General Real Estate Investing

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated over 5 years ago on . Most recent reply

Top growing cities/metro areas in last 4 years

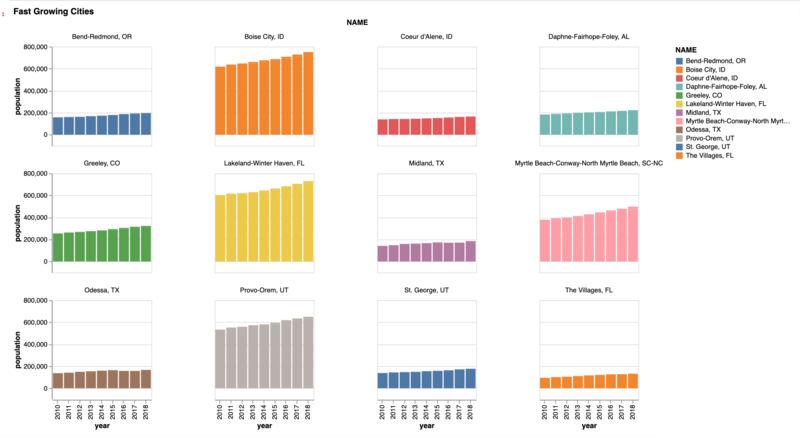

Was looking at some data on cities growth by population and have a set of top 12 cities/metro area. Would love to hear from the community as to which area they would pick for rental property investment.

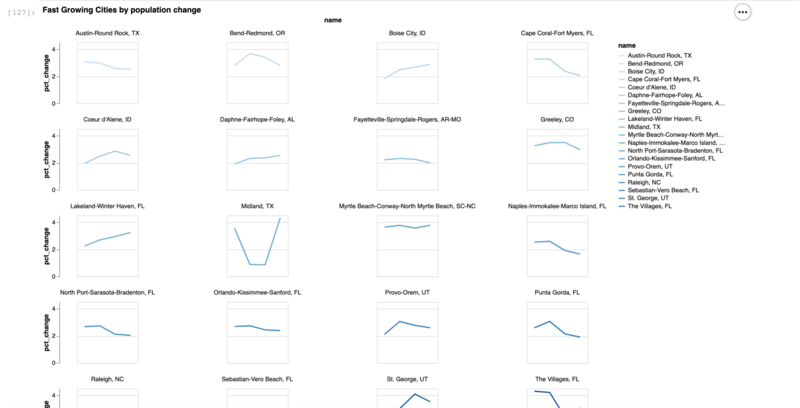

And instead of population growth if you just look at the percentage change in population you get a different set of cities but some cities are common and probably of interest to me.

Looks like Boise City, ID, Daphne-Fairhope-Foley, AL, Midland TX, Provo-Orem, UT seems good on both metrics #datadriveninsights. Would love to hear from real estate investors in those areas as to what they think about that market and any pros/cons.

Next steps I am going to dig more into employment, wages, rental vacancy and other things for the same market. Let me know which of the topic is of most interest. I will analyze that first.

Most Popular Reply

@Shrikar A. I’d stay away from Midland and Odessa, TX unless you really know the area and are really able to keep a pulse on the economy. That market lives and dies on Oil & Gas and that industry is pretty uncertain at the moment. My day job serves the O&G industry and the Permian region (includes Midland and Odessa) are important areas for us. Only experience I have in real estate in that area is we have a corporate apartment there and have to watch the swings in rent rates.

Definitely not saying there’s not money to be made but I would expect it to be a roller coaster ride.