Updated 5 months ago on .

- Real Estate Broker

- Cape Coral, FL

- 1,312

- Votes |

- 2,073

- Posts

Inventory Storm In SWFL

As we move into the summer of 2025, we want to bring you up to speed with key market changes affecting your rental investments in Cape Coral, Fort Myers, Lehigh Acres, and the greater SWFL region.

Over the past two years, I have sent several market updates expressing my concerns with the rising inventory of properties for sale and the rise of rental inventory levels. Unfortunately, I do not have positive news on either front. There has been a dramatic spike in rental inventory throughout Lee County but specifically Cape Coral, Ft Myers, and Lehigh. The data provided includes STRs (short-term rentals) which means that the total number is not correct and if you were to do the math, the percentage of increased rentals would not be correct.

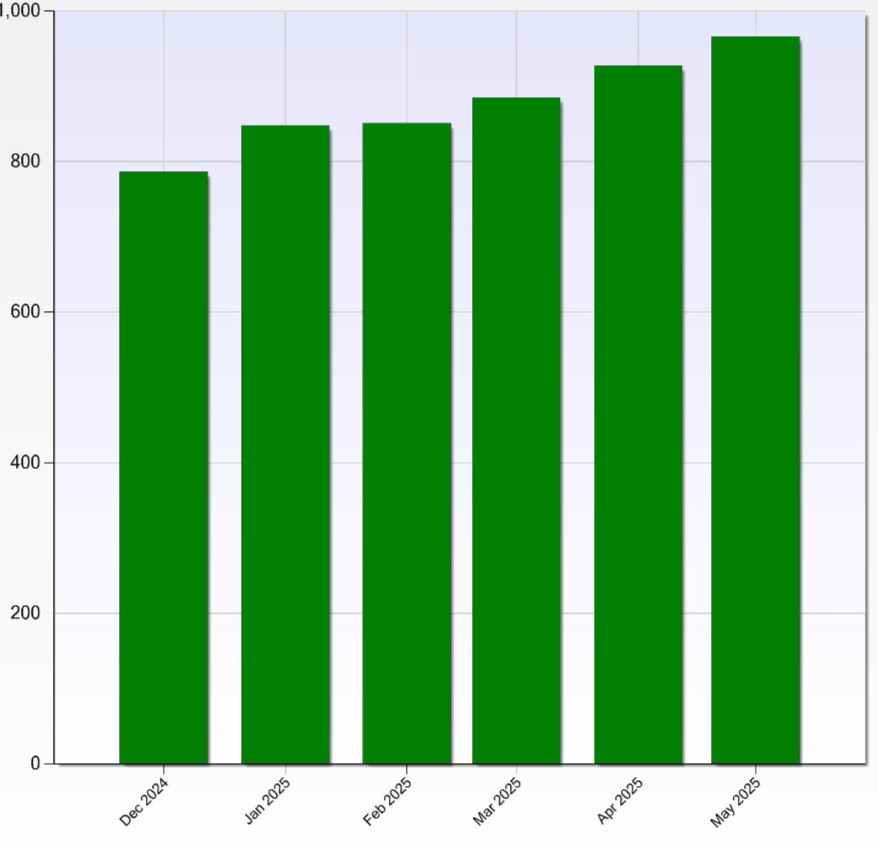

If you look at the 3 graphs - Cape Coral, Ft Myers, and Lehigh - you will see that inventory has increased dramatically since December, with consistent growth month over month. The charts show that from December until now there has been inventory growth from 20% - 25%. I can tell you that these are low compared to the actual numbers which are closer to 30% - 40% for annual rentals. As most of you are aware this creates a lot of concerns for your rentals/portfolios and also for us as property managers. A simple "supply and demand" theory states, that when inventory rises, prices decrease (unless demand also increases at the same rate). Demand is only increasing by 2% - 5%, not 30% - 40%.

Reasons for increased inventory

There are many contributing factors to the increased inventory - overbuilding, immigration laws, houses not selling, STRs not renting, and high interest rates to name a few. There are still HUNDREDS if not THOUSANDS of unfinished homes/units still in the building phase. All of this inventory has yet to come to market. The lack of sales is creating desperate sellers who are pivoting into annual rentals. Our number one customers right now are owners who cannot sell their properties for the price that they want, and they are transitioning them into annual rentals. As employees have returned to the office, inflation has gone up, and saving accounts have depleted so has the market for STRs. We have converted about 30 in the past 2 years and in the past week, I have personally spoken with 5 STR owners that want to transition into annual rentals.

Weathering the Storm

We are a property management team that is dedicated to giving you a better product, better service, and a better experience than any other company, in good times and bad times. We are not sitting idly by waiting for the storm to pass.

We are:

- Increasing marketing - better photos, descriptions, and we have even bought a drone and have been taking drone photography and video

- We have partnered with local assistance programs to help find tenants who are on assistance - getting them flyers, talking with their local specialists, and marketing on their website

- We are lowering tenant rents when their rent is above market rent

- We are fixing more maintenance concerns in a timelier manner

- We are trying to increase our tenants' experiences

- We ensure that every vacant property has a sign

The vacancy rate throughout Lee County is currently 15.4%. We are proud to say that our portfolio of properties has a vacancy rate of 8.3% (our goal is to be below 5% at all times). Despite us lowering rents during tenant renewals, drastically lowering rents after turnover, and our unit count staying the same, for the month of May we had our third highest revenue collection period. We are weathering the storm while continuing to row in the right direction.

