,000 per month ($1,200 per house) and net $7,000 per month after expenses.

In other words you put $84,000 per year in your pocket.

So, this series of articles gives you three general paths that may help you climb the mountain towards your free & clear goal.

- The All Cash Plan

- The Snowball Plan

- The Buy 3-Sell 2 Plan

This article will explain #2 – The Snowball Plan.

The Snowball Plan

Like plan #1, the second plan is also safe and steady, but it differs by introducing some debt. This addition of debt allows you to pay higher prices and buy higher-quality properties than with the All Cash Plan.

The Snowball Plan basically works like this:

- Save cash for down payments

- Purchase several income properties using conservative, low-interest loans.

- Save 100% of the real estate income plus extra savings from a job.

- Use all savings to apply towards one of the loans each month until one loan is paid early.

- Use all savings + new free & clear income to apply towards another loan until paid early.

- Repeat until all loans are paid off.

A Snowball Plan Example

Let’s say you want to end up with 3 properties free & clear. You could do more of course, but this will keep my example simple.

You decide to buy easy-to-manage single family houses. Your target properties might be 3 bedroom, 2 bath homes with a garage, in a solid neighborhood in a good school district.

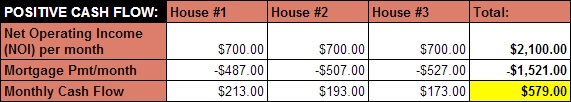

Let’s say each house rents for $1,200. After subtracting $500 in operating expenses, which does not include your mortgage payment, you would net $700 per month.

Since you have good credit, at today’s rates (in 2014) you plan to put 20% down and get a 4.5%, 30-year mortgage.

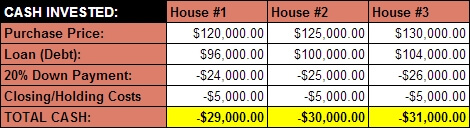

You work hard for a few months, and you buy three investment properties. Here are the numbers:

So, to purchase these three houses, you needed $90,000 cash plus good credit.

Here is what your positive cash flow would look like once you get all three properties rented:

As you can see, your rentals produce $579 per month in positive cash flow. I also assume you would save an extra $500 per month from a job or other income source.

In this plan, the main point is to snowball your mortgages (i.e. pay them off faster and faster over time) by eliminating one mortgage as quickly as possible, and then the next, and the next.

To do this snowball, you use every bit of the positive cash flow and extra savings to make an extra-large monthly payment on one mortgage.

Here is what that would look like in this case:

$579 … positive cash flow from rentals

$500 … extra savings from job

$487 … regular mortgage payment (Loan for House #1)

$1,566 per month = extra-large mortgage payment

This massive extra payment begins the snowball. Each time a mortgage is paid off, the additional savings are then added to the next loan. So the snowball gets bigger and bigger.

How fast does it accumulate in this case?

Mortgage #1 = free & clear in 70 months

Mortgage #2 = free & clear in another 48 months

Mortgage #3 = free & clear in another 35 months

So in a total of 12.75 years or 153 months, you have your 3 properties free and clear. This means all $2,100 of net operating income from the rentals goes into your pocket.

You have essentially started with a $90,000 investment, added $500/month for 153 months, and ended up with $2,100 per month for life.

Not bad! And if $2,100 per month is not enough, you can buy more properties in the beginning or buy more properties at the end using your extra cash flow.

Benefits of the Snowball Plan

No plan is perfect. But, I think you’ll find that The Snowball Plan has several big benefits.

Benefit #1 – Control:

Success does not depend upon inflation, luck, speculation, or a Wall Street expert.

What does it depend upon?

- Buying good properties, up front.

- Financing with a good loan, up front.

- Remaining a disciplined saver for 13 years.

These can be done with a little education, focus, and soul-searching.

Most real estate investors I know like this idea of having more control. They like that success depends upon their own efforts, not someone they don’t even know on Wall Street.

Benefit #2 – Visible, Measurable, and Steady Progress:

The progress you make in the Snowball Plan is visible, measurable, and steady.

You can literally track your progress month by month as you payoff your mortgages. Each chunk that is taken out of your mortgage is one step closer to your end goal.

The psychological benefit of this visible progress is HUGE.

Personal finance teacher Dave Ramsey often says that success with money is 80% behavior and only 20% math.

In other words, we are not robots, no matter how rational and intelligent we think we are. Visible and measurable progress gives us a little reward that reminds us “You’re on your way. Keep going!”

While rising stock prices can also give us visible and measurable feedback, they often roller-coaster up or down and terrify even the most self-disciplined of us.

