Multi-Family and Apartment Investing

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated 10 days ago on . Most recent reply

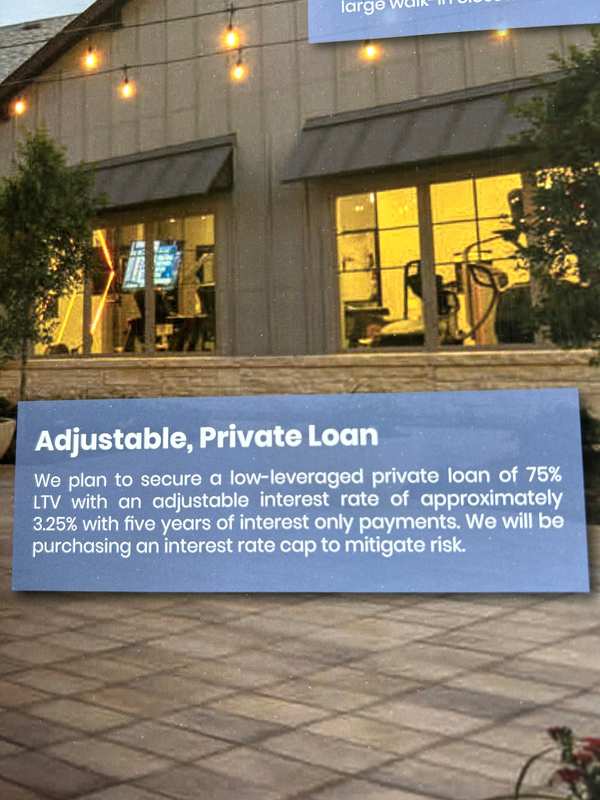

Rate cap risk in a syndication deal

I just recently had all my equity wiped out in a passive investment multifamily deal with a reputable operator due to my ignorance of what a rate cap actually is. So to pay it forward I am letting the other passive investors know that when you see the General Partners are paying for a rate cap, inquire about the terms. I didn’t know that rate caps could be as short as 6 months. Granted the costs jumped in 2022 as well, but it can be misleading the way the marketing pieces are presented as you can see from the picture so ask questions.

Most Popular Reply

- Cincinnati, OH

- 3,599

- Votes |

- 3,920

- Posts

As noted, there is a lot that is deceiving in many investor decks.

I have seen deals presented as Atlanta market, that are a solid 90 minute dive from Atlanta.

"Low-leverage", but in reality it is 75% LTV and then some pref equity on top of that (and ahead of the equity the deck is for)

One of my favorites are the co-GPs that have no involvement in deals (besides bringing equity and forwarding emails) touting track records and presenting deals like they own any of it

Class B neighborhoods that are the highest crime areas of the city.

Value-add plans that project rents growing to, say, $1500/mo in an area with $30k/yr avg household incomes

And most specific to this post:

In-the-money interest rate caps being touted as actual cash flow

DSCR Projections that don't take into account any rate cap replacement reserves

Touting floating rate loans as "FIXED FOR THREE YEARS", etc.