Buying & Selling Real Estate

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated about 1 month ago on . Most recent reply

- Investor

- San Antonio, Dallas

- 553

- Votes |

- 973

- Posts

Flood Of Pre-Foreclosures Coming - Is It Good or Is It Bad?

Well, it's not good.

Plus Side

1. It will add to the the available inventory

2. Can't think of a second plus

Negative Side

1. A property in pre-foreclosure has unpaid arrears. You have to bring the arrears current, if you buy before the Auction

2. Any liens go with the property, including unpaid property taxes and unpaid HOA fees

3. Houses in pre-foreclosure are rarely in good shape and usually require rehab

4. Usually you end up having to evict the seller

5. If you target pre-foreclosures in some areas, it's illegal with hefty fines

6. Margins are usually pretty tight dealing with pre-foreclosures, Not much equity

7. If you buy pre-foreclosures, in some locations the seller later can claim you cheated them and sue you

8. If the house was used for drugs, expect unwanted visitors seeking to buy drugs for the next couple of years

9. If you want to flip the property, consider the "seasoning" required

10. It will push market prices down and that's not good if you are trying to sell

11. An abundance of Pre-foreclosures in an area causes insurance costs to go up and property values to go down

12. It's always eventful, but not always in a welcome way

Most Popular Reply

- Investor

- San Antonio, Dallas

- 553

- Votes |

- 973

- Posts

Sure.

First you have to believe the previous administration wasn't forthcoming. That's something I wholeheartedly believe. They had a lot of reasons to hide the fragility of the housing market, called "wanting to get re-elected".

Second, I just bought a property that went through 3 loan mods in 3 years. That is something I haven't seen in 30 years of buying pre-foreclosures.

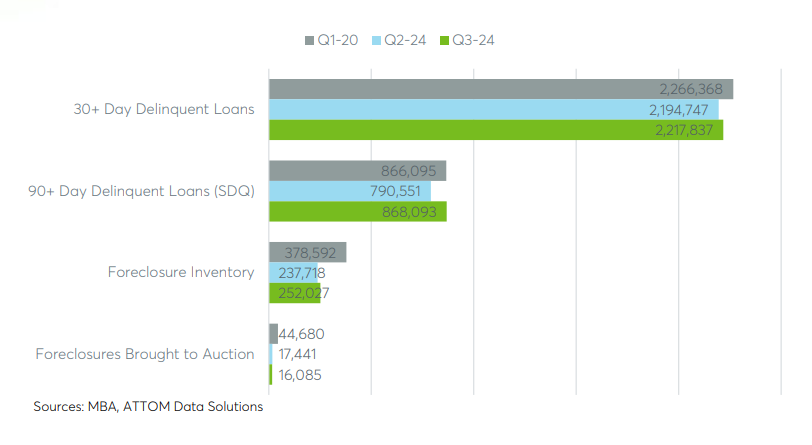

Third, you kinda have to understand the pre-foreclosure process to get this one 30, 60, 90 day delinquents are on the rise

Many are avoiding foreclosure thanks to ample home equity that allows them to sell through a pre-foreclosure sale,” said Ali Haralson, Auction.com President. “These homeowners can now leverage the power of Auction.com’s transparent marketplace to sell, furthering our mission of protecting homeowner equity.”

I'll post more as the information becomes available