Instead, progress with the Snowball Plan is steady and gets better and better over time.

Benefit #3 – Flexibility:

Real life is unpredictable, and our plans should be flexible to reflect that reality.

The Snowball Plan can be slowed or stopped as needed.

If you hit a major job crisis that cuts your extra savings, you can temporarily hold off on the full Snowball until you get back on your feet. You will actually continue making progress, just a little slower.

You are also flexible to decide how many or how few properties you want in the end. A bigger portfolio of free and clear properties will require more cash and more time invested, but you’ll have a bigger cash flow in the end.

Final Comments

My hope with giving you a plan like this is not to tell you exactly how it will happen in your life.

Former president and general Dwight Eisenhower famously said “In preparing for battle I have always found that plans are useless, but planning is indispensable.”

That is the idea here.

My plan will be useless if you think the details will happen exactly like I’ve written them here. But it may be very helpful if it gets you planning and thinking and moving forward.

So as I often do, I want to end my words with a challenge to you.

- Is the Snowball Plan something you’d like to implement?

- If so, what is the next step?

- When will you get started? (Now is a good answer:)

In the next article, I’ll give you the third and final free and clear plan, Buy 3-Sell-2.

Until then.

Enthusiastically,

Comments (22)

Hey Joseph,

Yeah, the plan would definitely be affected by prepayment penalties. I think the assumption in this example is that the loans were traditional, residential, mortgage loans. Most of these do not have prepayment penalties.

But you make a good point for anyone applying this with commercial or other loans. Definitely want to look at the terms and make sure you won't be paying penalties for an early payoff.

Thanks for the comment!

Chad

Chad Carson, almost 9 years ago

Hello Chad,

How would this work in regards to prepayment penalties? Some loans can require a hefty fee if paid off or refinanced earlier than thought and the bank no longer recieves interest as long as they thought. I'm not sure if this is just local to me but I would include to make sure to find loans that would not prohibit this plan. Just a thought you are more experienced than me thanks for the great read.

Joseph Rego, almost 9 years ago

Sadly this isn't an article I can send to myself. This is great stuff and I'm so grateful for all the intelligent people out in the world who share their experience freely!

Ben Wendt, about 9 years ago

Thanks Ben. Glad this was helpful for you. Happy to share.

I think you can just copy the link and paste it in an email. But I guess it's easier to share from the regular BP blog.

Best of luck in your investing!

Chad Carson, about 9 years ago

Cal Ray, over 9 years ago

Chad Carson, over 10 years ago

Hi Chad, I really appreciate all the articles you right. Very clear concise and chalk full of valuable information.

At 50, I think another important facet to consider when tackling an investment strategy is the time frame you have.

You are a very skilled teacher.

Thanks for sharing.

Liz Blazina

Elizabeth Blazina, over 10 years ago

I guess I do not get the math. Probably it is something I am misunderstanding about amortization. Please follow my thoughts and tell me what I am missing.

If I have $200k in debt, I pay interest on that debt no matter what. It does not matter if it is two loans or three. If I pay one of three off, it just means that I have not been paying off the other two. The others will have more interest and less principal in each payment. Also, it seems riskier because I have to be more disciplined about paying down the other loans. If we are talking about creating equity over time, it should not matter what loan that equity is in.

To that end @Matthew Weiser makes a good point about a 15 year mortgage. Not that it would be better to pay faster but it would be better to have a better interest rate if you are planning to fast pay anyhow.

Also, if you really are finding cashflow properties, it would make more sense to use your cashflow to buy more cashflow properties and increase your leverage faster. It is not conservative but with cashflow properties it is not that risky either.

The only scenario this philosophy works in is if you are stuck using conventional financing and have used up your allowable loans and you cannot trade up with a 1031 or create a bundled loan. This seems to be what @Bryan N. is getting at.

Or if you have poor DTI ratios and really need to show more income. I think this might be @Chad Carson 's scenario? However, these cashflow levels should not hurt your DTI much if you have an existing income.

Will R., over 10 years ago

Hi @Will R. Thanks for the detailed response/question. I think Kevin did a good job of explaining my take on the benefit of the snowball in terms of getting to a certain goal in a certain period of time.

I think something else not talked about often when people compare this approach to others that maybe have better math (ex: buying more properties, using more leverage) is the risk.

I look at this whole scenario like I'm climbing Mt. Everest. It's serious business. You could get caught in unexpected snow storms, fall in crevasses, or any number of fatal problems. Real life is not just math - it's managing the unpredictable.

