Classifieds

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated almost 10 years ago on . Most recent reply

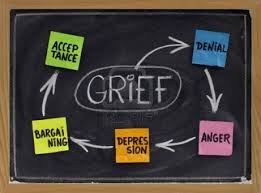

The Five Stages of Foreclosure Grieving

Wen trying to market to a specific niche or motivated seller group, it’s important that you understand what they are going through, and what emotional buttons to push in order to get them to respond to your direct mail or other advertising medium. This is especially the case when dealing with those in foreclosure, as they go through wide range of emotions during the process, much like someone who is grieving the death of a loved one or facing their own imminent demise. Being able to relate to them, and build a strong rapport, may mean the difference between whether or not you are able to land a highly profitable deal.

Wen trying to market to a specific niche or motivated seller group, it’s important that you understand what they are going through, and what emotional buttons to push in order to get them to respond to your direct mail or other advertising medium. This is especially the case when dealing with those in foreclosure, as they go through wide range of emotions during the process, much like someone who is grieving the death of a loved one or facing their own imminent demise. Being able to relate to them, and build a strong rapport, may mean the difference between whether or not you are able to land a highly profitable deal.

In her book entitled, "On Death and Dying”, Elizabeth Kubler-Ross explains the five stages a terminally ill patient g

oes through when informed of their potentially fatal illness.

The five stages she identifies in her book are:

- Denial (this isn't happening to me!)

- Anger (why is this happening to me?)

- Bargaining (I promise I'll be better person if...)

- Depression (I don't care anymore)

- Acceptance (I'm ready for whatever comes)

Stage 1 - Denial

Many sellers take a long time to come to grips with the fact that they are in fact losing their home, and that one day very soon a sheriff will be showing up with an eviction notice. They have heard random news stories about how people have fought their foreclosures and won (a myth), or they think that somehow they will be able to come up with the money to reinstate the loan.

If someone stays in this stage for a long time, they will most likely NOT respond to your first marketing letter, usually sent at the time the foreclosure is first filed in public records (Lis Pendens or Notice of Default). This “stage of grief” is the exact reason why it’s so important to send multiple letters, over an extended period of time (depending on your state’s foreclosure timeline), because you never know when they will move on to the subsequent stages.

Stage 2 - Anger

This can also be a very challenging and difficult stage in which to deal with distressed sellers. Many homeowners remain angry throughout the foreclosure process, and blame their troubles on those “crooks” at the bank, rather than accepting their responsibility for the promise they made to pay the lender at the agreed upon terms.

If the anger never subsides, homeowners have been known to significantly damage their home while moving out, stripping the property of anything of value, and even intentionally vandalizing the home. However, the vast majority of homeowners simply need someone to “vent” to, and that oftentimes is the investor that they call for help. If you lend them a sympathetic and understanding ear, you can oftentimes “talk them off the ledge” and help them see the benefits of doing a short sale, rather than just walking away from the home.

Stage 3 - Bargaining

This is the stage where sellers exhibit a lot of ambivalence, and can be easily swayed by a lender representative who promises to “take the pain away” by doing a nice and simple deed-in-lieu of foreclosure. The seller is oftentimes terrified of an actual foreclosure at this point, and if they haven’t heard from you in a few weeks, they may just take the lender up on this offer…completely unbeknownst to you.

This is why it’s extremely important that you tell your short sale leads to notify you anytime the bank calls. They should tell the lender that you are handling everything, and if they have a question, they should contact you. If you remove the decision making from the seller, you are much more likely to avoid a disaster when you are possibly just days away from an approval…and a big paycheck!

Stage 4 - Depression

At some point in the foreclosure/short sale process, every seller will come to the realization that this truly is the end of the road for their slice of the American Dream, and it may really hit them hard. Of course this is much more of a traumatic experience for a homeowner who has lived in the house for years and raised their kids there, as opposed to an investor who has never even seen the home.

Each seller deals with this process and this stage differently, however it’s important that we stay in regular contact with our sellers, and continue to reinforce the benefits of enduring the short sale process as opposed to a foreclosure. Sometimes you have to act as part-time investor, part time financial counselor, and part-time psychiatrist. However, the seller will thank you in the end when you have saved them from a foreclosure, and settle the largest debt of their life without a deficiency judgment.

Stage 5 - Acceptance

Eventually, nearly every seller will get to the point in the process where they will begin to accept the fact that they are losing their home, and they will start to move on emotionally. At this point, they might go ahead and move out, or at the very least begin to make plans for where they are heading after the sale. Once they start talking about life after the sale, they have officially made the switch in their head, and you can breathe a sigh of relief.

However, never let your guard down, as oftentimes sellers can slip back into one of the previous stages because of a chance encounter with an old friend, or a conversation with a “Realtor-friend” who has sold one house in the last 10 years, but somehow feels they are world’s expert on everything real estate. You need to make the effort to stay in contact with your sellers on a regular basis, and continue to reinforce the benefits of short sales vs. foreclosures.

For More Real Estate Articles & Advice (Plus 2 Free Gifts), Click Here to Subscribe!