Listed SS is abandoned - good or bad?

Came across a listed SS (on the market for months already with asking price gradually dropping from 160 to 125).

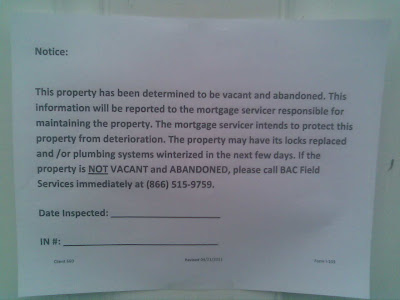

Drove by it and discovered that the property is vacant:

The property does not look so bad. Kind of jungle in the back, but not so bad in the front:

The TH was purchased back in 07 for 220k, 100% financing. Current lender - BOA (just purchased the loan in September, 3 weeks ago).

If in good condition inside, worth about 115-120 (currently listed at 125).

I didn't contact my agent to look at it yet, just doing preliminary DD.

* Vacant - is it good or bad for the buyer; would the bank be more inclined to sell faster?

* BOA - I understand they're tough to get a discount from ? When they purchased the loan, the property was listed as a SS already.

* Are my chances slim to none to get it for 105k?

Would like to buy and hold for good - decent area with rents in 1300-1400.

Any feedback is appreciated.

Sounds like it was foreclosed on if the bank is the record owner. So, it could now be an reo but not yet listed. Is the SS still "active"?

it's a MLS-listed Short sale. Not a foreclosure

BOA holds paper

I've never seen that "abandoned" notice but I did go to one vacant short sale where personal mementos and clothes were thrown all over the place, and the back door was wide open.

I think it is good news for you as a buyer, if you are interested. I had one short sale I made an offer on that was vacant and in poor condition inside and the listing agent told my agent that the bank was aware of the condition and "ready to liquidate".

Does the listing say if the short sale price is Approved, or if a negotiator has been assigned? In that case you may have more bargaining power.

Actually, aren't those numbers kind of mediocre? If it rents for $1350 a month wouldn't you need to get it for around 75K to meet the 50% rule? (I don't know the Baltimore market though--is this the lowest price range you can get without going into the slums?)

Originally posted by Bienes Raices:

Actually, aren't those numbers kind of mediocre? If it rents for $1350 a month wouldn't you need to get it for around 75K to meet the 50% rule? (I don't know the Baltimore market though--is this the lowest price range you can get without going into the slums?)

This one is in the County, no slums here ;)

George, those 50% rules don't work too well around here do they? I'd contact LA and see what's going on with it and maybe thrown in a low offer. I've bought shorts vacant, tenant occupied and owner occupied.

George, those 50% rules don't work too well around here do they? I'd contact LA and see what's going on with it and maybe thrown in a low offer. I've bought shorts vacant, tenant occupied and owner occupied.

Originally posted by Cheryl C.:

George, those 50% rules don't work too well around here do they? I'd contact LA and see what's going on with it and maybe thrown in a low offer. I've bought shorts vacant, tenant occupied and owner occupied.

It can be hard in my area too...

I wonder if the townhouse has monthly fees that could cut into the cash flow, and to what extent those fees cover maintenance of the exterior...

On the plus side, since it's an end unit, maybe it would be easier to rent?

Originally posted by Bienes Raices:Originally posted by Cheryl C.:

George, those 50% rules don't work too well around here do they? I'd contact LA and see what's going on with it and maybe thrown in a low offer. I've bought shorts vacant, tenant occupied and owner occupied.It can be hard in my area too...

I wonder if the townhouse has monthly fees that could cut into the cash flow, and to what extent those fees cover maintenance of the exterior...

On the plus side, since it's an end unit, maybe it would be easier to rent?

HOA is $35/mo - all the exterior is at the owner's expence. HOA only pays for common ground grass maintenance.

Actually abandoned properties pose a higher risk for the lender so they will generally change the locks on the doors and may choose to expedite the foreclosure process.

I would ask the LA the following questions:

1. Are the owners cooperative and are you in contact with them?

2. have you been in contract with BOA or submitted any previous offers?

3. Are HOA dues current?

4. Are there property taxes up to date?

5. are the utilities on?

These are all important questions because you need cooperative sellers and you need them paying HOA, taxes, and keeping their utilities on.

Good luck!

Originally posted by Bienes Raices:

Actually, aren't those numbers kind of mediocre? If it rents for $1350 a month wouldn't you need to get it for around 75K to meet the 50% rule? (I don't know the Baltimore market though--is this the lowest price range you can get without going into the slums?)

One quick note, I believe you're referencing the 2% rule, not the 50%...

The "50% rule" is simply that you can expect 50% of rent to go towards expenses...

The 2% rule says to target properties where you can get monthly rent equal to 2% of the purchase price. This is to try to achieve $100 a door in cash flow (after the 50% rule).

If a bank has tried to reach the owners for negotiation on the default (per federal ruling) and they are getting no response, or they have been specifically told by the owners that they have abandoned the property, the bank will post a notice stating the abandonment.

This is pre-foreclosure, they are just doing it to cover themselves legally on any possessions left inside. Also, they try to be pro-active about minor maintenance to avoid code violations from cities.

So, this is a pre-foreclosure posting.