Updated over 4 years ago on .

Biggest Frustration with the 1031 Exchange

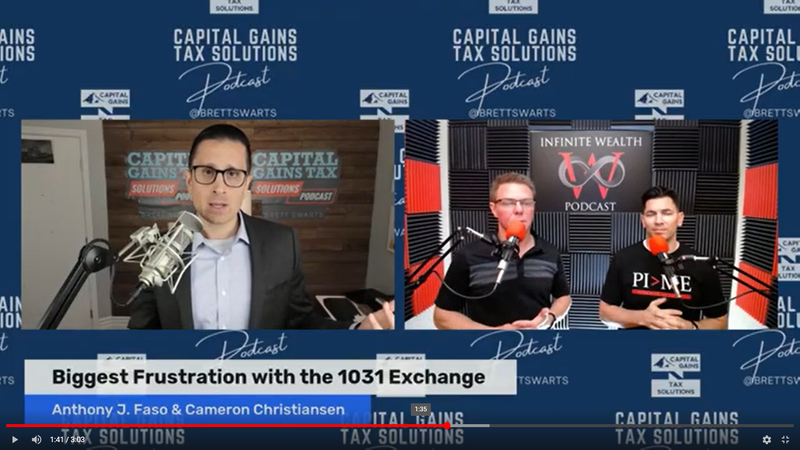

Biggest Frustration with the 1031 Exchange with Anthony J. Faso & Cameron Christiansen

Brett Swarts:

Welcome to the capital gains tax solutions podcast. I'm your host, Brett Swarts. We are doing a short teaser episode to the full episode which I just had with an amazing guest Anthony Faso, CPA, and Cameron Christiansen, and they are wealth strategist and host of Infinite Wealth, podcast, and Wealth Consultants out of Las Vegas, but in this episode, we're just focusing on one big question here. By the way, we're also streaming on Expert CRE Secrets as well. And this is the question for the guys: what's the biggest frustration when it comes to the 1031 exchange for yourself for your clients?

Anthony Faso:

Oh, tip for me the biggest frustration is going to be if we all were doing is we are deferring the tax. So, it's not like we're avoiding it. It's still there. We're just kicking the can down the road. And what I'm concerned about, is there some talks recently about raising the capital gains tax for some individuals, particularly if your incomes over a million dollars. So, my concern is, by kicking the can down the road, you may actually pay even more tax.

Brett Swarts:

Very well said yeah, we call it the shotgun wedding too, by the way, on the 1031 exchange. Right. So you're deferring it but you're having to get engaged in 45 days and overpay my other concern with that as well. Just a couple that is not only are you oftentimes just kicking the can, but you're putting yourself in your wealth at risk because perhaps Hey, you're selling high and buying higher 180 days remember what happened in 06-05-04, people were doing that until the music stopped in ‘08. And then they got crushed, run the front lines here in Sacramento. Friends, family, clients, lost half or all and spent the next 3, 4, 5, 10 years digging out of that. So, do not overpay on a strategy that doesn't give you liquidity to diversification. And we talked about that and the full episode but Cameron, what's your biggest frustration because we just heard from Anthony?

Cameron Christiansen:

Yeah, lacking control. Right? Typically what the space that we play in, we play in permanent tax savings. And so, that's what we're trying to take clients is we don't want to try not to defer anything is deferring. You're just deferring into an unknown situation. If we know where we're at, we're comfortable so let's take those tax savings put them somewhere else that we can actually use it and then put it to work moving forward so just be done with it.

Brett Swarts:

Beautiful. By the way, you can find Anthony Faso, CPA, and Cameron Christiansen at InfiniteWealthConsultants.com. Look at the full episode. It is actually on YouTube live right now you go to Capital Gains Tax Solutions or search Expert CRE Secrets and you will find more about that episode. See the episode. Look for the full episode or drop it here. Shortly go to Capitalgainstaxsolutions.com. We can help you with the deferred sales trust. Thanks, everybody for watching this short episode. Bye now.

Learn more about Deferred Sales Trust

Visit: www.capitalgainstaxsolutions.com