So what this kind of plan does is give us a plateau or a home base to shoot for on up the mountain. We push hard, it's fairly predictable, and we get there, pitch our tent and rest. That resting place has to do with CASH FLOW. Free and clear cash flow. Something we can use to eat. All of those paper profits can disappear or get stuck an inaccessible.

So we surely have to consider all factors, like the most profitable and rationale approach, but even if the snowball plan's math was not theoretically as good as another, I would choose it anyway because it's a great plan to balance growth with risk and survival.

The rich investors still standing in the end follow Warren Buffett's advice of not losing money. The snowball is a way follow Buffett's advice.

Chad Carson, over 10 years ago

So I didn't write this article but I do understand the math. If you want to be more aggressive or leveraged that is a possibility, but the point of this article was to show how to buy any number of properties, and to own them free and clear as quickly as possible.

so if you pay off the first loan as fast a possible using the extra CF from all 3 properties you are paying significantly less interest and will be done paying it off quickly. This frees up the money you were putting toward the mortgage on the first home to start paying down the second mortgage you want to attack, which at this point has already been paid down quite a bit by just making the minimum payment every month. Then rinse and repeat no matter how many properties you are trying to pay off until you own all of them free and clear. You end up paying much less interest on the loans in the long run compared to just paying them all "morgatage only" every month.

Hopefully that helps.

Kevin Harrison, over 10 years ago

Thanks for the post it is very insightful. I think the snow ball plan can be effective; it is teaching investors a way to manage leverage. If someone also supplementing their income with fix and flips or another source of income they could purchase more properties in the beginning or as they go and apply this plan on a greater scale.

Patrick Camuso, over 11 years ago

Chad Carson, over 11 years ago

Hi Chad, I really enjoy your posts. Is this plan better than getting 15 year mortgages on the properties?

Thank you.

Matthew Weiser, over 11 years ago

Hey @Matthew Weiser . Great question!

This plan works best with longer-term, lower-payment mortgages because it allows you to decide where your extra cash flow will be allocated, which allows you to make faster progress on one mortgage at a time.

With 15-year mortgages, you dilute your attack on the debt because you spread your cash flow over several mortgages instead of one.

Chad Carson, over 11 years ago

Great post..Thanks for this article,Chad.

Tussant Wright, over 11 years ago

thank you for reading, Tussant!

Chad Carson, over 11 years ago

There are many ways to do the snowball plan and honestly for conservative investors it's smart. Of course, you need to determine how many properties you need to equal a predetermined cash flow after all debt service is paid off. Another, potential pitfall is debt to income, but creative financing or paying off a property in the middle of your plan can overcome some of those obstacles. Leverage is very important to get started and acquiring properties as Pete T. Is suggesting and is smart as long as you have reserves in place for "rainy days". Overall, however you employ the snowball plan I believe it's one of the smartest ways to approach a real estate portfolio for the long haul. My personal goal is 10 $1K per month minimum properties. Then snowball quickly. Of course, lending rules may change that plan down the road.

Bryan N., over 11 years ago

@Bryan Neal Thanks for the comment! I like your perspective on the snowball. I agree, it's a smart plan for most conservative investors.

With your goal, will you have 10 x $1,000 gross income/rental? Or is that $1,000 total net cash flow for all 10 rentals?

Yes, good leverage is the key. I have used primarily creative financing because of my personal situation when I started (self/un-employed:), but for people with W-2 income and good credit, go for the conventional loans while you can.

Chad Carson, over 11 years ago

Great post Chad.

It would be nice if in the future you also provide some numerical examples with not-so-rosy cashflow numbers. For example, I live in an area where a $120K property might yield $800 in rent. While interest rates are lower, I'd still be looking at breaking even at best, which does not bode well for the "snowball effect" except for putting in cash from elsewhere.

Anyhow, just a suggestion that it'd be nice to see alternative examples of lower return numbers as well.

Tyler Cruz, over 11 years ago

Chad Carson, over 11 years ago

Why would you wait and save up 90k when you could be looking for deals to do immediately? Even if you had to put that amount down, wouldnt it make more sense to buy one with the first 30k- get it going and start looking while you save up the next 30k? You are paying off debt sooner and cash flowing earlier.

Pete T., over 11 years ago

@Pete T. Thanks for comment.

You don't need to wait for $90,000 to be saved up to start the plan. By all means by house #1. I explained it that way for simplicity of example. The main point is you'll load up early, either all at once or over a year or two, and then let it ride and snowball for the rest of the time. The more cash you have saved earlier on, the faster you'll get there.

Chad Carson, over 11 years ago