Sales

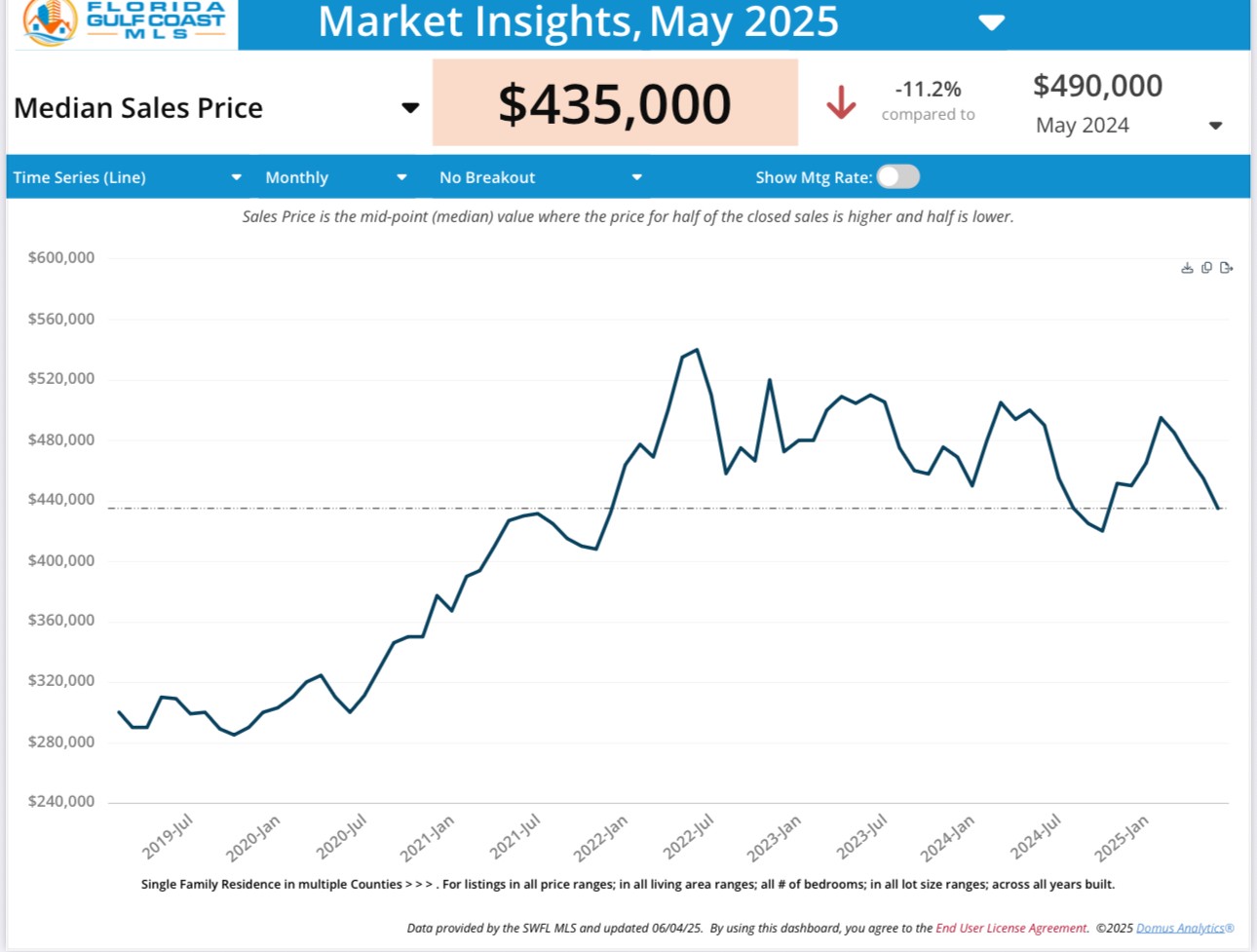

You will see from the sales chart below that we are on a steep decline in median sales price. On May 31, 2025, the median sales price of $435,000 matches the median sales price from 11/30/2021. Our slowest time of the year, and the time when prices are the lowest are from Sept - Dec. Meaning that we are going to continue to see a decline in sales prices for the next several months. During this time, I am projecting that we will have a median sales price of $370,000 - $410,000. This will put us back to pricing that we haven't seen since late 2020. It is a great time to buy and will continue to be a great time to buy for at least another 6 - 12 months. There are too many high-level policies and politics in play to say if the decline will continue, stabilize, or get worse. Footnote, this data is for SFHs not multifamily but from what I can see, multifamily is following this trend.

The storm is not over, and it is going to get worse. Rents are going to continue to drop, vacancies are going to increase, the timelines to fill units are going to increase, and expenses are going to rise. But, it will get better, and we will continue our dedication to giving you a better product, better service, and a better experience than any other company, in good times and bad times.

Adam Bartomeo / Broker

Bartomeo Property Management

Property Management Services - Bartomeo Realty

- Adam Bartomeo

- [email protected]

- 239-339-3969